What Jamie Dimon, Bill Ackman, and other CEOs and billionaires are saying about Trump's trade war

Big names in finance are predicting a recession — and many aren't happy with the president

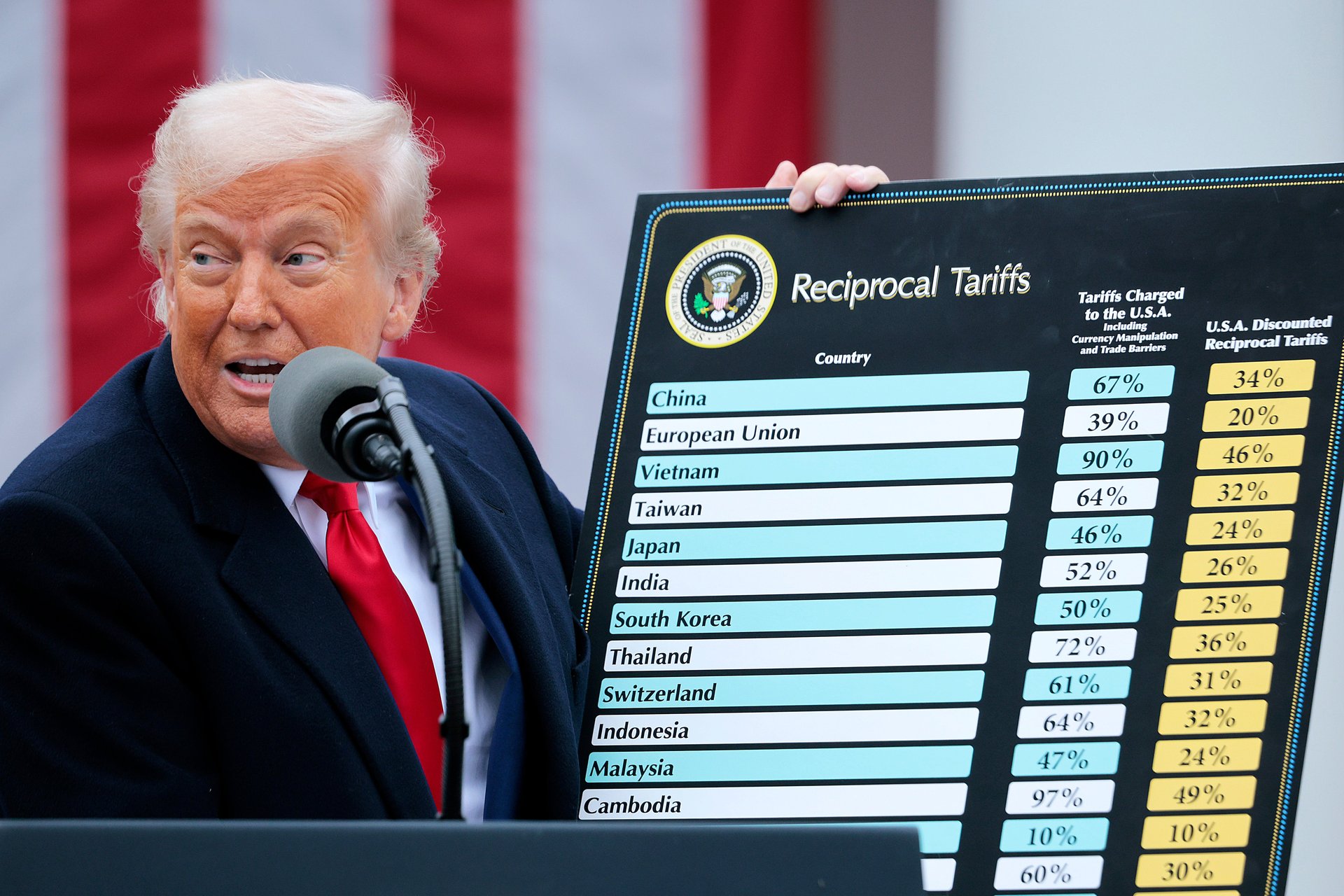

Chief executives and billionaires aren’t holding back their criticism of President Donald Trump’s sweeping tariffs, which would impose import levies on almost all of America’s major trading partners.

Even some of Trump’s former allies are now speaking out, calling the policy overly broad, short-sighted, and potentially damaging.

We’ve rounded up some of the most notable reactions — and they’re anything but subtle. Read on to see what they’re saying.

2 / 9

Jamie Dimon

JPMorgan Chase CEO Jamie Dimon sounded the alarm on President Donald Trump’s tariffs in his annual letter to shareholders on Monday, warning that the trade policy will likely spike inflation and is sure to slow down growth.

Dimon said “at least until recently” the U.S. economy was proving resilient “despite the unsettling landscape.”

“The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession,” Dimon wrote.

