India’s hotels may be finally recovering from demonetisation blow

India’s hospitality industry is trying to grab on to a tiny glimmer of hope, and never let go.

India’s hospitality industry is trying to grab on to a tiny glimmer of hope, and never let go.

After nearly two years of steady decline, hotels in India are finally seeing a growth in RevPAR, the revenue they earn per available room. This parameter assesses a hotel’s return on its inventory, and had, till recently, reflected a market that had turned gloomy after India demonetised high-value currency notes in November 2016.

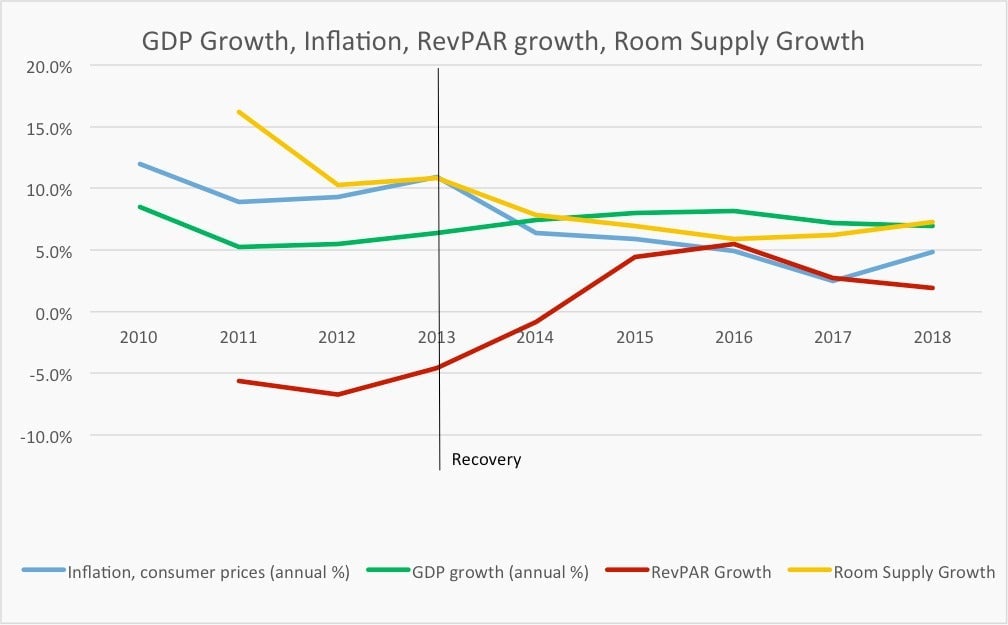

Between 2014 and 2016, the RevPAR grew at over 5% every year, according to JLL India, a global real estate services firm. “The impact (of demonetisation) was very visible on the hospitality sector. RevPAR growth dropped from 5.5% in 2016 to 1.9% till 2018,” said Jaideep Dang, managing director of the hotels and hospitality group at JLL India.

Now, JLL’s data show signs of a turnaround as RevPAR grew 2.6% last year. This appears to be a silver lining in times of an economic slowdown, where everything from biscuits and underwear to automobiles is seeing a decline in consumption.

The hospitality industry—hotels in particular—seems to have buoyed over this tide because of the favourable policy environment in India.

For instance, the goods & services tax (GST) on hotel rooms between Rs1,000 and Rs7,500 ($14 to $106) has been cut from 18% to 12%. For premium category rooms with tariffs above Rs7,500, the GST is now 18% instead of 28%.

These cuts were part of finance minister Nirmala Sitharaman’s stimulus measures announced on Sept. 20, which also included a cut in India’s corporate tax rates.

Season to be jolly

Hotels are predictably ecstatic. Share prices of major hotel chains in India soared after the GST cut. “A lower GST rate for the luxury hotel sector will boost revenues and spur demand further among travellers,” John Northern, the Shangri-La Group’s executive vice-president for the Middle East, India, and Indian Ocean, told Quartz.

JLL’s Dang also attributes this cheer to the commercial real estate market, which has seen a 20% increase in the stock that was absorbed. Others feel that the hospitality industry is unique because it is cyclical, and the boom and bust phases are par for the course.

“Ups and downs are characteristic of the tourism industry. What also happens is that when there is a boom, investors pump in more money, there is a lot of construction of new properties, and the market gets saturated,” explained Rakesh Mathur, former president of ITC WelcomHeritage Hotels, and advisory council member of the Federation of Associations in Indian Tourism & Hospitality. “Rate fluctuation and RevPAR in the hospitality industry is a simple function of demand and supply,” he told Quartz.

Unaffected

But is there demand at all, given the overall sentiment of gloom? “If you look at the GDP slowdown, it is a question of which industry is driving that. The services sector continues to see growth,” Mathur said. “If at all, there may be fewer lower-middle-class domestic travellers this season, but I don’t think it will impact foreign tourists at all.”

For the upcoming tourist season, too, JLL’s outlook is hopeful. “There has been a 1% decline in vacancy rates across the top seven business cities in India. This gives the hotel industry hope in 2019 moving into 2020, so long as the services sector continues to drive growth in the commercial office market in major cities,” Dang said.