10 common pitfalls first-time homebuyers should watch out for

Don't fall victim to these simple mistakes that could cost you your dream home, thousands of dollars, or both.

Buying a house for the first time is no simple task — and there’s almost too much room for mistakes.

Experts at Bankrate.com compiled a list of common errors that first-time homebuyers make and should try their best to avoid.

Continue reading to see which ones made the list:

2 / 11

Not getting pre-approval first

Before you go out house hunting, you should already be pre-approved for a mortgage. In competitive markets, this will guarantee that your realtor and home sellers will take you seriously.

3 / 11

Prioritizing the house over the neighborhood

Your neighborhood can be just as important as the house you choose. First-time homebuyers often seek out a home that checks all the boxes but should also focus on the place that makes the most sense for them.

4 / 11

Holding out for a “unicorn” house

Waiting for the unicorn that never comes will leave you missing out on a lot of great options. Looking for affordable and practical “starter” homes is key when buying a house for the first time.

5 / 11

Getting too emotional

Home buying is always going to be an emotional experience, but don’t let emotions rule your decisions. With things always in flux, it’s important not to get too attached to one house, especially if it’s out of your budget. Stay grounded and consider your long-term financial needs.

6 / 11

Not shopping around for lenders

Mortgage rates are high right now, and your chances of getting a good deal are much lower if you only talk to one lender. Compare offers from various lenders — Bankrate recommends talking to at least three — and you could save a good chunk of money.

7 / 11

Speeding through the process

Buying a home is exciting, but that’s no reason to get ahead of yourself. Make sure you have enough for a down payment and closing costs before jumping into the process. Bankrate recommends making a detailed timeline to know when you’re ready to take the leap.

8 / 11

Blowing past your budget

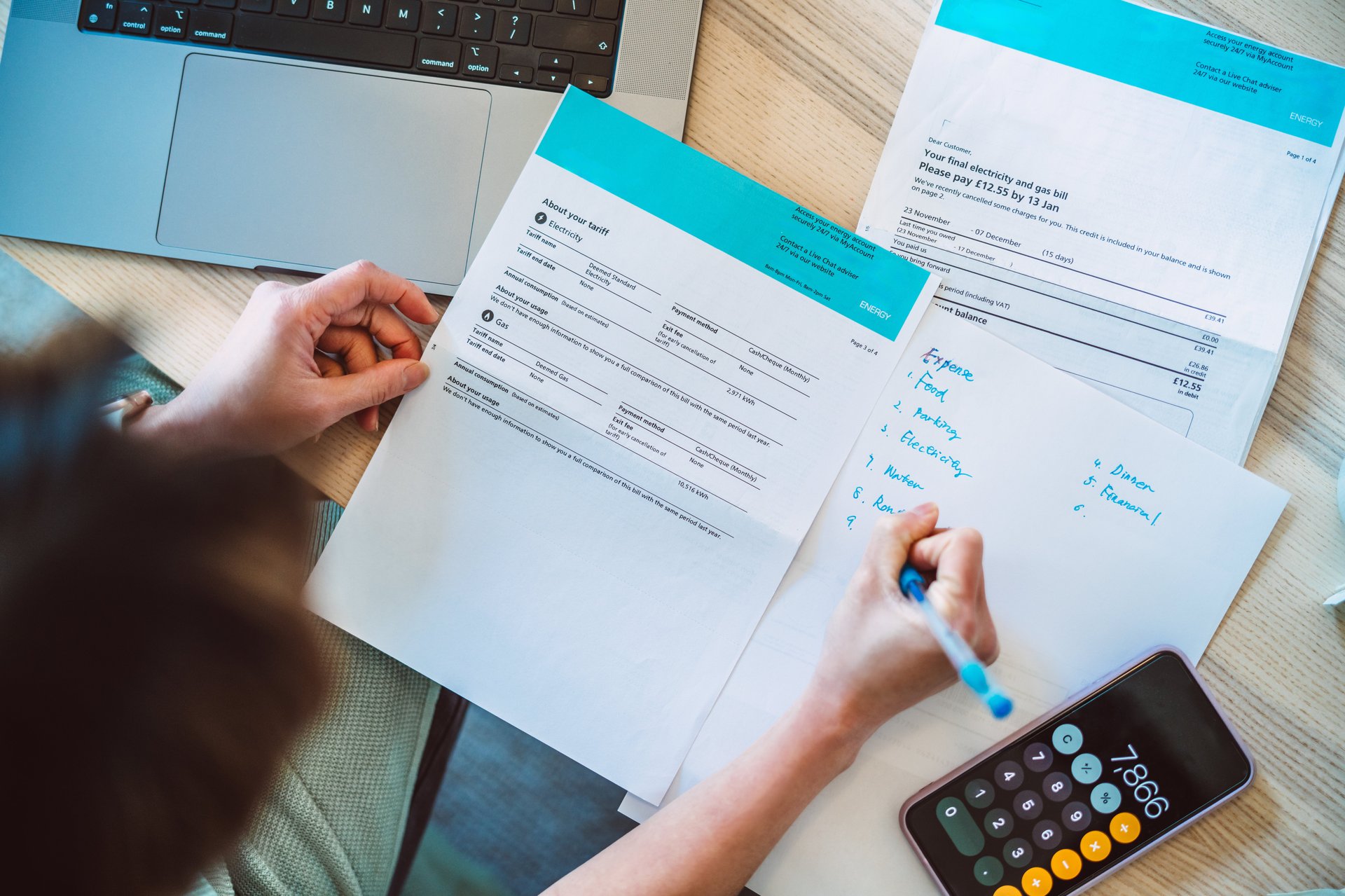

We all know the expression “house rich, money poor,” and you don’t want that to be you — especially if it’s your first time buying a house. Don’t buy a house you think you will be able to afford in the future. Be realistic about what you can afford now and plan accordingly.

9 / 11

Using up all your savings

First-time homebuyers often will drain their savings to score the house of their dreams, but then they’re left starting over at zero. Plus, should other expenses arise, they’ll find themselves in a lot of trouble.

10 / 11

Saving until you have 20% down

First-time homebuyers with a credit score over 580 are able to access Federal Housing Administration (FHA) loans that require as little as 3.5% down. You will need to buy mortgage insurance, but it’s a good option for people who are ready to buy but will be delayed for years if they’re trying to save up that 20%.

11 / 11

Forgetting about the hidden costs

Homeownership is expensive and full of hidden costs. Make sure you have enough saved to be prepared for roof damage or burst pipe.