Quartz Future of Finance: TransferWise will raise some fees in the coming year

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

It usually isn’t newsworthy when a company raises its fees slightly. Unless, that is, the company has boldly claimed that its mission is to charge zero fees. At some point, an annoying news reporter is bound to pester the CEO about it.

That’s what happened when TransferWise announced earlier this week that its revenue increased 53%, to $222 million, in 2018. The London-based money transfer company is one of the few financial unicorns that’s actually profitable; its net profit was $12.7 million for the fiscal year ending March 2019, it said.

I wanted to know more about the quest for zero fees. In a phone call, TransferWise chief executive Kristo Käärmann acknowledged that fees for some money transfer routes increased this year, even though the overall trend was lower. He said it doesn’t mark a change in strategy—the plan is to increase revenue by growing the customer base, and Käärmann said the number of customers has doubled since last summer, to 6 million.

“The increases aren’t that substantial and the thing that drives our revenue growth really is volume growth,” Käärmann said. ”We definitely don’t drive revenue growth through pricing. That’s not the point.”

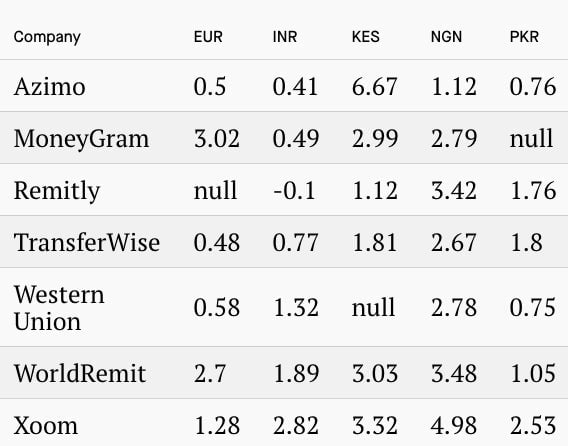

To be fair to TransferWise, the prices they charge are often (though not always) cheaper than other money transfer companies, and particularly so compared with bank rates. As an example, here are the percentage fees charged for transferring British pounds into a few other currencies, according to a snapshot provided last month by FXC Intelligence, a specialist data provider:

The recent fee increases didn’t contribute to revenue growth in figures TransferWise just announced because they took place after the company’s fiscal year. Even so, there seems to be a disconnect between the marketing, which signals a race to zero, and what has actually taken place.

TransferWise is a savvy marketer: young people stripped down to their undies in 2014 for its “nothing to hide” campaign. The company got dinged two years later by the UK’s advertising standards authority, which said its claims about customer savings versus banks were misleading. The fund industry, meanwhile, has demonstrated that “zero fees” gets much more media mileage than “sustainably low fees.”

So why the price hikes earlier this year? Käärmann said TransferWise had to raise fees on a few money transfer routes because it had slashed charges too aggressively in the past. The company doesn’t cross-subsidize routes—you can see a breakdown of its expenses here—and each corridor is expected to cover its costs. “We didn’t enjoy the price increases either,” he said. “But that’s what we had to do to cover our cost. Looking back at this, we were probably cutting too fast.”

Some other fees will have to be nudged higher in the future. Käärmann said the company will definitely cut prices in the next 12 months, and that it now lowers prices on some routes every couple of months. At the same time, he said there are some routes where the company “mis-underestimated” expenses and will have to adjust its prices higher. Käärmann said he didn’t know which ones yet, or when the hikes would happen.

The company says it prides itself on transparency. (You can read more about its philosophy here.) But unless it goes full Vanguard—the mutual fund company that’s able to charge bargain-basement fees because its users are essentially its shareholders—its not clear whether ever-lower fees will be sustainable. And it’s worth noting that even Vanguard, which turned low-cost financial services into something approaching a religion, still charges fees.

This week’s top stories

1️⃣ Tencent and Alibaba are refusing to hand over customer loan data to Beijing, according to the Financial Times (paywall). They have little to gain by cooperating with Baihang, a private credit scoring company started by the People’s Bank of China.

