Chinese police detain wealth management staff at the heavily indebted developer Evergrande

Police in a southern Chinese city say they have detained some staff at China Evergrande Group’s wealth management unit in the latest trouble for the heavily indebted developer

TAIPEI, Taiwan (AP) — Police in a southern Chinese city said they have detained some staff at China Evergrande Group’s wealth management unit in the latest trouble for the heavily indebted developer.

Suggested Reading

A statement by the Shenzhen police on Saturday said authorities “took criminal coercive measures against suspects including Du and others in the financial wealth management (Shenzhen) company under Evergrande Group.”

Related Content

It was unclear who Du was. Evergrande did not immediately answer questions seeking comment.

Media reports about investors’ protests at the Evergrande headquarters in Shenzhen in 2021 had listed a person called Du Liang as head of the company’s wealth management unit.

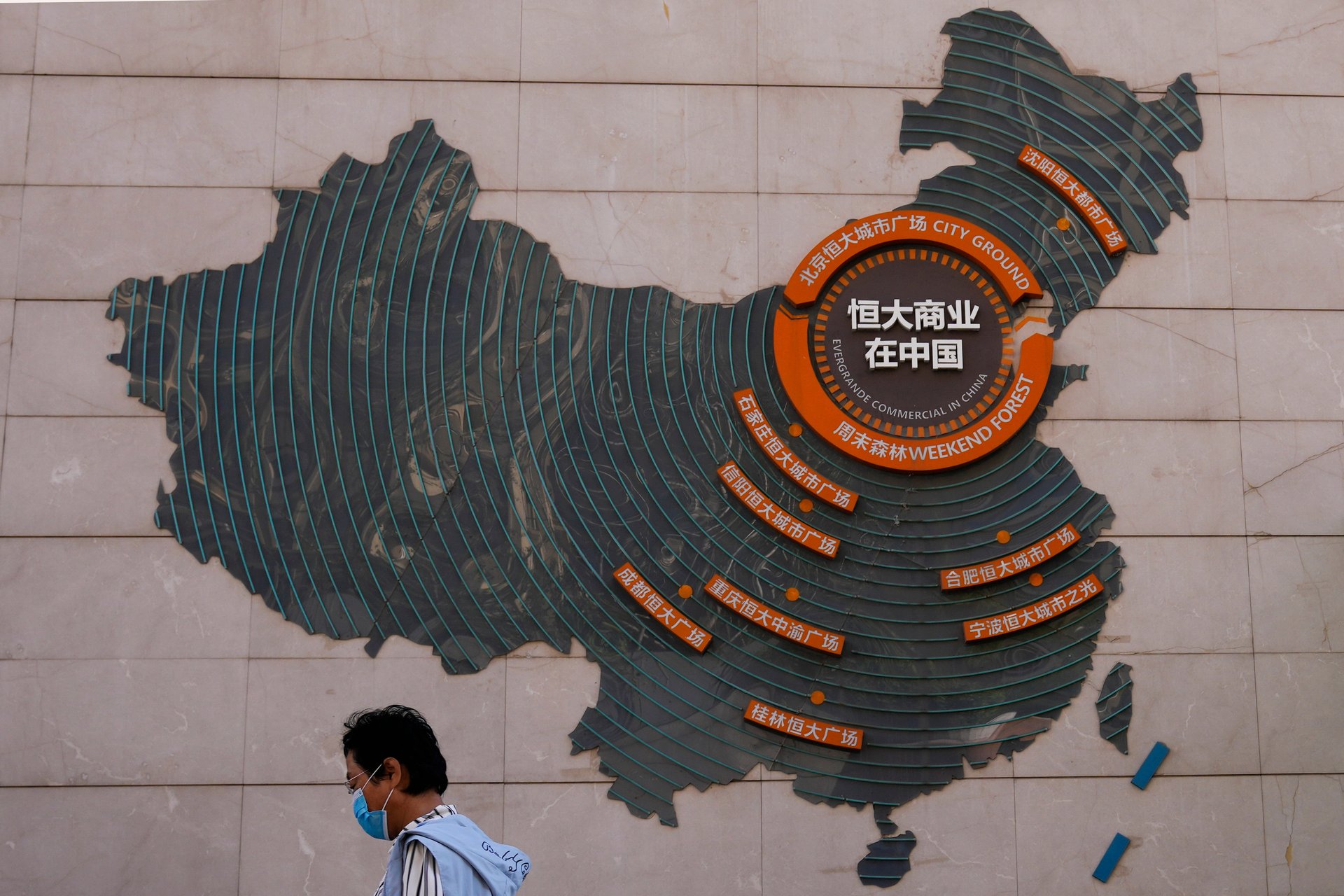

Evergrande is the world’s most heavily indebted real estate developer, at the center of a property market crisis that is dragging on China’s economic growth.

The group is undergoing a restructuring plan, including offloading assets, to avoid defaulting on $340 billion in debt.

On Friday, China’s national financial regulator announced it had approved the takeover of the group’s life insurance arm by a new state-owned entity.

A series of debt defaults in China’s sprawling property sector since 2021 have left behind half-finished apartment buildings and disgruntled homebuyers. Observers fear the real estate crisis may further slow the world’s second-largest economy and spill over globally.