France’s coronavirus plan, Snowden’s vindication, new black hole

Good morning, Quartz readers!

Good morning, Quartz readers!

Here’s what you need to know

France announces a coronavirus rescue package. President Emmanuel Macron has set aside €100 billion ($118 billion), including spending and tax breaks, to support the economy as coronavirus cases start to rise again in the country. The amount is four times what France spent during the financial crisis in 2008.

International soccer resumes in Europe. National teams will begin playing again after a 10-month break as the UEFA Nations League kicks off, with Germany and France meeting behind closed doors in Stuttgart, even as World Cup qualifiers in other parts of the world continue to be postponed.

The NSA’s mass surveillance program was ruled illegal. The US appeals court also said that intelligence officials who defended the program were not telling the truth, seven years after National Security Agency contractor Edward Snowden blew the whistle on it. “I never imagined that I would live to see our courts condemn the NSA’s activities as unlawful,” Snowden tweeted.

A cargo ship went missing near Japan. Japanese coastguards are searching for the vessel, which was sailing from New Zealand to China carrying thousands of livestock and 43 crew members. The ship sent a distress signal amid poor weather caused by typhoon Maysak, which wreaked havoc in Korea.

Obsession interlude: Future of Finance

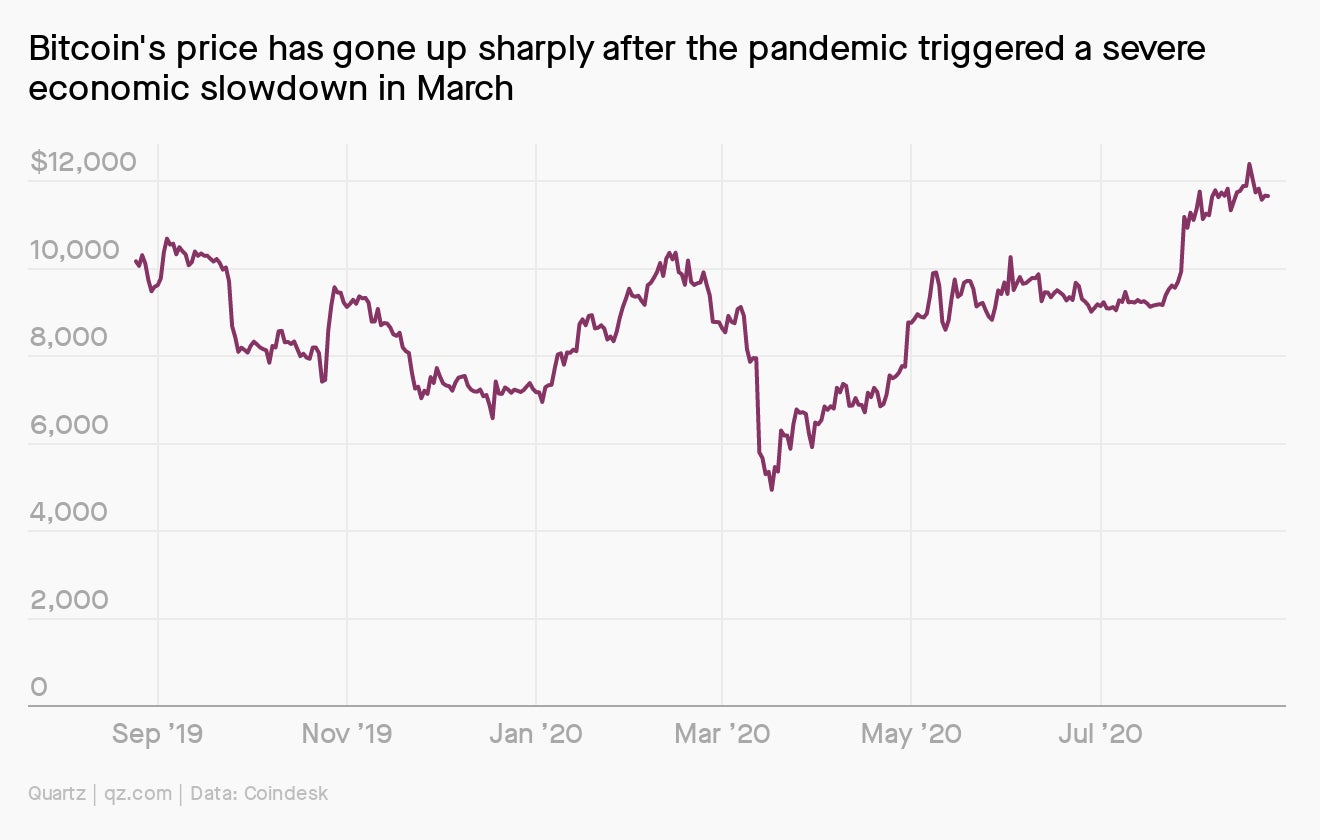

In 2013, India’s central bank issued its first warning about cryptocurrencies, which weren’t particularly popular at the time. By 2017, everything had changed: That year, bitcoin’s value rose from $900 to $20,000, and the possibility of making a quick buck attracted many Indians to crypto.

This rapid rise made the Reserve Bank of India (RBI) and the government jittery. After several warnings, the RBI cracked the whip in 2018, asking all financial institutions not to support trading of cryptocurrencies. The move completely crippled the crypto market; a few exchanges had to shut down, while others shifted out of India.

What followed was a two-year legal saga in India’s top court. The victor? Crypto. In March, India’s Supreme Court nixed the RBI’s directive. Uncertainty still looms (pdf), but for now, cryptocurrency is booming in India once again.

You can be certain, however, that we remained obsessed with the Future of Finance.

