EU-UK tensions, Capitol threat, 2 legit zebrafish

Good morning, Quartz readers!

Good morning, Quartz readers!

Here’s what you need to know

The EU accused the UK of breaching the Brexit deal. Britain’s move to delay border checks on goods entering Northern Ireland prompted the charge. Meanwhile, a loyalist paramilitary body has temporarily withdrawn support for the Good Friday peace deal over the checks.

China is the “biggest geopolitical test” for the US… That’s the Biden administration’s assessment as secretary of state Antony Blinken singled out China over the challenges it poses to the international system.

…and Beijing’s “Two Sessions” begins. The annual political gathering is expected to tackle the country’s five-year economic plan and overhaul electoral rules to cement control over Hong Kong.

Greensill Capital is preparing to file for insolvency. The UK financial startup backed by SoftBank is in talks to sell off large parts of its business and assets after it lost access to funds, and German regulators shuttered the bank it operates.

A militia group may be plotting to breach the US Capitol again. Citing intelligence, police warned of a possible attack on Congress, forcing the House to cancel today’s session as a safety precaution.

At least 38 protesters were killed in Myanmar. The death toll from the anti-coup protests is now over 50, as security forces opened fire with little warning. TikTok has been urged to take down clips shared in the country of men in military uniform threatening to kill protesters.

What to watch for

The Organization of Petroleum Exporting Countries (OPEC), the 13-member cartel led by Saudi Arabia, effectively controls the price of the world’s most valuable commodity by tightening or loosening the world’s oil tap.

OPEC will meet again today, joined by 10 “OPEC+” non-members including Russia and Oman, and will likely agree to increase production. By exactly how much is harder to say, but will indicate how close the group thinks it is to being out of the woods, writes Tim McDonnell.

Here’s a look back at the oil market’s crazy year:

March 2020: As the global economy freezes up, Saudi Arabia and Russia can’t agree on production cuts, and the price dips 30% overnight.

April 12, 2020: OPEC+ members agree to a record cut of 9.7 million barrels per day through June, about 10% of global production.

April 20, 2020: The price of oil goes briefly negative for the first and only time in history.

June-July 2020: As OPEC’s production cuts sink in, the price rises, but stalls around $40. This is by OPEC design: The price is workable for members, but still too low for most US producers.

July 15, 2020: OPEC agrees to roll back cuts through December to 7.7 million barrels per day.

Nov. 9, 2020: Oil company stocks and the oil price jump after Pfizer announces successful trials of a Covid-19 vaccine.

Dec. 3, 2020: OPEC+ members decide to bring an additional 500,000 barrels per day back into production through March. Saudi Arabia will ultimately backtrack, volunteering to cut 1 million barrels per day.

Feb. 8, 2021: The oil price returns to pre-pandemic levels for the first time.

