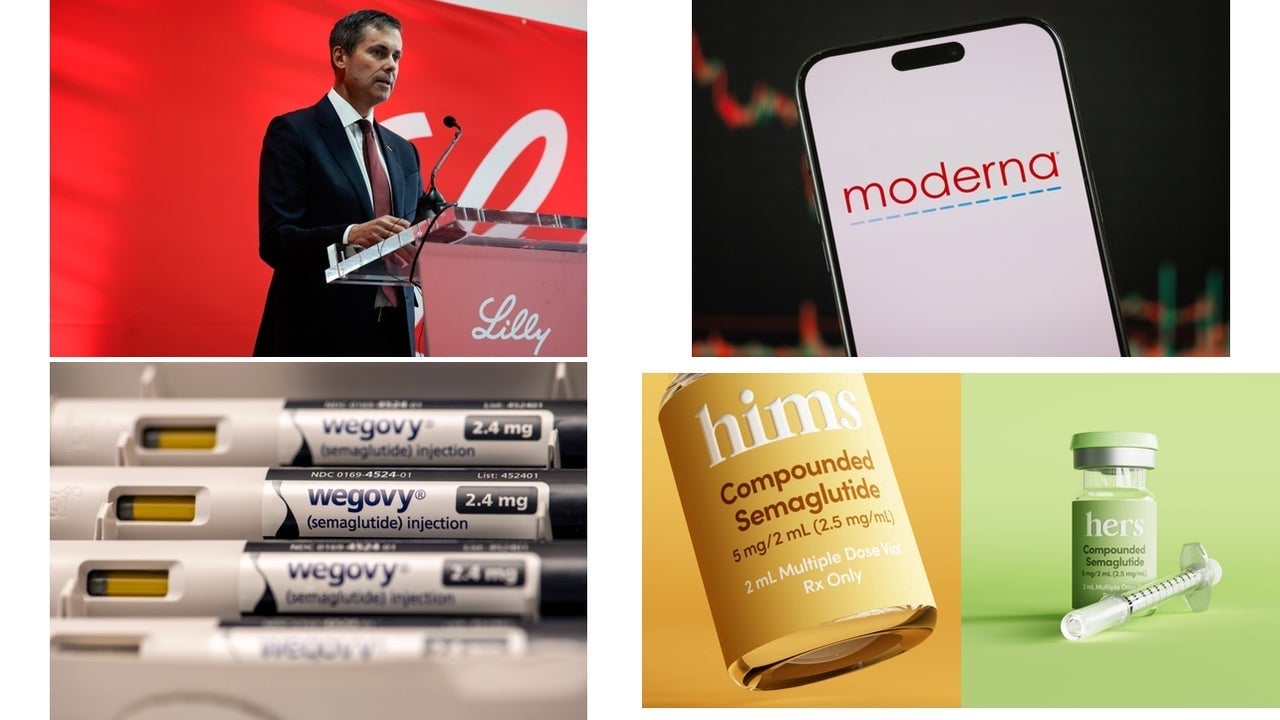

Eli Lilly's big investment, cheaper Zepbound, and what's next for Hims & Hers: Pharma news roundup

Plus, Moderna's bird flu contract with the U.S. is being evaluated

Eli Lilly announced plans to invest $27 billion in four new manufacturing sites in the United States. The pharma giant also made a wider range of doses of its blockbuster weight-loss drug Zepbound available in vials and at lower prices. Meanwhile, Hims & Hers, which profited heavily last year from selling an off-brand version of Ozempic, is now exploring alternative options after being forced to halt sales.

Check out those stories and more pharmaceutical news highlights from this week.

2 / 7

Eli Lilly (LLY), the maker of the blockbuster weight-loss drug Zepbound, announced Wednesday that it plans to invest $27 billion in four new manufacturing sites in the United States. But the company made it clear that those plans hinge on tax cuts. The new sites could create 3,000 permanent jobs and nearly 10,000 construction jobs, Eli Lilly said; the facilities would focus on producing active pharmaceutical ingredients (APIs) — the main ingredient in drugs, which the industry currently sources largely from China and other countries.

3 / 7

A $590 million contract awarded to Moderna (MRNA) by the U.S. government to aid in vaccine development for bird flu is being reevaluated, according to Bloomberg News. Bloomberg reports that the review is part of a government effort to re-examine spending on RNA-based vaccines, which is based on the same science that underpinned Moderna’s Covid vaccine. The vaccine contract was announced by the Department of Health and Human Services in the final days of the Biden administration. Vaccine-skeptic Robert Kennedy Jr. — a politician and lawyer, not a medical professional — now leads HHS.

4 / 7

A group that represents pharmacies that have been producing off-brand versions of GLP-1 weight-loss drugs just filed another lawsuit against the U.S. Food and Drug Administration (FDA). This time, it’s over the health regulator’s decision to remove semaglutide — the active ingredient in Novo Nordisk’s (NVO) popular Ozempic and Wegovy treatments — from its drug shortage list. Semaglutide has been on the agency’s shortage list since March 2022. During this time, pharmacies, telehealth companies, and other healthcare providers have been able to make and sell what are known as compounded versions of the drug. In its lawsuit, the Outsourcing Facility Association (OFA) claims that the agency is “dismissing evidence that the shortage persists” and that its decision will “deprive patients of a vital treatment.”

5 / 7

Hims & Hers (HIMS) made a killing last year selling an off-brand version of Ozempic, but with the drug’s shortage now declared over by the FDA, the company will soon have to halt sales of its cheaper alternative. That said, the millennial-focused telehealth company still has a few options on the table.

6 / 7

Eli Lilly (LLY) is making more doses of its blockbuster weight-loss drug Zepbound available in vials and at lower prices. The pharma giant announced on Tuesday that it is now expanding its single-dose vial offerings of Zepbound to include higher doses. Last August, Eli Lilly began selling the lowest doses of Zepbound — 2.5 mg and 5 mg — in vials rather than the standard auto-injector pen, cutting the price by about half. Now, it’s adding two higher doses to the mix and further reducing the price of the lower ones.

7 / 7

Hims & Hers (HIMS) stock took a steep dive, dropping more than 27% Tuesday morning — even after the millennial-focused telehealth company reported soaring sales for 2024 just the night before. Hims & Hers reported a striking 69% jump in sales for 2024, reaching $1.5 billion. But despite the strong growth, investors appear rattled by the looming loss of a key sales driver later this year.