Kenya has delayed the launch of the world’s first mobile-money government bond indefinitely

A little over a month ago, Kenyan authorities hailed what they said would be the world’s first government bond sold only on mobile phones, the M-Akiba bond.

A little over a month ago, Kenyan authorities hailed what they said would be the world’s first government bond sold only on mobile phones, the M-Akiba bond.

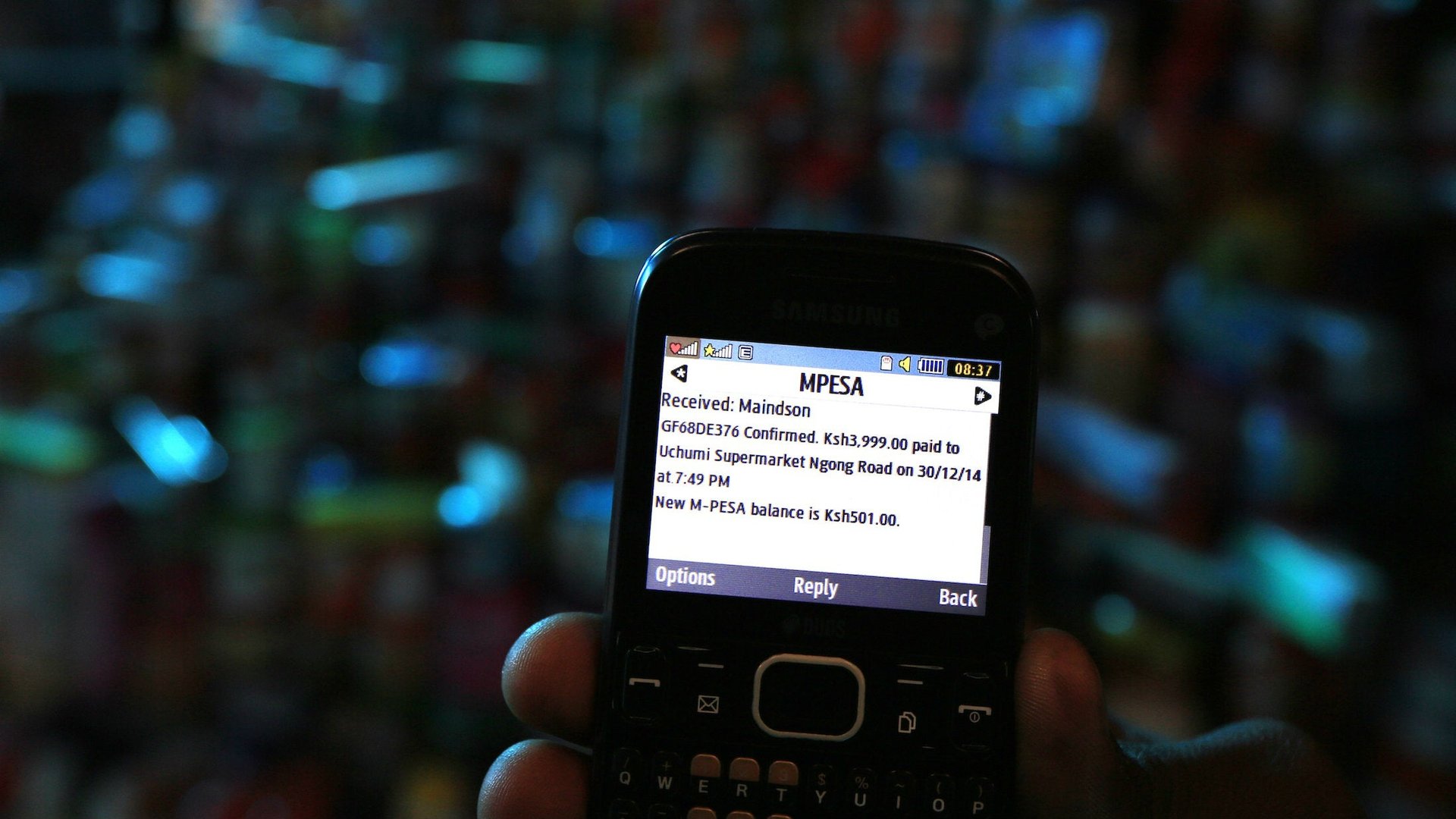

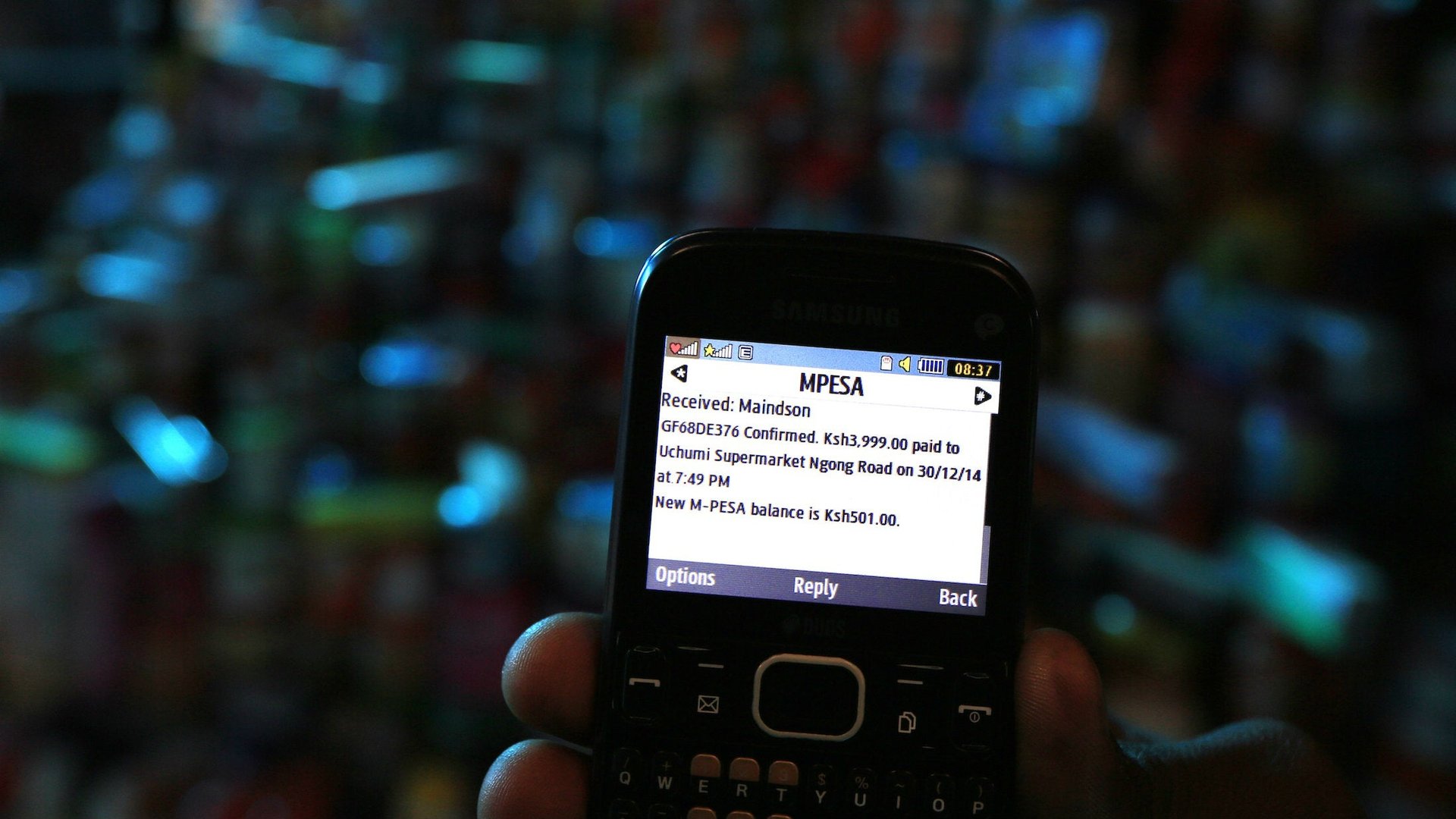

The bond—available to customers in a country well known for its love of mobile-money services like M-Pesa in increments as small as 3,000 shillings (about $30)—was to be launched last week, giving Kenyan families previously priced out of the bond market a chance to save and invest. Instead, officials have postponed the product indefinitely.

“We are waiting to see how rates in the market behave before we set an appropriate date,” Henry Rotich, Kenya’s National Treasury Cabinet Secretary, told The Nation. Clearance issues with the Nairobi Securities Exchange may delay the launch further.

The delay is another reflection of Kenya’s financial troubles—a weak shilling, a falling stock market, and increasingly expensive debt. A 20-billion-shilling one-year bond last week sold at an interest rate of 22.95%. Commercial banks are charging borrowers as much as 28% on their loans, while others are seeing rates of around 12%.

Interest rates have been pushed high as the government raises benchmark borrowing costs to protect the shilling as well as borrows heavily to deal with funding shortages.Kenya is trying to raise a total of about 220 billion Kenyan shillings (paywall) in 2015. The National Treasury is trying to get 80 billion shillings in syndicated loans from local banks.

Counties, public schools, and other government services have all complained about a cash crunch that has been made worse by poor tax collection and poor planning.