Africa’s reverse missionaries, Bitcoin’s ponzi-driven rise, agribusiness not agriculture

*Apologies for a delayed Brief this week.

*Apologies for a delayed Brief this week.

Hi, Quartz Africa readers!

Made in Africa

Even though the global economy has evolved significantly in the last few decades away from the industrial revolution which transformed the world’s advanced countries, there’s still much hope tied to the idea manufacturing will play a key transformative role in Africa today.

Yet, it may be foolish to place too big a bet on manufacturing in Africa, according to a new research paper from US think tank, Center for Global Development.

The researchers who used World Bank data looked at 5,500 firms in 29 countries compared labor and capital costs, productivity and efficiency of manufacturing in sub Saharan Africa with similar countries outside Africa, in particular Bangladesh. They did not have good news for most of the region.

In a bid to find out if African countries can “break into global manufacturing in a substantial way”, the researchers found factories in Africa were almost always more expensive to start and run. Looking at overall costs, small African firms had a 39% premium over comparative firms elsewhere while medium and large firms were around 50% more expensive.

Take a middle income African country like South Africa, labor costs were described as “very high” despite unemployment levels as high as 30%. A mix of structural factors, restrictive labor laws and high minimum wages mean the continent’s most advanced economy, is “not likely to emerge as a strong competitor in labor-intensive industry in the foreseeable future.”

Stable, coastal countries like Senegal, Kenya and Tanzania seem like strong candidates for a leading role in global manufacturing, yet they’re still too expensive. For example, the labor cost per Kenyan worker is $2,118 compared with Bangladesh where it’s $835. The capital cost per Kenyan worker is nearly $10,000, but it’s less than $1,100 in Bangladesh. As a middle income country, Kenya has a higher GDP per capita ($1,116) versus Bangladesh ($853). But even low income Senegal (GDP per capital $775) is twice as expensive as Bangladesh in terms of labor and capital costs.

There is good news, and it’s mostly all in Ethiopia. The researchers believe Ethiopia, already leading the way as Africa’s 21st century center for manufacturing, has the best likelihood of being the “New China” as labor costs rise in the “world’s factory” and social issues such as child labor arise in some other Asian countries. Fashion brands like H&M, Guess and J. Crew are already finding potential in Ethiopia, one of the few African countries whose labor costs ($909) are close to Bangladesh in the research.

The researchers are reluctant to speculate why African manufacturing costs are so high, but it isn’t difficult to imagine what some of the challenges would be. A lack of infrastructure such as transport networks and stable electricity in many poor African countries plus low levels of education will mean factory running costs and the African worker are going to be more expensive than they need to be. This can get exacerbated by unhelpful regulation and poor policy.

That’s why the authors suggest “carefully designed industrial policy” to “possibly unleash the potential for manufacturing and rapid industrialization.”

— Yinka Adegoke, Quartz Africa editor

Stories from this week

Cameroon’s Anglophone crisis isn’t about language—but resources. The French/English divide in Cameroon has led to a crackdown and killings that has seen protesters pushing for a separatist agenda. But as Amindeh Blaise Atabong reports from Yaoundé, the crisis is less about language and more about access to power and economic privileges.

Africans will be a third of all people on earth by 2100. Projections show that more than one in three people who exist on earth at the end of the century will live in Africa. Gilles Pison explains how a combination of declining mortality rates and high fertility are driving this rapid growth.

Africa’s “reverse missionaries” are bringing Christianity back to the UK. British missionaries once brought the Bible and Christianity to Africa. But as the tide of secularism rises, Lily Kuo finds in York that African Christians who come to the UK are revitalizing the religion in the country of the people who first brought it to them.

Africa’s richest man has a built-in advantage with the Nigerian government. Billionaire businessman Aliko Dangote has done a great job of establishing his reputation as the investor who bets on Nigeria more than any other, local or foreign. Yet this has come at a cost, thanks to successive Nigerian governments allowing one Dangote concession too many with far too few benefits to the country, argues Feyi Fawehinmi.

Startup funders can now look to raise money closer to home in Africa. The pan-African software developer training company Andela raised $40 million in its latest funding round backed a coterie of African-led investors. It shows startups can now raise significant rounds from VCs with a better understanding of local markets explains Yomi Kazeem.

Bitcoin’s rise in Africa is being driven by an old Russian Ponzi scheme. Cryptocurrencies are slowly becoming an important component in many developing countries especially those with unsteady financial markets. In Africa, Chelsea Barabas explains how the controversial large Russian Ponzi scheme MMM is driving bitcoin’s demand everywhere from Kenya to Zimbabwe to Nigeria.

