India’s so poorly insured that the family of the deceased gets less than 10% of what it needs

The 200-year legacy of India’s insurance industry is a paradox, given its dismally low penetration levels in the country.

The 200-year legacy of India’s insurance industry is a paradox, given its dismally low penetration levels in the country.

Indians remain woefully unprotected from life’s vagaries. In the event of the death of an earning member, an average Indian has only around 8% of what may be required to protect his or her family from financial shock, according to a report by IndiaSpend, a data-driven public interest journalism initiative. “This is much lower than the insurance coverage adequacy of 44% in Japan, 84% in Taiwan, and 67% in Australia,” the report, released on Jan. 15, added.

Further, up to 988 million Indians—or 75% of the country’s population, which is more than the population of Europe—do not have any form of life insurance, according to the study based on government and industry data.

Insurance premiums as a percentage of gross domestic product (GDP), or “penetration” in industry-speak, are merely 3.42%, far below the global average of 6.2%. Low awareness and the limited reach of insurance companies are the twin problems that have been plaguing the sector, which has led to low penetration.

That apart, most life insurance policies being sold in India are endowment policies that seek to combine the dual benefits of life cover and investment. The insurance cover offered by these endowment policies is significantly lower than what is offered by pure protection products, or term insurance plans. This is a major reason for Indians not being adequately covered.

For instance, the government-owned Life Insurance Corporation (LIC) of India, which commands a lion’s share of the market, offers 21 life insurance products. Of these, only three are term-plans, said IndiaSpend.

Then, typically, most Indians rely on the advice of their insurance agents to select products. Several instances of mis-selling by agents or banks have been noted. Lured by higher incentives, they commonly bundle off incorrect insurance products to gullible customers.

More needs to be done

Meanwhile, the government has been ramping up efforts to improve insurance coverage by introducing schemes for risk protection, especially for the socially and economically vulnerable sections. However, it is far from enough.

“These schemes are falling short of their objective of providing adequate risk protection for low-income households,” added the report.