“And even with the recent decline in market values, prices remain relatively high,” he continued. “These significant and somewhat unprecedented forces cause us to remain very cautious.”

Dimon explained he started writing the letter amid a weakening U.S. economy, adding “that was before the recent tariff announcement.” He told shareholders to not only expect rising prices on imported and domestic goods, but to prepare for a bevy of uncertainty. He cited “the potential retaliatory actions, including on services, by other countries, the effect on confidence, the impact on investments and capital flows, the effect on corporate profits and the possible effect on the U.S. dollar.”

3 / 9

Bill Ackman

Bill Ackman, the billionaire CEO of Pershing Square Capital Management, who was a major Trump backer during the 2024 election, issued a warning to the president on Sunday: Hit pause on the trade war or risk crashing the economy.

“The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country,” Ackman said in a lengthy post on X. “But, business is a confidence game and confidence depends on trust.”

Ackman added that by placing large tariffs on U.S. allies and enemies alike, “we are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital. The president has an opportunity to call a 90-day time out, negotiate and resolve unfair asymmetric tariff deals, and induce trillions of dollars of new investment in our country.”

Ackman said that the U.S. is headed toward “a self-induced, economic nuclear winter, and we should start hunkering down. May cooler heads prevail.”

4 / 9

Elon Musk

Even the world’s most prominent Trump supporter, Elon Musk, is displeased with the tariffs.

Musk, who runs the Department of Government Efficiency (DOGE), spent the weekend criticizing the administration’s top trade adviser, Peter Navarro, and amped up his criticism Tuesday, saying Navarro is “dumber than a sack of bricks.”

Navarro had gone on TV on Monday to suggest that Musk’s issues with Trump’s tariffs were because Musk’s Tesla (TSLA) automobiles were made with parts primarily from outside the U.S. Navarro noted that many of Tesla’s car parts come from Japan, China, Mexico, and Taiwan, all of which will be hit hard by Trump’s tariffs.

“He’s a car person,” Navarro said. “That’s what he does, and he wants the cheap foreign parts.”

Musk said Tuesday on X that “Tesla has the most American-made cars” and that, “By any definition whatsoever, Tesla is the most vertically integrated automaker in America with the highest percentage of US content.”

Musk has heavily criticized the Trump administration’s universal and reciprocal tariff plan and has appealed to the president to walk back the levied duties. Two sources told the Washington Post that Musk personally made an attempted tariff-related appeal to Trump — but has been unsuccessful in changing the president’s mind thus far.

Additional reporting by Shannon Carroll.

5 / 9

Ken Griffin

Billionaire banker and Citadel CEO and founder Ken Griffin called the tariffs a “huge policy mistake.”

“It’s going to cost you 20%, 30%, 40% more for your groceries, for your toaster, for a new vacuum cleaner, for a new car,” the GOP megadonor said, according to Bloomberg. “Even if the dream of jobs coming back to America plays out, that’s a 20-year dream. It’s not 20 weeks. It’s not two years. It’s decades.”

6 / 9

Bahram Akradi

“Tariff is not a beautiful word,” Bahram Akradi, CEO of the luxury fitness chain Life Time Group Holdings (LTH), told the Wall Street Journal Monday. “You cannot apply this type of gridlock and this much friction to the world’s trade.”

Akradi said if Trump can use the tariffs to get some better trade deals, “it would actually be good for everyone.” But he warned failure is not an option: “If they don’t, then I believe this last move will prove to be nuclearly bad,” he said.

7 / 9

Ray Dalio

Billionaire and Bridgewater founder Ray Dalio said he is “very concerned” about tariffs.

Dalio said in an CNBC interview, “I agree with the problem,” but added, “I am very concerned about the solution.”

8 / 9

Ryan Cohen

Former Trump fan and the CEO of GameStop (GME) Ryan Cohen isn’t happy with the tariffs.

He posted on X that “These tariffs are turning me into a dem.”

He also quipped that “I can’t wait for my $10,000 made in the USA IPhone.”

It’s a pretty sharp reversal from the CEO who said that “Trump is the shit” in October. But GameStop is feeling the pain from the Tariffs, announcing it had to delay preorders of the Nintendo (NTDOY) Switch 2 thanks to the new policy.

9 / 9

Larry Fink

Blackrock (BLK) CEO Larry Fink thinks a recession is already here thanks to the tariffs. “Most CEOs I talk to would say we are probably in a recession right now,” he said Monday.

Fink referred to the airline industry as a “canary in the coal mine.” “I was told that the canary is sick already,” he said.

Fink added that he thinks President Donald Trump’s tariff policies could make it difficult for the Federal Reserve to cut interest rates as it usually does during recessions, which could exacerbate inflation.

“This notion that the Federal Reserve is going to ease four times this year, I see zero chance of that,” he said. “I’m much more worried that we could have elevated inflation that’s going to bring rates up much higher than they are today.”

—Kevin Ryan contributed to this article.