For members—The future of the IPO

[qz-guide-hero id=”434623730″ title=”💡 The Big Idea” description=”Company founders have more ways to go public than ever before—and it’s shifting power from Wall Street to management.”]

[qz-guide-hero id=”434623730″ title=”💡 The Big Idea” description=”Company founders have more ways to go public than ever before—and it’s shifting power from Wall Street to management.”]

The billion-dollar question

Will the IPO ever be disrupted?

IPOs have traditionally been a black box, with Wall Street in charge of who gets shares at what price. Entrepreneurs complain that banks reward their clients with sweetheart deals at the issuing company’s expense. So they’re turning to alternatives:

• A SPAC gives management a chance to negotiate a price directly with its merger target, and investors can walk away and get their money back if they don’t like the deal.

Pop quiz

What kind of public listing are you?

- I’m edgy and I like to take chances.

- I have big ambitions but it takes time to get to know me.

- Everybody knows me, everybody loves me, and I’m a big deal.

- I don’t like scrutiny and I never want to grow up.

Answers: If you picked…

- You’re a Special Purpose Acquisition Company (SPAC): Basically a big pot of money looking for an acquisition target. You’re a little unusual and risky, but that’s sexy right? Let’s roll the dice.

- You’re a traditional listing. You might be the next mega-cap stock, but you’re not a consumer name everyone already knows. Taking some time to explain your story to investors could be worth the time and money.

- You’re a direct listing. As a company people already love and use regularly, you don’t need to hold investors’ hands. They know who you are and are salivating over your shares.

- You should stay in the private market. This way you don’t have to deal with a share price that twitches on every scrap of news, cope with pesky short sellers, or show the entire world your dirty laundry via regular financial statements.

Explain it like I’m five!

Why go public at all?

Mainly it’s because the public market is where the big money is.

Launching an IPO can be the only way for the founders of the most valuable companies to cash in on their hard work. Selling a billion-dollar startup to another company might not be an option if its competitors are too small to afford it. But the $45 trillion US stock market can absorb big companies without a hiccup.

And while being public is cumbersome and expensive, it can be beneficial for a company. The rigor and scrutiny involved can push a company to have strong processes that make it function better.

