The Race to Zero Emissions: clean energy jobs, green goods, and negative oil

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Decreases emissions

1️⃣ Oil prices went negative as storage filled up. That’s forced producers to close off wells. “This is creating damage to production and some of it will never come back online again,” said one oil analyst.

2️⃣ The chaos in the oil market is also closing oil refineries in North America amid a daily surplus of 15 million barrels. Crude scraped $10.01 per barrel yesterday, its lowest price since 1986, and is now plumbing negative territory.

3️⃣ Hybrid hydrogen cars finally hit the road. The city of Carmel, Indiana (pop: 93,510) is injecting hydrogen into gasoline for its fleet of vehicles. It’s a small part of a wave of new hydrogen technologies for heating, energy, and transportation aimed at supplementing or replacing fossil fuels.

4️⃣ Georgia just killed the United States’ last new coal plant proposal. State regulators refused to give the $2 billion, 12-year Plant Washington project more time to start construction.

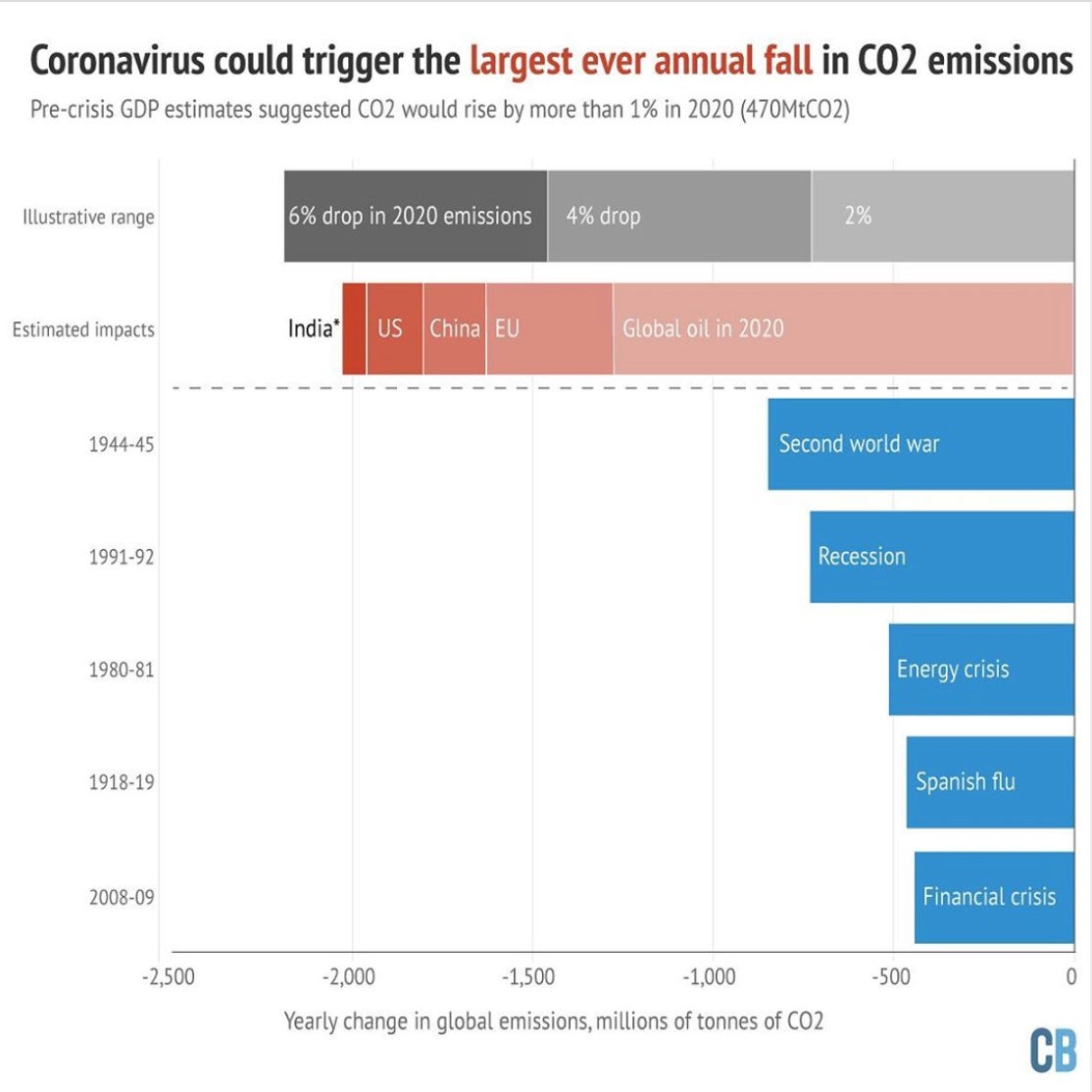

5️⃣ The Covid-19 pandemic may slash emissions by an unprecedented 2 billion metric tons of CO2, down 5.5% compared to 2019, according to Carbon Brief. But the UN notes we still need reductions of -7.6% per year through 2030 to keep warming below 1.5C.

