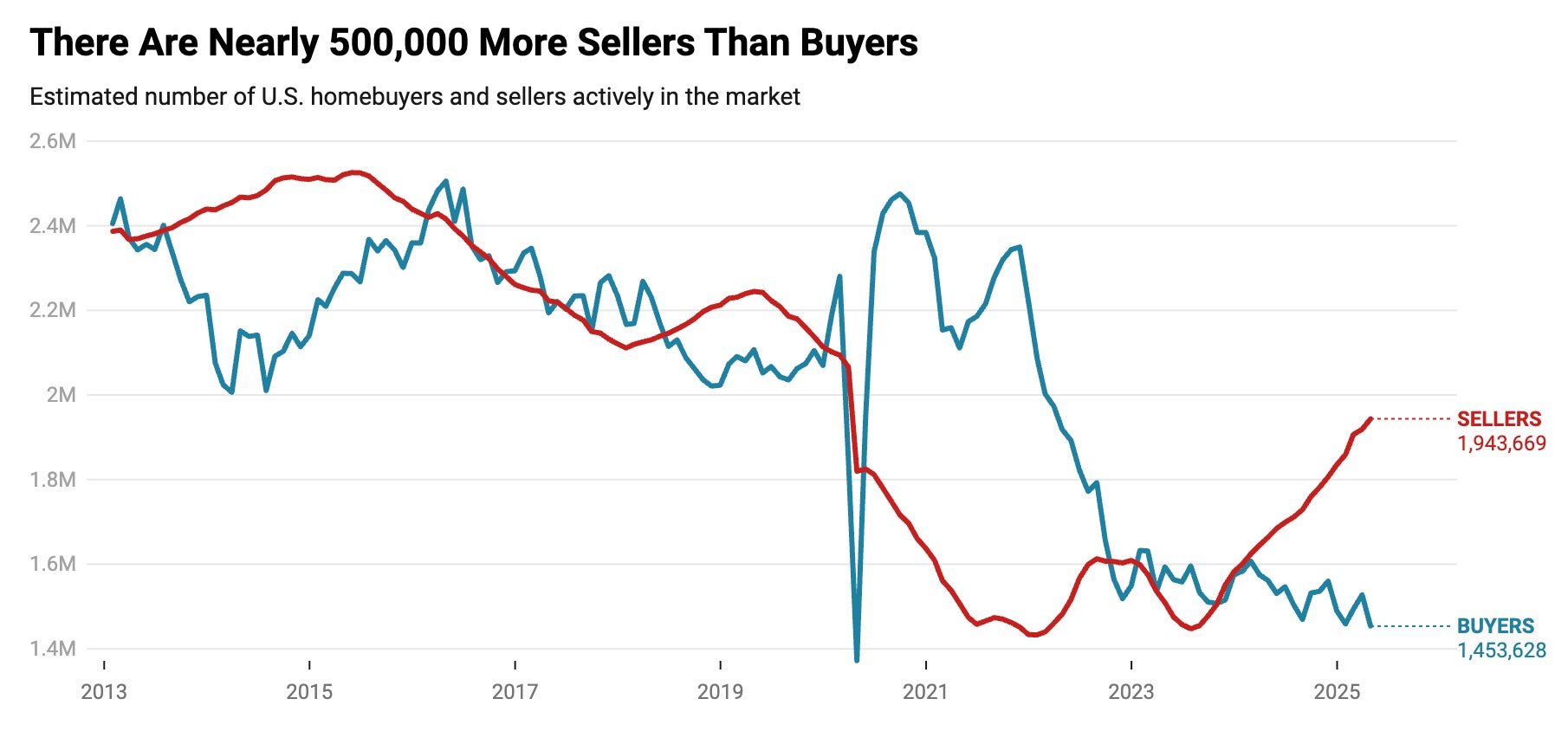

There are almost half-a-million more home sellers than buyers right now

It's the greatest surplus since records began in 2013

The U.S. housing market has undergone an unprecedented shift: Sellers now outnumber buyers by approximately 490,000.

Suggested Reading

It’s the largest disparity since Redfin, a real estate company, began tracking the data in 2013.

Related Content

Redfin’s report, published Thursday, forecasts that if current trends persist, home prices could decline by 1% by the end of 2025, on average. “Prospective buyers may see their purchasing power increase, and prospective sellers should consider selling sooner rather than later,” the report states.

The analysis reveals that there are an estimated 1.9 million active home listings compared to 1.5 million buyers. The 33.7% surplus of sellers over buyers marks a significant transition to a buyer’s market, a stark contrast to the seller-favored conditions of recent years. For instance just two years ago, buyers outnumbered sellers.

This imbalance is most pronounced in the condo sector, where sellers outnumber buyers by 83%, while the single-family home market has a 28% surplus of sellers.

Geographically, the disparity varies: Miami leads as the strongest buyer’s market, with a nearly 3-to-1 ratio of sellers to buyers. There are just seven seller’s markets; the most imbalanced is Newark, New Jersey, with a ratio of approximately 2-to-1. St. Louis is noted as the most balanced, where there are just 1.3% fewer sellers than buyers.

This surplus of sellers is contributing to a rise in price reductions and longer listing times. On Thursday, the National Association of Realtors reported a 6.3% decline in pending home sales from March to April 2025, with a 2.5% decrease year-over-year. This slowdown is attributed to rising mortgage rates, which averaged 6.89% in late April, deterring potential buyers.

The reductions trend began last year. In May 2024, 6.4% of home sellers cut their asking prices—the highest share since November 2022, according to an earlier Redfin report. Additionally, the median age of active listings reportedly rose to 46 days that month, indicating that homes are staying on the market longer.

Sellers are also increasingly forced to offer concessions to attract buyers. Redfin data indicates that 44.4% of home sales in the first quarter of 2025 included compromises, such as covering closing costs or funding repairs, up from 39.3% the previous year.

Concessions and decreased prices may offer respite for buyers who have been sidelined by high prices and mortgage rates. The average 30-year fixed-rate mortgage rate is 7%, which has approximately doubled since 2016, when rates began rising. Moreover, the median existing-home sales price reached $396,900 in January, up 4.8% from a year ago.