This week in membership: Climate tech’s second shot

Hi [%first_name | Quartz member%],

Hi [%first_name | Quartz member%],

Today is a big news day for Quartz, and we wanted to share it with you. First, Quartz is becoming an independent media company again. I’ve reached an agreement to purchase Quartz and take us private. I’m joined in this management buyout by Quartz’s editor-in-chief, Katherine Bell, and the rest of our staff, who will share equity in our new company.

Our second bit of news is that we’re refining Quartz’s mission to be: Make business better. Why? Because we believe companies should solve real problems without creating new ones. The global economy must be as inclusive as it is innovative, align financial incentives with the needs of our planet, and elevate leaders who act with integrity, empathy, and foresight. We think of this as a shared mission with you, our readers. We’ll continue to report on the ideas, people, and companies making business better. And we want to hear about the challenges you’re tackling in your work and the ways you’re pushing to make your organization better.

This week also marks our second anniversary of membership, and we’re celebrating with a week of special programming for our members. Stay tuned.

Your Quartz membership is especially important now that we are independent. I’m incredibly grateful for your support over the years. Thank you!

Zach Seward

[qz-guide-hero id=”434619650″ title=”💡 The Big Idea” description=”Silicon Valley lost billions of dollars investing in clean energy a decade ago. Now it’s back for more. Is it the next big boom, or bust?”]

🤔Here’s Why

1️⃣ Silicon Valley is abuzz over “climate tech,” startups dedicated to reducing emissions and pulling greenhouse gases out of the atmosphere. 2️⃣ However, the clean tech boom a decade ago didn’t go very well. 3️⃣ A new financing ecosystem has emerged and is trying to avoid the mistakes of the last boom. 4️⃣ Critics say Silicon Valley is merely a distraction from the challenge of spending trillions of dollars to deploy mature technologies like solar, wind, and batteries. 5️⃣ But this one is personal for many startup founders.

REMINDER

As a Quartz member, you’re invited to a special virtual event. In honor of our inaugural Members Week (that’s you!), we are for the first time bringing a beloved internal Q&A series—Between Two Derns—out into the wild. Join us on Friday, Nov. 12 from 11–11:30am ET, when executive editor Kira Bindrim will interview editor in chief Katherine Bell. We’ll learn where Katherine thinks the global economy is headed, what she wishes she knew about Quartz readers, and (why not?) if she’d rather be a dog or a ghost.

📝 The Details

1️⃣ Silicon Valley is abuzz over “climate tech” startups.

