A freshers’ guide to decoding CTC and negotiating a better pay in India

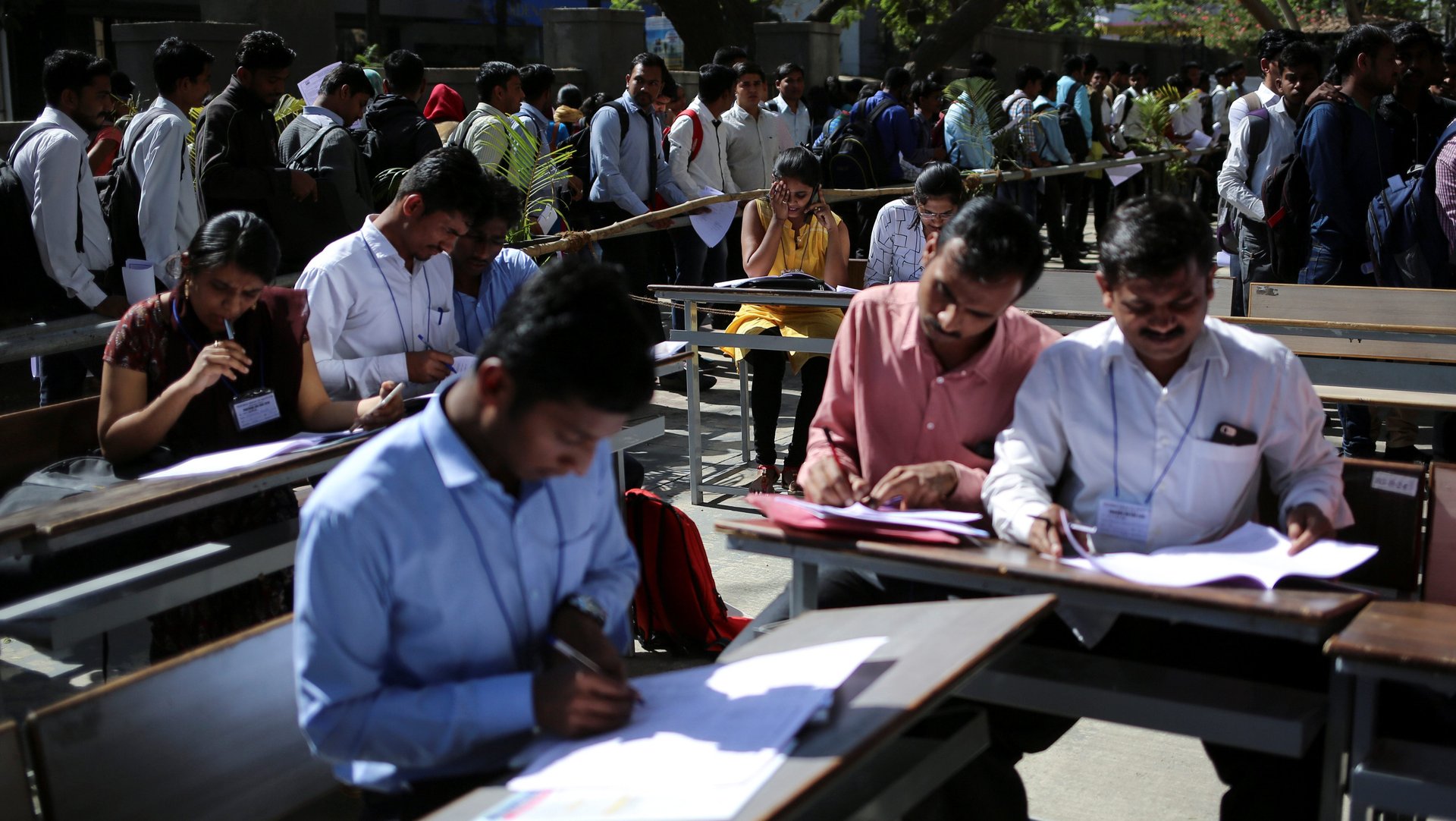

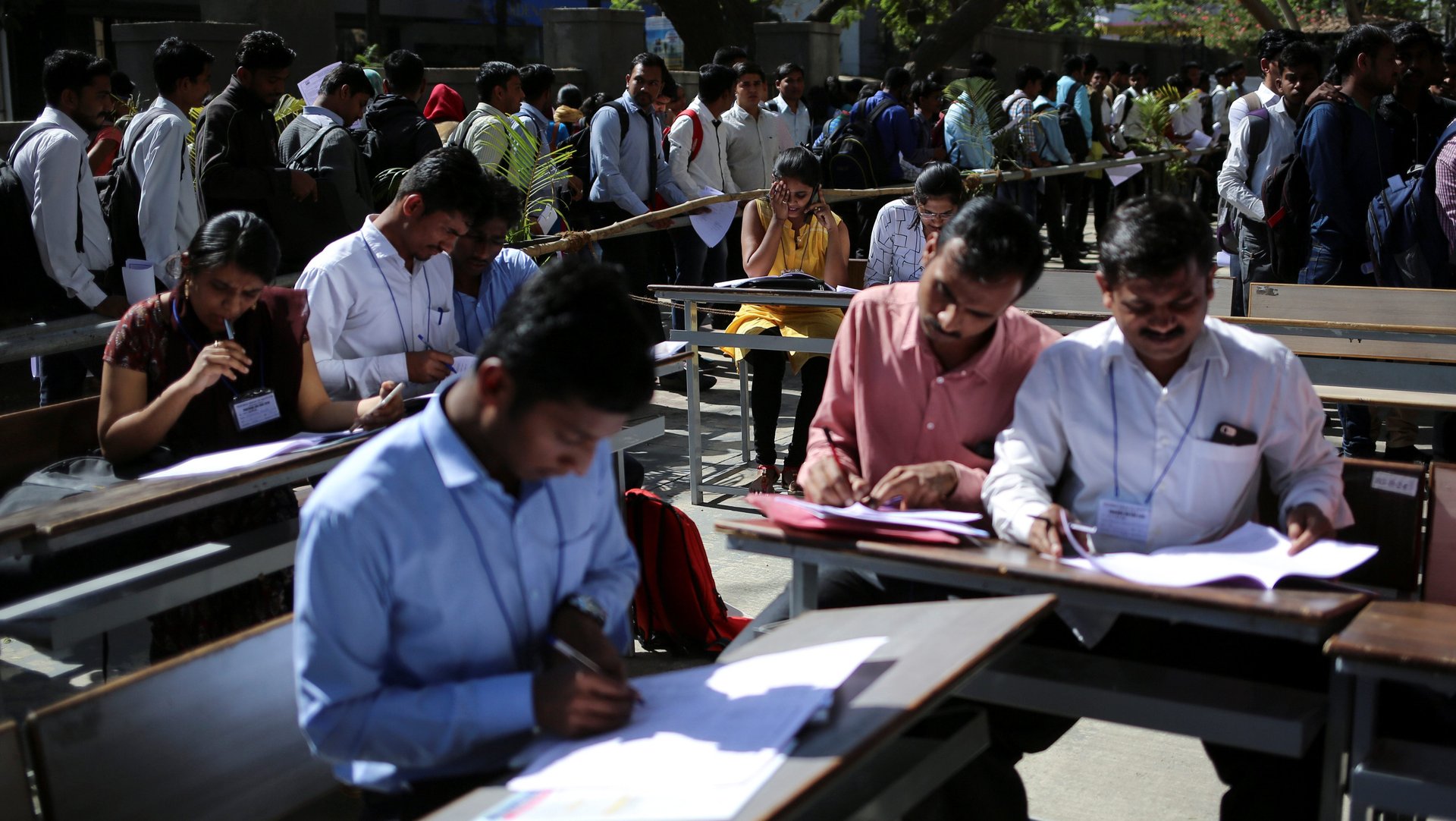

A fresher in the corporate world is almost like Alice in wonderland. The first job is just like a doorway to your professional life’s future and so, the baby steps you take into this adult corporate world need to be taken carefully, smartly and effectively.

