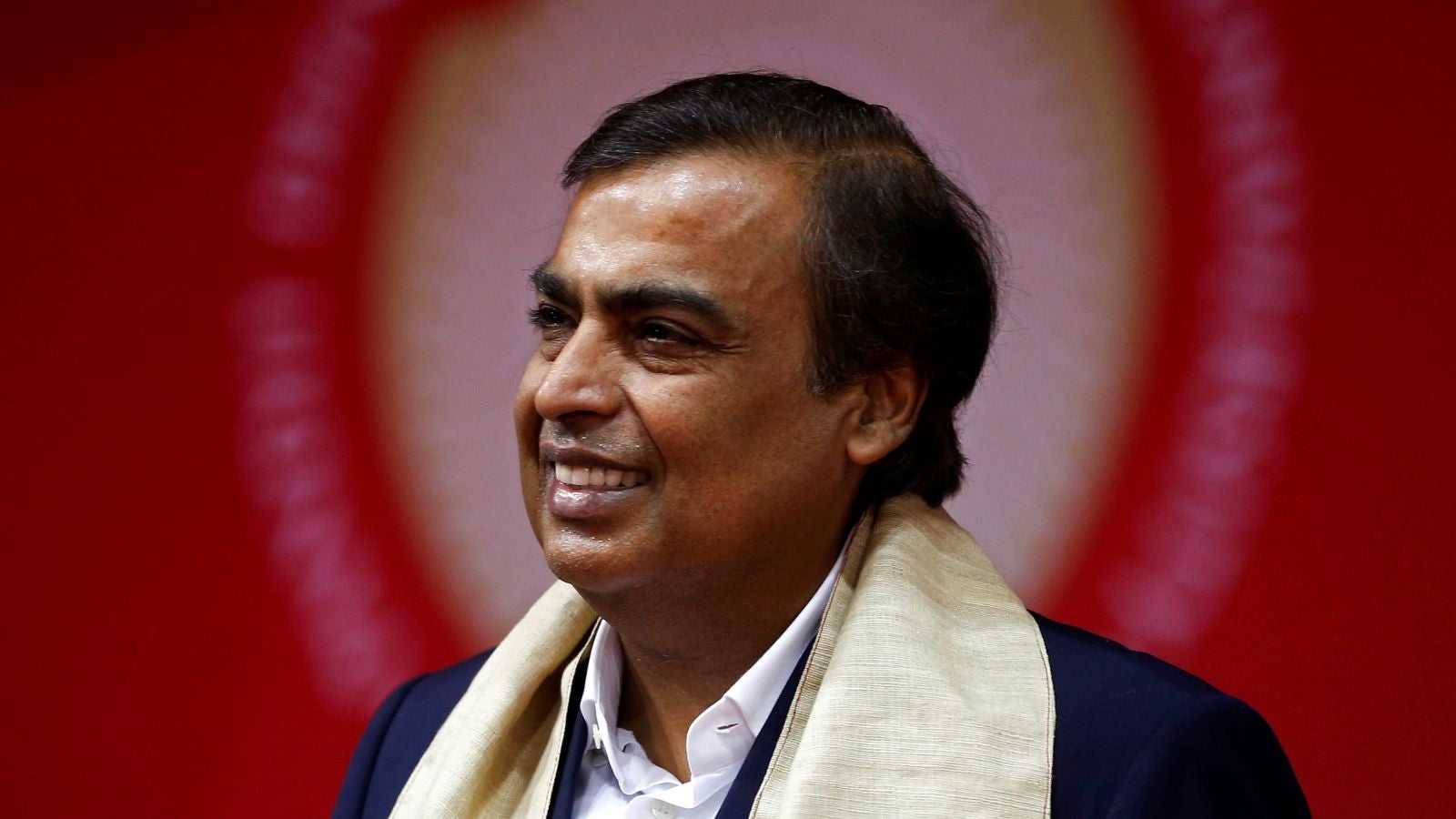

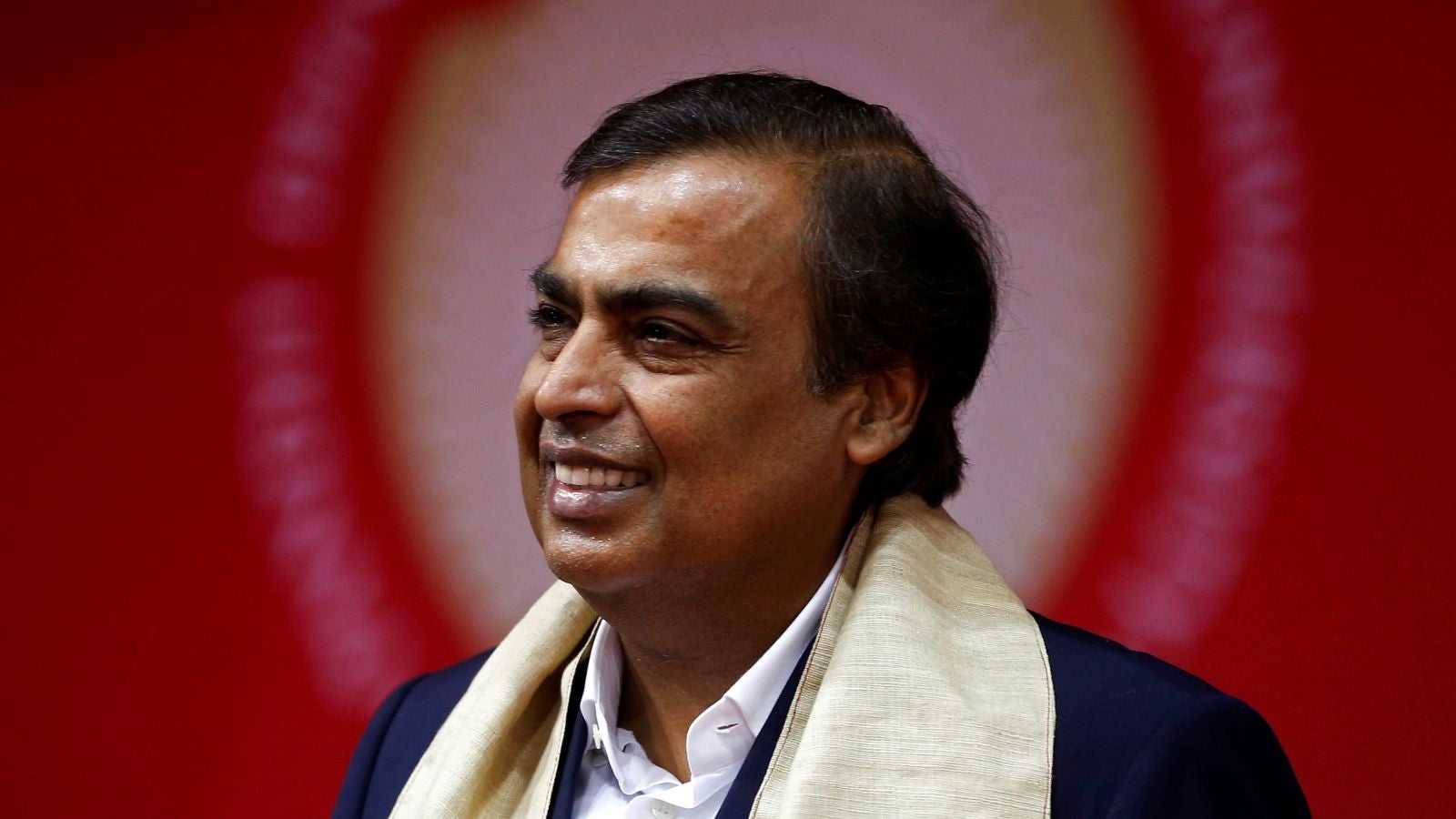

After its telecom rampage, Mukesh Ambani’s Reliance turns to Indian banking

India’s most valuable company, led by the country’s richest man Mukesh Ambani, has entered another business: banking.

India’s most valuable company, led by the country’s richest man Mukesh Ambani, has entered another business: banking.

The last new venture by Reliance Industries (RIL)— which entered telecom with Jio in 2016—disrupted the sector and drove weaker players into bankruptcy. Will its payments bank now do a repeat in the country’s crises-hit banking sector?

Jio Payments Bank, a 70:30 joint venture between RIL and the State Bank of India (SBI), commenced operations on April 03. The firm was one of the 11 applicants that received the Reserve Bank of India’s (RBI) in-principal approval in August 2015 to set up such a venture.

However, for now, Jio’s payment services are available only to a closed group. The details of the full-fledged launch will be announced in due course, said H Srikrishnan, managing director of Jio Payments Bank.

With this, RIL joins a club that includes India’s largest mobile wallet firm Paytm, telecom major Airtel, and the country’s postal service, India Post. Those yet to commence operations include the National Securities Depository, India’s first and largest depository, and another mobile service provider, Vodafone.

What are these?

In 2014, the RBI created two new vehicles for financial inclusion, payments banks and small finance banks. At the time, about 40% of the country didn’t have access to banking services.

