✦ How to finance an ultrasound machine

Hi, Quartz Africa members!

Hi, Quartz Africa members!

Healthcare in African countries tends to be heavily underfunded by governments. Only a few nations are able to spend the World Health Organization’s recommended $34 to $40 per person per year in basic healthcare, and millions of people on the continent die every year from malaria, tuberculosis, HIV/AIDS, and other diseases.

Private healthcare, on the other hand, is underinvested in, despite delivering almost half (pdf) of Africa’s health products and services. In the rural and poor urban areas of many countries, private primary-care clinics have sprung up to fill the gaps left by the public system. They are often the only healthcare option available, even though many of these establishments can’t afford basic infrastructure, like lab equipment needed for early disease detection.

What that does leave is more opportunity for innovation. Already, entrepreneurs and venture capital firms are starting to see the enormous potential around healthcare services in Africa, and developing solutions that expand access to medical practices, diagnostic tools, and financing.

🌍 Tell us what you think! To make sure Quartz Africa provides the content you’re looking for, we need to hear from you—take this four-minute survey to tell us what you think and how we can improve.

Cheat sheet

💡 The opportunity: Inadequate funding for healthcare, exacerbated by covid-19, is forcing traditional providers to change their models and adopt new tech products, creating opportunities in the industry.

🤔 The challenge: To ensure access, providers need to have proper infrastructure; services must be affordable, readily available, and optimized for customers.

