India’s central bank slashes rates and eases loan repayments to battle Covid-19

India’s central bank has joined the global fight against the severe economic fallout of the Covid-19 pandemic.

India’s central bank has joined the global fight against the severe economic fallout of the Covid-19 pandemic.

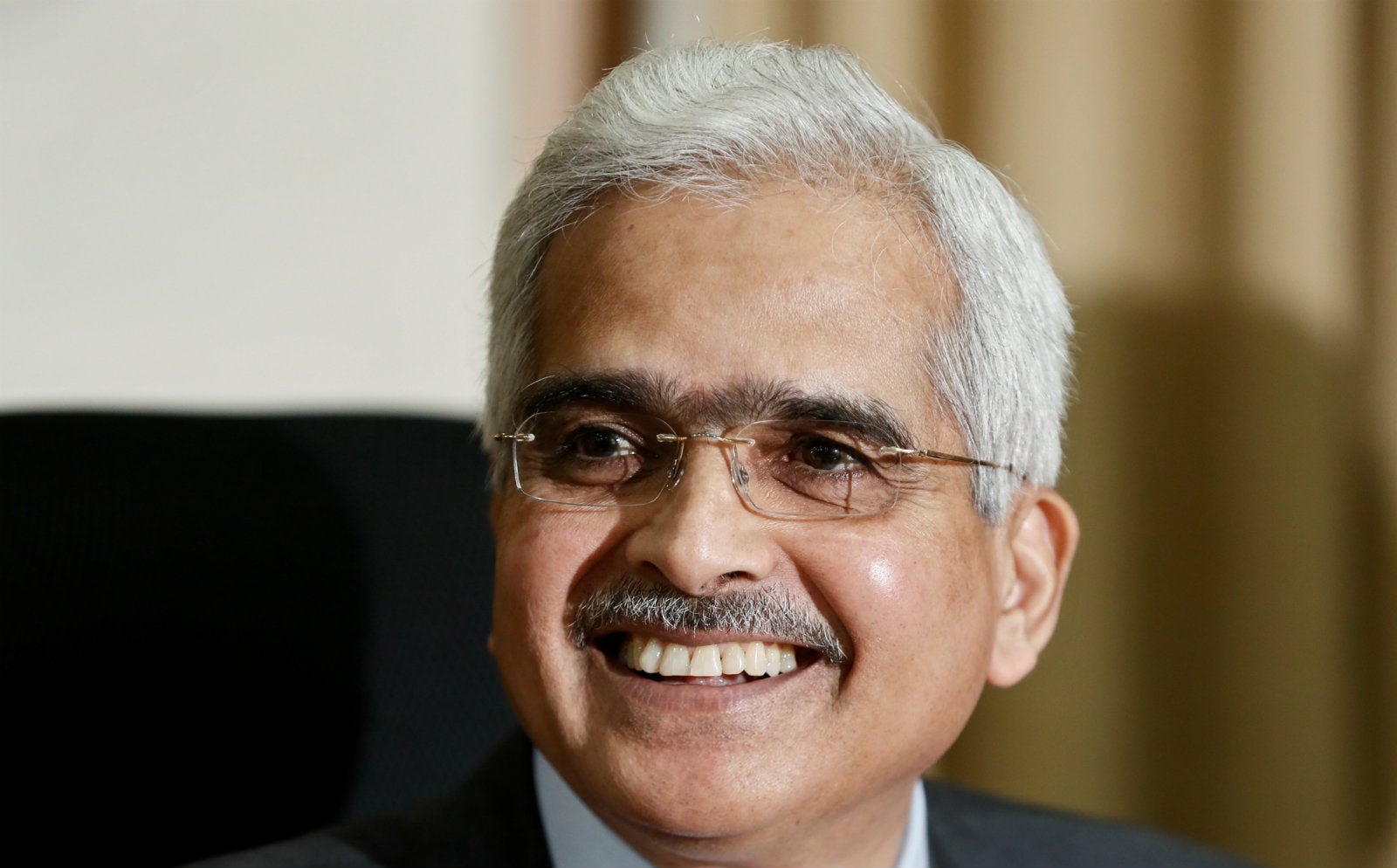

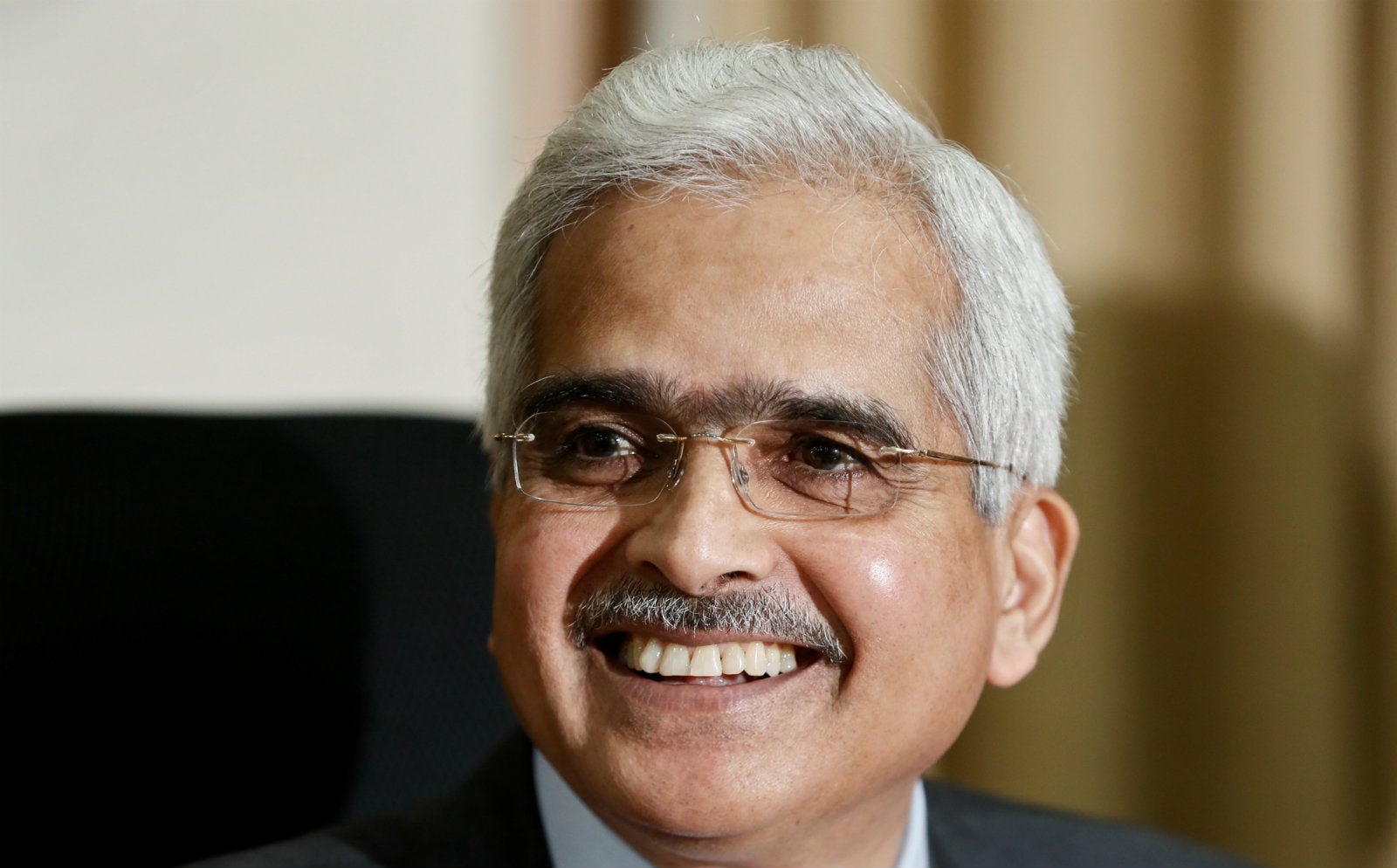

To safeguard the country’s economy, Reserve Bank of India (RBI) governor Shaktikanta Das today (March 27) deployed conventional tools such as interest rate cuts and unconventional ones such as putting loan repayments on hold.

The rate cuts are the biggest since the 2008 global economic crisis. The repo rate, at which the RBI lends to commercial banks, is down 75 basis points (bps) to 4.4%, the lowest since 2004. The reverse repo rate, at which the RBI borrows from lenders, was slashed by 90 bps to 4% so as to “discourage lenders from depositing money” with the central bank.

In tandem, the Cash Reserve Ratio (CRR), or the share of deposits that banks have to mandatorily park with the RBI, saw a 100 basis points cut to 3%.

Other extraordinary measures announced today include a three-month moratorium on payment of equated monthly installments (EMIs) on all term loans, including corporate, housing, and auto. Credit card dues, however, don’t count.

This means all lenders, including non-bank entities, can allow deferment of EMI repayments from borrowers. This will not result in asset quality downgrade of banks, nor will the credit history of the borrower be impacted, the RBI assured.

Emergency meeting

The slew of measures came a week ahead of a scheduled meeting of the RBI’s monetary policy committee (MPC) on April 3.

They also come amid growing fears that Covid-19 will cripple India’s already-battered economy. “This kind of uncertain outlook has never been seen before,” Das said. “There is a possibility that large parts of the world will slip into a recession.”