2️⃣ The Carlyle Group is analyzing the stories people tell each other. The private equity firm is looking to better understand how economic activity is influenced by narratives, Bloomberg reports, which is something Nobel prize-winner Robert Shiller has researched.

3️⃣ US challenger banks started by offering fee-free checking accounts. Now, as we appear to be nearing the end of the credit cycle, a number of them are pushing into personal loans, as American Banker reports (paywall).

4️⃣ Amazon rolled out a way for customers to buy things online using cash. Shares of Western Union, which is participating in the program, briefly spiked.

5️⃣ The International Monetary Fund seems worried about crypto stablecoins. These digital assets rely on banks to hold their reserves. Nonetheless, the IMF suggests that these digital currencies could result in financial institutions losing their role as intermediaries.

The future of finance on Quartz

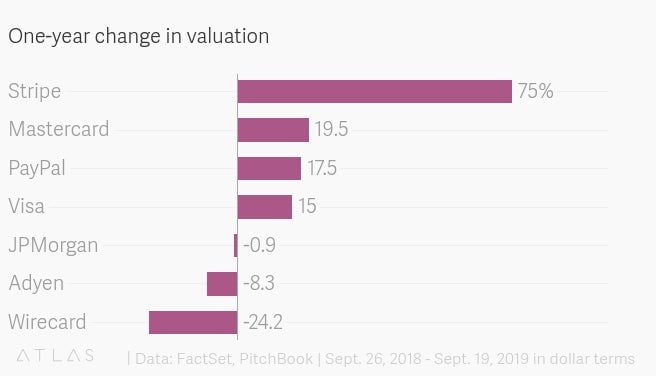

Stripe raised $250 million in funding, at an eye-popping $35 billion valuation. Bernstein research, meanwhile, indicates that the growth in digital payments could be slowing ever so slightly.

Reports suggest that China could soon unveil a digital currency or payment system of some kind. It could help the People’s Bank of China surveil citizens and control interest rates.

It’s been three years since Brits voted to leave the EU, and London is even more dominant in foreign-exchange trading. Granted, the UK is yet to officially leave the bloc, but Brexit hasn’t been the mortal wound to its prized financial sector that many feared.

Choose our next adventure

Two weeks ago readers voted for more reporting on cash deserts and financing for small businesses. My colleagues and I are plowing ahead: This past week I called a bunch of Small Business Administration offices around the US, from Arkansas to Ohio. One person brought up merchant cash advances: A small company might be making money hand over fist, but its income can be swallowed up by these high-interest loans.

Another person, not with the SBA, said small businesses are overwhelmed with loan offers—by email, physical mail, search engine ads, you name it. The risk is that they end up taking a loan because they’re in a jam and need some money quickly, but then end up hooked on debt they can’t afford.

If you have any tips or suggestions, I’m always open to them: [email protected]. And if you’d like to support my work, you can become a Quartz member here. You’ll get 50% off Quartz’s annual subscription if you use the promo code JD2912 at the checkout.

Always be closing

- Kazakh fintech Kaspi.kz is looking to raise about $500 million via an IPO in London. Financial Times (paywall) sources expect the payment and e-commerce company to score a valuation of $5 billion.

- Credit card startup Petal, which offers rewards to people with little credit history, raised $300 million in debt financing from Jefferies.

- Open-banking platform Plaid raised $250 million from the likes of Visa and Mastercard.

- TouchBistro, an iPad point-of-sale system for restaurants, raised C$158 million ($119 million) from investors including Barclays, RBC Ventures, and JPMorgan.

- Trulioo raised $70 million. Goldman Sachs led the investment in the digital ID company.

- Deutsche Bank spent €50 million ($55 million) for a 4.9% stake in Deposit Solutions, a deal that values the Hamburg-based open-banking startup at more than €1 billion.

- Julo extended a fundraising by an extra $10 million. The peer-to-peer lending platform is based in Indonesia.

- Affirm is looking to raise as much as $1.5 billion in a combination of debt and equity, TechCrunch reports.

- Barclays is participating in a studio for women entrepreneurs.

I hope your week has been a profitable one (pick your own metric). Please send money-transfer hacks, tips, and other ideas to [email protected].