Coronavirus: Mall but dead

Hello Quartz readers,

Hello Quartz readers,

Remember shopping? Remember thinking to yourself “Maybe I will buy a thing today!” and then leaving your house to go do that? Remember meandering through a store, picking up and putting down various items, and strolling down unnecessary aisles? Remember silently convincing yourself that you do in fact need a hippopotamus-shaped gravy dish?

Shopping now is…different. Customers prize cleanliness and efficiency above all, and retailers long focused on making stores “experiential” now face a new mentality: Get in, get what I need, get out. That’s on top of retailers’ pre-pandemic challenges, including the shift to e-commerce and the looming shadow of Amazon (✦ Quartz member exclusive).

Today we’re looking at how coronavirus ripped a hole in US retail, and what things look like on the other side. Let’s get started.

Closing time

American malls have been in decline for years, but Covid-19 is increasing the pain. With stores shuttered and shoppers slashing discretionary spending, a large share of mall tenants are failing to pay their rents, and a wave of permanent store closures is likely. At the center: retailers that serve as important anchors in US shopping centers.

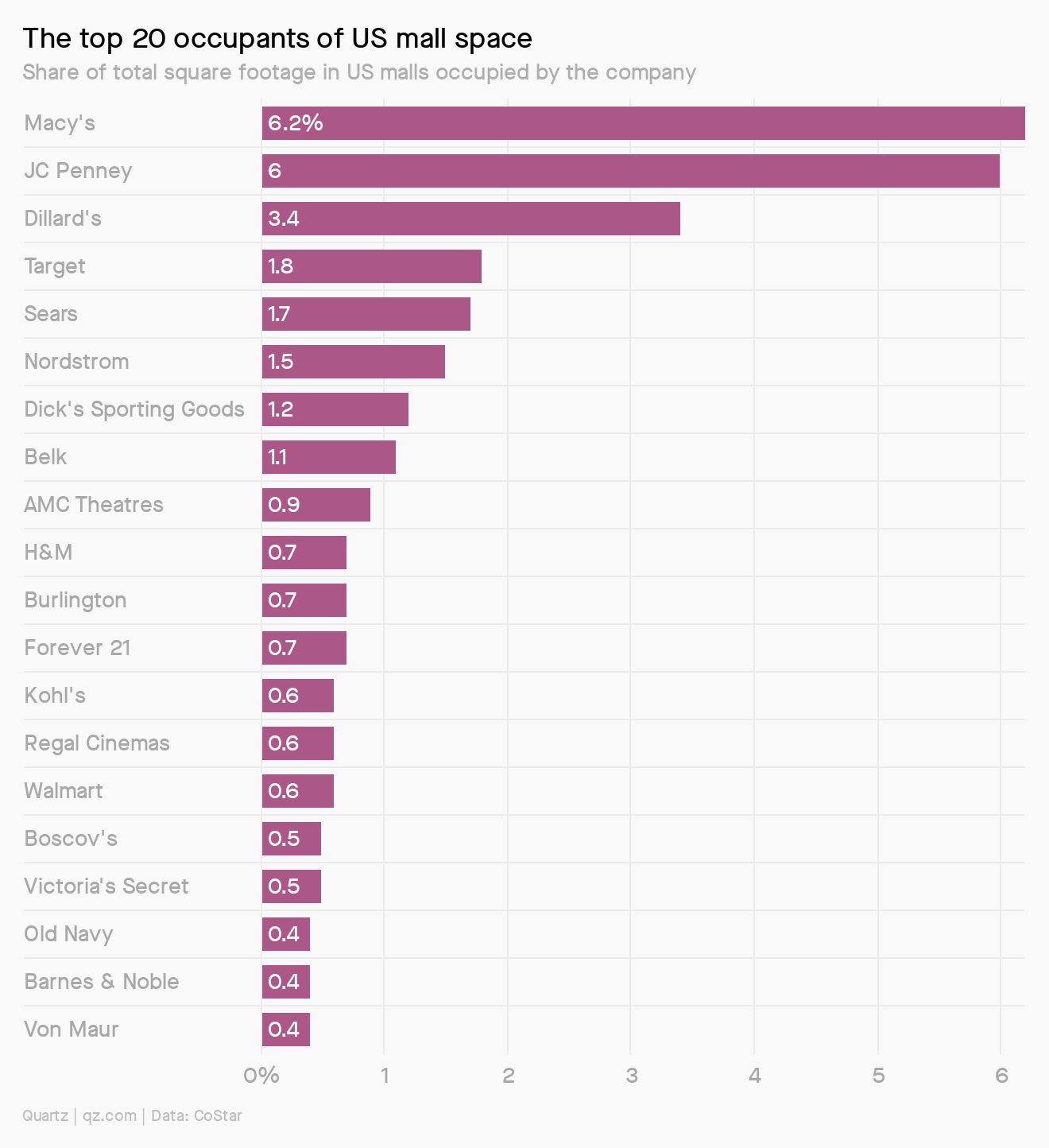

Take No. 1 mall tenant Macy’s, which occupies 6.2% of the square footage in US malls, according to real-estate information firm CoStar. On May 21, Macy’s said it expects about $1 billion in losses this quarter, equivalent to its entire profit in 2019. The next largest mall tenant, JC Penney, recently declared bankruptcy and announced it would close 242 stores. Other big renters of mall space include Nordstrom, which plans to close 19 stores, and Victoria’s Secret, which said it will close about 250 stores in the US and Canada.

CoStar found that 14 of the top 20 occupants of US mall space are department stores and apparel chains, which it said “puts malls at particular risk of future tenant move-outs.” These retailers have historically been critical anchors, generating foot traffic and luring other businesses, sometimes with co-tenancy clauses that allow them to break their leases if the anchor leaves. As more anchors close—Green Street Advisors estimated as many as half of mall-based department stores could shutter in the next two years—smaller tenants may abandon malls too.

The stores that remain could see visitors fall even further as shoppers avoid venturing into crowded indoor spaces. Respondents to one small survey of more than 500 US consumers by First Insight, a retail advisory firm, ranked shopping malls and department stores as the retail spaces they felt least safe shopping in as stores reopen. Respondents felt more secure in grocery stores, big-box stores, drugstore chains, and even small local businesses.

Mall that we want

Before the pandemic, gyms had started to pick up square footage in US malls. In a post-mall world, what else might fill the space? Here are a few ideas we came up with in the newsroom:

🎨 Indoor paintball

🎓 Universities

🏠 Affordable housing

👓 VR playground

💼 Coworking space

🌿 Giant greenhouses

Retails from the crypt

Just like when you’re buying clothes, it helps to see how things look. In five charts, here’s a glimpse at the pandemic’s impact on US retail.

