Africa’s 2020 elections, Nigeria’s weak passport, Zimbabwe’s China currency swap

Hi, Quartz Africa readers!

Hi, Quartz Africa readers!

Invest here

We noted last week how the fast growth at some of Africa’s small to medium-sized economies is expected to help Africa’s aggregate economy outpace the global average.

For some, the issue of whether real gross domestic product is still a useful measure of economic progress is a matter for serious debate. This is particularly important when it comes to African countries because many still underperform on global developmental metrics even after several years of higher than average GDP growth.

Regardless of whether GDP or other metrics of human wellbeing are the best way to measure economic progress, this hasn’t stopped savvy investors from taking risks in African markets—and some have benefited greatly.

Perhaps the best recent example is Shenzhen, China-based Transsion, which has never sold a phone in China but is Africa’s top seller of mobile phones with a 40% plus market share. Last September, Transsion successfully raised $400 million in its $6.5 billion initial public offering on Starboard, China’s new Nasdaq-style stock exchange. Transsion’s success has encouraged other Chinese startups or relatively young companies to look to Africa.

And it’s not just Chinese companies, Orange the French telecoms giant has consolidated its Middle East and Africa businesses with a new headquarters in Casablanca, Morocco. The company has confirmed it is looking at an IPO among other options for the new unit. The consolidated business which has enjoyed a 6% growth rate does about €5 billion ($5.6 billion) in annual revenue and has an enterprise value (equity + debt) of around $11 billion.

African consumers might not yet generate the highest average revenue per user for a mobile network operator and smartphones need to be priced below $50 to sell in large numbers in Africa, but 1.2 billion people are valuable for any business serious about building scale.

But how do ordinary African investors and their countries benefit when international companies build value by serving African consumers? This is not a completely new issue, traditional multinationals and extractive companies have, for better or worse, done business on the continent for well over a century. What is different is the increased speed and transparency of the digital age.

It’s perhaps yet another reminder of the need for more homegrown investors and better economic policies to support local investment.

— Yinka Adegoke, Quartz Africa editor

Five stories from this week

These are the key African elections to watch in 2020. Millions of Africans will go to the polls in 2020 to elect their leaders with political stakes high, as always. Rudolf Ogoo Okonkwo analyzes expectations as Ghana, Côte d’Ivoire and Tanzania are among ten countries that will be voting for a president. Another nine countries will have parliamentary elections.

Nigeria dropped the most in the ranking of powerful passports over the last decade. Nigerian passport holders can visit fewer countries now than they could in 2010 without first obtaining a visa. It’s a decline in passport power that has seen Africa’s largest economy increasingly become home to one of the continent’s weakest passports.

A fresh crop of China’s most promising tech companies are looking to set up shop in Africa in 2020. Much of the focus on Chinese interest in Africa has focused on infrastructure and construction. But after poring over the prospectuses of companies listing on China’s Starboard exchange, Alexandria Williams finds a new wave of Chinese tech and biotech companies are looking to Africa for success.

Fintech startups are making it easier for Nigerian millennials to invest in US stocks. A lack of know-how and on-boarding requirements for US brokerage firms have long prevented middle-class Nigerians from easily investing in US stocks. However, as Yomi Kazeem explains, a crop of fintech companies focused on wealth management are bridging that gap and enabling young Nigerians buy slices of the world’s most profitable companies.

A currency swap deal with China could backfire on Zimbabwe’s hope to build forex reserves. Amid its worst economic crisis in decades, Zimbabwe is banking on a currency swap deal with China to ease lingering problems. But, as Farai Shawn Matiashe in Harare explains, the benefits of the deal appear far more tilted towards China than Zimbabwe.