Charting VC investment in Africa

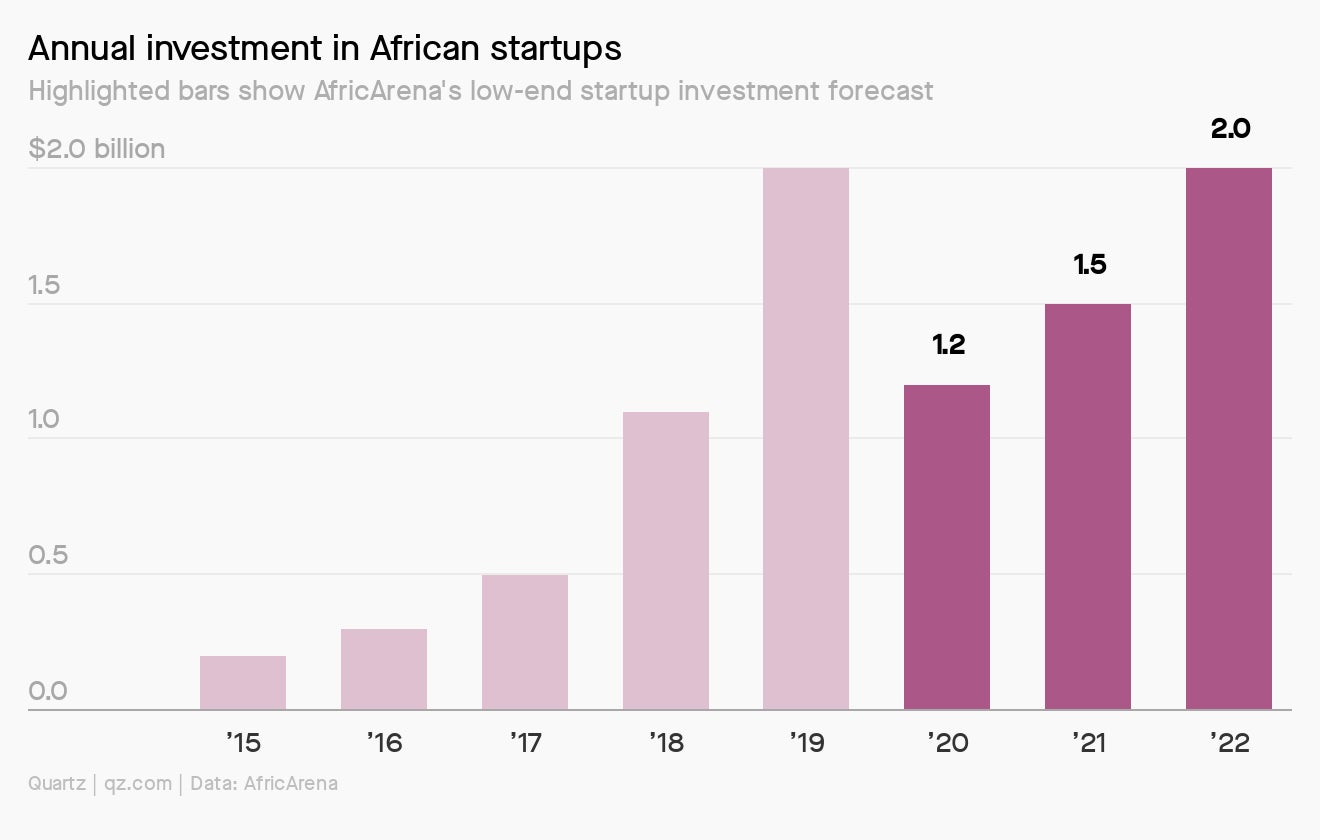

Investment in African startups could drop by as much as 40% by the end of the year due to the Covid-19 pandemic—but the bigger question for smaller startups is if they will remain alive at all.

In an effort to help startups stay afloat, Ventures Platform, an Abuja, Nigeria-based early-stage fund, is creating a startup relief program to disburse emergency grants of up to $20,000 to early, high-growth stage startups that may require cash lifelines.

Sign up to keep up with the continent with the Quartz Africa Weekly Brief today:

Quiz: A Wall Street Whodunit

This famous investor could be considered the godfather of today’s retail stock trading boom. Who is it?

- George Soros

- Larry Fink

- Bernie Madoff

- Bill Gross

We’ll give you the answer at the end of this email. If you’d like a cheat sheet, check out our field guide to the next bubble.

✦ Here’s a hint: There’s no scheme involved in this special offer. Land yourself a paywall-free experience by joining Quartz for 50% off using code “SUMMERSALE.”

We’re obsessed with climate migration

Oh the places we’ll (have to) go! Sea level rise, sweltering temperatures, parching drought, intense wildfires, catastrophic flooding, powerful hurricanes—the effects of climate change are widespread and varied across the globe. Threats to some of the most populous parts of the world could trigger the largest human migration to have ever occurred. In fact, it’s already begun. Will new destinations be ready when the migrants show up? Get a move on with the Quartz Weekly Obsession.

