Quartz Future of Finance: What fintech means to Visa and Mastercard

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

I was going through my inbox this week and noticed two things. The first is that I have around 34,000 unopened emails. The second is that there have been a flurry of announcements about fintech firms partnering with Visa and Mastercard. These card giants have agreements with the likes of Revolut, Monzo, and Brex in Europe and the US, as well as Toss in South Korea.

Mastercard says it is the leader in these partnerships, but Visa says it is catching up. The former’s executives mentioned “fintech” at least three times during the company’s last earnings call, and the word came up seven times during Visa’s.

How much of this is hype? Visa and Mastercard, worth more than $650 billion in combined market cap, processed around $4 trillion of payments last quarter. London-based Revolut, by comparison, has handled about $85 billion since it went live in 2015. By far, the vast majority of Visa and Mastercard transactions come by way of their traditional bank partners.

I asked Bernstein analyst Harshita Rawat how vital these fintech partnerships really are for the card networks, and whether they are just hoping some of that magic unicorn dust will rub off on their own valuations. She says these partnerships genuinely matter:

“These fintechs, and there are so many of them around the world, were perceived as disrupters a few years ago, and now they look more and more like these new age banks, and banks are natural partners to Visa and Mastercard.

“Visa and Mastercard, their businesses are built on partnerships. These guy were created to partner with banks and merchant processors around the world to enable payment acceptance—ubiquitous payment acceptance.”

And:

“In that context, fintechs just look like new-age banks. They’re a fast growing segment so it’s important to partner with them. But don’t get me wrong, the vast, vast majority of volumes for Visa and Mastercard are their large bank partners.”

Visa and Mastercard aren’t the only companies founded before the internet was invented that are now looking for growth by working with fintechs. Consumer credit reporting companies have been talking up their relationships with tech startups in the personal loan sector. “Fintech” was mentioned around 10 times in TransUnion’s last earnings call, according to transcript data from Sentieo, and Experian appears to be making a push as well.