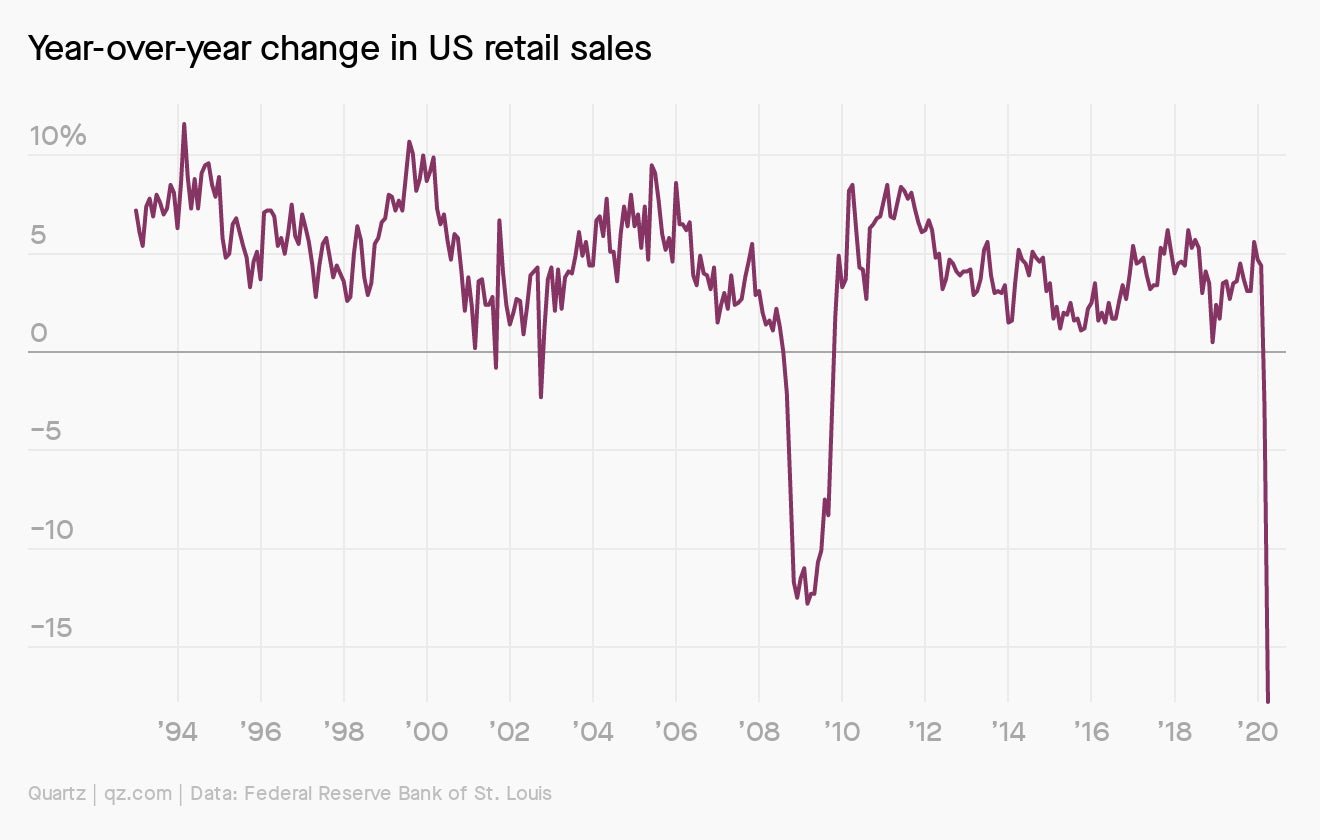

1️⃣ In April, US retail sales plunged 16.5% compared with last year, much worse than the 12.3% expected. “We have never seen economic data like this before in history,” Chris Rupkey, chief financial economist at MUFG Union Bank, told CNBC.

