Future of Finance: China pilots digital currency, mobile banks, trading the virus

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

China is piloting a digital currency. The People’s Bank of China is testing it out in four big cities (paywall), according to the Wall Street Journal, though it won’t be issued widely in the near term. Some civil servants will get a subsidy in the digital yuan as part of the test. Around 19 companies—mainly in retail, restaurants, and entertainment—in Xiong’an were invited to participate in the experiment, according to The Beijing News.

The pilot, says David Birch, author of The Currency Cold War, has funny timing: the PBOC’s research institute is pushing ahead with a whizzy currency while the US is mailing out paper stimulus checks. “It could be coincidence,” Birch said. “Or it could be what economists call a ‘weak signal’ for change. In 100 years we’ll look back and see that it marked the end of the American century.”

As we’ve talked about before, some of the countries that are doing the most research into central bank digital currencies happen to be those where paper currency is going out of fashion the most quickly. The Bank for International Settlements thinks consumers will lose out if paper money goes away—they won’t have a way to access central bank money during a crisis. They will be dependent on commercial bank money and may be more prone to panic when the economy goes haywire.

But I’m still not convinced that a blockchain or distributed ledger or whatever makes a currency more attractive in international trade. The yen is a haven currency even while Japanese consumers remain embarrassingly committed to paper cash. Things like rule of law, deep capital markets, and transparency matter.

Birch suggests keeping in mind’s China’s Belt and Road ambitions. A farmer in a developing country might very well be doing business with China—buying tractors from the world’s second biggest economy and selling goods back to it. Why not do those transactions in digital renminbi? The farmer’s local currency may be unstable. And handling these transactions in US dollars isn’t easy—there are foreign-exchange expenses and some undertakings (sending money to family abroad) could be blocked by US sanctions. If that farmer can download an app and do all the transactions in digital Chinese money, no need for a bank account, wouldn’t that be more attractive than paper stamped with a dead US president?

Branch-less banking

One aspect of the coronavirus pandemic is that existing trends like digitization are being accelerated. Electronic payments and contactless transactions are getting a bump that no amount of marketing could buy, and so too is online banking.

Will fully digital banks be the winner here? Harit Talwar, global head of consumer business at Goldman Sachs, (predictably) thinks branch-less banks like the one Goldman runs will be winners. The “digitization of financial services to serve customers 24/7 is accelerating in front of our eyes,” Talwar said in a video. ”I wonder what traditional banks with thousands and thousands of brick and mortar branches are going to do.”

Will consumers flock to fintech apps, or will they just use the apps from their existing banks more often? A somewhat leading indicator could be new account signups and active mobile users during the second quarter.

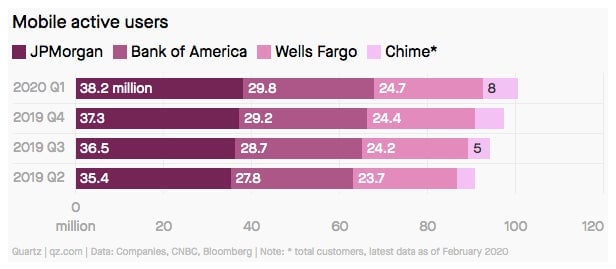

Many of the incumbents have roots going back a century or more and it looks like they are adapting to the shift to mobile. The above data compare active mobile users at some of the largest US banks with the total customer base at Chime, a digital startup bank (active users are sometimes around 40% of the total customer figures). On this measure, the incumbents don’t look too shabby.

Trading the virus

Funding is drying up for many kinds of startups, but not for digital brokerages (and payment companies—see the deals section). Freetrade in the UK is planning a round of crowdfunding next month and a series B raise from venture capital investors as soon as later this year, according to a post in its community forum. Last week Bloomberg reported that Robinhood is close to raking in another $250 million or so.

While most economic activity has frozen over, trading has gone ballistic. There are signs that retail investors are looking for bargains, perhaps hoping the crisis is a chance to buy Tesla stock on the cheap. Some people may be filling their lockdown time by day trading from their sofas.

At Stake, a brokerage that provides trading in US stocks, buying and selling of Tesla, Facebook, Amazon, Netflix, and Disney has increased four fold. Volatility ETFs (like VXX and UVXY) have gone truly bonkers, with volume shooting up as much as 35 times compared to January. Trading of short ETFs that let traders bet on a market decline (like SQQQ) has skyrocketed by 25 times.

It makes sense that VC money, of which there is plenty, would be looking at fintech brokerages right now, says Stake founder and CEO Matthew Leibowitz (the company is self-funded and profitable and isn’t looking to raise money). The brokerage business model is holding up despite the virus turmoil, marketing costs have dropped, and finding talent is probably easier, too, he said.

Leibowitz, formerly of high-frequency trading firm Optiver, pointed out that manic trading volumes and volatility may not last. If that happens, it’s the VCs that could get burned. We’ve been here before: “In 2007, the action was crazy, and then 2009 and 2010 were really tough,” he said.

This week’s top stories

1️⃣ Dealmakers are turning to drones to keep their transactions on track, Bloomberg reports. Investors can use drones to conduct on-site inspections of mining pits and factories to value those assets.

2️⃣ Facebook is looking to partner with three domestic firms for mobile payments in Indonesia. The US tech giant plans to seek regulatory approval for the venture, according to Reuters.

3️⃣ LendingClub is cutting 30% of its workforce. Executives salaries will be reduced by around 25%.

4️⃣ Monzo, the UK startup bank, has applied for a banking license in the US (paywall). That puts it ahead of Revolut, another neobank that’s looking to expand in the American market, according to The Telegraph.

5️⃣ Hybrid homeownership arrangements could put owning a home within reach of more people. It could also provide a source of funding for some people during the coronavirus pandemic, Issi Romem writes in the New York Times.

The future of finance on Quartz

Remittances are expected to drop by 20% in 2020, the largest single-year decline in the past century. These money transfers are an important source of funds for many low-income countries.

Indian banks are bracing for retail loan defaults, after binging on the debt in recent years. The central bank announced a three-month moratorium on term loans and credit-card debt last month.

In the US, loan loss provisions are up, but at least the credit-default swaps linked to American lenders have declined. Trading was perky during the first quarter, though executives don’t necessarily expect that to continue.

Elsewhere on Quartz

Just as Greece began to move out of a decade-long economic crisis, the coronavirus outbreak forced a nationwide shutdown. That’s made delivery workers essential but vulnerable in cities like Athens.

Always be closing

- AvidXchange, a payment automation company, raised $128 million. Sixth Street Partners, Mastercard, Lone Pine Capital, and Schonfeld Strategic Advisors were among the investors.

- Trovata got $4.3 million in investment. JPMorgan led the deal in the cash-reporting automation company.

I hope your week has been a profitable one (pick your own metric). Please send tips, inverse ETFs, and other ideas to [email protected].