Lira tumult, China’s oil refineries, #BookTok

Good morning, Quartz readers!

Good morning, Quartz readers!

Here’s what you need to know

Beijing began a secret trial of Michael Kovrig. The former Canadian diplomat, detained in China since December 2018, faces espionage charges in a case widely seen as revenge for Canada’s arrest of Huawei executive Meng Wanzhou. The trial of Michael Spavor, the other jailed Canadian, concluded last Friday without a verdict.

Turkey sacked its central bank chief. Again. Investors are bracing for tumult after the Turkish president fired Naci Ağbal, who had just hiked interest rates by 200 basis points to fight inflation and support the lira.

Protests in Bristol turned violent. Demonstrators had gathered peacefully in the British city to oppose a crime bill that would grant police officers broad new powers, before scenes descended into chaos last night.

Credit Suisse may consider spinning off its asset management arm. The Swiss bank’s CEO signaled that could be one course of action as the firm grapples with the collapse of Greensill Capital, which managed its $10 billion supply chain finance funds.

Investors want to freeze Tsinghua Unigroup’s overseas assets. Global bondholders want to prevent the Chinese state-backed semiconductor group, which defaulted on domestic bonds in November, from using them to pay off debts.

The world has a new most profitable company. Saudi Aramco’s net income slid 44% in 2020, giving Apple claim to the crown. Aramco still earned $49 billion for the year and looks committed to paying its dividend.

A factory fire in Japan could cause chip shortages for the auto industry. So warned the CEO of Renesas Electronics, the third-largest maker of automotive silicone, as one of its plants is set to be offline for a month after Friday’s fire.

The Tokyo Olympics won’t have overseas spectators. The decision was expected, and is now official.

What to watch for

GameStop is reporting fourth-quarter and fiscal 2020 results after the close of US markets on March 23. It will be the video-game retailer’s first earnings release since a short squeeze rattled the markets.

