Trump’s phone call, vaccine latest, Mafioso influencers

Good morning, Quartz readers!

Good morning, Quartz readers!

Here’s what you need to know

In a leaked recording, Donald Trump demanded extra votes in Georgia. The Washington Post obtained audio of a call in which the US president told a senior state official to overturn his defeat. Georgia elects two US senators tomorrow.

The Fiat Chrysler and PSA merger could be approved today. Shareholders are voting on a $52 billion deal to create the world’s fourth largest auto company, to be called Stellantis.

Iran said it has begun enriching uranium. This violates the nuclear deal abandoned by the US, and complicates matters for the incoming Biden administration.

Bitcoin continues to soar. The cryptocurrency topped a record $34,000 at one point yesterday, and (at time of writing) is hovering just below $32,000.

Tesla met Wall Street’s hopes, but not its CEO’s. The electric car maker delivered 180,570 vehicles in the fourth quarter of 2020, but failed to reach Elon Musk’s full-year goal of 500,000.

The Chinese government threatened the US again. It promised “necessary measures” in response to the removal of several companies from the New York Stock Exchange.

Julian Assange learns his fate. A British court is ruling on whether to extradite the WikiLeaks founder to the US.

What to watch for

Health officials around the world will begin to deal with the effects of Christmas and New Year’s gatherings on the trajectory of the Covid-19 pandemic, while vaccine delivery issues remain key.

- Prior to the holidays, Europe and the Americas accounted for more than 80% new Covid-related deaths worldwide, raising the prospect of new restrictions.

- A new, more infectious strain of the virus is spreading. The new mutation was first observed in the UK and has now been found in China and the US.

- Scientists around the world are debating vaccine delivery strategies. With infections surging in many places, one shot or two?

- The UK rolled out the Oxford-AstraZeneca vaccine. An 82-year-old man was the first to receive the shot, with over half a million doses ready for use today.

- India will begin administering the Oxford-AstraZeneca vaccine, but will not yet allow the drug’s local manufacturer to export it. Its simultaneous approval of locally developed Covaxin is sparking some concerns.

