Quartz Future of Finance: 10,000 fintech startups and the infrastructure is getting worse

Hello readers!

Hello readers!

Thousands of people met in Amsterdam this week to talk about the future of money. There was a lot to discuss at the Money20/20 conference: More than 10,000 fintechs have started up, and payments specialists like Stripe, Adyen, and TransferWise are among the most valuable, fastest-growing firms out there. Applying technology to the movement of money is a big business.

Paradoxically, while the number of ways to move money digitally increases, some of the underlying infrastructure is getting worse. The correspondent banking system—the chain of financial institutions that pass money around the world—isn’t that profitable for many of the players that are part of it. It works best for big corporate payments, and wasn’t set up for smaller, high-frequency consumer transactions. Meanwhile, the risk has risen for banks to get the bejeezus fined out of them by the US Department of Justice, for things like failing to screen properly for money laundering or sanctions. Banks are fleeing the correspondent banking system, even as the amount of money flowing through the network increases, according to the Bank for International Settlements.

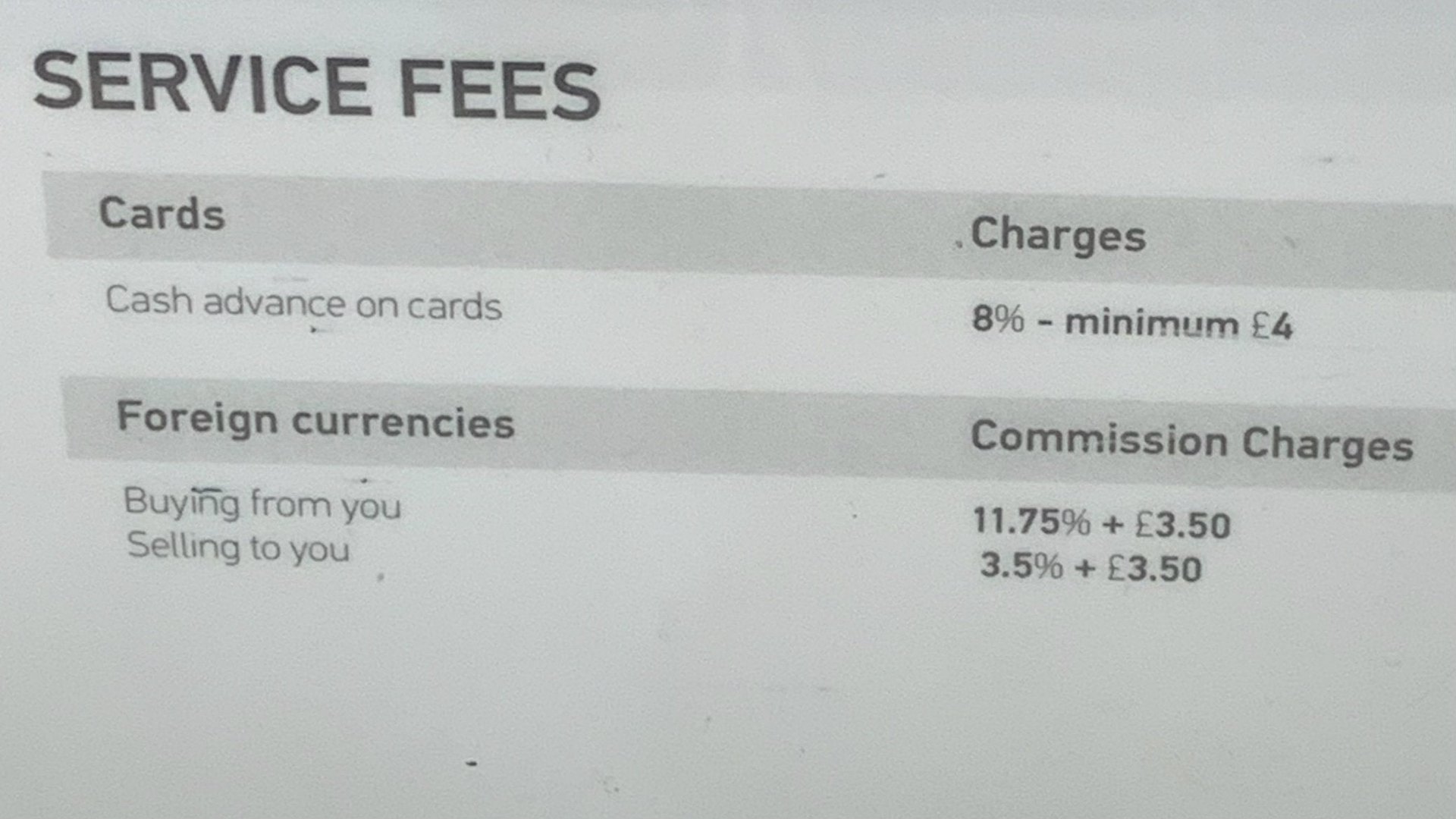

For all the talk about fintech, remittances are still expensive for a lot of people. Some $530 billion was transmitted last year, and on average it cost $14 to send $200 across borders. It’s easy to find places where it’s even more expensive than that. On my way to work yesterday, I stopped by London’s Victoria bus station to look at the rates offered by Western Union, where sending £200 ($254) of remittance costs about £27:

Doing the same thing with TransferWise costs more like £1 to £1.34 (using the pound-to-euro and pound-to-Indian rupee pairs as examples), according to the company’s website. TransferGo, another London-based startup, also offers bargains for sending money in other currencies. So why are people still spending so much?

