Walmart is looking at taking PhonePe’s model to other nations

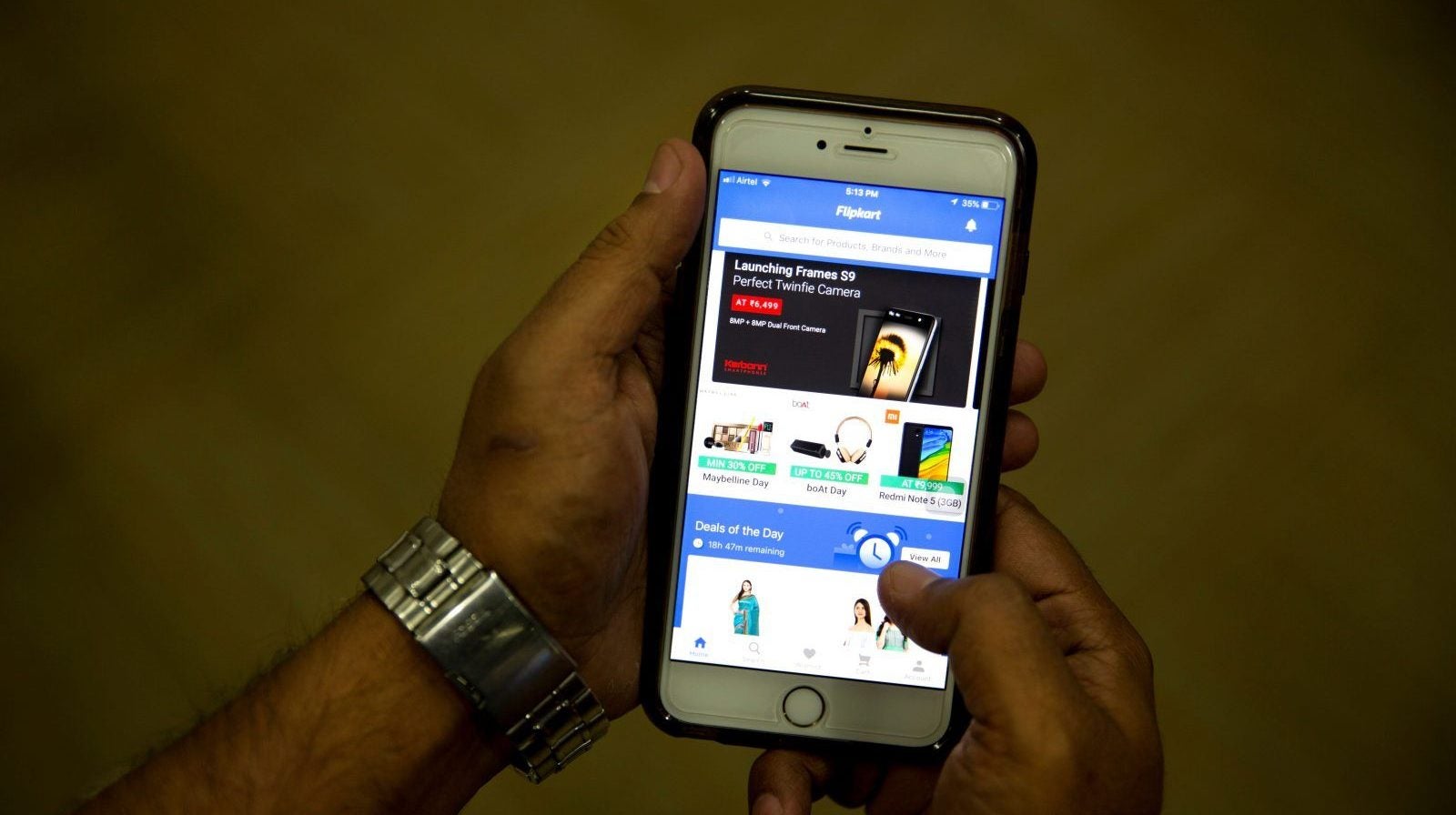

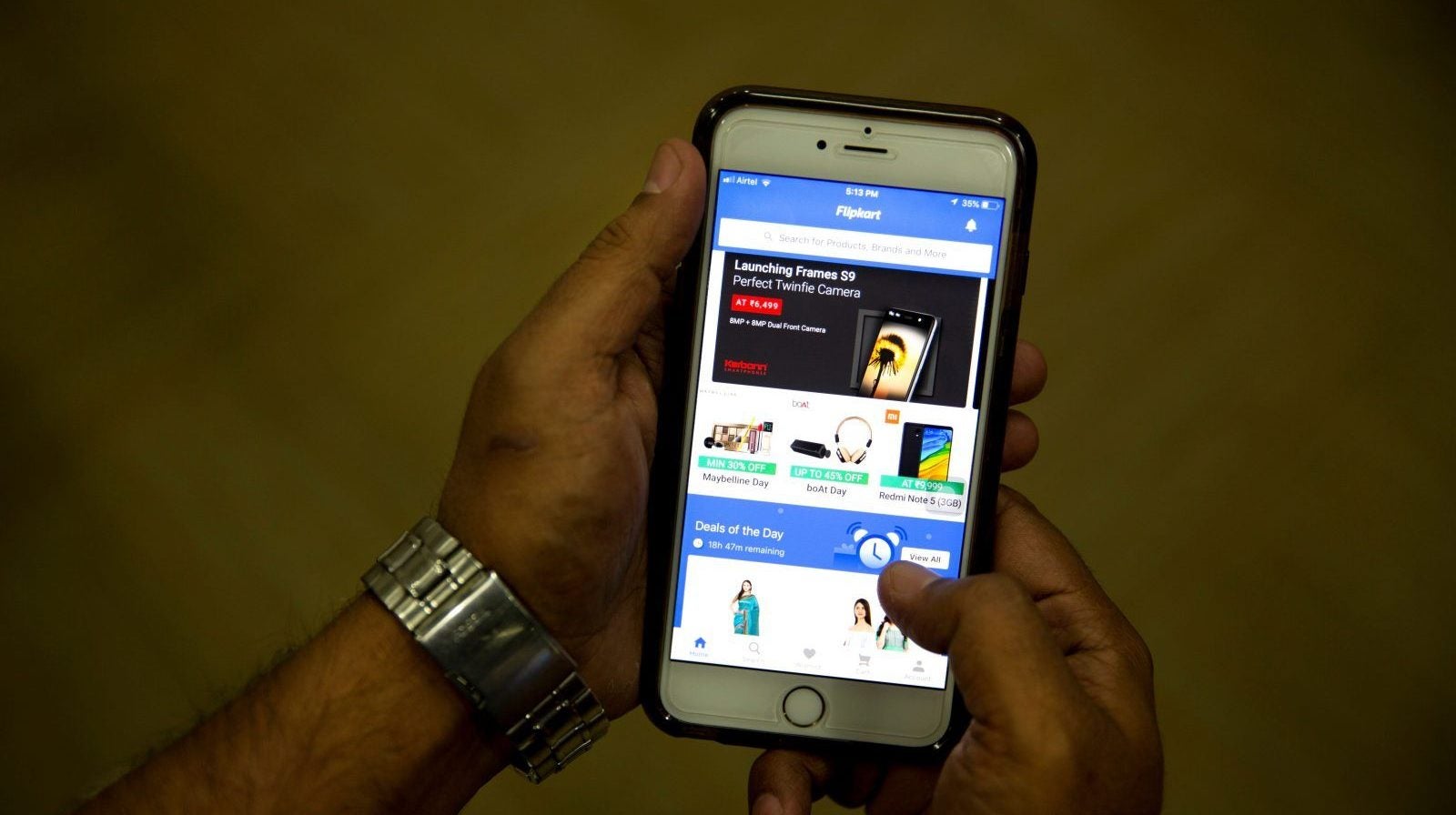

After a year of speculation, Walmart finally picked up a majority stake in India’s e-commerce giant Flipkart for $16 billion (Rs1.13 lakh crore) last May. Now, the US retailer is working on making the most out of this costly acquisition.

