Future of Finance: Regulators ask about zero commissions, Cash App raps

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

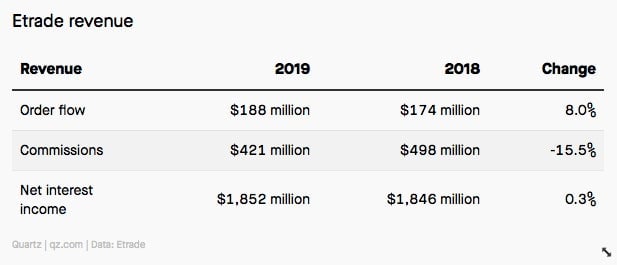

The waves from zero-commission retail brokerage are still getting bigger. To recap: Discount brokers like Robinhood are credited with slashing fees, pushing other US brokers like Charles Schwab and Etrade to go to zero as well. (Commission-free brokers are also popping up the UK, like Freetrade and Stake.) As these charges disappear, it’s putting pressure on discount brokers’ revenue, driving the likes of Etrade into the arms of investment bank Morgan Stanley.

It’s getting attention from regulators, too. In the US, the Financial Industry Regulatory Authority has 26 questions for firms that don’t charge commissions. It wants to know how these commission-less brokers are making money, and how they disclose fees. Finra also wants to know in detail about any payment for order flow arrangements (PFOF).

We’ve talked before about this practice. One of the ways American brokerages like Robinhood, Etrade, and Charles Schwab make money is by selling customer orders to high-frequency-trading firms. These orders don’t go on an exchange like Nasdaq or New York Stock Exchange, and instead typically get filled directly by the HFTs. Etrade, for example, cut some commissions to zero in October, but it still makes money from things like PFOF and net interest income.

Market makers like to buy retail orders because they’re usually small and uniformed. This is unlike the professional institutions that may be buying and selling large chunks of stock, anticipating trends, and putting a dent in the market—and costing the HFT money. HFTs (also known as market makers) say they can offer more competitive prices when they know the trades are from regular people, whose strategies are more benign.

A report from Greenwich Associates says retail traders are getting better service than ever. Market makers have to compete with each other to win business from brokers, which keeps a lid on trade-execution prices. HFTs provided savings of $1.3 billion for retail customers in 2018, according to Greenwich.

Still, there are critics who say PFOF creates a conflict of interest, giving brokers an incentive to send the orders to the HFT that offers the highest payment, rather than the best trade execution. It also makes it difficult for retail traders to know which broker offers the best-priced services.

One of the market makers competing for those retail orders is Virtu. Doug Cifu, the company’s CEO, said in an earnings call that the lack of commissions is driving more retail volume. He also says brokers will be more attentive to HFTs:

“When you have brokers now that are not getting paid on a per trade basis, their interests are 100% aligned with the market maker, not just Virtu, but our competitors, to segment flow, which may be more toxic, may be more professional in nature and candidly, more difficult for a market maker to handle.”

Cifu is talking about segmentation—that is, making sure professional trades aren’t getting mixed in with retail trades. Market makers can offer extra-cheap quotes when they are confident it’s “mom and pop” money. But if that person is wealthy and savvy (let’s say it’s a retired hedge fund manager making bigger trades), the situation can reverse, causing losses for the HFT. Put another way, market makers want to buy order flow, but only if the trades are small and unprofessional.

Without trade commissions, the broker is more likely to listen to the market maker and partition the smart trades. Or as Cifu said:

“When you align the interest of the retail broker with the market maker, you can have a better performance. We can allocate our price improvement dollars more adroitly to real—true retail orders that are deserving of those dollars and not get run over, frankly, by orders that may come through a retail pipe but look, feel and smell an awful lot like an institutional order.”

There’s a case to be made (paywall) that US stock brokerage would get more expensive if PFOF went away. Even so, Cifu’s comment—brokers’ “interests are 100% aligned with the market maker”—suggests that it might be right to worry that zero-commissions are changing the industry’s incentives.

Cash App rap

Shares of Square, Twitter founder Jack Dorsey’s other company, are on a hot streak, gaining around 20% this year. The company says its Cash App had about 24 million monthly active users as of December, a 60% increase from a year ago, and gross payment volume rose about 25% last quarter from a year ago to $28.6 billion. The peer-to-peer payment app can be used to trade bitcoin, and it added fractional stock investing last year.

Dorsey pointed out that peer-to-peer payments are an efficient way to rack up new customers (if your friend has a particular payment app, you may need to download it too to pay/receive money from your friend). “We also benefit a lot from all the songs that are out there that have Cash App either in the name or in the lyrics,” he said in an earnings call.

He’s right—there are lots of Cash App raps. There are many with “Cash App” in the lyrics and at least 20 with those words in the song title. I’ll leave you with a few words from Marty Mula’s Cash App:

I’m like pay me my funds

This week’s top stories

1️⃣ Expect more fintech M&A, Fortune reports, following Intuit’s $7.1 billion acquisition (paywall) of Credit Karma. Acquisitions can be a better exit when the IPO markets have cooled.

2️⃣ Klarna reported its first ever loss. The Swedish “buy now and pay later” bank blamed credit losses (paywall) on its new markets where first-time customers less reliably pay later.

3️⃣ JPMorgan is planning a digital bank in the UK, according to Sky News. Goldman Sachs launched its Marcus online bank in Britain in September 2018.

4️⃣ TransferWise is on pace to catch up to Western Union’s foreign-exchange flows in the coming years, according to FXCintelligence. Still, growth at TransferWise slowed in 2019, a potential inflection point for the money transfer company.

5️⃣ Scooter startup Bird launched Bird Pay. The combination of transportation and financial apps has been popular in Asia, but the strategy has extra challenges—like entrenched existing financial companies—in developed markets.

The future of finance on Quartz

Goldman Sachs led a $55 million funding round into Africa’s Jumo amid a surge of interest in the continent’s financial startups. Jumo offers loans, savings, and insurance services, and has 15 million customers.

Revolut tripled its valuation to $5.5 billion when it raised $500 million from TCV. There’s growing talk from financial startups about getting to profitability, but not much visibility on their progress.

UNICEF, the UN agency that provides aid to children, has been taking donations in bitcoin and ether since October. The assets go into its Innovation Fund, which then funnels the crypto to companies as seed investment.

Elsewhere on Quartz

TikTok is China’s first truly global app. With hundreds of millions of monthly users and burgeoning TikTok stars, ByteDance’s hit video app is here to stay. But “TikTok’s roots are a double-edged sword,” writes Quartz reporter Jane Li. This week’s field guide for members tells you why.

Always be closing

- Grab, the Southeast Asian ride-hailing company, got $856 million of investment. The company is making a push into financial services.

- QED Investors, which has stakes in companies like Credit Karma and Nubank, closed a $350 million fund.

- Anthemis raised $90 million for a venture capital fund focused on insurance startups.

- Lendio, a marketplace for business loans, got $55 million in funding.

- Checkout.com, the London-based payment platform, acquired French startup ProcessOut.

I hope your week has been a profitable one (pick your own metric). Please send tips, Cash App lyrics, and other ideas to [email protected].