Nigeria’s tourism opportunity can be unlocked by local online booking platforms

In economic terms Nigeria is best known as Africa’s largest economy and its number one oil producer, but unlike many other African countries, travel and tourism comes far down the list of GDP contributors.

In economic terms Nigeria is best known as Africa’s largest economy and its number one oil producer, but unlike many other African countries, travel and tourism comes far down the list of GDP contributors.

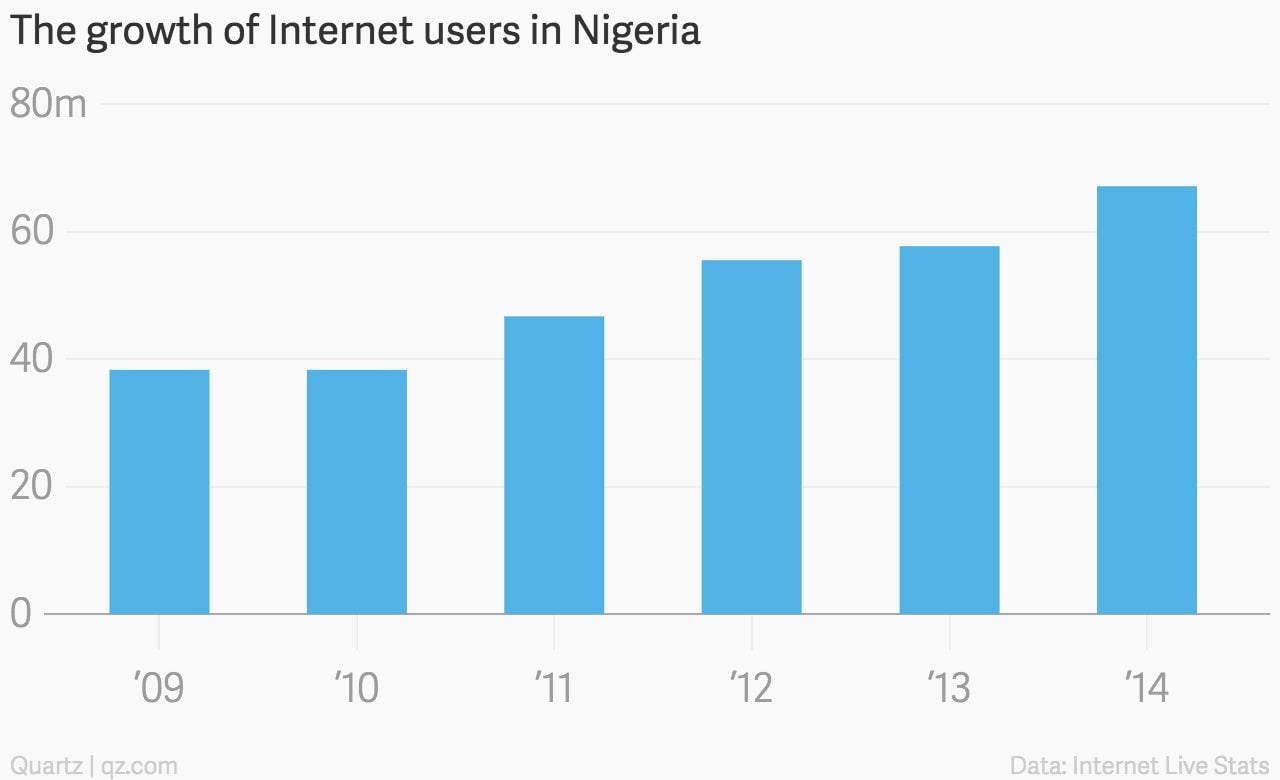

But as Internet penetration grows, even as poor road network infrastructure continues to make it difficult to get around, the rise of local e-commerce is making it easier for Nigerians and visitors to explore a large and culturally diverse country which is yet to fully exploit its tourism potential.

