More regulation could actually improve financial inclusion in Africa

Implementing nationwide regulatory laws significantly improve financial ecosystems and the spread of digital mobile services, says a new financial inclusivity report. Brookings Institution looked at 26 countries across Africa, Asia and Latin America and assessed those countries’ commitments in devising national financial strategies, penetration of mobile services, and the various use of both traditional and digital financial services.

Implementing nationwide regulatory laws significantly improve financial ecosystems and the spread of digital mobile services, says a new financial inclusivity report. Brookings Institution looked at 26 countries across Africa, Asia and Latin America and assessed those countries’ commitments in devising national financial strategies, penetration of mobile services, and the various use of both traditional and digital financial services.

Kenya, South Africa, Uganda, Rwanda and Nigeria ranked among the top ten in the list of countries surveyed. Kenya scored high because of the Kenyan government’s support for branchless banking activities through modifications introduced into the Finance Act. This allowed third-party entities, based in places as varied as supermarkets, gas stations and post offices, to act as agents for the banks. Formal arrangements between banks and mobile phone networks in Nigeria have also drawn millions of people into the formal financial system.

The launch of consumer protection laws in countries like Tanzania and Kenya has also showcased government commitment to create sustainable financially inclusive environments for customers. This was considered vital in order to get more customers to trust the financial system in the long run. For instance, in Nigeria, there was a noted decreased in fraudulent bank transactions in 2015, which dropped to 2.3 billion naira ($7.1 million) from 6.2 billion naira ($19.3 million) in 2014.

The idea of African government regulators being a possible conduit or enabler of new consumer technology services isn’t how several regulators have typically treated new technology. As the use of internet-based technology and consumer services have grown rapidly in popularity many local regulators on the continent have struggled to keep up and for the most part have been a hinderance to progress. Apps like WhatsApp, Twitter and Skype are just a few of the communications and social media platforms that have proved problematic for regulators from Morocco to Nigeria to South Africa.

