Bitcoin's coming boom, Trump's stock and meme coin sink, and Netflix hits $1,000: Markets news roundup

Plus, People bought the wrong stock thinking it was part of OpenAI’s Stargate Project

We may earn a commission from links on this page.

Start Slideshow

Start Slideshow

Advertisement

Previous Slide

Next Slide

Christopher McMahon, CEO of Aquinas Wealth Advisors and author of “Faithful Finances”, spoke with Quartz for the latest installment of our “Smart Investing” video series.

Advertisement

Advertisement

Previous Slide

Next Slide

Just days before Donald Trump’s inauguration as 47th president of the United States, the businessman-turned-politican launched his latest venture: a new cryptocurrency token.

Advertisement

Advertisement

Previous Slide

Next Slide

Advertisement

Previous Slide

Next Slide

President Donald Trump’s name isn’t selling like it used to.

Shares of Trump Media and Technology Group, the company behind the president’s social media platform Truth Social, fell more than 7% in pre-market trading Tuesday. Trump Media’s shares last closed at $40.03.

Advertisement

Advertisement

Previous Slide

Next Slide

The Detroit automakers’ shares are rising Tuesday while their fully-electric rivals saw their stocks fall as President Donald Trump began tearing into his predecessor’s pro-EV moves.

Advertisement

Advertisement

Previous Slide

Next Slide

With Donald Trump set to be inaugurated as President of the United States on Monday, cryptocurrency stands as an unlikely part of his path back to power. The story of his return to the White House cannot be told without acknowledging how digital assets helped boost his political fortunes after his departure in 2021. Since his victory in November, Bitcoin rose from $75,000 to an all-time high of $108,135 on December 17, 2024, a 44% jump.

Advertisement

Advertisement

Previous Slide

Next Slide

Stocks surged Tuesday afternoon, fueled at least in part by tempered expectations around the severity of President Donald Trump’s potential tariffs.

Advertisement

The Dow Jones Industrial Average soared 448 points, or about 1%, the S&P 500 index climbed about 0.8%, and the Nasdaq index ticked up 0.65%.

While Trump signed a swath of executive orders on his first day in office, ranging from return-to-office mandates for federal workers to moving to end birthright citizenship, his tariff talk was much softer than analysts had expected.

Advertisement

Previous Slide

Next Slide

Advertisement

Previous Slide

Next Slide

Christopher McMahon, CEO of Aquinas Wealth Advisors and author of “Faithful Finances”, breaks down why institutional adoption of crypto will drive prices higher

Advertisement

Previous Slide

Next Slide

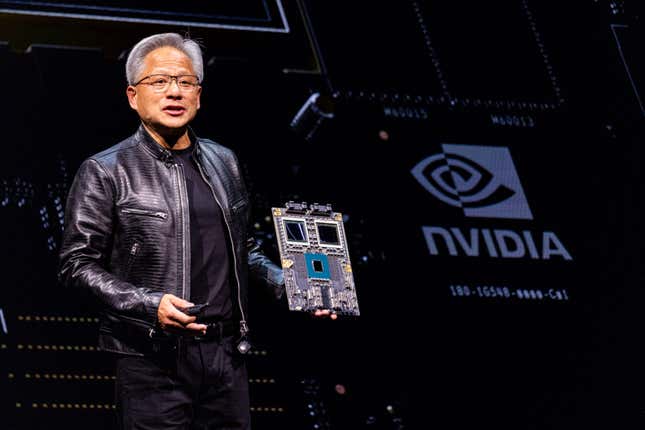

Nvidia (NVDA) reclaimed its title as the world’s most valuable public company on Tuesday as Apple’s (AAPL) shares slid.

Advertisement

The chipmaker’s stock was up about 2.4% during mid-day trading Tuesday, pushing its market cap to $3.45 trillion. Meanwhile, Apple saw its shares fall by almost 4%, landing its market cap at $3.33 trillion. The iPhone maker’s shares are down by more than 9% so far this year, while Nvidia’s shares are up 2%.

Advertisement