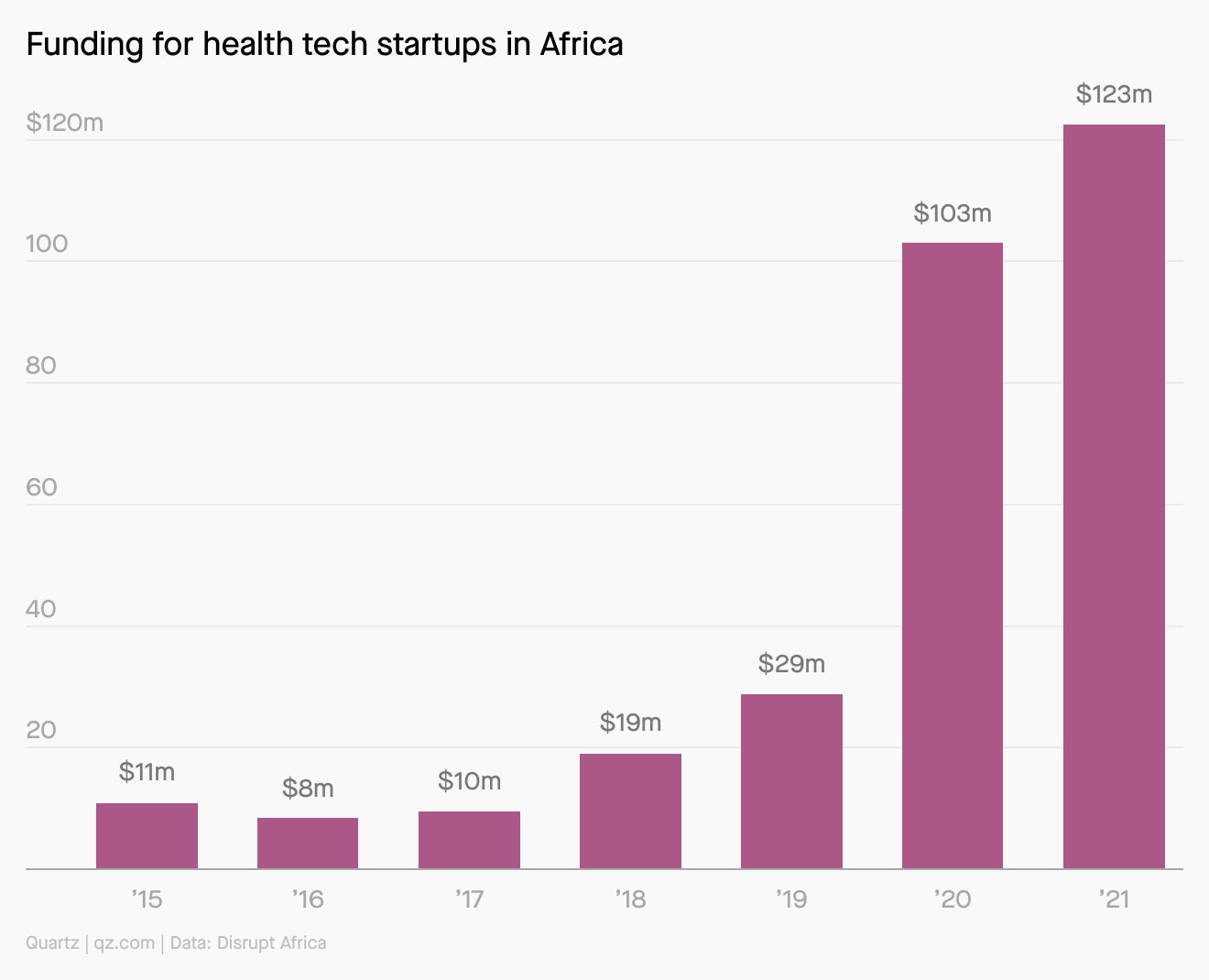

🌍 The road map: The health-tech sector is relatively young, with many sub-sectors, such as infrastructure financing, still underdeveloped. Also, most funding to date has gone to health-tech startups in the “big four” African countries: More than 80% of such funding in 2021 went to South Africa, Nigeria, Egypt, and Kenya, leaving other areas relatively untapped.

💰 The stakeholders: Existing health-tech startups in Africa include Vezeeta, mPharma, 54gene, and Ilara Health. VC firms participating in funding these companies include AfricInvest, Gulf Capital, Saudi Technology Ventures, JAM Fund, and Unbound.

5.7%: Portion of all Africa funding that went to e-health startups in 2021

55: Number of African e-health startups that raised money in 2021

19%: Increase in funding to African e-health startups from 2020 to 2021

$2.2 million: The average raised by each African e-health startup in 2021

The case study

Name: Ilara Health

Some of the deadliest diseases in Africa can be controlled by early detection, but many people in the continent struggle to access even basic blood tests. That’s because primary care clinics often can’t afford them, making evidence-based disease diagnosis difficult.

To address that infrastructure challenge in Kenya, Nairobi-based Ilara Health provides essential diagnostic devices to small primary healthcare clinics that typically lack capital and have limited access to credit. Clinics pay 10-20% of the cost upfront, and the rest in installments over two to three years. In the event of a default, Ilara recovers its devices for resale.

Ilara’s available devices include ultrasound machines, hematology machines, hemoglobin test devices, and chemistry analyzers. The startup’s staff go door-to-door to clinics, and Ilara has to date partnered with about 1,100 clinics in Kenya, across 42 counties and issued over 1,700 devices. To access affordable devices itself, Ilara partners with companies using next-generation equipment whose technology lowers manufacturing costs allowing Ilara Health to pass on those cost savings to end users.

In conversation with

Maximilian Mancini is one of the three co-founders of Ilara Health. He is also its chief strategy officer, with professional experience that includes three years as a London-based investment banking analyst in healthcare. Here are some choice quotes from our conversation.

💡 On starting Ilara Health:

⚕️ On Ilara Health’s goal:

🇰🇪 On starting a business in Kenya:

Healthcare deals to 👀

LifeQ, a South African provider of biometrics and health information from wearable devices, raised $45 million last year to scale operations. LifeQ’s data are used in health management solutions.

Vezeeta, an Egyptian startup for searching, booking, and reviewing doctors and medical services, in 2020 raised $40 million to boost product innovation and fund global expansion.

mPharma, a Ghana-based startup that is building a network of pharmacies, raised $35 million this year for expansion and building its tech infrastructure.

🎵 This brief was produced while listening to “Katerina” by Bruce Melodie (Rwanda)

Have a highly motivated rest of your week,

—Carlos Mureithi, Nairobi-based Quartz Africa contributor and former East Africa correspondent

One 🩺 thing

In 2021, 50.9% of funding for African e-health startups went to companies in South Africa. 10 of the 55 e-health startups that were funded in 2021, were in South Africa accounting for sizeable deals.