A flamboyant Indian industrialist is now chased by a bank his ancestor founded

A scion of one of India’s most storied business families is now being chased by the bank his ancestor founded.

A scion of one of India’s most storied business families is now being chased by the bank his ancestor founded.

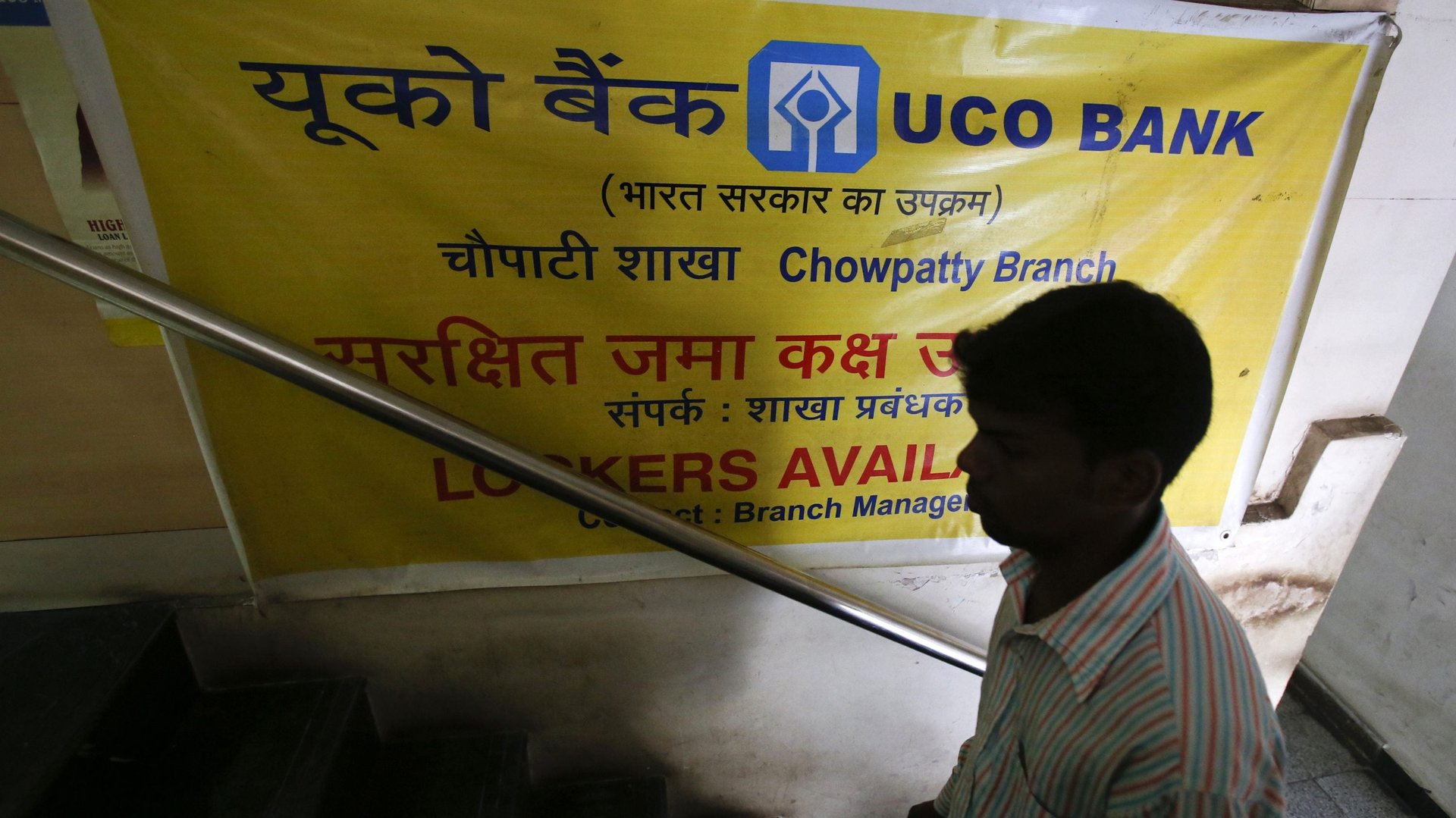

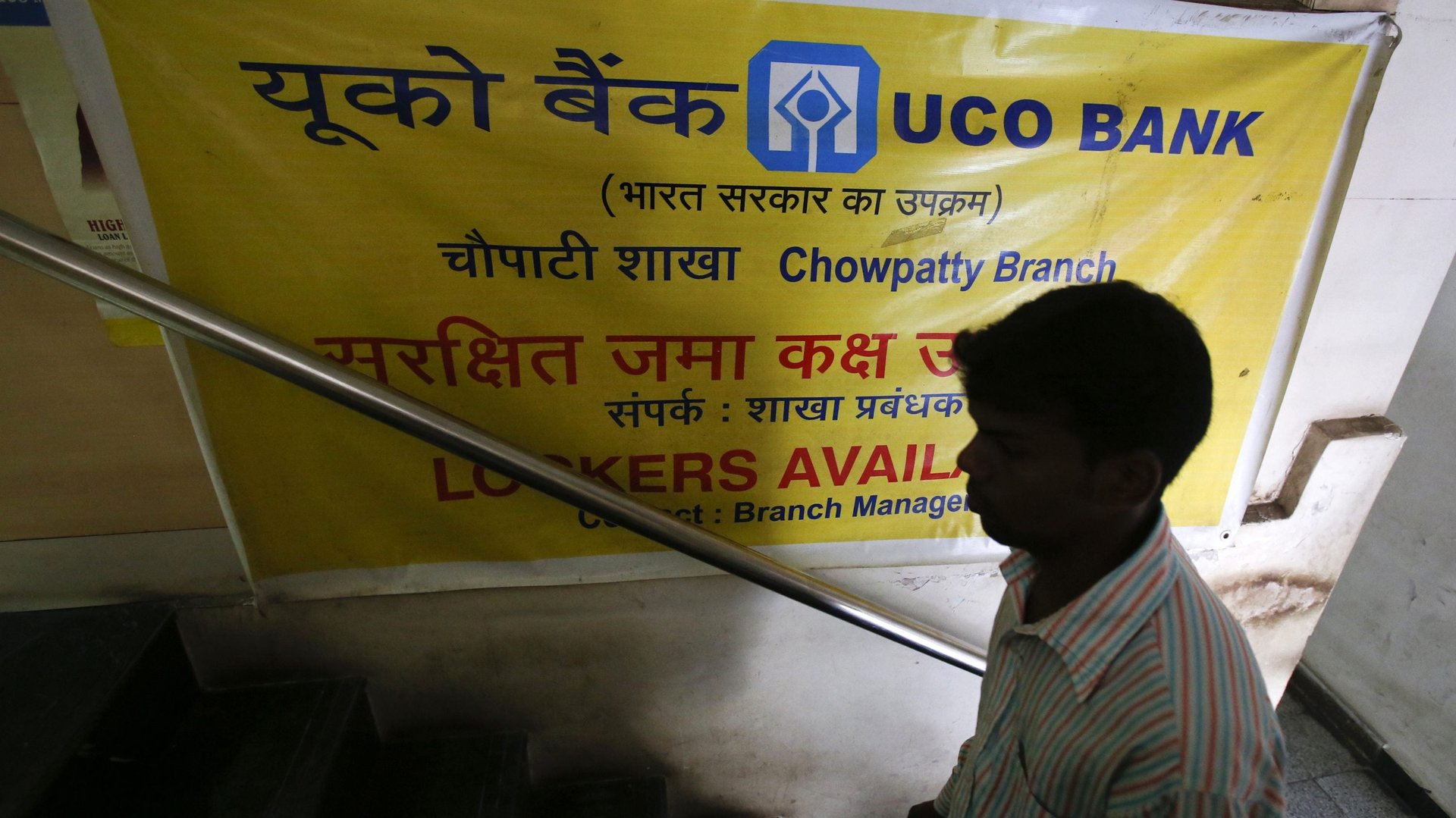

Yashovardhan “Yash” Birla, a member of the Birla family and chairman of the Mumbai-based Yash Birla Group, was declared a wilful defaulter by the Kolkata-based UCO Bank, yesterday (June 16). The lender issued a public notice after Birla Surya, of which he is a director, failed to repay loans amounting to Rs67.65 crore (around $10 million).

“Due to non-repayment of dues, the account was declared a non-performing asset on June 3, 2013. The borrower has not repaid the dues owed to the bank despite several notices,” UCO Bank said in its notice.

The bank was established in 1943 as United Commercial Bank by Ghanshyam Das Birla, the brother of Yash Birla’s great grandfather Rameshwar Das Birla. It was nationalised by the Indian government in 1969.

Under India’s central bank norms, a borrower is tagged a wilful defaulter if on failure to meet repayment obligations despite having the capacity to repay, or if the loan is not used for the purpose it was availed for in the first place.

The notice also carried a photo of Yash Birla, an uncommon practice in India. In 2016, the Reserve Bank of India (RBI) had stated that banks can publish photographs of wilful defaulters but asked them not to so indiscriminately.

UCO Bank’s move may have at least temporarily capped a turbulent, yet flamboyant, life story.

Troubled life

Birla was only 22 when tragedy struck: His father Ashok Birla, mother Sunanda, and sister Sujata died in a plane crash in Bengaluru in 1990. A student in the US back then, the young man was now suddenly heading a business empire of 20-odd companies ranging from automotive to yarn to power.