After a year of speculation, Walmart finally picked up a majority stake in India’s e-commerce giant Flipkart for $16 billion (Rs1.13 lakh crore) last May. Now, the US retailer is working on making the most out of this costly acquisition.

The Bentonville-based retailer hopes to deploy in other countries the lessons of PhonePe, Flipkart’s digital payments arm, Rahul Chari, PhonePe’s co-founder and chief technology officer, told Quartz. This includes how to operate a digital payments business in a country where online transactions are still nascent, Chari said.

While world’s largest retailer operates its own payments arm—Walmart Pay—PhonePe’s success is unique.

A late entrant into India’s booming fintech space in 2015, it has managed to cement its position, facilitating nearly 8 million transactions in a day, according to the company.

In the next phase, PhonePe aims to increase its tie-up with merchants from the current two million to five million, Chari said. Last week, it was introduced as a payment option at Walmart India’s 23 wholesale stores and this tie-up will help the firm meet its merchant-acquisition targets. The company will also look at introducing wealth-management products while its lending plans have been put on hold for now.

Currently in India, 95% of payments are in cash but digital transactions are expected to reach $1 trillion by 2023, according to investment banking firm Credit Suisse.

Chari also spoke to Quartz about more likely collaborations with Walmart and the overall digital payments ecosystem in India.

Edited excerpts.

Are there any synergies that you are exploring with Walmart?

The first thing we wanted to do (after the acquisition) was to take the PhonePe service to the smaller kirana stores and merchants via Wamart’s B2B services. And there, payment is only the first space, as there are lots of other opportunities in lending or credit solutions to small-time sellers that can be offered. Or we can even look at how to provide value-added services that can increase their footfall and can give them more value. So that is the next step.

Is Walmart looking at the possibility of taking PhonePe outside India?

Walmart is very excited with our business, learning about payments and what we are doing with our open payment ecosystem model, interoperability, us being open to other merchants to create their presence on the PhonePe app, etc. They continue to check in on what is working and what is not and they have had discussions about other markets where they can either replicate or take some of the learnings.

Will it be the US or other markets?

It will be markets outside of the US because, in the US, the card penetration, as well as the trust factor that cards have, is not a problem. I think peer-to-peer transfer was one thing that was not very easy, but Venmo has done a good job of solving some of that. So, I don’t think there is necessarily a large problem in the US. Most of it is outside of the US, but not restricted to southeast Asia.

Coming back to India, how significant is the focus on partnering with offline merchants?

In the larger scheme of fighting cash, the offline space is the holy grail. That’s because most of the transactions here happen in cash and it is a large part of consumers daily spends. So if a business wants to have a large share of the digital transactions, then offline is something that has to be important for anyone in the payments or the fintech space. It also helps in bringing personalised experience to customers and is useful for the merchant. A lot of players are focusing only on consumers with very little focus and value proposition for merchants. We want to reverse that using PhonePe.

Do you have any fund-raising plans?

We already had a commitment of $500 million from the Flipkart group and we haven’t gone down that amount so far. So we are in a good place and Walmart also remains extremely excited about us. So we are not necessarily in the market to raise funds at this point.

Recently the central bank gave a six-month extension to digital wallet companies to finish the know your customer (KYC) process. Do you think it is enough?

It helps from the perspective of trying to find alternative plans in trying to do KYC, but the physical KYC itself has its limitations. So the extension only helps companies like us create alternative plans as there has been uncertainty regarding the direction since it is an investment for anybody to get the process off the ground. But scalability remains a challenge. For a smaller player, doing a national-level KYC and building the reach may not really be feasible anymore.