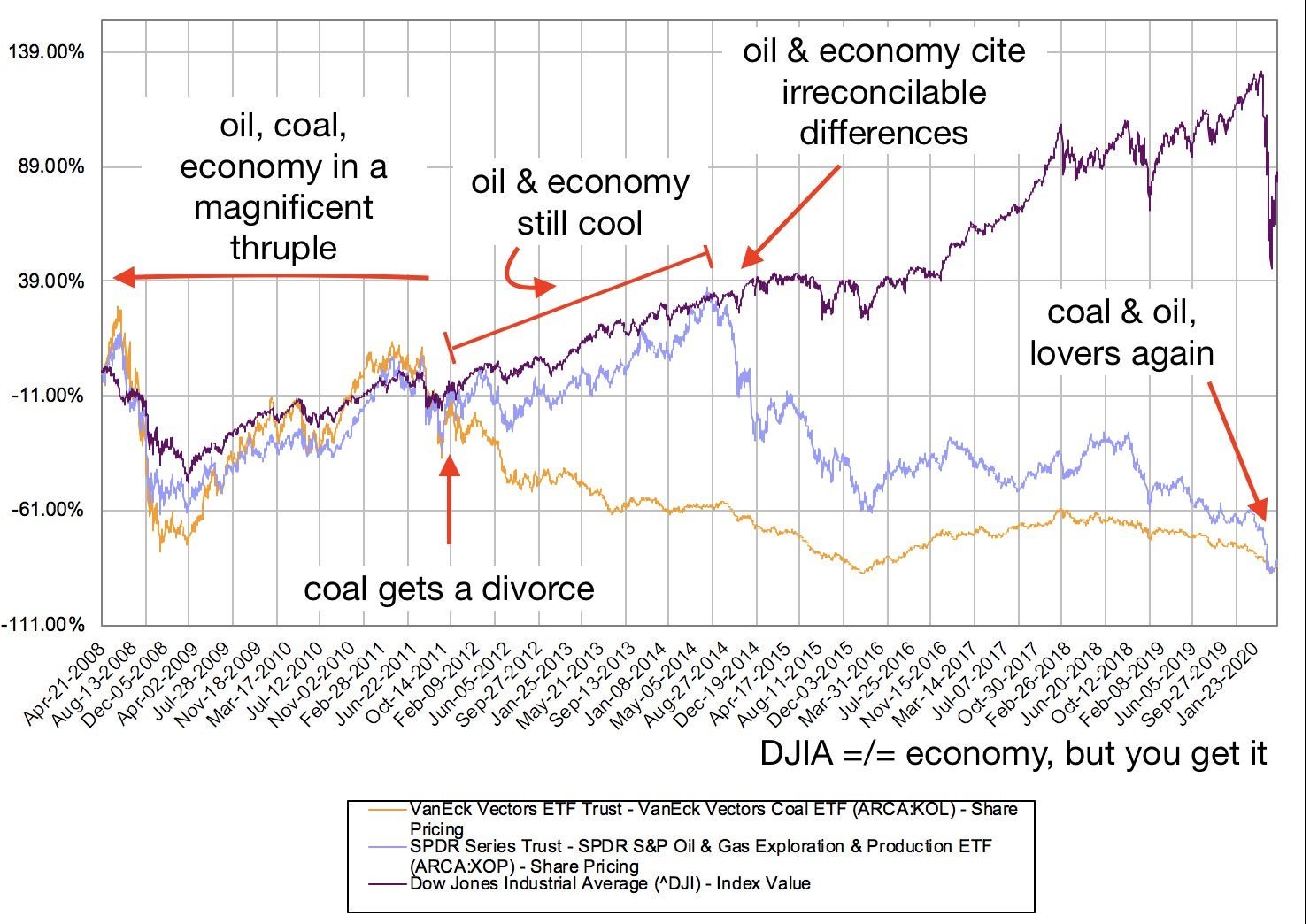

Coal and oil, together again

It’s been a rough year for US oil. On April 14, dozens of energy executives, analysts, and others gathered (on video) to warn the Texas Railroad Commission that the industry was on the verge of collapse. With prices plummeting far below the break-even point, the agency responsible for regulating Texas oil and gas mulled forcing producers to stop pumping. Scott Sheffield, the CEO of Irving-based Pioneer Natural Resources, argued it was the only way to stabilize the industry after years of unprofitable expansion. “No one wants to give us capital because we have all destroyed capital and created economic waste,” he said, according to the Texas Tribune. It’s part of a long-term trend decoupling the prospects of the economy from coal and then oil and gas. Kelly Mitchell, an oil and gas analyst at the watchdog group Documented, took to Twitter to explain “the most moving thruple love story of our time” and its untimely end.

Net-zero (for now)

1️⃣ UK’s National Grid will pay wind farms to shut down and hydropower projects to pump water into reservoirs for later release as energy amid a glut of electricity.

2️⃣ Royal Dutch Shell says it will cut the carbon intensity of its products by 65% and make its operations “net-zero” emissions by 2050. The company follows similar plans by BP, Repsol, Ørsted, and other European energy firms to reduce emissions.

3️⃣ Norway approved Equinor’s plan to build floating wind turbines to power its oil and gas platforms. The 11 turbines capable of generating 8MW will cover about 35% of the energy use for five platforms.

4️⃣ Carbon feedbacks are a central source of uncertainty in climate models, yet only half of climate modeling groups include them. That’s a risky assumption: Amplifying feedbacks such as melting permafrost could force warming 25% higher than IPCC projections.