Initially, the group was run by advisors handpicked by Birla’s grandaunt, Priyamvada Birla. These advisors had no real interest in his business, Birla had claimed in 2012 in an interview with Business Standard. “By the time I got my own team, eight or nine years were gone.”

In 2012, the group had revenues of Rs3,000 crore ($430 million) and made a profit (before tax) of Rs1,000 crore. He also owned valuable real estate—he was once the proud owner of Birla House, a 1930s mansion spread over two acres in Malabar Hill, one of India’s most sought after neighbourhoods, which once even hosted Mahatma Gandhi.

Yet, by the time Birla came on his own, things were already downhill. The past several years have been particularly rough.

By 2014, Birla was being probed for financial irregularities committed by his companies even as investors hounded him. The Mumbai police launched a probe against group firm Birla Power Solutions for alleged default of payment on a fixed deposit scheme. It owed Rs214 crore to 8,800 investors. The police attached immovable properties belonging to Birla Power.

Around this time, he was also selling-off his personal and movable prime properties. In 2016, the Maharashtra government attached his Mumbai assets, including the famed Birla House.

Glitz and glamour

Yet, Birla, a father of three, wasn’t viewed as much as the head of a floundering business empire. The 50-year-old was known more for his partying ways and as an art collector. Then there is his other obsession, body-building.

A 2014 Mint newspaper article even described him as “bohemian”:

Yash Birla, who lives in Mumbai’s historic Birla House in the Malabar Hill area, made news for his sense of fashion, lifestyle and appearance—just about everything other than his business.

His Instagram feed is a testament to his lifestyle.

As Yash Birla and his empire reach the crossroads, his next move would be keenly watched—not just in the business world, but also in the country’s top party circles.