The Meta-morphosis

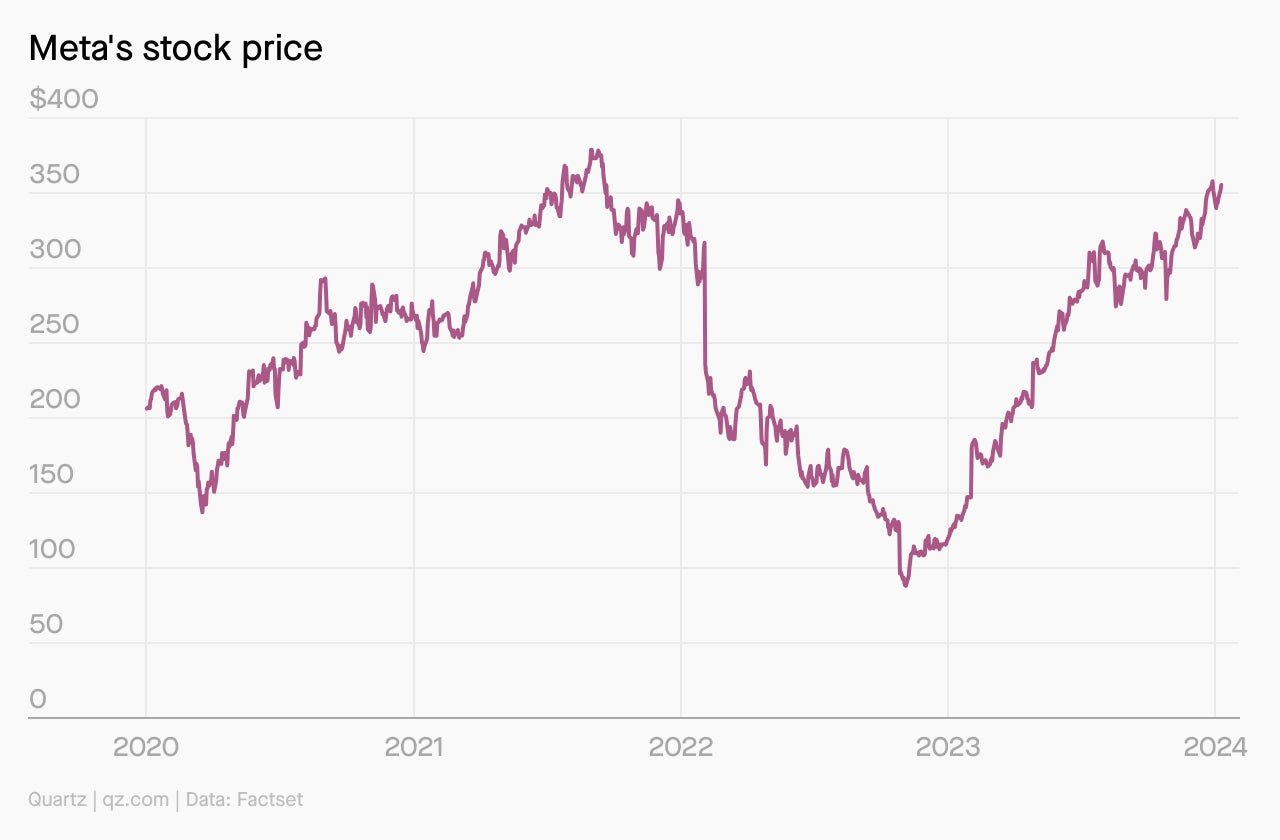

Meta's stock price is at a 28-month high. Will it go higher?

Hi, Quartz members,

One morning in November 2022, when Mark Zuckerberg woke from troubled dreams about the metaverse, he found himself transformed into a poor man. Or, well, not poor—merely less rich. If he lifted his head a little, he could see the CNBC ticker, showing Meta’s stock price languishing in the region of $90. His net worth had shrunk to a paltry $35 billion, down from $125 billion at the beginning of that year. People were calling for him to step down as CEO. “What’s happened to me?” he must have thought.

He may well think that again now, in contrasting sentiment. This past week, Meta’s share price hit $370, its highest mark in more than two years. (His own net worth is in the region of $134 billion, per the Bloomberg Billionaires Index.) On Wednesday (Jan. 10), a Mizuho analyst issued an even rosier target price of $470, and forecast 15% year-on-year revenue growth in 2024, to $153.5 billion.