Some people don’t have bank accounts, smartphones, and internet access, cutting them off from cheaper digital options. About 30% of the world’s population lacked access to payments services as of 2017.

Given the high cost of sending funds across borders, policymakers worry about “shadow payments”—such as sending money through unregulated cryptocurrency exchanges, which have been prone to hacking and scams. You hear tales of cash bundles being handed to bus and taxi drivers for transport across borders.

“If you look at the people impacted by the fees, it’s the people who need the money the most,” said Harsh Sinha, CTO of TransferWise. “It’s a problem that should have been solved given the technology that exists.”

Some people simply don’t realize how much they’re paying for foreign-exchange transactions. Sinha, who used to work at PayPal, says it’s painful to see lines for the currency desks at airports. “A part of me dies,” he told me at the conference in Amsterdam.

Some of these issues are gradually being addressed. Watchdogs in Europe and Australia are looking to make foreign-exchange costs more transparent. Global regulators are working in emerging economies to shore up banking standards, which could reassure larger institutions about the provenance of funds they’re asked to help move. Big banks are automating transactions, and the Swift interbank co-operative is being upgraded. The situation is improving, but much more slowly than you might expect given the enthusiasm for fintech ventures these days.

This week’s top stories

1️⃣ Facebook says it doesn’t have the skills to be a payment company. An exec in Amsterdam said the goal is to make it easier to buy things in Facebook’s family of apps, and declined to discuss reports of a Facebook crypto coin.

2️⃣ The UK financial regulator is clamping down on peer-to-peer lending. Officials are forcing companies to provide better information to investors and test their financial acumen. The scrutiny is expected to drive away some platforms.

3️⃣ Software is eating the banking sector. European banks have struggled to become more profitable, but research suggests that going digital sooner rather than later can help boost return on equity.

4️⃣ Finn is finished. The accounts from JPMorgan’s digital bank aimed at smartphone-obsessed youngsters will be folded into the Chase mobile app. The bank recently launched a Finn-like online process for opening Chase accounts across the US.

5️⃣ Square forwarded some email receipts to the wrong consumers. The episode illustrates the promise and peril of collecting data on hundreds of millions of transactions.

Heard on headphones

“What we want to hear is their conquer-the-world strategy,” Scott Kupor, managing partner at Andreessen Horowitz, said about pitch meetings on the HBR IdeaCast. “If we can make you change your entire business plan in one meeting, that’s generally not a good thing. It does go to the heart of your conviction and the depths to which you believe your own conquer-the-world strategy.”

The future of finance at Quartz

Are we reaching peak fintech? Even Curve’s CEO hasn’t heard of 90% of the startups out there. Many are still convinced that the financial sector, despite the vast moat of regulation surrounding it, is due for disruption.

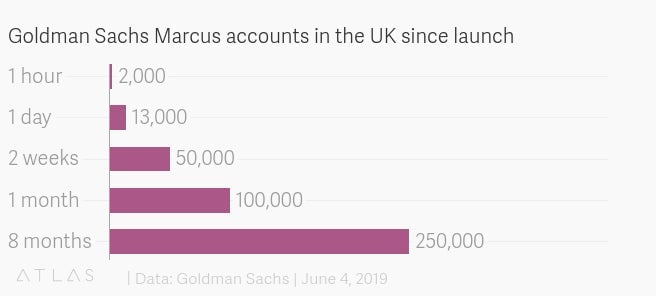

Marcus attracted 2,000 accounts in the first hour it was available in the UK. Goldman’s retail unit has added more than 250,000 customers in Britain since it launched in September.

Kenya is issuing new banknotes to cut down on corruption. To exchange old money for new money, people without a bank account will have to prove the cash belongs to them.

There’s little hope for cryptocurrencies in India right now. The nascent sector doesn’t expect prime minister Narendra Modi to lighten up on crypto in his second term.

Always be closing

- Biz2Credit, a lending platform for small businesses, got $52 million worth of financing.

- Step, a digital bank for teens, got $22.5 million of investment. Stripe led the deal, and Will Smith forked over some cash as well.

- Tink raised more money. PayPal invested €10 million ($11.3 million) in the Swedish firm, which builds financial aggregation software. It raised €56 million in February.

- Possible Finance raised $10.5 million. The short-term lender charges APRs in the range of 150% to 200%.

- LINE and Visa are partnering. They will make a marketing push ahead of the 2020 Olympics in Tokyo to accelerate Japan’s move to “cashless society” and will collaborate on blockchain services.

- Ebay and Santander teamed up on loans in the UK. They’re hoping to fend off competition from tech giants as well as fintech startups.

Hope your weekend is invigorating and profitable (pick your own metric). Please send any receipt mixups, tips, and informed opinions to [email protected].