Payments banks are allowed to accept smaller-value deposits of up to Rs1 lakh ($1,538). They can also sell investments, insurance products, and mutual funds, besides remitting money and issuing debit cards. However, they can’t lend money or issue credit cards.

What to expect?

RIL is already present in several industries like petroleum, natural gas, entertainment, retail, media, education, and healthcare. In 2016, it entered the telecom space, quickly emerging as one of the country’s largest operators. The resultant competition has forced incumbent operators like Aircel to file for bankruptcy. Others such as Airtel and Vodafone have had their profits severely squeezed.

Experts anticipate a similar disruption in the payments bank space, too, although the details of Jio’s services are yet unknown.

“Reliance has very deep pockets and even though it has been a late entrant in other industries, it has managed to make its mark. It is likely that we will see something similar in banking as well, considering they already have a ready customer base (from its Jio Money wallet business) and point of sales contact,” said an analyst requesting anonymity.

In any case, Ambani’s might lies not just in his deep pockets. ”Its (Jio’s) ability to connect to more customers will be relatively easier compared to other players as it is already present in several other industries and, therefore, will definitely have an edge,” Kalpesh Mehta, partner at auditing firm Deloitte Haskins & Sells, explained.

However, Jio’s competitors in the payments banks space are putting up a brave front. ”Banking is a more tightly regulated industry compared to others,” said Rishi Gupta, managing director and CEO of Fino Payments Bank. “There are several existing lenders, including the global ones. So disruption can’t be at the same scale as in the telecom space.”