The transformation in Meta’s fortunes was, admittedly, part of a broader rally in equities—and, in particular, in megacap tech stocks. But it wasn’t just being swept along by the current. Behind Meta’s bumper 2023 is a host of factors—all of which are still in play in 2024.

CHARTED

METAPHYSICS

What lies behind the revival of Meta’s stock price? The Weekend Brief picks out three crucial factors:

🛑 The metaverse freeze: When Facebook rebranded itself as Meta, it intended to pivot towards the metaverse, the virtual world for which it could sell hardware, develop software, sell advertising and subscriptions, and more. But the focus on the as-yet-unproven business model of the metaverse didn’t enthuse investors, who watched in dismay as the company proceeded to lose around $50 billion on this gamble. Shareholders urged Zuckerberg to dial down his “super-sized and terrifying” metaverse bet—and he did, when his stock hit the doldrums in late 2022. He also laid off employees, cut other costs, and embarked on a “year of efficiency”—sweet music for investors.

💲 The advertising rebound: Through 2022, as the US fretted about the prospect of a recession, the market for digital ads shriveled up. Alphabet’s total quarterly revenue growth fell from 41% to 6%. When Snap missed third-quarter analyst estimates, its stock plunged more than 30%. Meta was not immune, reporting quarter after quarter of declining ad sales. But as the likelihood of a soft landing for the economy grew, ad sales surged last year; Meta’s revenues grew 23% in the third quarter of 2023, when compared to the same quarter in 2022.

Analysts reckon some of Meta’s products still have room to grow their ad income. Reels, for instance, represents only around 10% of total Instagram ad impressions at the moment, according to Tinuiti, an independent performance marketing firm. But since the launch of Reels, users have spent 40% more time on Instagram, Meta executives said during their third-quarter earnings call. As Instagram’s short-video format picks up steam, its total ad impressions will grow as well.

🤖 In the spring of 2023, Meta announced another pivot. Its top investment priority, Zuckerberg said, was the flavor of the month: artificial intelligence. Cue the cheering. Last year, he created a focused group to design generative AI products, trying to push Meta’s AI researchers to build things that could earn the company money. The company also began sharing its large language model, Llama, as open-source software, in a bid to attract developers and catch up to OpenAI and Google.

Knitting AI into Meta’s suite of platforms could yield streams of income that weren’t imaginable even three years ago. The Mizuho analyst who recommended Meta last week offered one example: the use of AI to automate customer service over WhatsApp. (Zuckerberg had already called business messaging “the next major pillar” for Meta back in October.) “Based on our estimate, we believe that WhatsApp represents the largest potential given its large base of...2 billion [users] and the room for monetization improvements compared to the overall Meta platform,” the analyst wrote. Cha-ching!

TWO BIG NUMBERS

13: The number of mentions of “metaverse” in Meta’s earnings call transcript (pdf) for the third quarter of 2022.

3: The number of mentions of “metaverse” in Meta’s earnings call transcript (pdf) for the third quarter of 2023.

ARE YOU HEADING TO DAVOS?

⛰️ If you’re almost every person, the answer is: “Nope.” The World Economic Forum’s annual meeting in the Swiss Alps brings together powerful people in the public and private sectors to talk about the state of the economy (and all sorts of other things) while sipping hot chocolate and hunting down the best raclette.

Quartz will be there, bringing you regular updates about who’s saying what—and who’s pointedly not saying what. Click over to our Need to Know: Davos 2024 page to sign up for our daily Davos newsletter, and to see sample editions from last year. The WEF runs from Jan. 15-19 and, as always, our Davos email—unlike a ticket to Switzerland—is free!

ONE 🐮 THING

A man’s gotta spend his money. On Facebook this week, Zuckerberg revealed that he’s that he’s doing it by feeding beer and macadamia nuts to his herd of cows. On his Ko’olau Ranch on the island of Kauai, in Hawaii, Zuckerberg is raising Wagyu and Angus cattle to create “some of the highest quality of beef in the world,” he wrote. The beer is brewed on site, from grain grown on the ranch; the nuts are harvested there as well. (“Each cow eats 5,000-10,000 pounds of food each year, so that’s a lot of acres of macadamia trees,” Zuckerberg wrote.) It’s as if he’s laying in extreme gourmet supplies for the end of days. Just below his ranch, as WIRED found out, is a 5,000-square-foot shelter with its own water and energy supply. The ranch compound itself is “an opulent techno-Xanadu,” with at least 30 bedrooms—and an industrial kitchen in which to cook A-grade steaks during the apocalypse.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Reinvent your weekend,

— Samanth Subramanian, Weekend Brief editor