Indians no longer have to worry about their money being used to rescue banks

India’s Narendra Modi government has nixed a controversial bill that proposed to allow the use of depositors’ money to rescue distressed banks.

India’s Narendra Modi government has nixed a controversial bill that proposed to allow the use of depositors’ money to rescue distressed banks.

The Financial Resolution and Deposit Insurance Bill (FRDI), tabled in parliament in August 2017, had come under fire from the public, bank employees’ union, and industrialists due to this bail-in clause. Critics had dubbed it draconian as bank account holders could be stripped off their life savings.

Although there has been no official word from the government on this, a member of the opposition Trinamool Congress told the Lok Sabha, the lower house of parliament, on July 31 that railway minister Piyush Goyal had written to a parliamentary panel regarding the withdrawal. Goyal is temporarily in charge of the finance ministry in the absence of minister Arun Jaitley due to ill-health.

“It is a very good move by the government, as due to the panic it had caused it would have had shaken the faith of the masses in the banking system,” said Charan Singh, a former professor at the Indian Institute of Management Bangalore. “At a time when attempts are being made to bring more people into the banking ecosystem, this move could have backfired.”

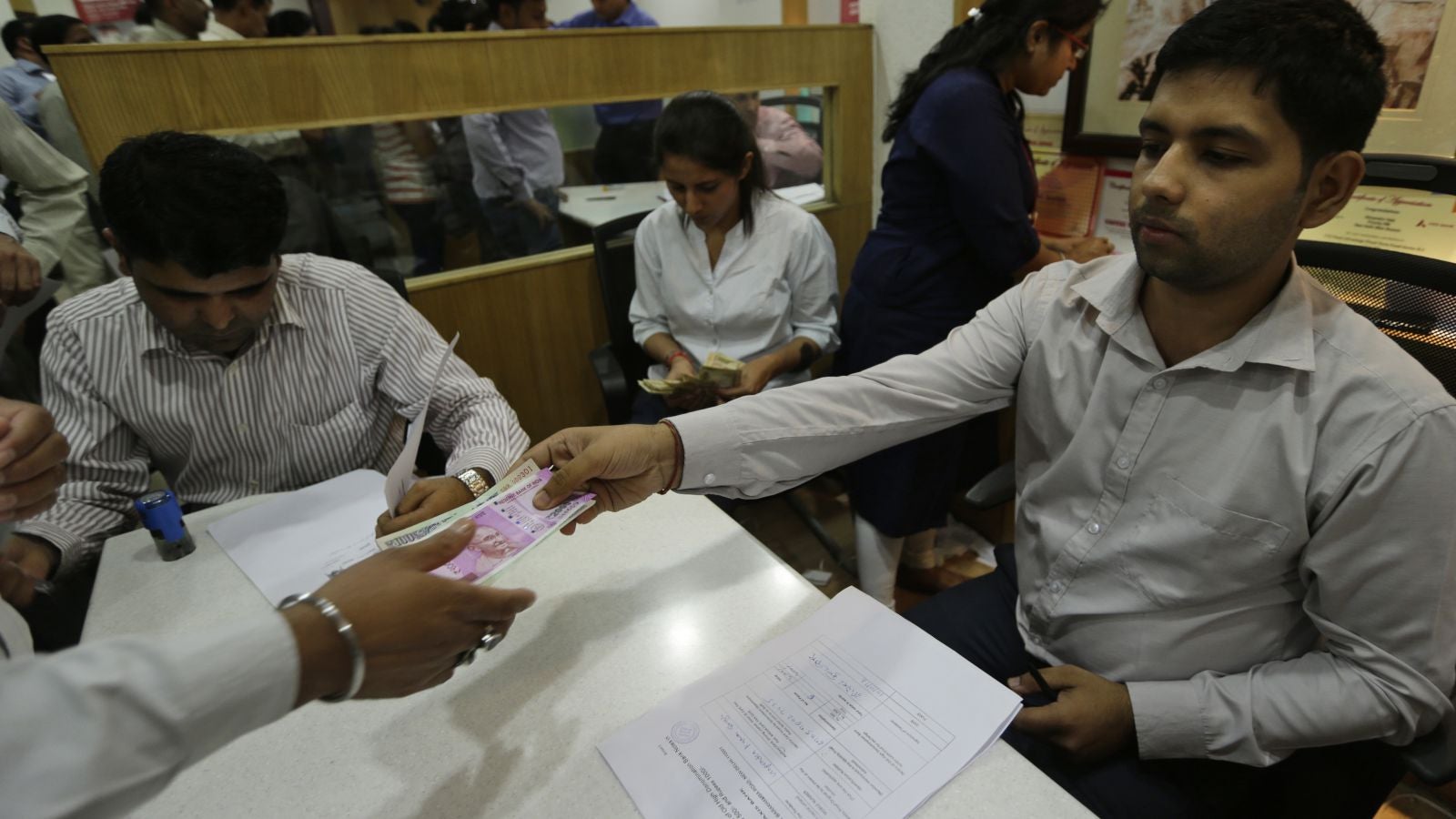

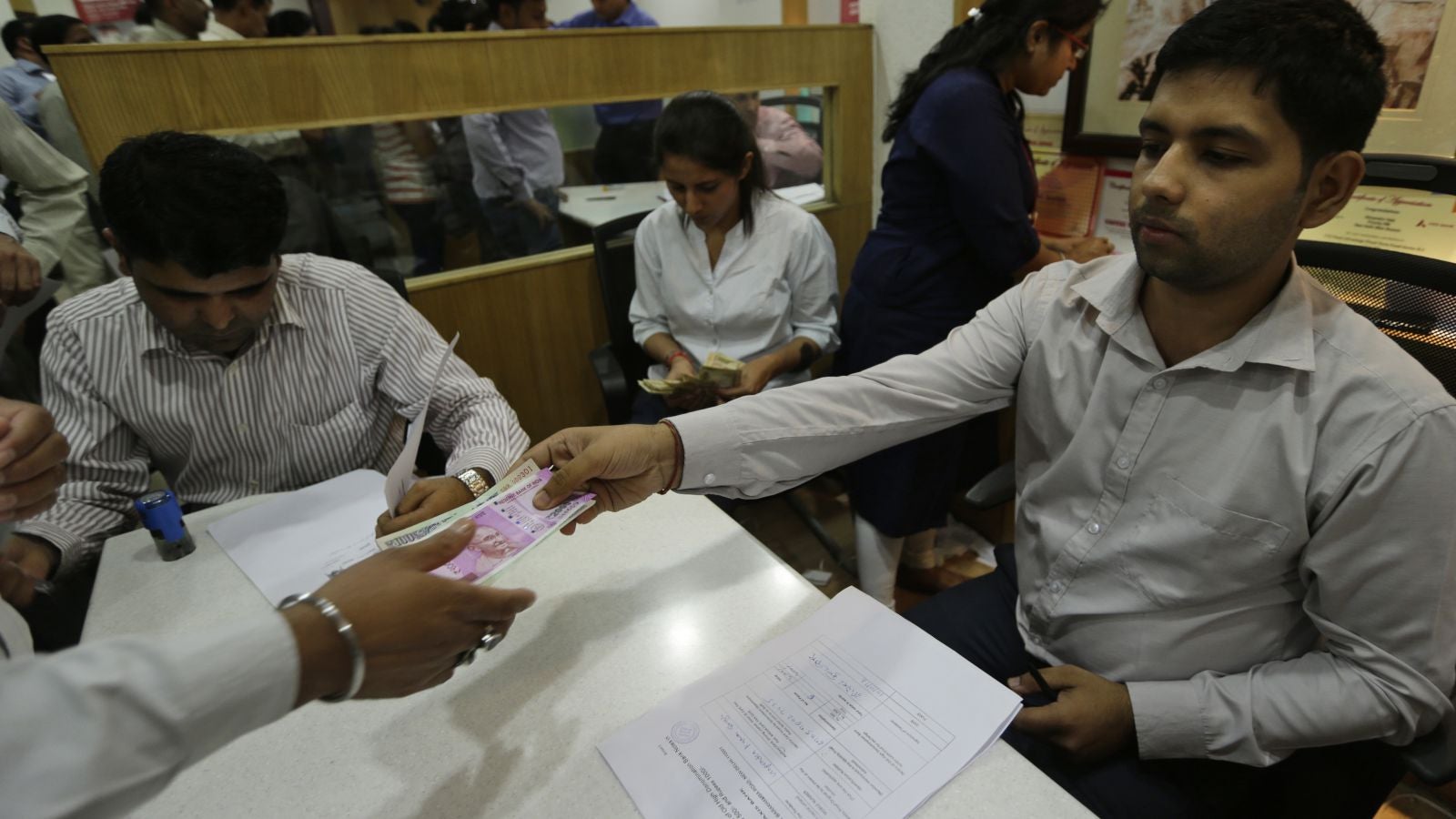

Indian banks are staring at a ballooning bad-loan crisis. By March, the gross non-performing assets (NPA) in the country’s banking system had soared to 11.6% of the total loans. A string of frauds, including the nearly $2 billion scam at Punjab National Bank earlier this year, has only added to banks’ woes and eroded customer confidence.