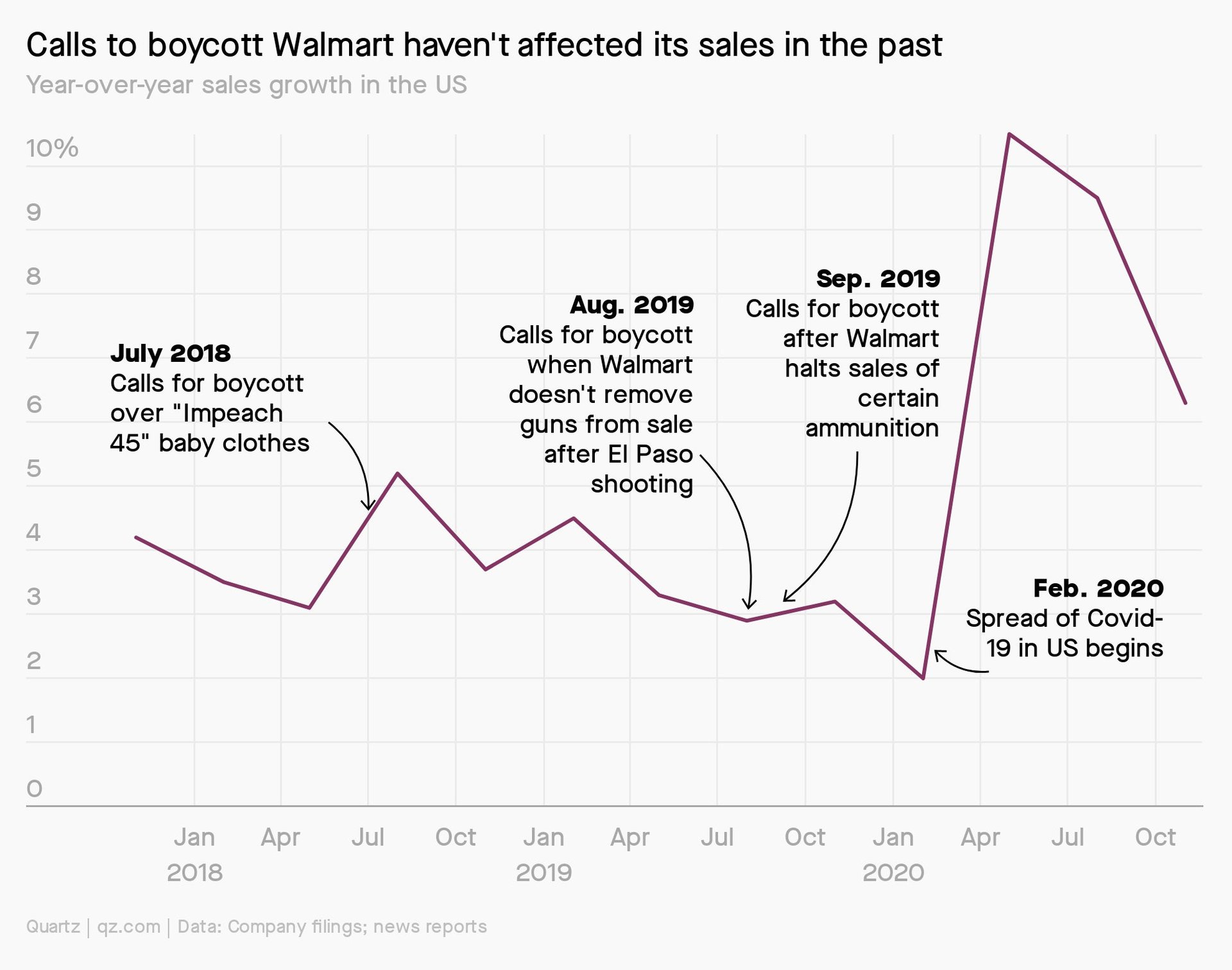

Charting boycotts of Walmart

Walmart has been a repeat target of calls for boycotts over the years. The demands often focused on Walmart’s treatment of workers, but recently, they’ve reflected partisan anger that can easily surface online. US senator Josh Hawley is now furious after the company’s Twitter account mistakenly called the Republican lawmaker a sore loser.

But these boycotts rarely materialize into mass movements, and if they do, they’re not having any evident effect on the retailer, whose US sales have continued to grow steadily.

New Year, New Economy?

The unique nature of the coronavirus recession makes a fast recovery possible. The financial systems crippled by toxic assets and permanently broken industries left behind by other recent recessions required an economy-wide restructuring to fix. In contrast, while the suffering and dislocation of the pandemic have been staggering, societies have the tools to provide relief and a speedy recovery.

However, the global economy still faces the myriad of problems it did before 2020, from trade wars to inequality to weak investment. Our latest field guide provides a preview of what to expect for the global economy in 2021, including the indicators to watch, and potential wildcard events.

Surprising discoveries

You have a follow request from the Mafia. A popular Facebook page was shut down after its proprietor was sentenced to 30 years in jail, but he’s hardly the only capo with an online influence strategy.

Buying indulgences? Australian authorities said $1.8 billion was sent from the Vatican to the Australian Catholic Church over seven years, but both have denied knowledge of the transfers.

The longest diplomatic asylum ends. Two convicted Ethiopian war criminals spent 29 years in the Italian embassy in Addis Ababa, but are now set to leave after being granted probation.

Golf had a great pandemic. The sport grew leaps and bounds in 2020 because it’s outdoors and makes for easy distancing.

Prince still owes taxes. The IRS says the late musician’s estate owes another $32 million after executors undervalued his assets by $80 million.

Our best wishes for a productive day. Please send any news, comments, holes-in-one, and mysterious wire transfers to [email protected]. Get the most out of Quartz by downloading our iOS app and becoming a member. Today’s Daily Brief was brought to you by Hasit Shah, Mary Hui, Tripti Lahiri, David Yanofsky, and Tim Fernholz.