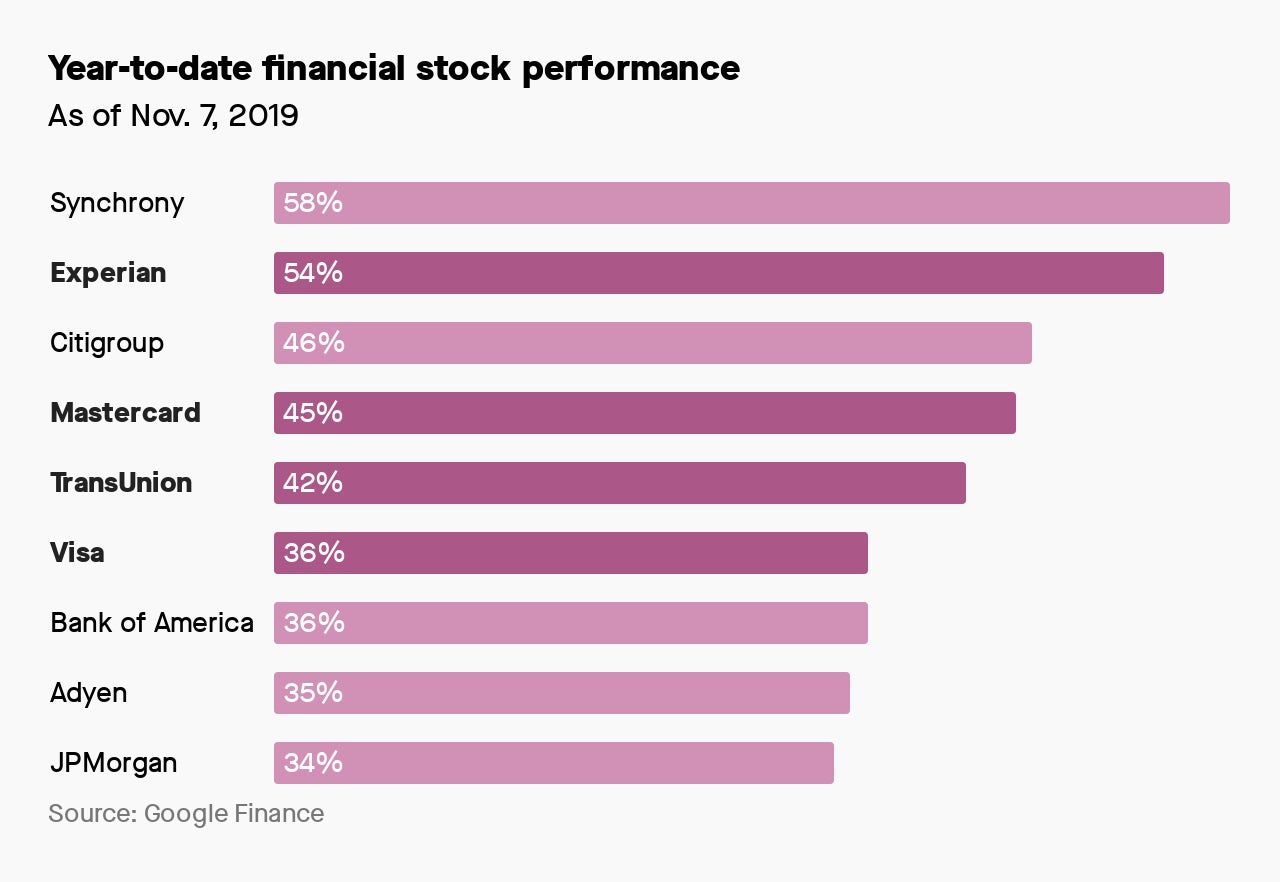

It seems to be working. If you look at returns this year for financial stocks, decades-old companies that are working with fintechs have been some of the best performers. US consumer borrowing and digital payments have been winning bets, too.

As an executive told me at Web Summit this week, there are too many unicorns in the world. (A theme I’m planning to report more on in the coming weeks.) Not all of these big-spending upstarts are going to make it. As Uber and WeWork have shown, fast growth doesn’t necessarily translate into profits. Companies like Visa and TransUnion seem to have figured out a way to bet on fintech without having to pick winners and losers.

This week’s top stories

1️⃣ Spain’s Santander bought 50% of Ebury, a payments platform in the UK, the Wall Street Journal reports (paywall). As low rates squeeze profits, payments and trade finance are an increasingly important way for European lenders to make money.

2️⃣ A secretive financial data company called Ion has splurged on technology acquisitions for more than a decade. The Financial Times reports (paywall) on growing signs that the Bloomberg rival’s debt load could be untenable.

3️⃣ The People’s Bank of China will issue its digital currency to commercial banks and other institutions. The central bank will rely on competition to determine which tech, and which companies, distribute the digital money to the public.

4️⃣ JPMorgan has been building a wallet for customers of tech companies, according to Bloomberg. These firms can use it to save on processing fees; for JPMorgan, the service could grow the bank’s cash and payments business.

5️⃣ Robinhood users exploited a glitch to place options trades with ultra-high leverage, according to Bloomberg. A law professor at Georgetown suggests that using this loophole could amount to securities fraud.

The future of finance on Quartz

Foreigners visiting China will finally be able to pay like a local—with their mobile phone. The Alipay app for international users has restrictions, such as a maximum prepaid top up of 2,000 yuan ($285). Tencent is also working with foreign card networks.

Jim Simons pioneered quant investing years ago. The mathematician has been rewarded for trusting the black boxes that churn out trading decisions, as his flagship fund’s returns have blown away other legends like Warren Buffett and George Soros.

Britain has been a frontrunner when it come to instant payments. But there are growing concerns about criminals exploiting these speedy transactions, and the Commons Treasury committee wants to slow things down.

Traders are lobbying for shorter hours in London. Buying and selling at the London Stock Exchange stretches to 8.5 hours per day, compared with 6 hours in Asia and 6.5 hours in the US. Shorter hours could help boost diversity.

Always be closing

- Aura, a lender for low-income borrowers, got a $130 million asset-backed revolving credit facility from a US investment firm.

- Immo Investment Technologies raised €11 million ($12.2 million). The startup purchases homes on behalf of buy-to-let investors.

- Mylo, a Canadian savings app, raised $10 million.

- Chip, a savings app, raised £7.3 million ($9.4 million) through a combination of angel and crowdfunding.

I hope your week has been a profitable one (pick your own metric). Please send any conference call transcripts, tips, and other ideas to [email protected].