From Pets.com to Amazon, 7 companies that died in the dot-com bubble — and 4 that survived

The dot-com crash, 25 years ago this month, killed some companies and wounded others. But some tech giants eventually thrived

The arrival of the internet in the mid-1990s set off an investment boom as techies and entrepreneurs tried to work out what the “World Wide Web” could do — and how to make it turn a profit. Investors, afraid of missing out on a technological revolution, were willing to provide almost unlimited capital.

This led to some companies that have prospered to this day — and others that floated on a raft of cheap money without any clear route to profit, or even a well-defined business model. It was also the era of the so-called “burger company,” born to be flipped to a larger firm.

It all started falling apart 25 years ago this month, when the dot-com bubble was followed by the dot-com burst and crash of 2000. The Nasdaq Composite index peaked at 5,048.62 on March 10 of that year, more than double its value from just a year earlier. Within weeks of that high, the index began its fall, with a mix of factors spooking investors. Eventually, the Nasdaq shed more than 75% of its value, wiping out $5 trillion in market capitalization.

Some firms were caught by the falling tide and simply went bankrupt after running out of money. Others were bought by other companies or struggled on for a few years before succumbing. A few giants took a hit but bounced back, while others never fully regained their former glory.

Check out who died, who survived, and who eventually thrived.

2 / 12

Victim: Pets.com

Possibly the most infamous failure of the first internet bubble, Pets.com was an online retailer of pet supplies. The company — which became famous for its puppy sock-puppet mascot — went bankrupt nine months after its $82.5 million initial public offering in February 2000. It never developed a working business model that could successfully challenge in-person retailers.

3 / 12

Victim: WebVan

The FreshDirect of its day, internet-based grocer WebVan shut down in June 2001 and filed for bankruptcy, laying off about 2,000 workers. It had burned through more than $800 million seeking to expand rapidly and cement its first-mover advantage by building its own infrastructure from scratch.

4 / 12

Victim: Kozmo.com

Kozmo was another early attempt at a web-based retail business that promised one-hour delivery of videos, games, DVDs, music, maps, books, food, and other goods. The venture capital-backed firm shuttered in April 2001, hamstrung by high costs and its refusal to impose delivery fees or minimum orders.

5 / 12

Victim: Boo.com

The U.K.-based fashion e-retailer burned through $135 million of venture capital in 18 months before going into receivership on May 18, 2000 — after having been online for less than a year.

6 / 12

Victim: Napster

Not technically a victim of the dot-com bubble, file-sharing service Napster was forced to shut down in 2001 to comply with a U.S. copyright ruling. After a bankruptcy, changes in ownership, and a merger with Rhapsody, the brand and logo are now the identity of a competitor to Spotify.

7 / 12

Victim: Compaq

The PC maker, already suffering from the price wars of the time, was pummeled by weak sales of higher-end computers during the dot-com bust and was purchased by HP in 2002 for about $24 billion. The new owner discontinued the brand in 2013, but the Compaq (HPQ) name has been licensed to other firms since.