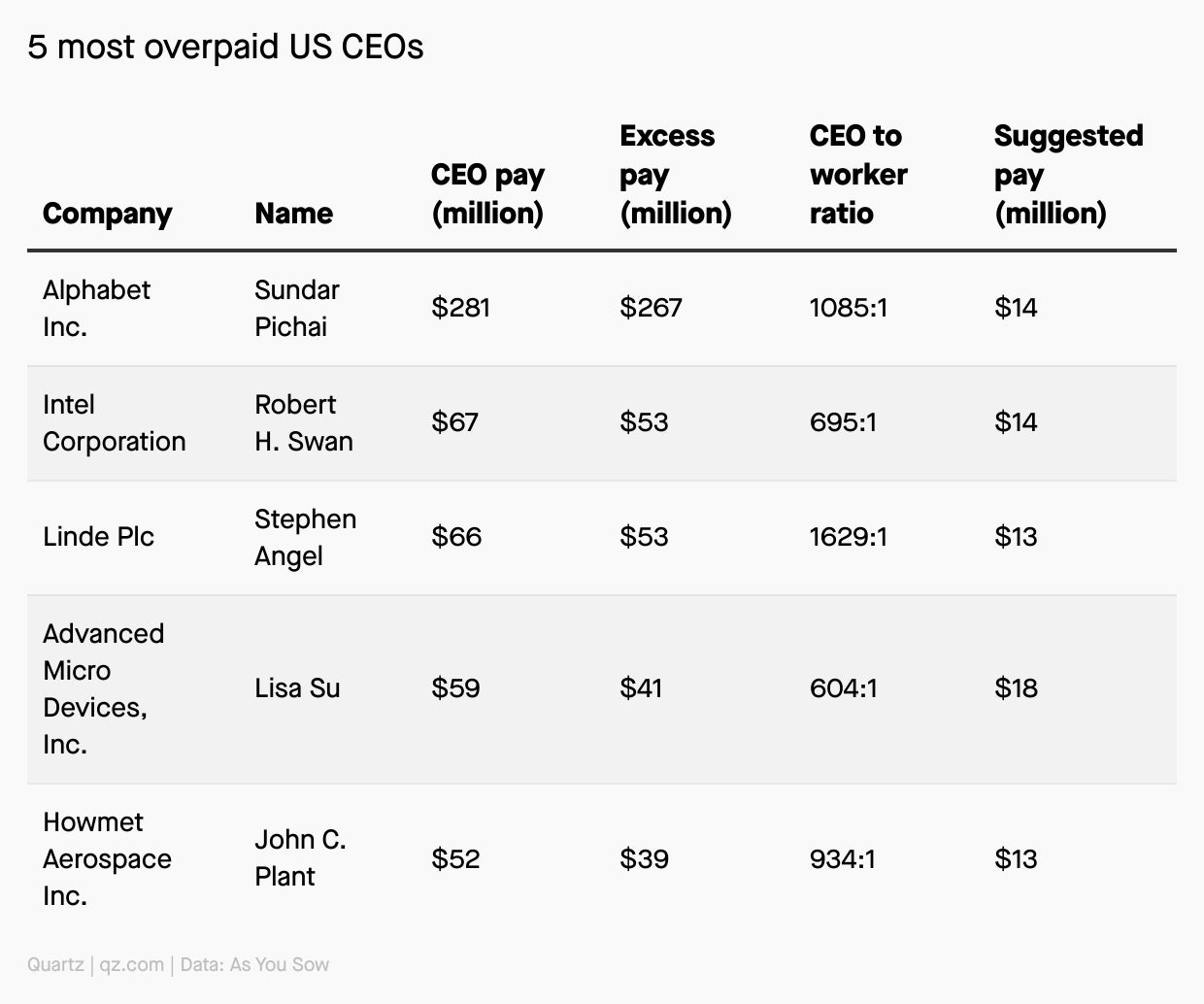

Charting overpaid CEOs

Sundar Pichai doesn’t give Alphabet enough bang for its buck. The CEO was paid $280 million in 2019—1,085 times the compensation of the average Alphabet employee (about $258,000)—and hasn’t delivered enough in return to make the expense worth it.

As You Sow, a shareholder advocacy group, hopes to leverage the power of shareholders to direct companies toward corporate social responsibility and environmentally sustainable actions by ranking overpaid US CEOs. It even suggests a fair wage for each CEO’s performance level.

Here are just the top five.

Rooftop solar: Death knell or savior for the electricity grid?

Interest in solar energy skyrocketed in Texas after the winter storm that caused blackouts for millions of the state’s households and left others with multi-thousand-dollar electric bills. While solar is a threat to utility companies, it could also work to their advantage, with a few updates to their business model.

335%: New user registrations in Texas on online solar installation marketplace EnergySage in the week after the storm

$500 billion: Potential cost to US utilities for climate resilience upgrades by 2050

~10 million: Number of households in the northeastern US that could get most of their power from solar by 2030, which would inflict $15 billion in losses on utilities

13%: Amount total US electricity demand could grow by 2035

✦ Quartz believes every industry can be part of the solution to stop the worst of climate change. Read all our climate economy coverage—and everything else on our site—with no paywalls for a week.

Surprising discoveries

The Perseverance rover has the processing power of a 1998 iMac. If only it also had the desktop’s signature blue accents.

A 15th-century Ming Dynasty bowl turned up at a yard sale. The $35 find could be worth $500,000.

The Thai navy rescued four felines from a sinking ship. Cat-astrophe averted.

Zebrafish brains light up when they listen to MC Hammer. Their opinions on harem pants are still unknown.

Buy now on Facebook Marketplace: Amazon rainforest plots. Just one hitch, the sales are illegal.

Our best wishes for a productive day. Please send any news, comments, rare ceramics, and rarer iMacs to [email protected]. Get the most out of Quartz by downloading our iOS app and becoming a member. Today’s Daily Brief was brought to you by Mary Hui, Tripti Lahiri, Annalisa Merelli, Susan Howson, and Liz Webber.