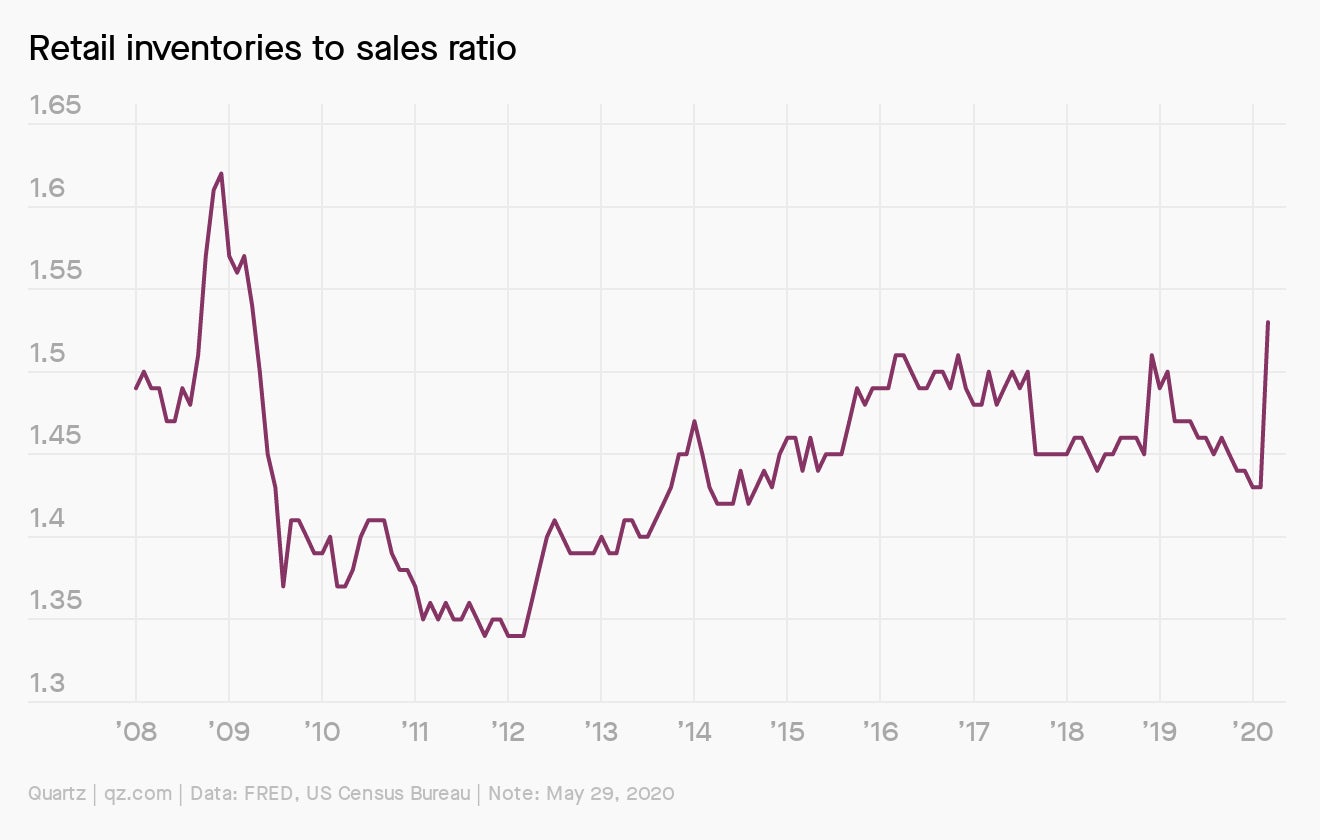

2️⃣ Retailers’ inventories-to-sales ratio is signaling the biggest glut of inventory in more than a decade. That’s a problem for fashion retailers especially, since they have seasonal items with a short shelf life. To make room for new collections, they’ll almost certainly have to lean heavily on discounts.

