The era of WhatsApp banking is with us

Hi Quartz Africa readers,

Hi Quartz Africa readers,

How about forgetting all the ATM cards and banking apps you have and instead transacting through WhatsApp? That practice is already making inroads in east Africa, and it could be bigger than you can imagine.

This week I sat down with Kihara Maina, chief executive of I&M bank, with branches across east Africa. He is optimistic about the potential of WhatsApp banking, fueled by the rising affordability of smartphones and mobile internet.

“We want to keep offering customer-centric solutions to Africa’s youth.”

Though Absa was the first bank to launch the service in the region when it unveiled it for Kenyans last year, I&M has rolled it out in Tanzania and Rwanda in the past few months. Maina says it will launch in Kenya later in the year.

How does it work? Well, the bank usually has a contact that acts as a WhatsApp Business number. You have to save it in your contacts and then initiate a conversation by saying “Hi.” It will give you prompts to check balances, statements, requesting new checks, and more. To send money, you only need to open the chat window of the recipient, tap the payment option, type amount, enter PIN, and send the money.

Last year I interviewed Absa’s head of digital channels Andrew Mwithiga, and he said regarding security, “We have put up stringent measures to make WhatsApp banking secure for everyone. We have several security layers on the platform.” He also spoke about Meta’s double encryption and internal cybersecurity mechanisms.

The long term goal is to make your WhatsApp number your bank account just as your email is the bank account number on PayPal. It sounds convenient. If history has shown anything though, it’s that wherever banks are innovating, fraudsters will be on the lookout for loopholes. —Faustine Ngila, east Africa Correspondent

What to watch for in the Quartz Africa Member Brief

The number of businesses selling online in Africa has been rising in tandem with smartphone and internet penetration as well as the uptake of digital payment services. E-commerce revenues in Africa, which stood at $27.97 billion in 2020, are projected to hit $46.1 billion by 2025.

Sendy is a Kenyan logistics company that was founded in 2014 and primarily offered an on-demand delivery platform connecting riders and drivers to customers, who included businesses and individuals. The company has pivoted from A to B delivery to providing complete fulfillment infrastructure for e-commerce and consumer brands across the continent.

Learn more about Sendy in this coming Wednesday’s edition of the Quartz Africa Member Brief. To get the Member Brief directly in your inbox (and save 40%) by becoming a member today.

[button href=”https://qz.com/africa/subscribe/plan/?utm_campaign=0722-MemberBriefPreview-AfricaWeekly&code=QZAFRICA40″]Join Quartz Africa with 40% off[/button]

Stories this week

Nairobi’s startup magnet is getting stronger. After Rwanda launched a Fourth Industrial Revolution center, Kenya has responded by launching an international financial center. Conrad Onyango explores how this could attract more funding for startups.

MTN Nigeria’s newest bank lost $53 million in a few days. The company’s finserve subsidiary, MoMo, suffered a widespread cyberattack. Alexander Onukwue reports on the scale of the damage and examines why MTN is suing 18 commercial banks.

This is where to invest in west Africa. Startups in the region are attracting more funding than any other cardinal region in Africa. Seth Onyango explains why, highlighting the best countries to invest in.

How Rwanda became a nation of four official languages. Linguistics researcher Jeremie Eyssette looks at how the history and policies of Rwanda’s languages are benefitting the country of a thousand hills.

Morocco is cracking down on migrants. Instead of prosecuting rogue police forces who contributed to the death of 23 migrants attempting to cross the Melilla border to Spain, Morocco is charging 65 migrants in court. Faustine Ngila examines the ordeal.

Person of interest

Fatmata Binta has popularized the culture and cuisines of the Fulani people, who are nomadic pastoralists in west Africa. The Fulani make up the biggest nomadic tribe in the world, with more than 20 million people moving tirelessly across the Sahara Desert.

Binta is the first African to bag the Basque Culinary World Prize worth $105,000. Faustine Ngila takes a look at how Binta beat 1,000 applicants around the world.

Quotable

“It’s surprising how a bandit would own a gun while a good man trying to defend himself and his family doesn’t have one.” —Bello Masari, governor of Katsina state in Nigeria

Zamfara state in Nigeria wants farmers to arm themselves. The state is asking 10,000 farmers to apply for gun licenses to defend themselves against attacks. Alexander Onukwue explores the reasons behind this curious occurrence, but also the risks involved in getting more weapons into people’s hands in a country that has a huge black market for firearms.

Spotlight on a Quartz Africa 2021 innovator

When we use ride-hailing, food delivery, or banking services, each transaction generates specific data about us that can be used to create new, customized services. But these data are in each provider’s silo, which means innovators often lack reliable, secure access to them.

This is the problem Fara Ashiru Jituboh is solving with Okra, a financial data company that is moving beyond open banking (nudging banks to open their vaults of customer data) to pioneer open finance in Africa. Jituboh’s vision is that Okra becomes a single channel for any business to request customers’ data—wherever the data are, with the users’ consent, and at the least possible cost. For customers, the reward is a larger pool of solutions based on their own data.

Check out Quartz Africa’s Innovators 2021 list, which showcases the pioneering work of female Africans.

Dealmaker

Kukua, the company behind Africa’s first animated superhero franchise, Super Sema, raised $6 million in a round led by Chinese tech giant Tencent and Alchimia. Kukua’s offices are in Nairobi and London, and this is its second raise since a $2.5 million round in 2018 when it was founded.

Sava, a South African fintech startup, raised $2 million in a round in which many African investors—including Quona Capital, Breega, CRE Ventures, and Ingressive Capital—participated. The company’s product is for small businesses to manage their expenditure and keep records. Its next step: providing credit cards.