8 / 12

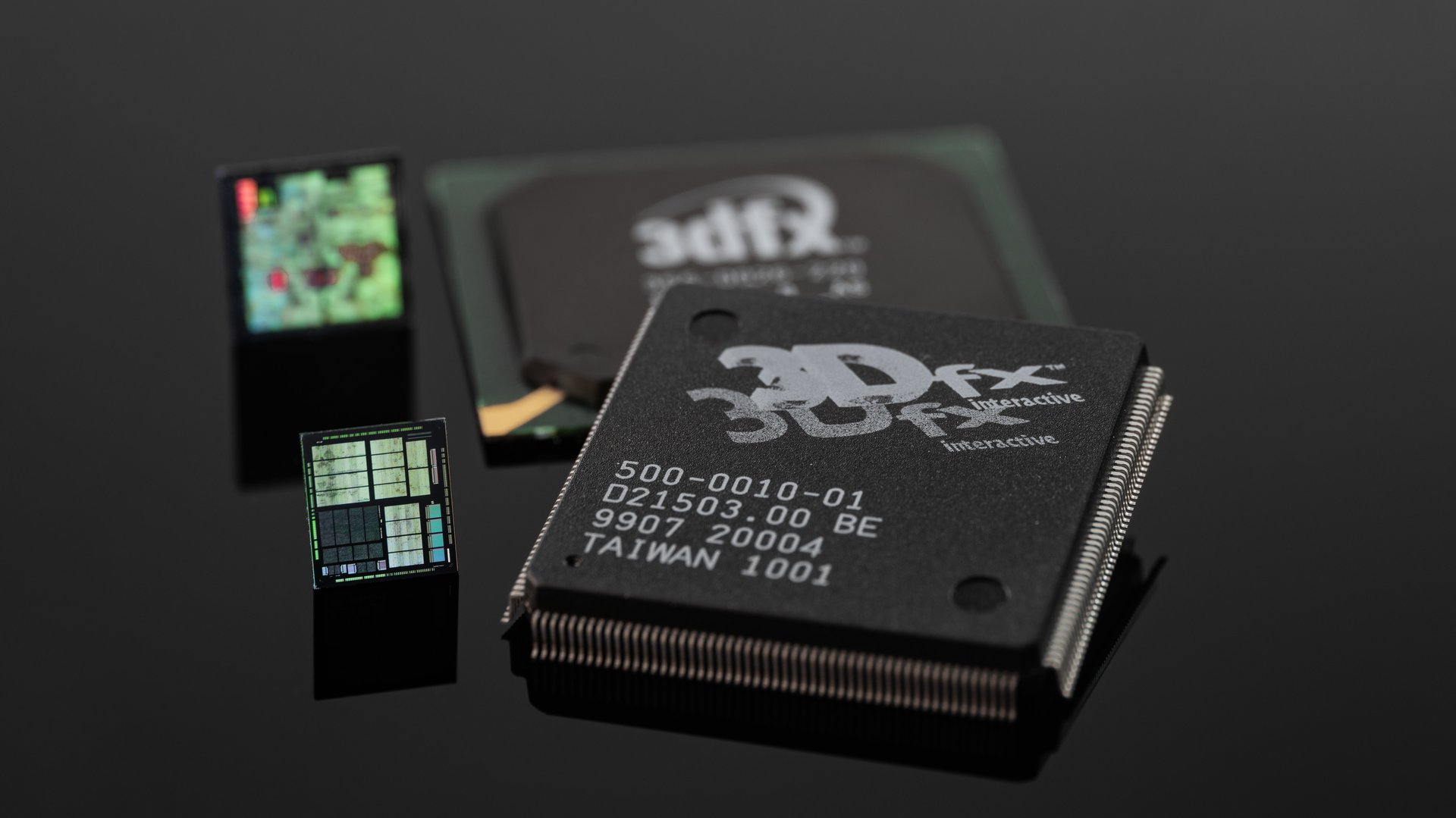

Victim: 3dfx

The graphics-card maker 3dfx (NVDA) Interactive sold most of its assets to Nvidia — which was principally interested in the company’s IP rights — in December 2000 and declared bankruptcy in 2002.

9 / 12

Survived but wounded: Yahoo

Yahoo! (APO) was the Google of the early internet era, providing a directory of websites and a “portal” — a start page from which to enter the internet — seen as a major prize in an era before tabbed browsing. The stock plunged from a split adjusted high of $125 per share to as low as $4 during the crash. While it survived, in part due to the funds it had raised at high valuations, it never regained its former status and is now owned by Apollo Global and Verizon. In search, it has long since been eclipsed by Google.

10 / 12

Survived and eventually thrived: Amazon

Amazon’s (AMZN) stock fell more than 90% during the dot-com bust. The selloff weighed particularly heavily on internet-based retailers, many of which didn’t have well-developed operating models or paths to profit. Jeff Bezos’ company took about 10 years to regain all the value it lost. But today it’s one of the most valuable companies in the world.

11 / 12

Survived and eventually thrived: Apple

Apple (AAPL) lost more than 80% of its market value during the collapse. The computer giant went through difficult times in the 1990s, losing market share amid the personal computer price wars of the period. The troubles prompted the return of Steve Jobs and a $150 million investment by Microsoft in 1997. But it wasn’t until the introduction if the iPod in 2001 and then the iPhone in 2007 that the company was on the path to becoming today’s $3.1 trillion behemoth — the most valuable company in the world.

12 / 12

Nvidia

Nvidia, which went public in 1999 at the height of the bubble, did fairly well during the ensuing crash, with its stock dropping just 15% and rebounding to fresh highs by early 2002. It had recovered from the 2009 market-wide selloff by 2016. It is now a leader in AI chipmaking and the second-most valuable company in the world after Apple.