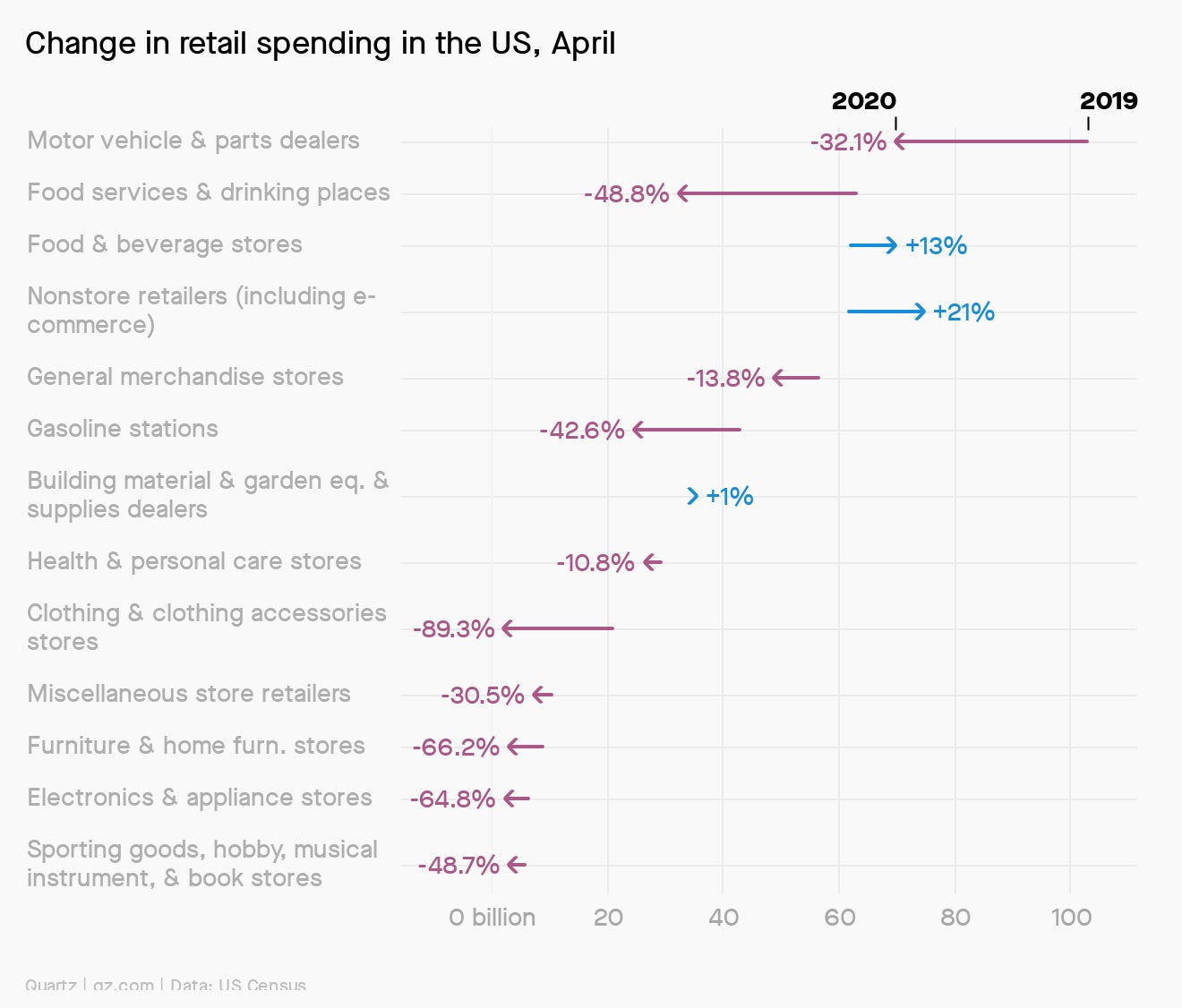

3️⃣ Clothing retailers have been hit hardest by the crisis, since fashion is the sort of discretionary purchase many shoppers have put on pause. E-commerce and grocery retailers, on the other hand, have benefitted from stay-at-home orders. Spending on do-it-yourself home improvement and gardening companies also eked out an increase in April.