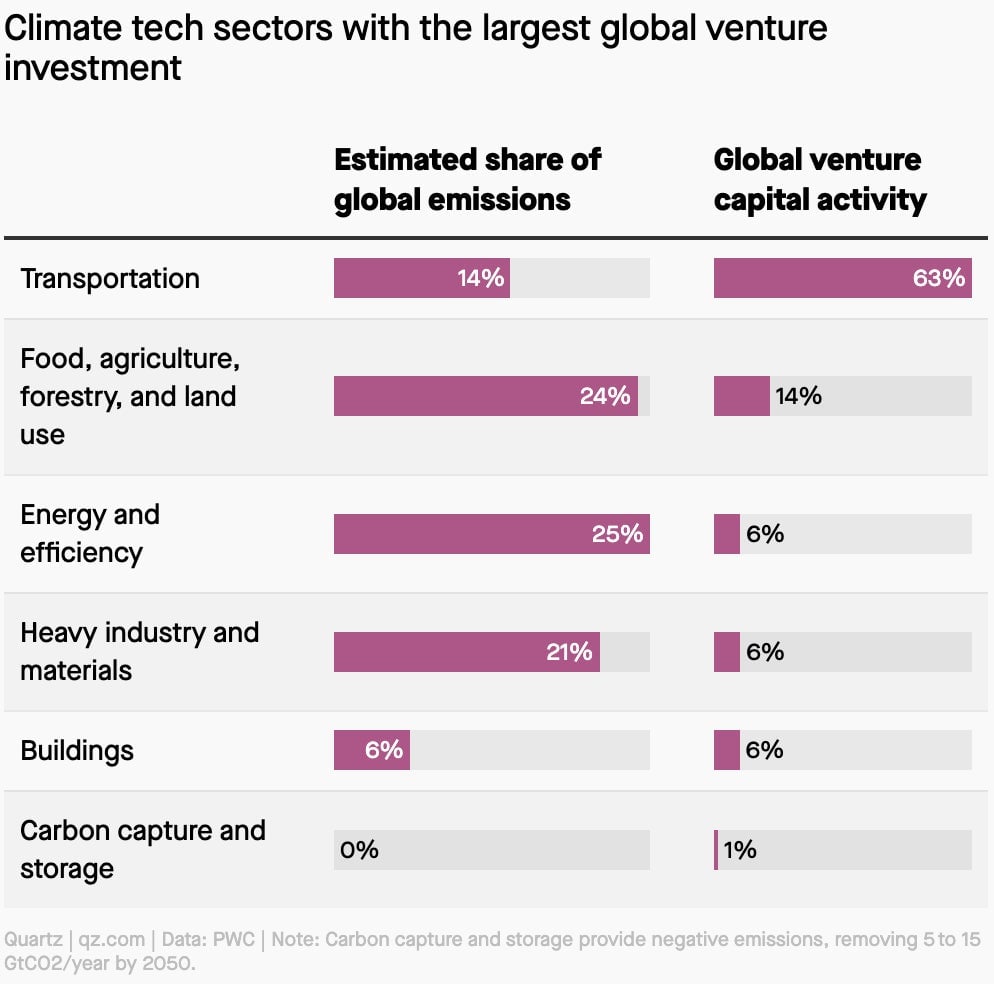

The “climate tech” category is suddenly catnip for inventors, just like bitcoin or AI were a few years ago. But what counts as climate tech? Here’s an overview:

Quartz identified 87 standout startups across these sectors worth keeping an eye on.

2️⃣ The clean tech boom a decade ago didn’t go very well.

No moment captures the optimism of the last boom better than John Doerr’s TED talk in 2007. The partner at famed venture firm Kleiner Perkins walked on stage recounting a dinner conversation he had about global warming with his young daughter. “She turned to me and said, ‘Dad, your generation created this problem; you’d better fix it,’” he said, his eyes brimming with tears. Kleiner Perkins invested $630 million across dozens of companies with half its partners targeting what Doerr predicted would be a $6 trillion business. Billions of dollars from other investors followed: Silicon Valley could get rich while changing the world.

It didn’t work out. Politics and economics conspired against clean tech—from the failures of US climate policy to fracking to an influx of cheap solar panels from China. By 2011, “the clean tech sector was in shambles,” according to a post-mortem by the MIT Energy Initiative. VCs had plowed $25 billion into the sector and saw more than half of it vanish. Of the clean tech companies funded after 2007, more than 90% failed to return even the initial capital invested, the lowest share of any sector. Even when they did succeed, early returns didn’t compare to software startups. Investors fled to safer shores in social media and cloud services.

3️⃣ A new financing ecosystem has emerged and is trying to avoid the mistakes of the last boom.

A new landscape of funders wants its at-bat, and they’ve learned from the last bust. This new ecosystem spans every stage: accelerators, government grants, project financing, and perhaps most critically, financing far beyond Silicon Valley’s venture model.

4️⃣ Critics say Silicon Valley is merely a distraction from the real challenge.

Quartz sat down with Jigar Shah to explore how Generate Capital, his investment fund started in 2014, plans to convince Wall Street and capital markets that the accelerating energy transition is a profitable and safe bet. Generate invests in commercializing large-scale technologies, from renewable energy and heating equipment to urban farms and wastewater treatment. After early investments of $2 million to $20 million per project, Generate recently made a $600 million investment with energy efficiency company Alturus to help Fortune 1000 companies increase their energy savings and efficiency.

That may sound boring, says Shah, but it’s the best way to move the needle. Shah argues tech companies’ primary role in reducing emissions is as the customer for technologies, not the innovator. “Of all the things that need to be done to switch from old infrastructure to new infrastructure, the least important part of it is the technology being cost-effective,” he says.

5️⃣ But this one is personal for many startup founders.

“Entrepreneurs want to do something meaningful with their lives,” says Dawn Lippert, CEO of Elemental Excelerator, a nonprofit investing in commercializing climate-related startups. Y Combinator, a top accelerator, saw the same thing after announcing it was seeking startups to tackle carbon removal. “You have these founders say, ‘I figured out that the only life mission I have is this,” says YC partner Gustaf Alströme. “There aren’t that many categories where we have founders saying things like this.”

Ask enough founders why they’re starting a climate startup, and most will recall a moment when they couldn’t ignore it anymore. For Osi Van Dessel, a SpaceX engineer exploring energy storage ventures, it was the brutal 2017 wildfires, the most destructive fire season in California’s history (at the time), worse than the prior nine years combined. Tim Latimer, founder of the geothermal company Fervo, was working as a petroleum engineer the same year for BHP in the West Texas oil patch. High underground temperatures were fouling fracking wells. His job was to troubleshoot them. But Hurricane Harvey hit Houston that year, unleashing catastrophic flooding worsened by climate change. “I realized it wasn’t a tomorrow problem, it was a today problem,” he said. “The more I learned about climate change, the more I didn’t want my whole career to be about getting oil out of the ground.”