And India cannot be immune.

An hour before the announcement, Moody’s Investor’s Service slashed India’s GDP growth forecast for calendar year 2020 from 5.3% to 2.5%. “In India, credit flow to the economy already remains severely hampered because of severe liquidity constraints in the bank and non-bank financial sectors,” said the global ratings agency.

The country is currently in the midst of a 21-day lockdown to contain the spread of the coronavirus that has brought most parts of the economy to a standstill. “We are living through an extraordinary situation,” Das admitted. “However, tough times never last, only tough people and tough institutions do.”

Benign inflation

The RBI said the easy monetary policy is unlikely to spur inflation, which has been above the central bank’s comfort zone in recent times, that too, mainly due to a rise in food prices. However, “due to the uncertain conditions,” Das did not give out any inflation projections.

Inflation is expected to be subdued in the coming months owing to lower food prices and falling international crude prices. The RBI cut policy rates five times in 2019 to lift a sagging economy, before pausing in December and February in view of high inflation.

The central bank’s latest measures come a day after finance minister Nirmala Sitharaman announced a Rs1.7 lakh crore ($23 billion) package to help the poor and marginalised live through the crisis. The measures ranged from direct cash transfers to an increase in wages under the nation rural employment programme (MGNREGA).

Globally, central banks are making efforts to prop sagging economies. On March 15, the US Federal Reserve had cut interest rates to near zero. This, along with the stimulus, was reminiscent of the quantitative easing measures taken in response to the global financial crisis in 2008. Following the Fed’s move, central banks in Japan, New Zealand, South Korea, and Australia, too, eased policy.