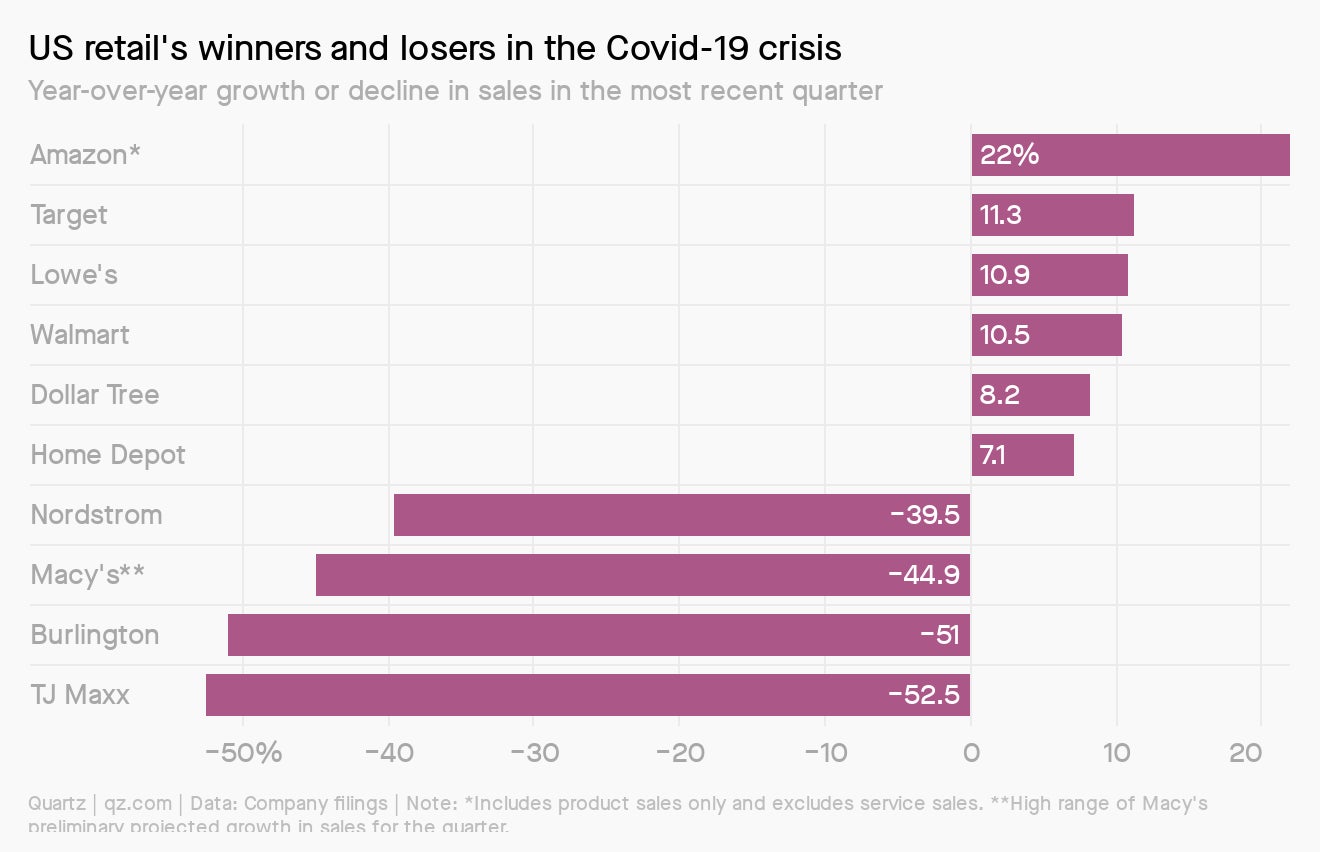

4️⃣ These dynamics have created a wide gap between US retail’s winners and losers. On the one end are companies such as Amazon, Target, and Walmart, which have seen sales rise IRL and online as Americans stock up on groceries and cleaning products. On the other end are retailers selling non-essentials that had to close stores, or, like TJ Maxx and Burlington, didn’t have strong e-commerce operations to lean on.