Quartz Gems

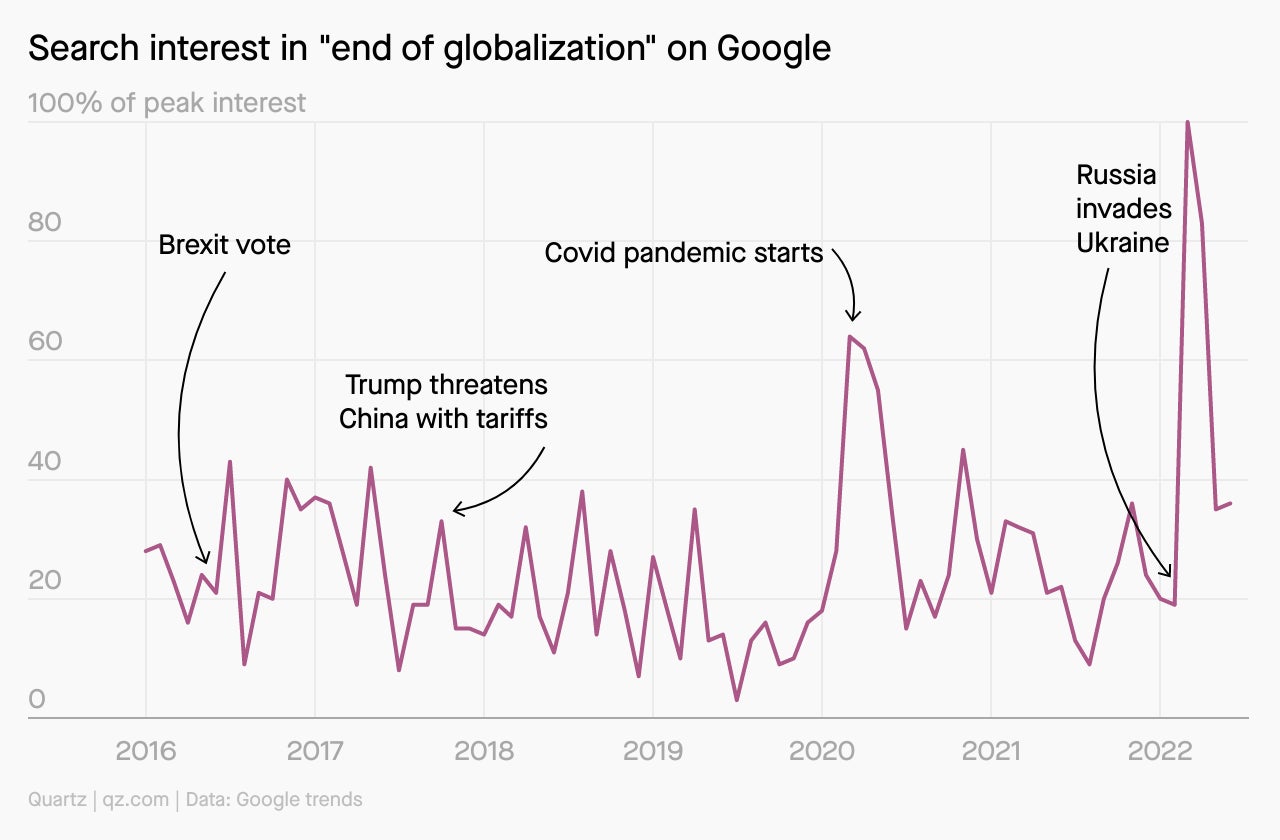

The end of globalization has been greatly exaggerated. In 2016, after the Brits voted to exit the EU, many took it as a sign of globalization’s unraveling. The alarm sounded again in 2018, when then-president Donald Trump launched a trade war on various fronts. In 2020, covid triggered a whole new wave of predictions about the collapse of global economic integration, with calls of globalization’s death reaching a fever pitch after Russia invaded Ukraine earlier this year.

The best of the Quartz Obsession podcast

🐱 A pasta ad where a child rescues a kitten.

🦶 An ancient wooden toe.

🤢 A ball of undigested squid beaks.

We had so much fun on the Quartz Obsession podcast that we created a bonus episode of some of our favorite moments from the past season. We’ve partnered with Hark Audio, a podcast curation app, to share them with you. The cool thing about Hark is that you can jump from each moment into a full episode. Try it out!

Other things we liked

LGBTQ asylum seekers from Nigeria are among deportees from the UK. Nigerian authorities received 38 migrants among them gay people from the UK last Thursday. The BBC’s Chris Ewokor explains why they were sent back despite staying in the UK for decades.

Ghanaians are protesting against a new levy. At 26%, inflation is hitting Ghana hard. Citizens were angered by the government’s decision to impose a 1.5% tax on electronic transactions and took to the streets, as reported by Business Insider’s Emmanuel Abara Benson.

Zimbabwe’s plan to mint gold is exciting investors. Al Jazeera’s Chris Muronzi reports that president Emerson Mnagangwa is keen on minting gold to curb rising inflation in the country and triple the lending rate from 80% to 200%—a move that makes investors happy.

When you kiss nyaope, you marry it. New Frame’s Nation Nyoka explores the plight of young women living in a drug house in Gauteng, South Africa who are addicted to a low grade form of heroin called nyaope.

ICYMI

Picture the global good. Apply for the 2022 CatchLight Fellowship for creative leaders in storytelling and stand a chance to receive $30,000 in financial support. (July 18)

Apply for a $12,000 grant. The Association of Commonwealth Universities has announced applications for the Human Resources in Higher Education Community Challenge grants. (Aug. 15)

🎵 This brief was produced while listening to “Allo” by Balti (Tunisia)

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, WhatsApp banks, and Fulani dishes to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.