Impressive crypto scams, gendered startup financing, stolen art

Hi Quartz Africa readers!

Hi Quartz Africa readers!

Early this month, 17 African finance ministers released a statement in support of IMF managing director Kristalina Georgieva in the wake of allegations that she instructed staff to manipulate data to favor China while she was the chief executive of the World Bank.

Last month, an inquiry found that Georgieva had played a key role in interfering with the World Bank’s 2018 Doing Business survey. The allegations cast doubt on Georgieva’s future at the IMF, but after reviewing the claims, the fund’s executive board on Oct. 11 announced she was remaining as its managing director, saying their investigation “did not conclusively demonstrate” impropriety.

In their statement, the 17 African finance ministers lauded Georgieva and the IMF’s work for poorer countries, including debt forgiveness, and provision of more than $30 billion to African economies last year. They described Georgieva as a “true partner” who has “demonstrated integrity, energy, and progressive advice” and called for a fair investigation on the data manipulation allegations.

With the exception of Botswana, the countries that released the statement received millions of dollars in financial assistance and debt service relief from the IMF in 2020. Notable amounts include $8 billion to Egypt, $3.4 billion to Nigeria, and $2.47 billion to Sudan as financial assistance.

In the Doing Business rankings, the 17 countries gained an average of 11 positions during Georgieva’s tenure at the World Bank.

Hannah Ryder, CEO of Development Reimagined, an African-led international development consultancy with headquarters in China, said that rather than pay attention to Georgieva, the African finance ministers could have set their own agenda, and engaged on issues that are “much more substantive” related to the Doing Business report, including bias and the need for reform.

Instead, for Ryder, their choice to focus on Georgieva indicates more than anything that “the coordination process really needs to evolve.” —Carlos Mureithi, east Africa correspondent

Stories this week

Inside Africa’s impressive crypto scams. Africa is one of the fastest-growing regions for crypto adoption, but the popularity of the digital currencies is proving lucrative ground for scams. Carlos Mureithi looks into two of the world’s biggest crypto scandals, both of which stem from the continent.

France’s support of African startups raises questions. At an Africa-France summit held this month, French president Emmanuel Macron announced a fresh €130 million fund ($150 million) to invest in African startups. Alexander Onukwue explains the origins of the initiative, and asks whether Africans are given a voice in determining its priorities.

A year of Stripe ownership. What becomes of a thriving African tech company after it is acquired by the world’s most valuable startup? Alexander Onukwue looks back over the last 12 months to see how Paystack has evolved as far as product and growth, on the first anniversary of its acquisition by Stripe.

Nigeria steps up anti-fraud measures. As online transactions boomed in 2020, financial fraud went through the roof in Nigeria across all channels from mobile apps to USSD. In response, the country’s central bank published new guidelines to tighten the screws around its customer identity database, Alexander Onukwue reports.