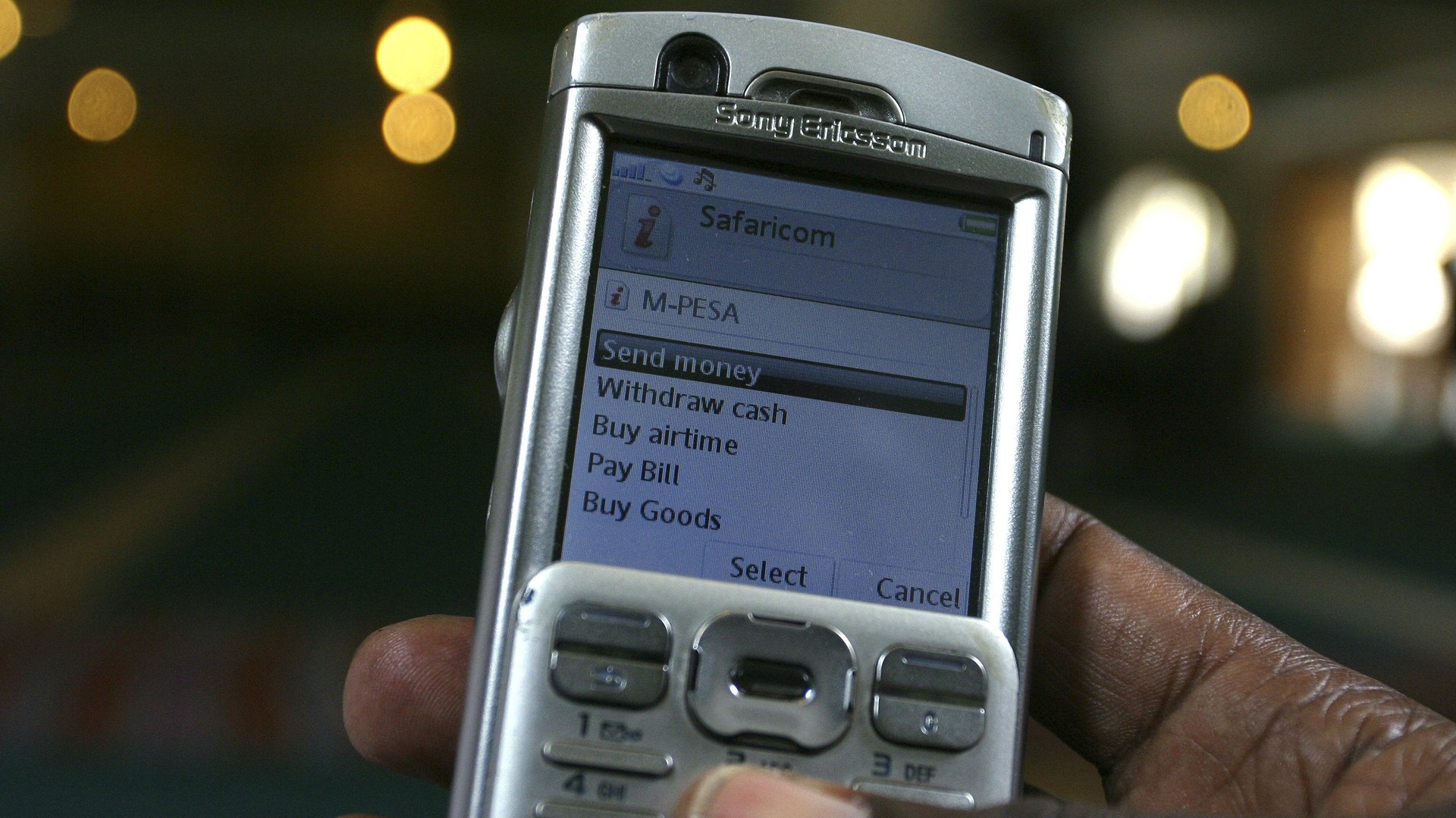

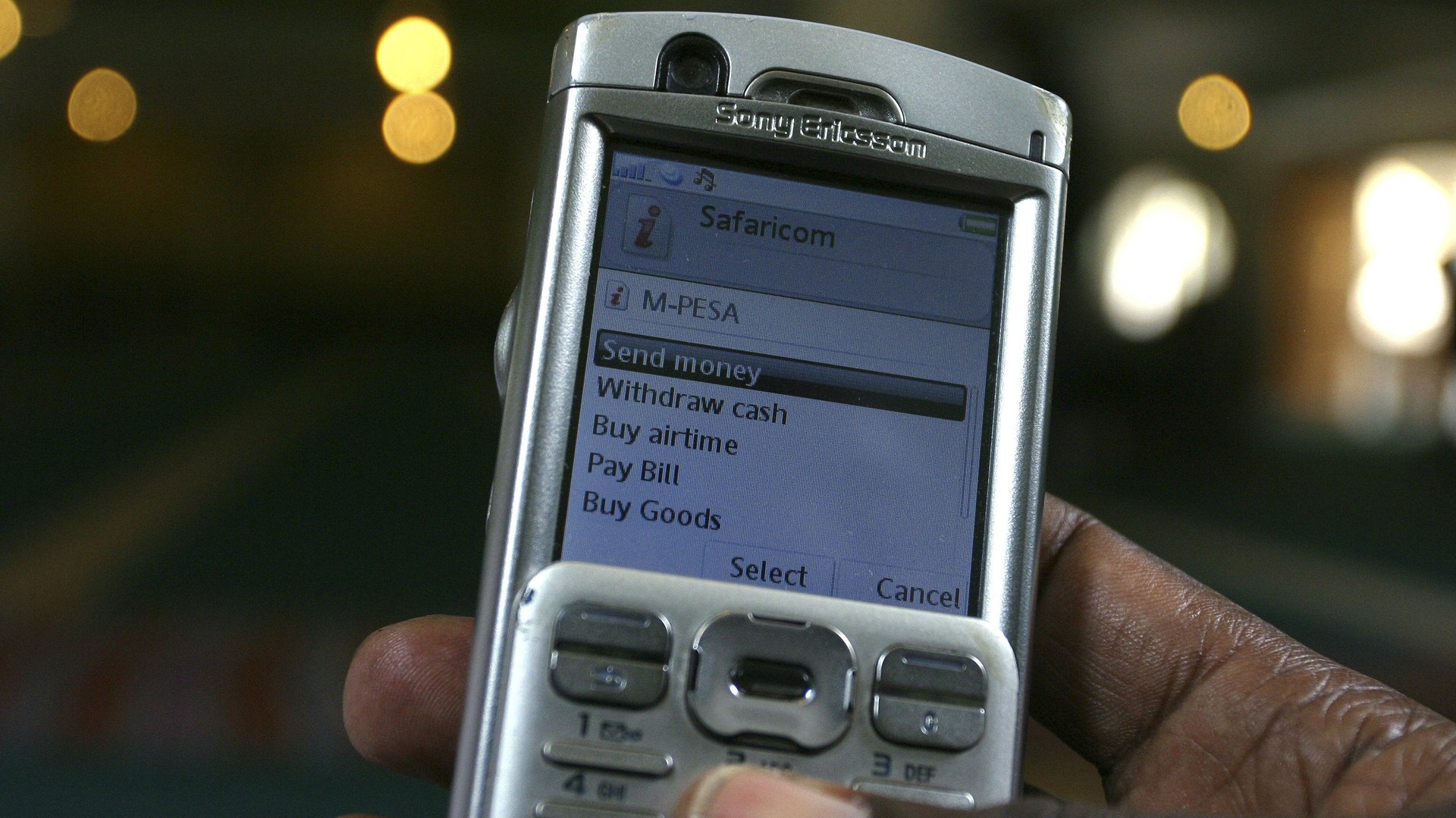

Significant development in mobile money infrastructure in other African countries also acted as a major boost for financial inclusivity—surpassing the use of traditional bank accounts in many countries. Kenya scored the highest because of its mature mobile money market, with the success of M-Pesa service amplifying the number of people who had access to financial services.

One in five adults in Rwanda actively used mobile money, about double the percentage of bank users. This put it alongside 19 other countries in 2015 (pdf, p. 32), majority of them in Africa, which had more mobile money accounts than bank accounts. Thirty-five percent of adults in Uganda also had registered mobile money accounts. Even in Ethiopia, which scored low on the survey, the introduction of the M-Birr service facilitated over 273,000 transactions in 2015.

Yet, African countries have a lot of obstacles to overcome if they are to bring hundreds of millions of people into the banking fold. This includes providing financial literacy for women and people in rural areas. In Egypt, just over 9% of women had a bank account with a formal financial institution.