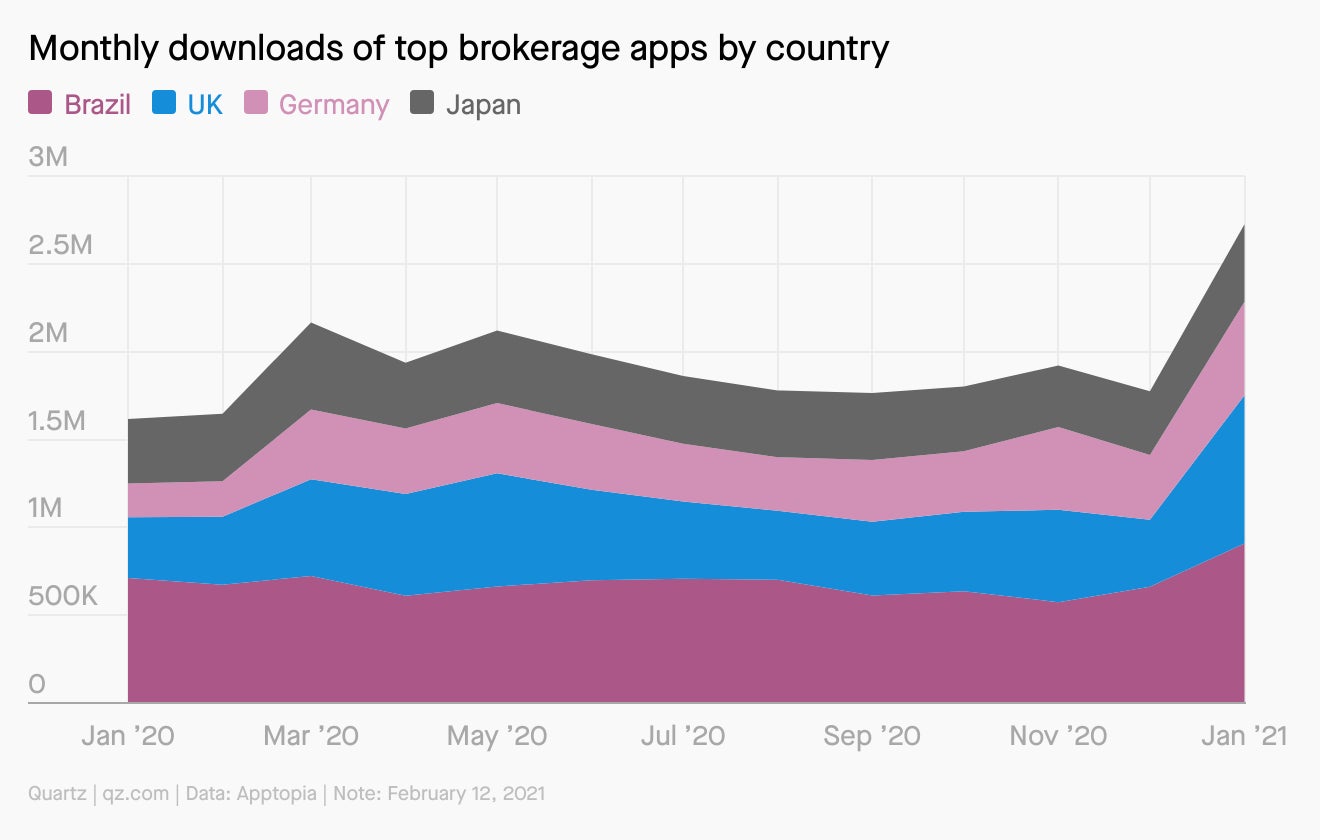

It’s not just Wall Street analysts and Redditors who will be watching the results closely. The GameStop saga ushered in a wave of retail brokerage account signups—not just in the US, where GameStop is based and where retail stock trading is practically a national pastime, but all around the world.

GameStop fever seems to be cooling, if more recent trends in trading-app downloads are any indication. But retail brokerages are stocked up with a fresh batch of traders who could keep buying and selling even as that story fades.