The bill sparked such serious panic that reportedly in certain parts of the country people were queuing up to withdraw their deposits.

Wary depositors could have even considered diverting money into non-financial products like gold and realty, besides cash, added Singh.

Truth versus hype?

Similar bail-in regimes exist in other G-20 countries.

In any case, the Indian government believed that the FRDI bill was far more depositor-friendly compared to the laws in some other countries.

Bank deposits are currently secured up to only Rs1 lakh ($1,459) by the Deposit Insurance and Credit Guarantee Corporation. “In case if a bank goes under, depositors can only get back Rs1 lakh, which is far lower than what they possibly could have gotten if the bill was implemented,” said VG Kannan, CEO of industry body Indian Banks’ Association. “But in the case of the FRDI bill, depositors’ share could have been converted into equity stake into the bank and they could have managed to recover more.”

On the other hand, critics insisted that the entire amount could also be written off and bank customers could end up losing their deposits either partially or fully.

Bankers also argue that the government and the Reserve Bank of India would not allow a bank to fail and, therefore, such a scenario would not have arisen anyway.

“In several instances where a bank has been struggling, we have seen that a stronger bank has been nudged to take over the weaker bank and the customer and the employees’ interest has been protected,” said Ashutosh Khajuria, executive director of Federal Bank. “Therefore, it is extremely unlikely that this situation would have even arisen.”

However, with the general elections less than a year away, the Modi government seems to have played it safe.