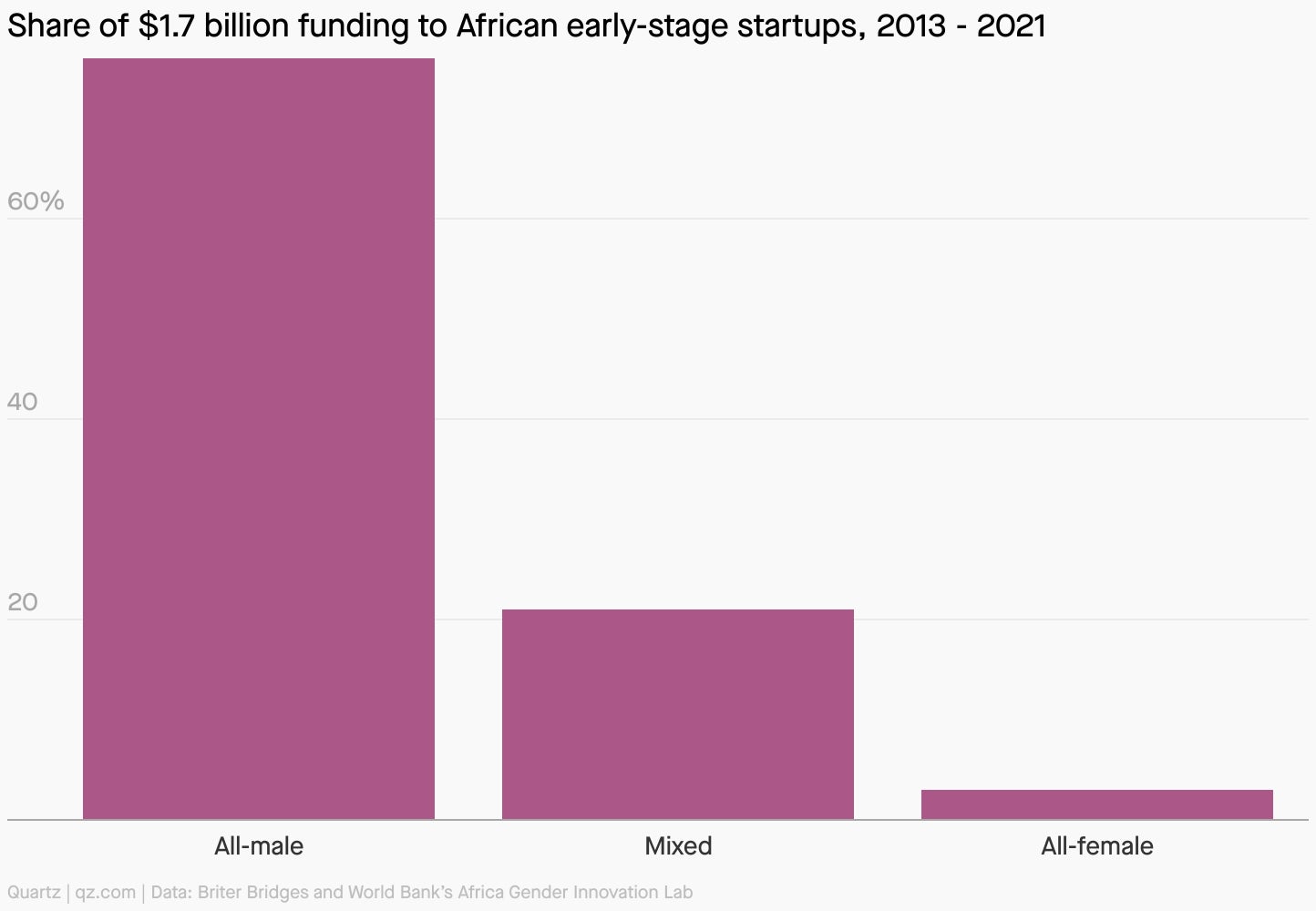

Charting the gender gap in African startup financing

At least five African fintech startups founded and led by women have raised more than $1 million in venture capital in 2021. Some of the women involved are among the most innovative African minds of 2021. But their companies remain outliers in a male-dominated funding environment, new research suggests.

The analysis, which is based on deals made since 2013, found that just 3% of $1.7 billion in investment went to all-female founding teams, with 76% channeled to all-male teams. Alexander Onukwue reports that this trend is as recent as 2020, and is most pervasive in sectors like fintech.

Dealmaker

IHS Towers, the Nigerian operator of telecom towers, went public on the New York Stock Exchange this week, raising $348 million on its first day. The 20-year-old company gained a $7 billion valuation from stock sales at $17 per share, with MTN being among investors that sold stock. It is the biggest IPO by an African company on the NYSE.

Tala, the 10-year-old company that provides quick loans in Kenya and four other emerging markets, has raised $145 million in an equity-only Series E round. Investors include Upstart, Stellar Development Foundation, Kindred Ventures, and the J. Safra Group. The company has come under scrutiny for its high-interest loans but says it has 6 million customers and has given $2.7 billion in loans.

Nigerian fintech Mono raised $15 million in a funding round led by Tiger Global, a US investment firm known for its rapid due diligence and aggressive investment strategy. It is Mono’s third equity raise in as many months since launching its open banking service in September 2020, and this deal is Tiger Global’s third African investment following bets on Flutterwave and Fairmoney earlier in the year.

Eden, a Nigerian company that provides food, cleaning, and laundry services to users at home, raised $1.4 million in a round by UK firm LocalGlobe, joined by Samurai Incubate, Future Africa, Village Global, Rising Tide Africa, and Enza Capital. Eden’s services are only available in Lagos, where 600 people use at least one of the services.

Quartz Gems

Netflix bingeing knows no borders. In 2014, Netflix gambled its audiences would watch content produced in countries around the globe. Fast forward to 2021, and there’s a very good chance that, if you’re a Netflix subscriber, you’ve seen the South Korean apocalyptic drama Squid Game, no matter where you live or what language you speak.

The Squid Game phenomenon underscores a fundamental change taking place in the viewing habits of western audiences, largely fueled by the broad, location-agnostic Netflix catalog. Though some viewers have started entire web forums around trying to get the platform to stop recommending foreign cinema, the reason Netflix’s algorithm includes content from all over is not some sort of kumbaya-like mission to unite the world. It’s simply discovered that investment in non-Hollywood movies and shows pays off, because people like them.

Coming up, we’ve got a whole edition of The Company focused on Netflix, so you’re going to want to add it to your queue. You’ll need a membership, though—sign up today and get 40% off with code QZEMAIL40.

Other things we liked

Reimagining African folktales. Netflix and Unesco are on the hunt for African filmmakers to work on six short films based on the retelling of “Africa’s most-loved folktales”. The Guardian’s Lizzy Davies reports on this initiative to find films that will premiere in 2022, the latest move by Netflix to further globalize African content.

Using mobile money to pay for music. In Africa, people are more likely to have a mobile phone than a bank account. For Reuters, Nqobile Dludla and Supantha Mukherjee write that music streamers are partnering with telecommunications companies to enable people to pay for the service using mobile money.

Using anti-slavery sentiment to steal art. African art is scattered in Western museums around the world, from Paris to Berlin. In Al Jazeera, Nosmot Badamosi goes deep into the history of Britain’s theft of African art.

How Africa was erased from history. The creation of the modern world is mostly credited to Europeans, but African ideas and African lives were the source of almost everything they achieved, writes Howard French in his new book, Born in Blackness, excerpted in the Guardian.

Tracking China’s hand in African tech. In TechCabal, Daniel Adeyemi examines how African tech has been affected by expanding Chinese influence, using Huawei’s footprint as a case study.

ICYMI

A conversation on private-public partnerships. Invest Africa and Black Mountain Investment Management will hold a panel discussion on opportunities for investors in private-public partnerships for state-owned corporations. (Oct. 21)

Staying updated on COP26. Quartz will be in Glasgow for the UN climate change conference known as COP26, and we’d like to bring you along with us—via email of course. Sign up for our free Need to Know: COP26 limited email by hitting the button below, and we’ll keep you posted. (Oct. 31-Nov. 12)

🎵 This brief was produced while listening to “Ngé” by Oliver N’Goma (Gabon)

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, Netflix recommendations, and crypto cash to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.