Charting the rise of SPACs

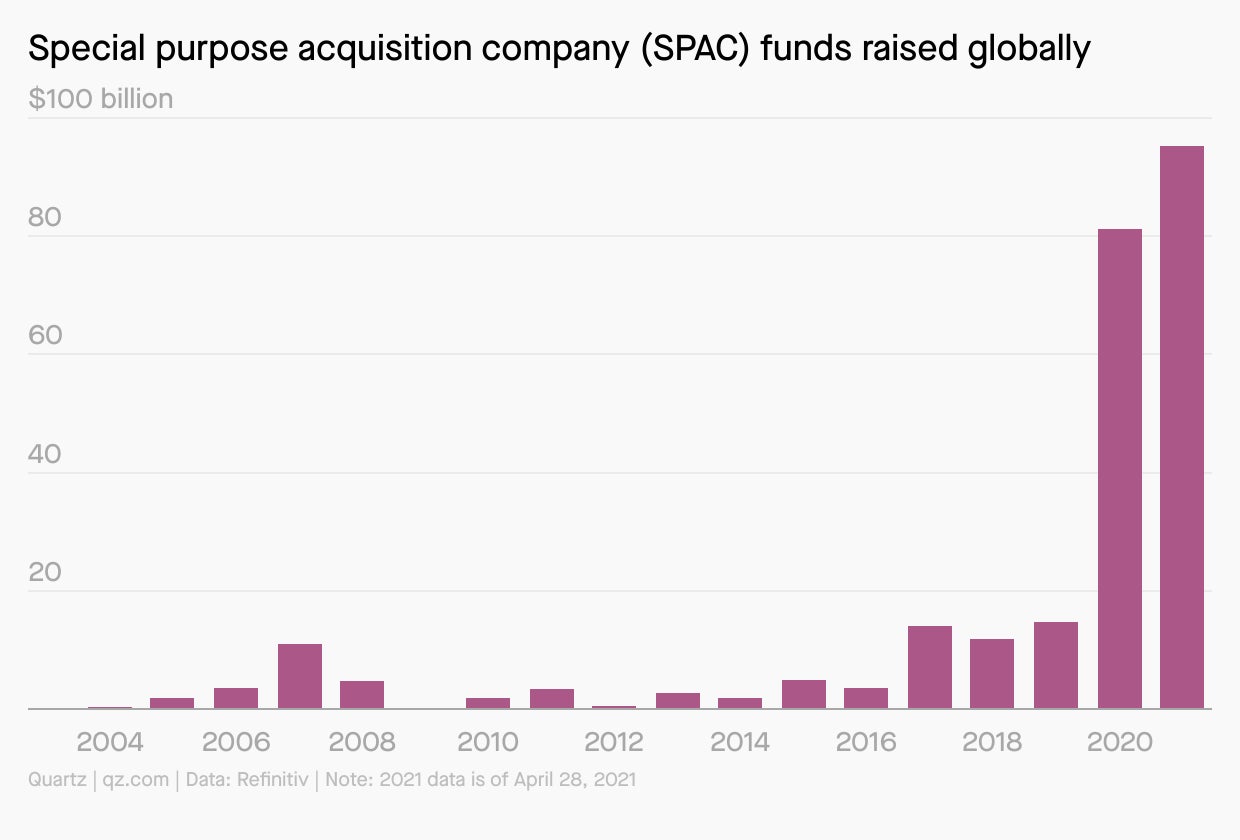

The purpose of a special purpose acquisition company (SPAC) is to acquire an as-yet unidentified private company, taking it public through the merger process. SPACs were all the rage this year, but nobody thinks the SPAC mania can continue the way it has.

One big number

4: Number of the 442 companies that went public in the US last year that had women founder-CEOs, according to data compiled by Business Insider and Nasdaq.

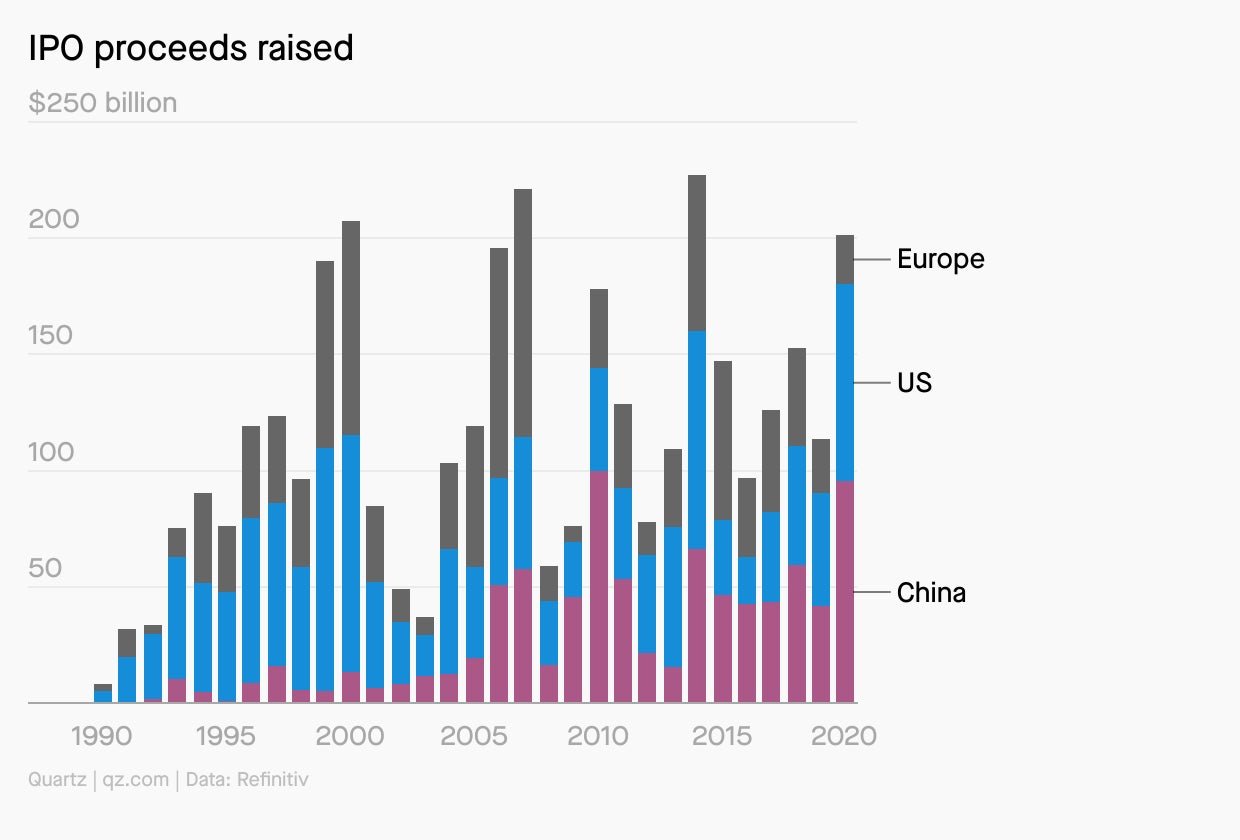

Charting the new geography of IPOs

China’s IPO market exceeds the US’s in terms of capital raised. But size doesn’t tell the entire story. Chinese investors don’t have as many options and regulations make IPOs especially lucrative for those investing. That means China’s stock market is large but much more localized than the US—and likely to stay that way.

📣 Sound off

Are IPOs rigged to favor institutional investors?

Yes, and the startups going public pay for it.

In last week’s poll about third-party cookies, 55% of respondents said they’re reserving judgment on what their demise means until they learn what replaces them. How very reasonable of you.