Hims & Hers found its groove in weight loss and personalized medicine — and the stock is surging

The company's CEO said its weight loss offerings could generate $100 million in revenue in 2025

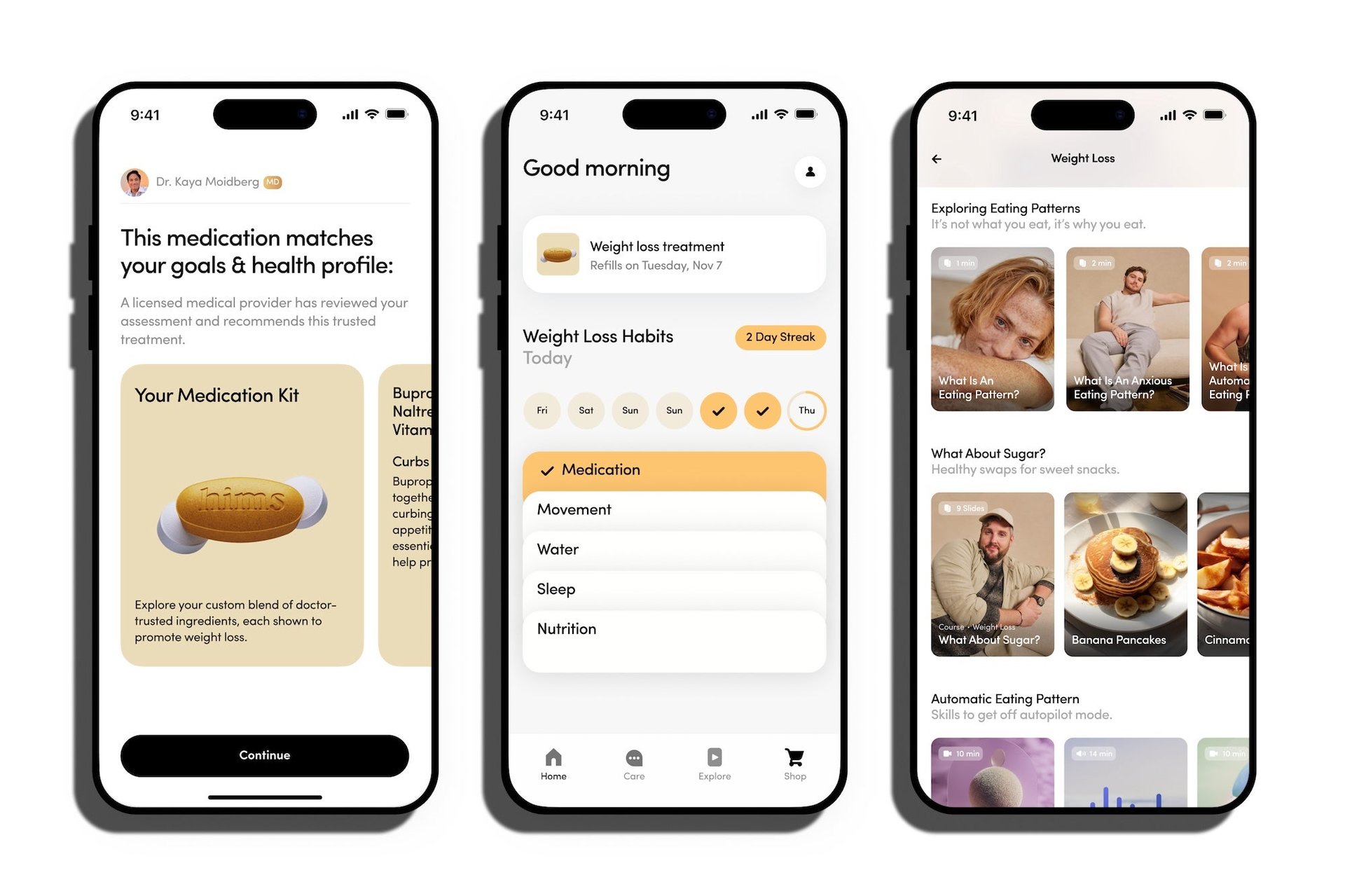

Personalized treatments, including for weight loss, from the millennial-skewed telehealth platform Hims & Hers will lead the company to its first profitable year.

Suggested Reading

The company made the projection in its latest quarterly earnings report and investors took note, shooting the company’s stock up 31% on Tuesday.

Related Content

This comes during a tough time for the telehealth sector as virtual doctor visits have been on the decline in the years following the pandemic. Hims & Hers success with personalized treatments and weight loss offerings could point a path forward for the industry.

Hims & Hers was founded in 2017, known as just “Hims” at the time, as a platform for men to get prescriptions online for erectile dysfunction and hair loss medications. Since then, it has expanded to offer treatments for men and women to address skin care, anxiety, and overall sexual health.

Last year, the company started testing an AI tool that recommends users personalized treatments unique to their needs.

And more recently in December, Hims & Hers launched a weight loss program that includes access to weight loss medications — just not the ones you’re thinking of. The company’s current weight loss medication offerings focus on treating the underlying causes of weight gain. Eventually, Hims & Hers plans to offer GLP-1s, the new class of weight loss drugs that the highly sought after Ozempic and Wegovy belong to.

“We very much expect it to be on the platform and we would expect in the coming years for those to contribute very meaningful growth to the business,” Hims & Hers CEO Andrew Dudum told investors on a call Tuesday.

During that call, Dudum also said that the company’s personalized treatments for dermatology, mental health, and weight loss treatments each have the “ability to deliver more than $100 million of revenue in 2025.”

Its number of subscribers grew 48% year-over-year to 1.5 million by the end of 2023.

Virtual doctors on the decline

In contrast, other telehealth companies have been struggling in recent quarters as virtual doctor’s visits have sharply declined since peaking during the pandemic. Without the need to social distance, it seems more patients prefer to have their medical needs met in person.

Telehealth visits plummeted (pdf) 45.8% in the fourth quarter of 2022, to 41.5 million visits from 76.6 million in the second quarter of 2020, according to data from the market research firm Trilliant Health.

More recent data from the Centers for Medicare and Medicaid Services shows that downward trend continued in 2023. Medicare beneficiaries who used at least one telehealth service fell 73% to 2.8 million (pdf) in the second quarter of 2023, from a peak of 10.2 million during the same period in 2020.

Jason Gorevic, CEO of the telehealth company Teladoc, described the the telehealth market as “fairly well-penetrated” in a call with investors last week. He added that revenue growth from the company’s U.S. virtual care products will be in the “low single-digits moving forward.”

Amwell, another telehealth company, reported a 10% (pdf) drop in revenue in the quarter ending Dec. 31 to $70 million, from $79 million in the same quarter the prior year.