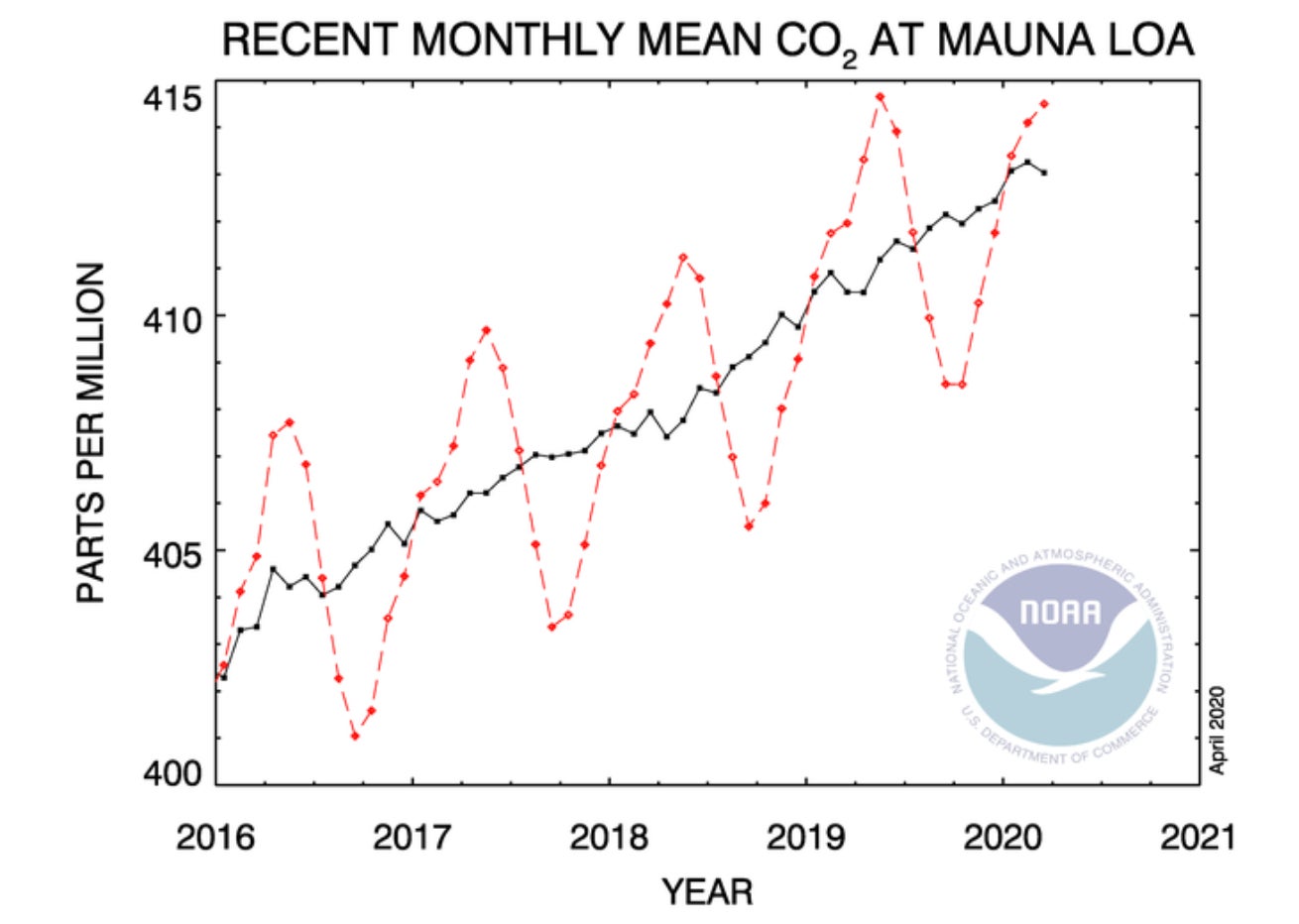

5️⃣ The pandemic may become the first economic crisis to show up in atmospheric CO2 data. Concentrations at Mauna Loa are still peaking, but the first sustained global reduction of fossil fuel emissions in modern history is expected to show up soon.

Betting on the past

Alberta is doubling down on oil. Premier Jason Kenney said the Canadian province will take an $1.5 billion equity stake and issue $6 billion in loan guarantees to ensure the Keystone XL pipeline is built (while slashing incentives for tech innovation). But other countries are heading in the opposite direction. Researchers at Oxford and Cambridge assembled a dataset of 350 “green” products to analyze the competition for a low or no-carbon future. They found that richer countries moved up what they called the green complexity index—the “extent to which countries can competitively export a diverse range of technologically sophisticated green products”—suggesting they were more competitive in developing the next generation of goods and services. Germany, Italy, China and India all stand out given their GDP per capita.

🔼 Increases emissions

1️⃣ Shell surprised analysts by committing to a joint $6.4 billion gas project in Australia with PetroChina despite record low gas prices. It’s the first major investment decision by Shell after the industry slashed billions of dollars in capital expenditures during the pandemic.

2️⃣ The Federal Energy Regulatory Commission announced its intent to effectively raise the minimum cost of offshore wind and batteries compared to fossil fuel plants. The rule prompted New York senator Chuck Schumer to call out the agency’s attempt “to slow any transition to clean energy.”

3️⃣ More than 100,000 people in the clean energy sector have lost their jobs, according to an analysis of Department of Labor data by environmental groups, with as many as half a million job cuts on the way. In North Dakota, the coronavirus outbreak has shut down a 900-person wind turbine plant.

4️⃣ The US EPA changed its methane accounting rules that environmental groups say make it less likely to identify major leaks. The new rules may make it harder to find “super-emitters” releasing highly concentrated methane.