Surprising discoveries

McDonald’s has beef in Australia. It’s suing fast-food chain Hungry Jack’s (as Burger King is known there), arguing that its “Big Jack” burger infringes the “Big Mac” trademark.

This dog was born to walk. A network of volunteers helped Pipsqueak the dachshund on its 10,000 mile (16,000 km) journey to rejoin its owners in Australia.

Banana slugs are fire-proof. The colorful mollusks avoided a wipeout during recent California wildfires by burying themselves up to 9 ft (3 m) underground.

The UK is facing a book bonanza. An unusually high 579 books will hit British bookstores today after months of book-launch delays.

There’s a new black hole in town. By “new” we mean the “previously unknown intermediate-mass type.”

Whodunit answer: Bernard L. Madoff ran the world’s largest Ponzi scheme. He was also a key pioneer of payment for order flow, a business model that helps underpin “commission-free” stock brokerage for everyday traders. It has become a critical money maker for brokerages like Robinhood and Charles Schwab (Schwab was an early Madoff customer). Read the story of how the Ponzi mastermind enabled the US retail trading boom in our guide to the next bubble.

Our best wishes for a productive day. Please send any news, comments, snug banana slugs, and wandering weiner dogs to [email protected]. Get the most out of Quartz by downloading our app on iOS and becoming a member. Today’s Daily Brief was brought to you by Isabella Steger, Mary Hui, Susan Howson, Yomi Kazeem, and Max Lockie.