Bitcoin keeps smashing records. Check out its wild 2024 in 3 charts

Donald Trump's election win has boosted Bitcoin to record highs, with the leading cryptocurrency outpacing both crypto rivals and traditional assets

Bitcoin has been on a tear since Donald Trump’s election win, and it could be poised for even more gains. The leading cryptocurrency hit $93,000 on Wednesday, with an $100,000 milestone getting closer and closer.

Suggested Reading

On the campaign trail, Trump promised to turn the country into the “crypto capital of the planet,” and Bitcoin, the world’s largest and oldest cryptocurrency, neared a record high of $90,000 on Tuesday.

Related Content

Trump has already appointed two pro-crypto candidates, Elon Musk and Vivek Ramaswamy to lead the Department of Government Efficiency, or DOGE (also a ticker symbol for Dogecoin, a meme token promoted by Musk).

Bitcoin and other cryptocurrencies have been soaring after last week’s election outcome, which has sparked investor confidence in digital assets. Over the past four years, Bitcoin has been extremely volatile, as shown by the 2022 collapse of the crypto giant FTX. The price fluctuates around economic events, regulatory actions, and market sentiment, which is why Trump’s appointments will be critical.

We looked at Bitcoin’s volatility in 2024 and compared that with other assets and peers.

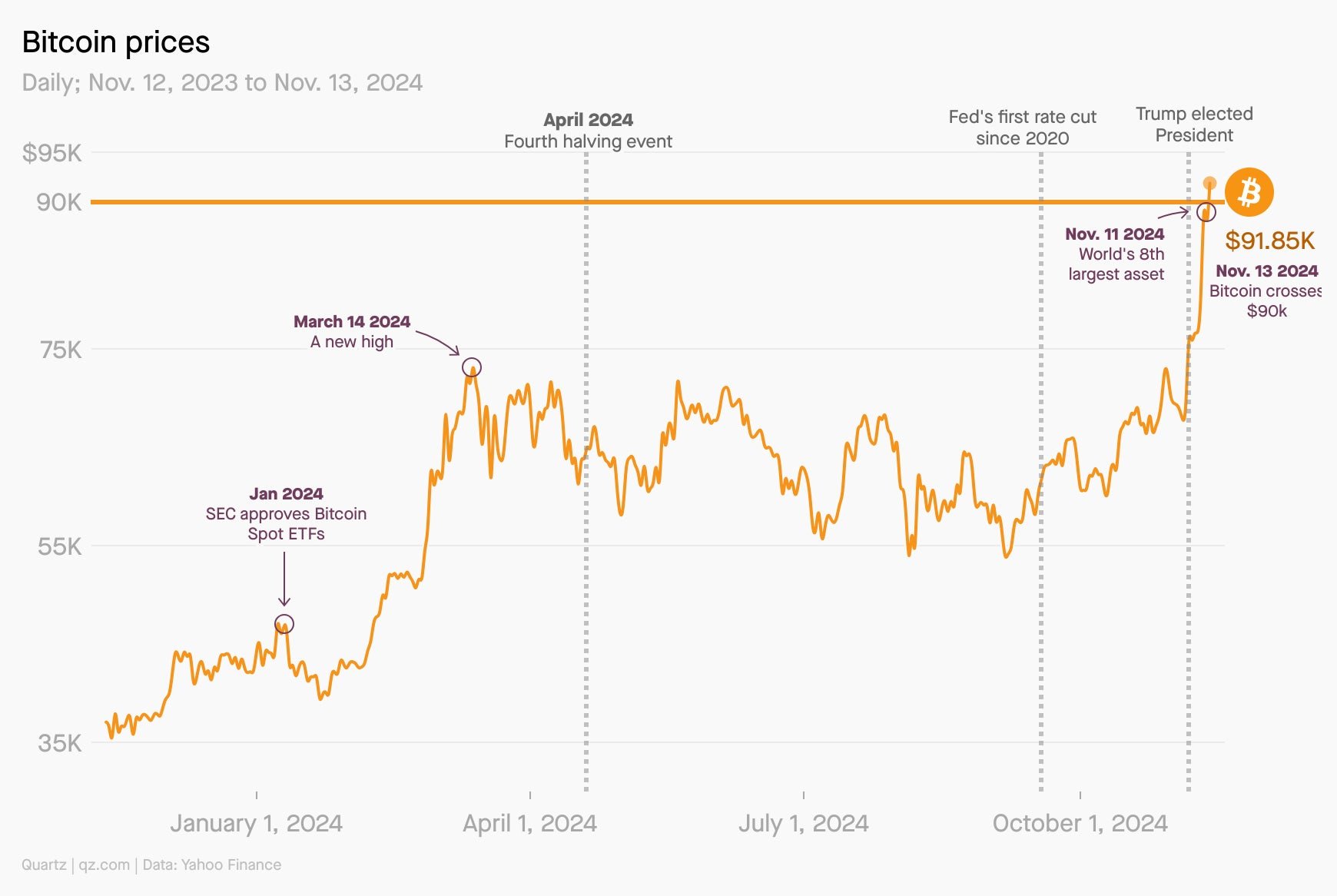

Bitcoin’s volatility in 2024

A large volume of outflow occurred this year after the Securities and Exchange Commission approved the first 11 Bitcoin spot ETFs on Jan. 10, 2024. The market rebalanced itself as other assets (such as Ethereum, Tether, and Dogecoin) gained popularity among investors.

Bitcoin’s price quickly ticked up after fund approvals in late February and early March. During the first week of March, Bitcoin’s price continued to set records, crossing $73,000 at one point.

On April 19, 2024, Bitcoin had its fourth and latest halving event, which reduced the reward for a mined block. Bitcoins are created by mining software and hardware at a specified rate, which splits in half every four years, slowing the number of coins created.

On Sept. 18, 2024, after the Federal Reserve announced its first rate cut since the start of the COVID-19 pandemic, Bitcoin showed a sharp surge on the following day, rising to $63,000 from the $60,000 it was two days prior.

The leading cryptocurrency saw another all-time high (of $76,943) after Trump was reelected before it closed at $75,904 (a 9% increase from $69,360) on Nov. 5, 2024.

Bitcoin compared to Ether and other cryptocurrencies

According to recent data from Coin Market Cap, in 2024, the global value of cryptocurrency rose to $2.87 trillion from roughly $1 billion in 2013.

Bitcoin’s value surpasses the combined market caps of Ethereum, Tether, Solana, and BNB — bitcoin’s 60% dominance in the crypto market demonstrates higher investor confidence compared with its peers.

Bitcoin compared to gold, Nvidia, and other assets

On Tuesday, Bitcoin’s market cap briefly reached $1.78 trillion, making it the eighth-largest asset by market cap (surpassing silver), according to data retrieved from Companies Market Cap, a website providing data on cryptocurrencies.

Bitcoin trails gold, Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Google (GOOGL), Amazon (AMZN), and Saudi Aramco in global asset rankings. But despite already impressive year-to-date growth, Bitcoin would need to be 10 times its current level to match gold’s market cap.