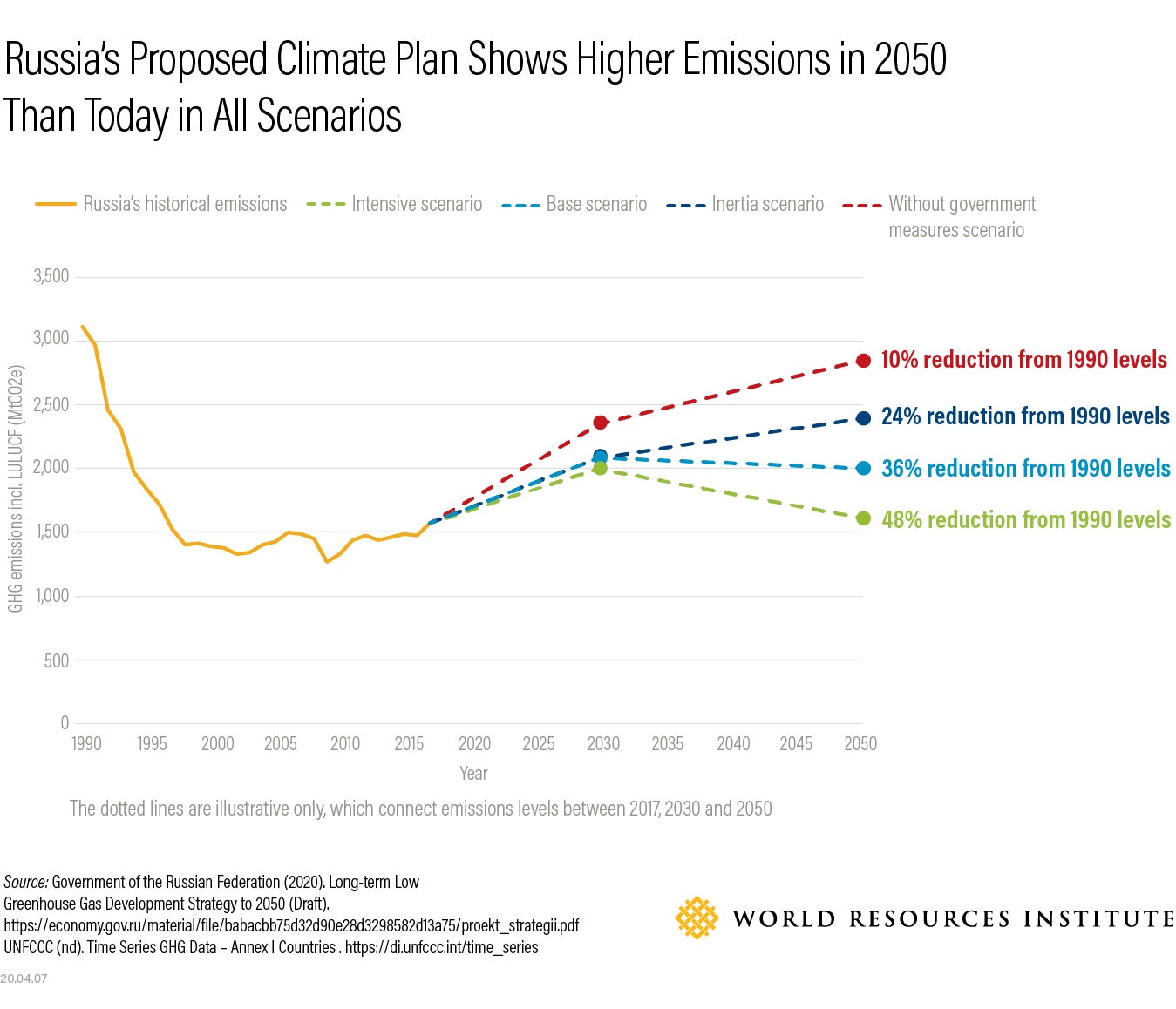

5️⃣ Russia’s new climate plan is out. And it’s not much. The nation’s emissions are projected to increase through 2050 and not approach net-zero for another 80 years or more.

Stats to remember

As of April 19, the concentration of carbon dioxide in the atmosphere was 416.05 ppm. A year ago, the level was 413.86 ppm.

For Quartz members

When India announced its 21-day coronavirus lockdown, thousands flocked to online grocery delivery for the first time. The companies likely to thrive after this pandemic are the ones who can use this moment to overcome obstacles that pre-existed it.

Have a great week ahead. Please send feedback and tips to [email protected].