Chart of the week

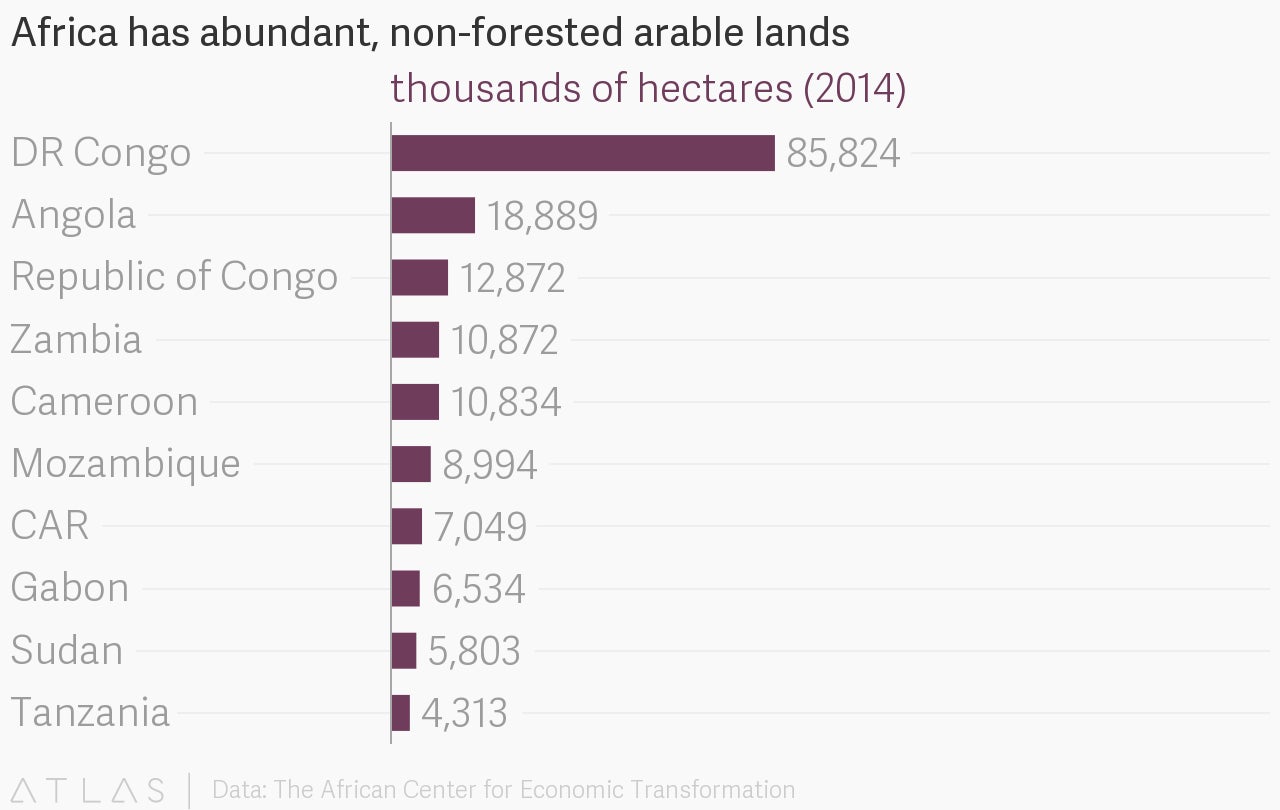

The future of farming in Africa is not agriculture but agribusiness. Africa has roughly over half the global total of uncultivated arable land, but is still unable to feed itself and achieve food security. To reach these goals, and draw younger educated Africans into farming, policymakers need to frame agriculture less as a subsistence activity and more as a business, reports Abdi Latif Dahir.

Other Things We Liked

Once the face of Liberia’s war, a former soldier runs for office. The image of Joseph Duo jumping in the air after firing a rocket-propelled grenade became one of the most defining photos of the Liberian conflict. In this week’s elections, Duo, armed with his college degree, was among 984 aspirants vying for a seat in the legislature, Claire MacDougall reports for the New York Times.

The world’s longest river is sick—and getting sicker. Battered by population growth and climate change, the Nile river is crumbling and impacting lives for the worse. Traveling along the river from Ethiopia to Egypt, Peter Schwartzstein writes in the BBC about how the death of the river could trigger a regional conflict.

Keep an eye on

UN Africa Week (Oct. 16-20). The United Nations Africa Week showcases the continent’s advancement in socio-economic, political, and environmental sectors. The event will take place in New York.

Botswana, Zimbabwe, Nigeria, and South Africa inflation rates (Oct. 16-18). Inflation rates in Botswana and Zimbabwe will be announced on the 16th, Nigeria on the 17th, and South Africa on the 18th. In Nigeria, this comes as the presidency seeks approval from lawmakers for $5.5 billion of foreign borrowing.

AfriLabs Annual Gathering 2017 (Oct. 18-20). The largest gathering of technology and innovation hubs in Africa will take place in Cairo, Egypt. The theme this year is “Smart Cities,” and looks at how big data and the internet of things to improve life in African cities.

Our best wishes for a productive and thought-filled week ahead. Please send any news, comments, suggestions, Dangote tax benefits and African bitcoins to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.