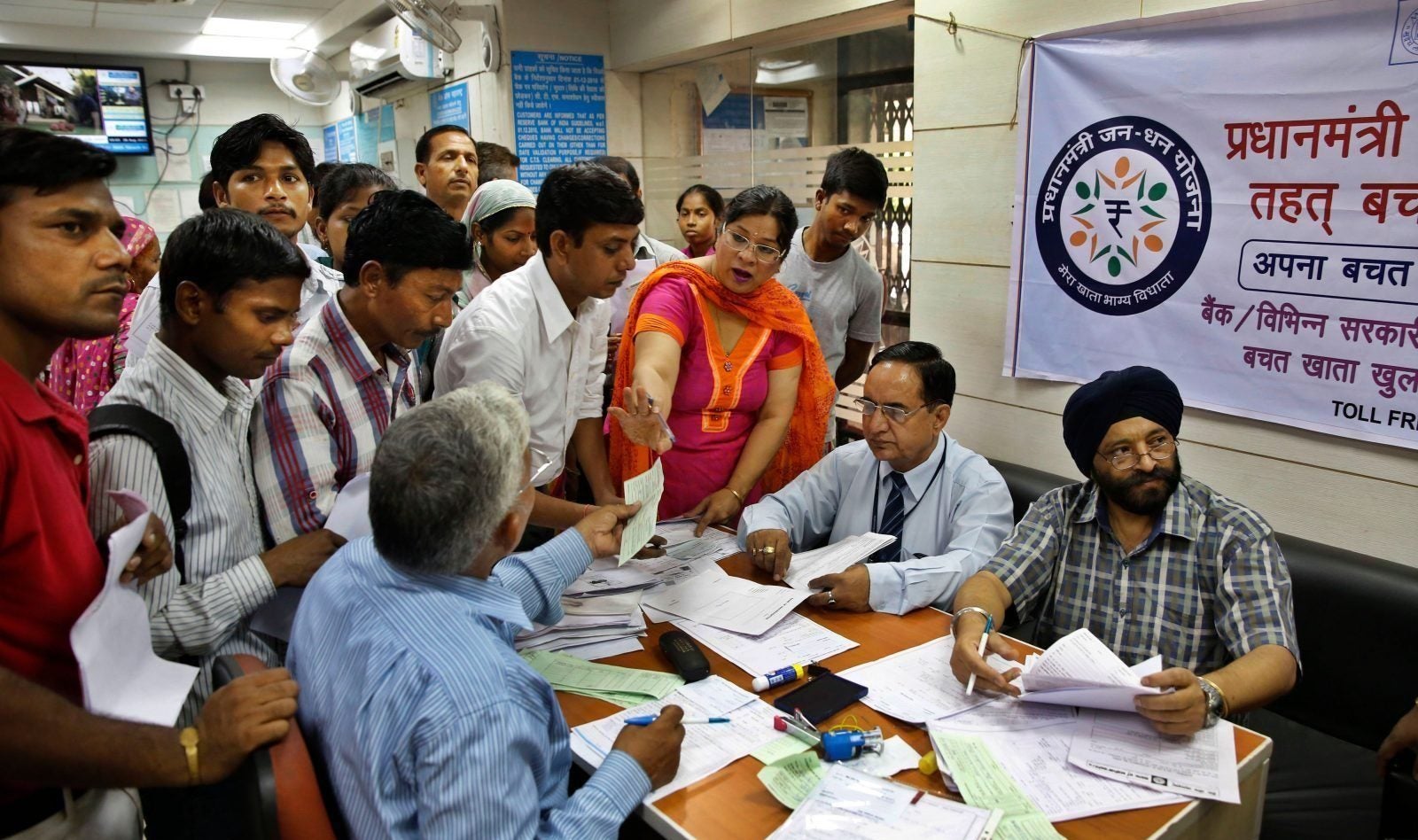

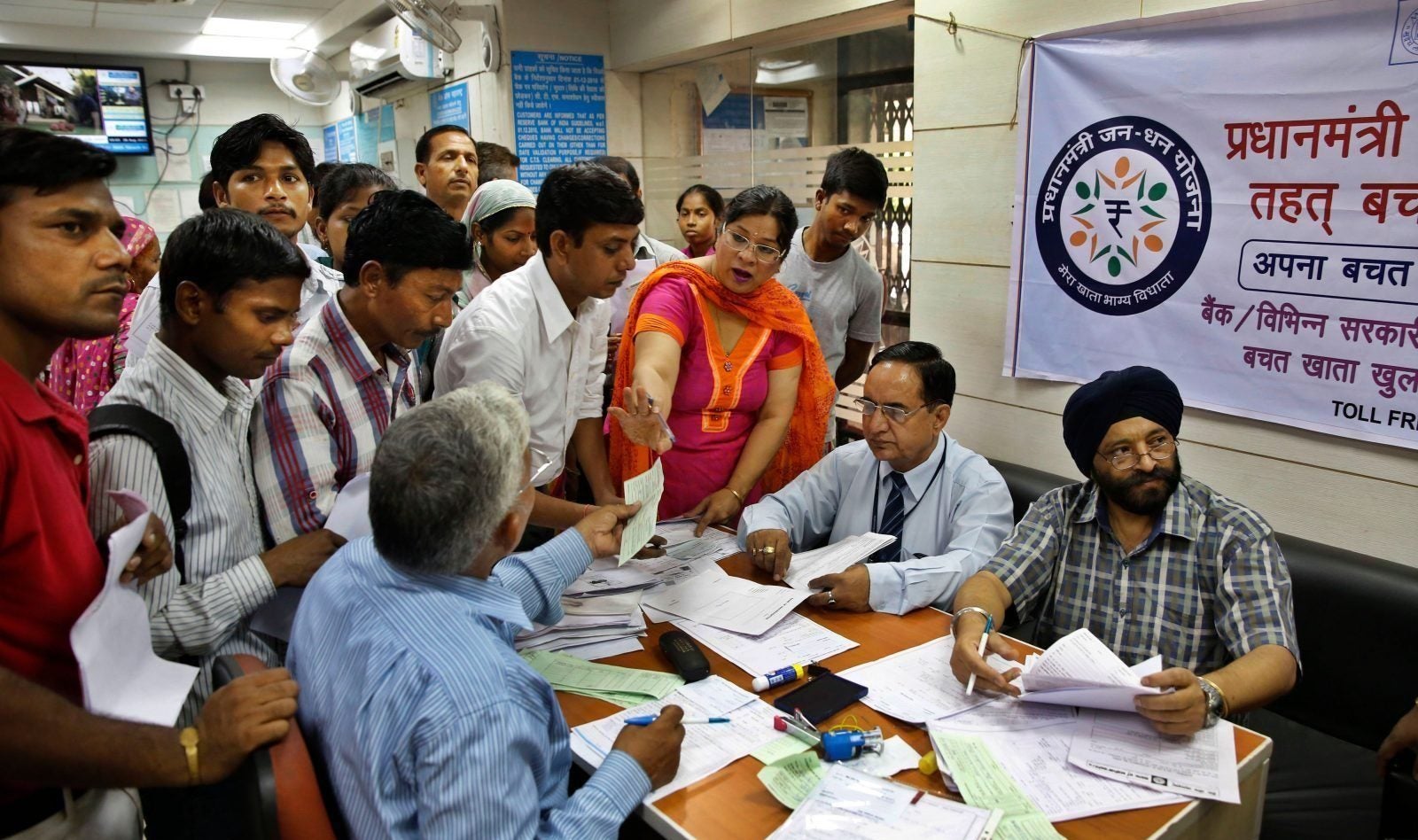

For instance, the Narendra Modi government’s flagship financial inclusion scheme, the Pradhan Mantri Jan Dhan Yojana (PMJDY), was launched in 2014, looking to provide a bank account for every Indian. It also provides an insurance cover along with the debit card. But this cover is applicable only if the account holder has made a transaction 45-90 days prior to the date of the accident, according to the scheme’s guidelines.

This defeats the objective of insurance coverage as over 20% of the PMJDY beneficiaries hadn’t even been issued debit cards, PMJDY data from December 2016 show. Also, 48% of people holding an account with a financial institution in India have neither deposited nor withdrawn any amount in the past year, according to the 2017 Global Findex data released by the World Bank.

Ensuring insurance benefits to more Indians, then, remains a daunting task.