The Race to Zero Emissions: oil sands, gas flares, and other shutdowns

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Decreases emissions

1️⃣ Banks keep ditching coal. Australia’s Westpac Banking will exit the sector by 2030. That leaves just one major bank in the country, Australia and New Zealand Banking Group, backing the coal industry in the world’s second-largest thermal coal exporting nation.

2️⃣ France has proposed a minimum price floor for oil in the EU. Current oil prices around $20 “do not reflect their true cost for climate,” the French government stated in a policy paper, referring to environmental damages from flooding to heatwaves.

3️⃣ The world lavished more than $5.2 trillion (6.5% of global GDP) on fossil fuel subsidies in 2017. The International Monetary Fund says it’s time to cut back as it readies a $1 trillion coronavirus stimulus package.

4️⃣ Oil and gas leases across 145,000 acres of Montana were vacated by a federal judge. The Trump Administration failed to consider their environmental impacts, states the order, insisting the US government account for the climate impact of approving more fossil fuel drilling and extraction.

5️⃣ Coronavirus shutdowns are expected to shave an unprecedented 8% off the world’s carbon emissions, or nearly 2.9 gigatons. That’s six times larger than the drop following the 2008 global financial crisis, the International Energy Agency’s Global Energy Review reported on April 30.

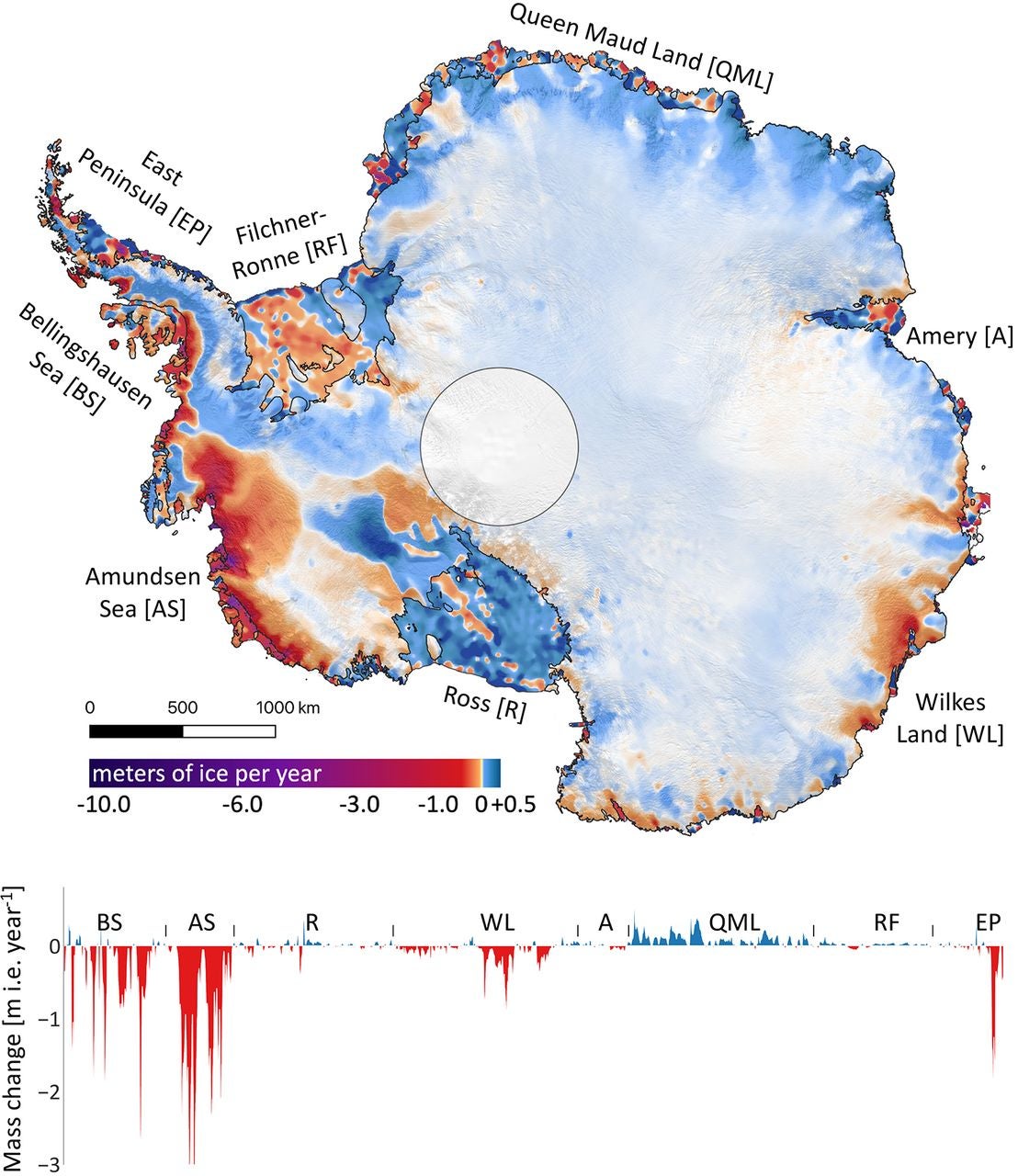

Space lasers

Over the last 16 years, NASA has watched as the Greenland and Antarctic ice sheets have slowly melted. Since 2003, NASA’s orbiting ICESat (and then ICESat 2 in 2018) have used laser altimeters shooting 10,000 pulses of light per second to measure ice loss as fresh water entered the oceans. Now, scientists report that ice losses have far outpaced new ice deposition. At least 318 gigatons of ice from Greenland and Antarctica have been lost, raising sea levels by about 14 millimeters (.55 inches).

Net-zero (for now)

1️⃣ Covid-19 is closing Canada’s carbon-intensive oil sands for business—at least for now. ConocoPhillips, Husky Energy, Cenovus Energy, Athabasca, Hangingstone, and others have all voluntarily slashed production, and steeper cuts of more than 25% are on the horizon.

2️⃣ A California start-up, Ways2H, says it can convert trash into hydrogen gas for lower cost than solar and wind power. While a waste-to-hydrogen industry is years away, pilot plants around the world are now turning organic waste, sewage, and even plastic and tires into hydrogen gas.

3️⃣ Oil companies using a tax credit for carbon storage claimed nearly $1 billion in fraudulent tax benefits, the US Treasury asserts. New Jersey senator Bob Menendez (D) is now calling for the IRS to go after bad actors.