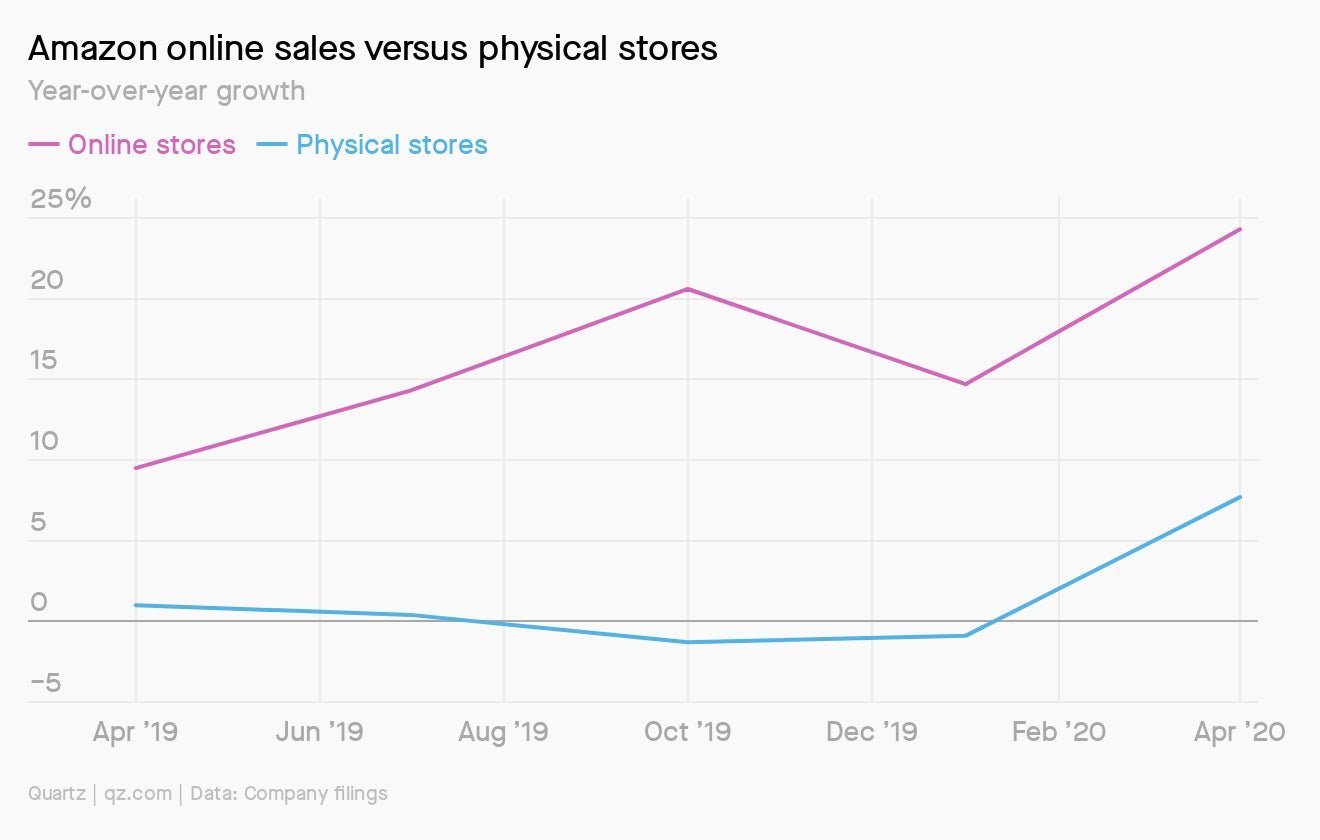

5️⃣ Did we mention Amazon? Despite some missteps, the e-commerce juggernaut looks positioned to emerge from the pandemic even stronger. Amazon has gotten a boost from consumers stocking up on essentials and other items, and not just online. In the quarter ending March 31, revenue from its physical stores, which consist almost entirely of its Whole Foods grocery chain, also jumped.

What’s in store

As tentative retail reopenings begin, we’re starting to catch a glimpse of how the shopping experience could evolve. Here’s some of what you might expect:

- More reservations and appointment options

- Curbside pickup

- Social-distancing signage

- More efficient layouts

- Robots, probably cleaning things

- Contactless payments

- Lots and lots of hand sanitizer

It’s in the jeans

The pandemic is pummeling clothing companies, but it’s the workers in factories that make these clothes who have been suffering the most. Over the decades, fashion companies have concentrated their supply chains in countries with low wages in order to keep costs down and profits up. Garment workers often exist on the brink of poverty, without much of a safety net for themselves or their families.

Covid-19 is now sending shockwaves through that system, with devastating consequences for workers. In a story for Quartz members, Marc Bain uses the humble pair of jeans (✦) to illustrate how global trade is being disrupted by the virus. In the same field guide, you can learn about the world’s dependence on China for pharmaceuticals, the extraordinary measures needed to produce a Covid-19 vaccine, the pandemic’s impact on how Americans eat meat, and the global machine that keeps hand sanitizer available.

Speaking of trade, we will trade you one year of Quartz membership for $60, which is a 40% discount on your first year. Not sure yet? Try kicking things off with a seven-day free trial.

Essential reading

- The latest 🌏 figures: 7,435,727 confirmed cases; 3,505,535 classified as “recovered.”

- Goliath and Goliath: Covid-19 is helping Walmart make up ground against Amazon.

- Coolcoolcool: The UN says we’re in for the worst food crisis in 50 years.

- Emotional labor: Data show Americans are afraid to quit their jobs right now.

- WHO said: Can you catch Covid-19 from someone without symptoms?

Our best wishes for a healthy day. Get in touch with us at [email protected], and live your best Quartz life by downloading our app and becoming a member. Today’s newsletter was brought to you by Marc Bain and Kira Bindrim.