A fresher in the corporate world is almost like Alice in wonderland. The first job is just like a doorway to your professional life’s future and so, the baby steps you take into this adult corporate world need to be taken carefully, smartly and effectively.

Apart from assessing your logistics from home to the workplace and upgrading your wardrobe for corporate-style outfits, these steps also include salary discussions and understanding which salary components work better for you. Hence, it becomes mandatory to learn how to decode the salary structure and negotiate the pay in a reliable way at the very beginning of your career. Here is how:

Decoding the CTC

The cost to company package, or CTC, comprises all the payments and benefits, whether fixed or variable, that you are entitled to, while the take-home pay is what you get after all the mandatory deductions.

The CTC typically includes fixed heads such as basic pay (which ranges around 40-50% of the CTC), home rent allowance (which ranges around 40-50% of the basic salary), employees’ provident fund (EPF), gratuity, other reimbursements such as car fuel and mobile bills etc., and variable components such as annual bonus and performance bonus.

Generally, employers include their share of PF contribution as well in the CTC. Some IT companies often add training costs in their CTC as well, which, naturally, are not a part of the take-home.

An employee is supposed to contribute 12% of their basic pay and dearness allowance (DA) in the PF account. Therefore, a very high basic component would mean less take-home pay, but it will make you eligible for higher gratuity which is paid at the time of leaving the company, given that you have completed at least five years with the employer. Some companies which include gratuity as part of the CTC pay you the equivalent amount as ex-gratia, in case you end up leaving before completing five years as required. While the PF money comes back to you with interest when you retire, along with helping you avail a tax deduction of up to Rs150,000, under Section 80C of the Income-tax Act.

Then comes the variable pay-outs, which may not show up in your salary but are paid on a monthly, quarterly, or annual basis, depending on your organisation. This is essentially a performance-linked pay and employers are not mandated to pay the full variable pay. Some companies may also include the cost of group medical or life insurance, food subsidy, bank interest subsidy, etc., which make the CTC pay structure attractive. Hence, if you are at the starting point of your career, it is advisable to negotiate for a higher take-home salary and a lower variable portion.

However, negotiating higher on the variable pay has its own advantages, as it keeps you more relevant and agile with respect to market dynamism. So, this is all you need to know about the CTC in order to negotiate better.

Negotiating a better pay

Now that you have a fair idea regarding how you decode the CTC, you need to remember having a strong alternative to the negotiated agreement. It will enable you to speak fearlessly and negotiate better.

While appearing for the interview, you should delay the salary discussion for as long as you can. When asked for a target salary, deflect the question by sharing how you prioritise a meatier role over the pay and try making the employer mention his offer first. In case you quote a figure and they deny, always push back against the “No” and explain your reasons for a higher figure each time.

If you are told, “This is the maximum basic salary for this role,” ask for a sign-on bonus and an increment after six months instead of a year.

Always remember that both settling for less and walking away without negotiating will affect your entire career. For instance, it is better to start with a figure higher than what you want in order to have some space to concede later. Accepting the offer immediately leaves money on the table that you could have received otherwise, and rejecting the offer makes you miss those extra perks which could have made the offer worthwhile.

Don’t be in a hurry.

Most importantly, no reasonable employer will deny your request for a written offer. If that becomes the case, ask other employees in the firm about standard practices beforehand and reconsider your risks. Following these notes and tips will certainly help you build your case for higher pay, and perhaps other benefits, too. In essence, know your value, organise your thoughts, remember to be kind but firm, choose your moment, and shine through.

We welcome your comments at [email protected].