4️⃣ Tesla is angling to be a distributed electric utility. Its Autobidder software allows battery owners to automatically sell surplus electricity back into the grid by coordinating the flow of electricity from hundreds or thousands of batteries.

5️⃣ A Chinese coal mining firm says it will finish a $199 million solar-powered hydrogen plant this year. The electrolysis project, which it claims is the largest of its kind, will produce 160 million cubic meters of hydrogen per year.

Future floods

Historic flooding is the new normal as climate change alters weather patterns around the globe. To predict and perhaps prevent some of this damage, the World Resources Institute (WRI) has built a flood prediction tool, Aqueduct Floods, with researchers in the Netherlands. The models show where people, property, and GDP are most at risk, and what investments might help prevent damage. WRI estimates floods will affect twice as many people by 2030, or 132 million people, and three times as many by mid-century. But for every $1 spent on flood protection infrastructure, WRI predicts more than $248 in damages can be avoided.

🔼 Increases emissions

1️⃣ Falling electricity prices due to the coronavirus are idling nuclear plants around the world. Unprofitable reactors from France to Sweden have gone offline in the EU.

2️⃣ Royal Dutch Shell slashed the dividend it pays to investors by two-thirds, the first such move in more than 70 years. The cut may mark an era of less attractive fossil fuel investments in a climate-constrained world.

3️⃣ New findings suggest carbon sinks such as tropical forests and permafrost are turning into net emitters of carbon dioxide, reports Yale Environment 360, jeopardizing our ability to keep global temperature rise below 1.5C.

4️⃣ Mexico’s electrical grid operator has suspended intermittent energy supplier tests that would help new clean energy projects come online and displace fossil fuel generators, according to Bloomberg. The Centro Nacional de Control de Energia blamed the coronavirus.

5️⃣ The Environmental Defense Fund says one in 10 flares in the oil-rich Permian Basin are malfunctioning or unlit, releasing 230,000 metric tons of climate-warming methane into the atmosphere. That’s 3.5 times worse than US government estimates.

Stats to remember

As of May 3, the concentration of carbon dioxide in the atmosphere was 418.12 ppm. A year ago, the level was 414.81 ppm.

For Quartz members

Officials are spending and lending more than $5 trillion to keep their nations from tumbling into an economic black hole caused by the novel coronavirus. To pay for it, these countries are having to borrow a bunch of money.

Have a great week ahead. Please send feedback and tips to [email protected].