What's up, Dave?

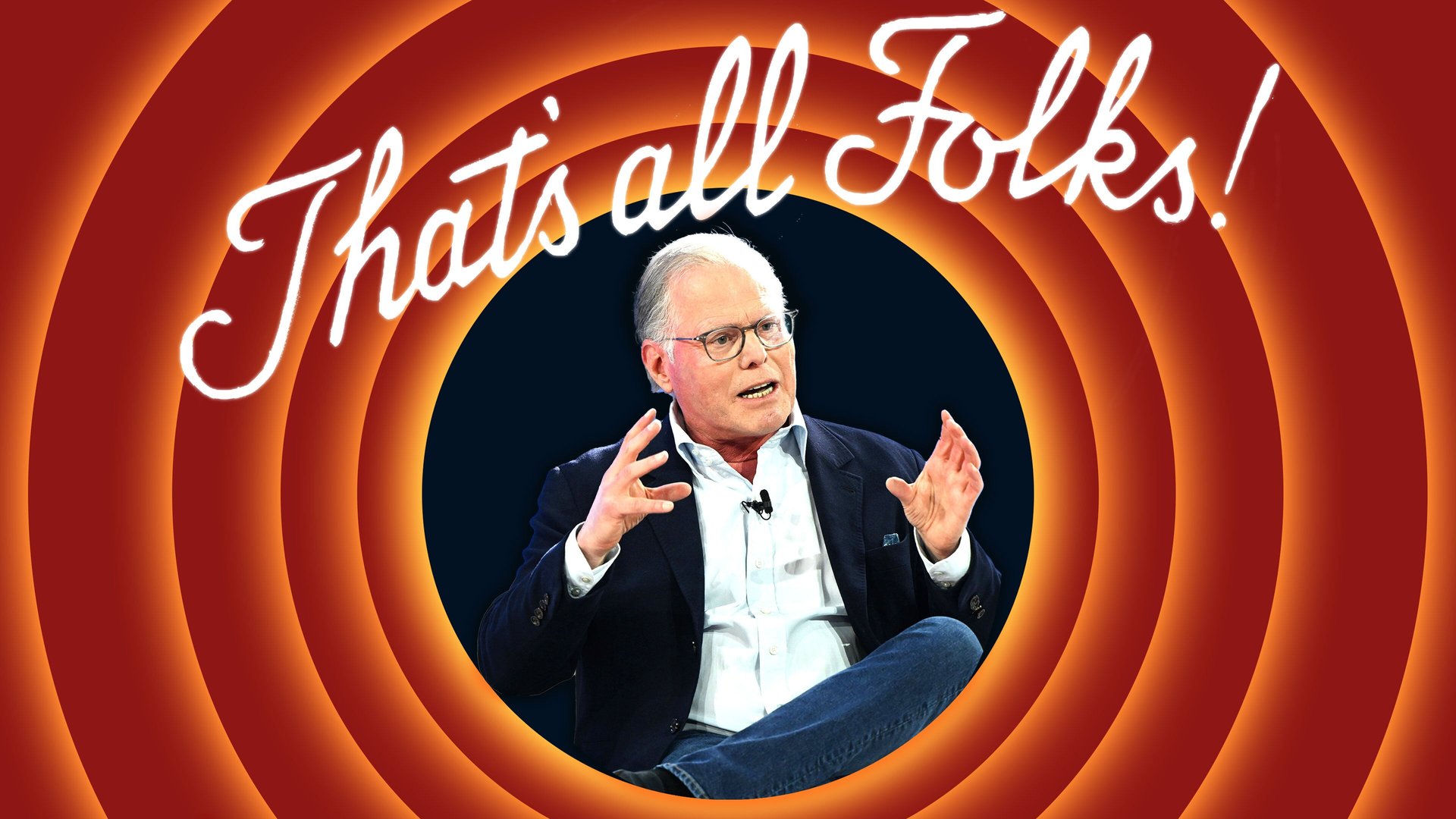

Warner Bros. Discovery and its CEO David Zaslav are in a fight for their lives.

Hi, Quartz members!

Suggested Reading

These are turbulent times in the media industry — even if you’re the second-highest-paid CEO in Hollywood. This weekend we take a look at the home of Bugs Bunny, the storied Warner Bros. (with its new partner Discovery), and its lightning rod CEO, David Zaslav.

Too much, too late?

It’s a rare Hollywood mogul who would take the risk of appearing before a crowd of students at a university with a prominent film school, especially in the middle of a strike by Hollywood writers and actors against studio pay practices and the future use of AI. But that’s what Warner Bros. Discovery CEO David Zaslav did, and the payback was swift and brutal. “Pay your writers,” the students at Boston University’s 2023 commencement chanted.