Charting China’s oil refinery surge

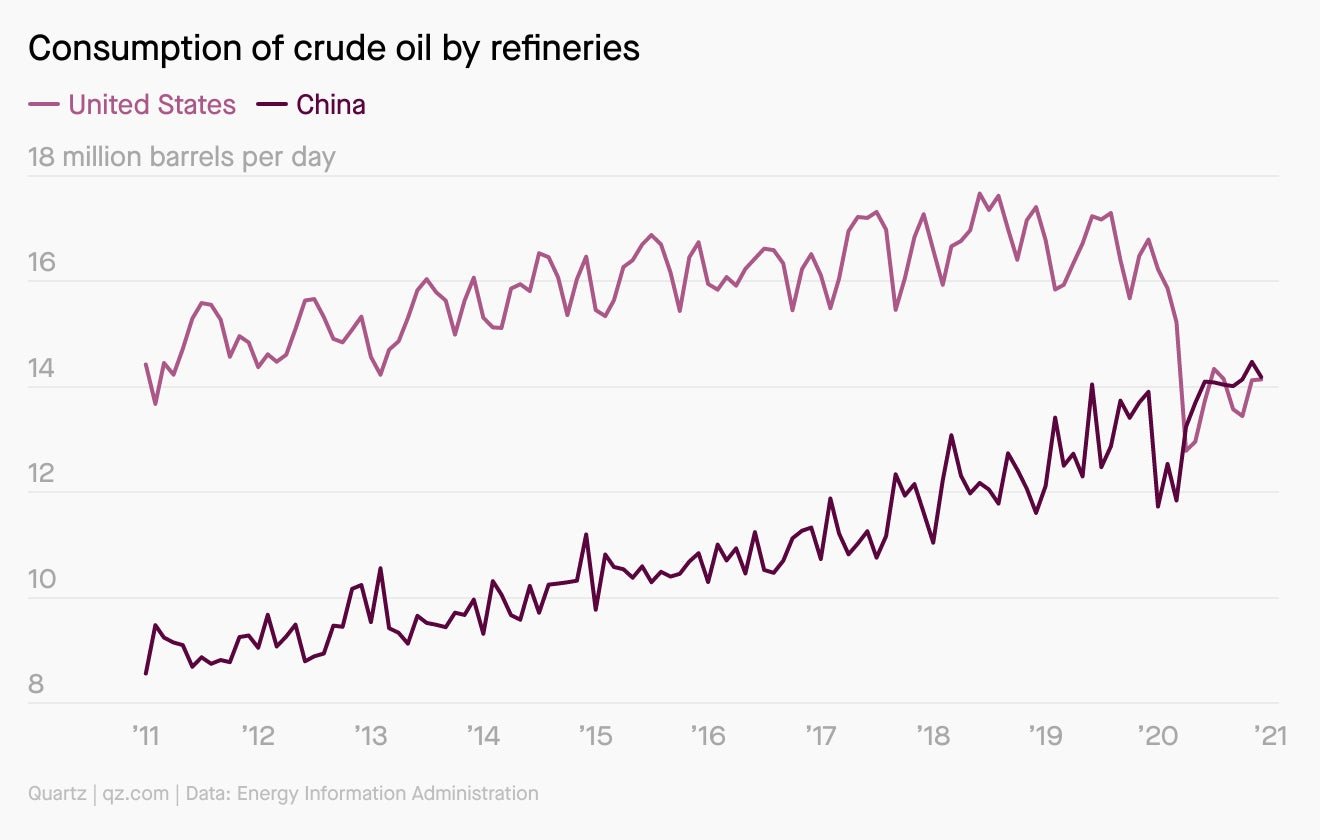

The US, home to more oil refineries than any other country, has lost its title to China as the world’s largest refiner of raw crude oil, writes Tim McDonnell.

China began refining more crude oil into gasoline and other products for the first time in 2020 and has largely remained in the lead, according to new data from the US Energy Information Administration.

With fewer customers, low prices, and much less crude as US producers curbed drilling in the pandemic, American refiners have had little reason to operate. But Chinese oil refiners were primed to respond in the opposite way to oil price fluctuations: When oil prices fall, the government pays Chinese refiners to ramp up production

A billion-dollar question

What will happen when Tesla sets up shop in India?

Electrics represent less than 1% of vehicle sales in India, but the industry’s proponents are hoping that will change after Tesla arrives. It’s not yet clear when that will be. But Tesla registered its first Indian subsidiary this January, and there are signs the company is preparing to set up factories in the country.

When Tesla does truly break into the Indian market, it will face numerous challenges to gain a foothold, from homegrown competition to affordable pricing. But if it can overcome them, Tesla can further extend its global industry dominance by opening itself up to millions of new customers—plus, experts suspect, kickstart the growth of electric vehicles in India itself.

✦ To gain access to all of Quartz’s stories, plus our field guides, slide presentations, workshops, and more content available exclusively to Quartz members, try it out for free.

Surprising discoveries

TikTok is influencing the book industry. Videos of users openly sobbing at the dramatic endings of their favorite reads on #BookTok are driving unheard-of sales.

Volkswagen is trouncing Tesla in the stock market this year. Legacy car makers are touting their readiness for electric vehicles, and investors appear to be buying it.

Miami called in SWAT teams to help break up raging spring breakers. University students have flocked to the vacation destination by the thousands, and haven’t been respecting Covid-19 curfews and crowd limits.

Fagradals Mountain, a volcano in Iceland, erupts after 6,000 years of dormancy. Fortunately, the only major disruption to nearby residents are noxious gases—but those can be avoided by staying indoors.

Climate change threatens to clip winters, springs, and autumns by 2100. The northern hemisphere would have six months of summer instead of a balanced four seasons.

Our best wishes for a productive day. Please send any news, comments, automotive silicone, and unruly vacationers to [email protected]. Get the most out of Quartz by downloading our iOS app and becoming a member. Today’s Daily Brief was brought to you by Mary Hui, Tripti Lahiri, Katherine Foley, Nicolás Rivero, John Detrixhe, and Heather Landy.