Chart of the Week

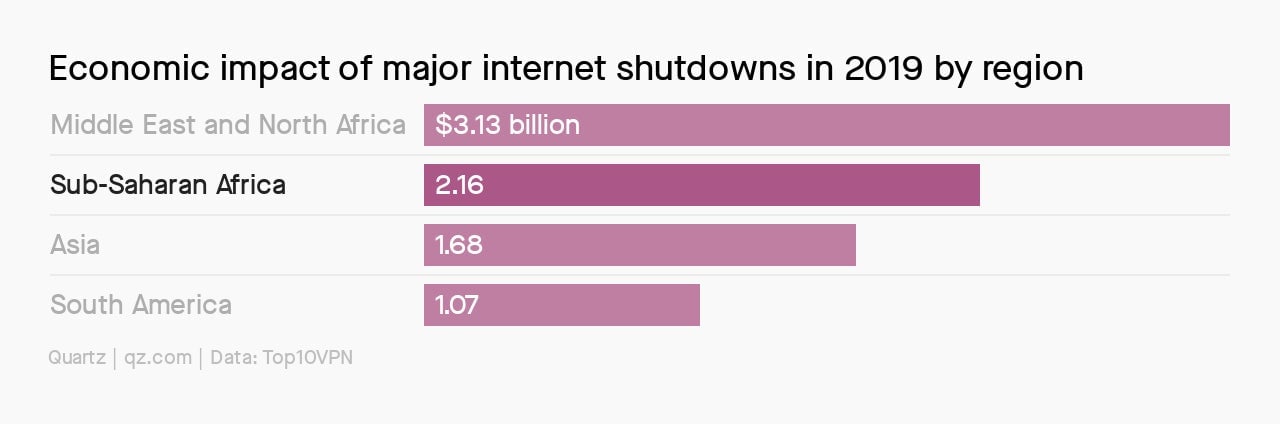

Internet and social media shutdowns cost African economies over $2 billion in 2019. Deliberate internet and social media blackouts lasted nearly 8,000 hours across Sub-Saharan Africa. But they came at a major cost as Africa accounted for around 25% of global economic impact of internet access disruptions.

The Dealmaker

Samurai Incubate, a Tokyo VC firm, has launched the Samurai Africa No. 2 Fund with a target of 2 billion yen ($18 million). It will target investments of around $50,000 to $500,000 in Kenya, South Africa and Nigeria with a focus on sectors including finance, logistics, healthcare and e-commerce…Mubawab, a real estate classified ads platform, raised $7 million from Emerging Markets Property Group, a United Arab Emirates-based real estate group. Mubawab operates in Algeria, Morocco and Tunisia as well as other Middle East states…Iyin Aboyeji, a co-founder of Andela and Flutterwave, has launched the Future Africa initiative—an early-stage investment fund that will offer $50,000 in funding to up to 20 African founders annually.

Quartz in Nairobi

Quartz Africa is looking a full-time reporter based in Nairobi to cover East Africa. The role is best suited to a journalist with at least three to five years’ experience, a strong sense of how to write a headline and frame a story, and take an entrepreneurial approach to their work. They’ll also be able to convey curiosity and humor in their writing and to use alternative story forms and data. International experience and languages are a plus. Please read the full job details here and apply by Jan. 31.

Quartz Membership

Accounting is at a crossroads. The Big Four accounting firms “are under more scrutiny than at any time since the Enron scandal,” writes Quartz contributor Michael Rapoport. This week’s state of play explains what’s wrong with how public companies are audited and how the industry is trying to course correct.

Other things we liked

African history did not start with the Transatlantic slave trade. In an essay which focuses on West Africa, historian Toby Green in Aeon tackles the tendency to focus on the slave trade as the key period of African history. “Even at the height of the Atlantic trade, there is much more to say about West African history than can possibly be glimpsed by focusing only on the slave trade.”

The problem with being optimistic about Kenya’s debt management. For The Elephant, economist David Ndii digs into the numbers for Kenya’s economy and comes out feeling not very confident about the current government’s ability to manage the amount of debt it piled on in the last decade. As Ndii sees it, Kenya doesn’t so much have a looming debt problem as an ongoing revenue crisis.

Patrice Lumumba, the one who preferred death to imperialism. The killing of Congo’s (now DR Congo) first prime minister Patrice Lumumba had reverberations beyond Central Africa and backfired on those believed to be involved. As well as sparking global outrage, it disgusted nationalists across southern Africa, writes Brooks Marmon for Review of African Political Economy.

ICYMI

NextGen Ecosystem Builders Africa 2020. A management development program for startup teams in African accelerators and incubators. (Jan. 30)

Future Food Fellowship. Up to ten fellowships will be awarded to support research projects at post-doctoral level in areas of food and nutrition sciences. (Mar. 31)

Keep an eye on

UK-Africa Investment Summit 2020, London (Jan. 20). The British prime minister Boris Johnson will host African governments and businesses to showcase and discuss investment opportunities across the continent and the UK’s role in supporting through investment and partnerships.

Fifth African Diaspora Investment Symposium Jan 23-25 (Silicon Valley. African diaspora entrepreneurs will gather at the Computer History Museum in Mountain View, California for this event and the Builders of Africa’s Future Awards. Major corporations including Ebay, Johnson & Johnson, SAP and more are joining, as well as Kenya’s minister of ICT.

*This brief was produced while listening to Akulaleki by Samthing Soweto feat. Sha Sha, DJ Maphorisa & Kabza De Small (South Africa).

Our best wishes for a productive and ideas-filled year ahead. Please send any news, comments, suggestions, ideas, strong passports and election observer jackets to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.