The payback for Zaslav’s cost-cutting leadership at the studio — which he took over in 2022 when he was leading Discovery, a successful but relatively small cable network — came almost as fast, and is looking increasingly brutal. Sure it’s freed up cash to pay down some of the $50 billion in debt that financed the deal. But it’s left the company starved for investment, just as the advertising market has collapsed. The company’s stock price has plummeted, falling from around $25 when he led the purchase, to a little more than $7 this week. And Zaslav’s missteps have been fodder for Hollywood’s vicious media scene.

At CNN, Zaslav’s handpicked chief Chris Licht drew heat for firing some favorite journalists, including the aggressive media reporter Brian Stelter. Then Zaslav ordered Licht to host an unfiltered and un-fact-checked town hall with Donald Trump, a bid to attract right-wing viewers from Fox, drawing cries of outrage from CNN anchors including Christiane Amanpour. An Atlantic profile of Licht soon followed, and within days Licht was out the door.

Then came the TCM debacle: The mildly profitable classic film channel was a leftover from Ted Turner’s time atop Warner Bros. in the late 20th century, and a beloved channel for film fans and directors. Zaslav gave walking papers to its entire staff. After angry calls from Stephen Spielberg and Martin Scorcese, Zaslav walked back some of the cuts.

And then came losing the next decade of NBA games. When the basketball league cut a new $77-billion plus deal for carrying its games, Warner Bros. got cut out, and Amazon took its place. Zaslav is suing, but it’s unlikely he’ll be able to change the league’s mind.

Then there’s Zaslav’s pay package: Last year he received $50 million, making him the second-best-paid studio chief in Hollywood, while WBD lost $3 billion. In 2021, while still at Discovery, he earned $247 million and top spot on Time magazine’s list of the most overpaid CEOs in America. Critics say his pay is not aligned with the company’s best interest.

Zaslav’s biggest challenge is that he took over the studio just as traditional revenue streams have collapsed. While broadcast TV is enjoying a renaissance, cable is losing ads, and viewers are increasingly exasperated with the cost of subscribing to multiple streaming services. That was the impetus behind Zaslav’s vision of a combined sports stream with Disney/ESPN and Fox, Venu. That vision is now in jeopardy after a Federal judge blocked the project while she hears a challenge from rival sports streaming service Fubo, which alleges the streaming alliance is anti-competitive.

“How they got into this pickle was a combination of events out of their control and some decisions that could have created different outcomes,” said Jessica Reif Ehrlich, an analyst at Bank of America who covers WBD closely. “As soon as they combined” Warner Bros. and Discovery, she said, “pay TV just fell off a cliff, and there was the advertising recession, a secular trend as ads moved from linear to digital and other areas.” The actors and writers strikes the following year helped the company increase free cash flow, as it wasn’t meeting payroll or making movies. But in the long run, it cut investment just as consumers were returning to theaters after the pandemic.

Even the vaunted DC studios, WBD’s answer to Disney’s Marvel franchise, has had a slow start. Batgirl was mothballed, Flash fizzled, and now hopes are riding on a musical about the Joker starring Lady Gaga, and a remake of Superman scheduled for next year.

Financial headwinds

The headwinds Zaslav faces are daunting: When second-quarter results came in last week, WBD wrote off $9.1 billion from the value of its linear networks, as TV advertising revenue fell 10%, reflecting a 13% drop in TV audiences (outside sports). The Warner Bros. studios saw a 4% decline in revenue, including a 41% drop in revenue from video games. All in, WBD’s revenue dropped 5% from a year earlier, and pre-tax profit was down 15% for the quarter. Shares immediately fell another 11%, raising speculation among analysts that the time might be ripe for a major change. Zaslav’s pay package makes it more difficult to right the ship, said Reif Ehrlich,

What’s next?

CFO Gunnar Wiedenfels has done a sterling job of cutting costs, reducing duplication among the company’s many divisions, and freeing up a lot of cash. That’s let WBD pay down $10 billion of debt. But that may not be enough for WBD to survive in its current form, say analysts. Here are some possible options for the studio:

- Sell off key assets. But closing sales and getting regulatory approval could take up to two years, and WBD may not have that much time.

- Merge its streaming operations with other streamers. Gaining scale would help reduce churn and marketing costs, and like the sports venture, attract viewers who are tired of paying for multiple subscriptions.

- Merge with a broadcast network, most likely Fox, since CBS, ABC, and NBC all have their own futures mapped out. That would provide a strong home for WBD’s cable networks.

- Sell off CNN (a necessity if WB merges its linear channels with Fox).

- Split the company in two: Put the cable channels in one basket with the company’s debt, and keep the studios and streaming in another company.

All of this suggests that Warner Brothers Discovery may be nearing the end of its run as an independent company. “If they actually are going to break it up, these assets are incredibly valuable,” Reif Ehrlich said in an interview. But she added, “I don’t know that they have the luxury of time to turn it around. If they can’t fix it, somebody will fix it for them.”

Grab your popcorn and pull up a chair. It’s gonna be a heckuva show.

— Peter Green, Weekend Brief writer