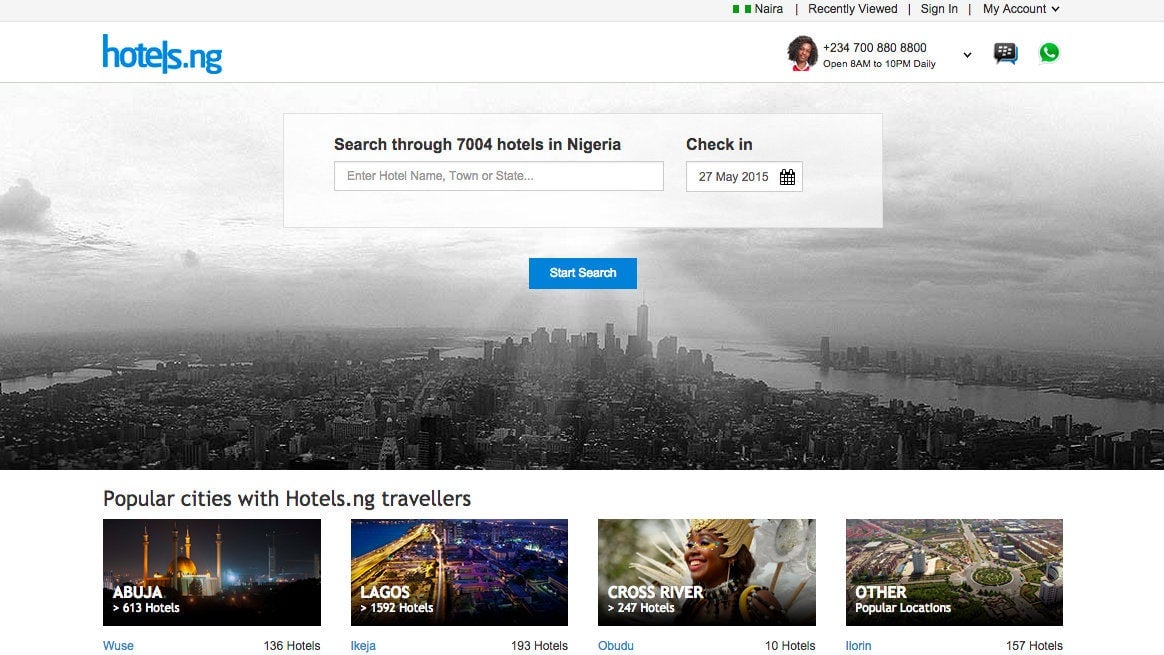

One such e-commerce bet was made this week by investors in online booking platform Hotels.ng with a $1.2 million investment. It was backed by Lagos-based EchoVC Pan-Africa Fund, an early stage technology fund with roots in Silicon Valley, and Omidyar Network, an investment arm of eBay founder Pierre Omidyar. The start-up had already secured $250,000 of capital from Spark.ng, another Lagos-based firm that “builds companies” run by Jason Njoku, the founder of iRokoTV, the so-called Netflix of Africa.

Two key things are happening in Nigeria to create this market opportunity. First, the growing numbers of people with access to the internet. Second, the domestic tourism market is becoming increasingly lucrative. The World Travel & Tourism Council estimates the direct contribution of travel & tourism to Nigeria’s GDP in 2013 was 757.3 billion naira ($3.8 billion) or 1.6% of GDP. It was expected to grow by 2.5% in 2014.

In this context, e-commerce in Nigeria is becoming the conduit through which entrepreneurs such as Hotels.ng are filling the gaps in the market.

‘Three years ago it was impossible to book online in Nigeria. 10,000 hotels but [you] couldn’t find any online,’ Mark Essien, founder and CEO of Hotels.ng told Quartz.

Now, such a shift is possible. From 2013-14, the number of internet users grew by 16% to 67 million, according to data from internetlivestats.com. By 2025, half of all Nigerians are expected to be online. ‘As the entire online market grows, we grow as well as part of that,’ Essien says.

Hotels.ng revenue model is based on commission. The 7000+ hotels are featured on the site for free but then pay a small percentage of what they earn to the platform. Essien says Hotels.ng became a ‘self-sustaining business’ in 2014.

But the challenges for startups are numerous and unpredictable in Nigeria. An example is the fuel crisis that gripped the country this past week. It forced the company to invest in solar panels for their offices in Lagos, an unanticipated cost. This is something that start-ups elsewhere don’t have to deal with.

“One thing about Nigeria is that overhead costs, or starting costs are much higher than in US/Europe,” Marek Zmylowski, co-founder of Jovago.com, another Nigerian-based hotel booking platform, told Quartz. ”Electricity costs thousands of dollar monthly, because you have to power your office by a generator. When you rent a space, it’s common you have to pay a year or even [two years] in advance. Internet costs – same situation, hundreds of dollars monthly just for couple of Megabits bandwith.”

Hotels.ng will use the cash infusion to fund their expansion strategy beyond Nigeria. ’We are going [further in] to West Africa, in Ghana. It has the most similarity to Nigeria. After that, French-speaking countries. Probably Senegal because they have an attractive tourist market. Then next is East Africa,’ says Essien.

The infrastructure challenges that are characteristic of emerging markets create opportunities for Jovago.com and Hotels.ng. “Bad road infrastructure and high road congestion is of course a challenge when you talk about delivery, but is at the same [time a] driver for customers to move to online purchases,” says Zmylowski.