Consumer confidence at an-all time low as Indian economy stares at a deep recession

Indians are fast losing all confidence in the country’s economy.

Indians are fast losing all confidence in the country’s economy.

For the third consecutive month, in September, consumers in the country said they were more pessimistic than before about India’s economic prospects, revealed the Reserve Bank of India’s (RBI) Consumer Confidence survey (pdf). The consumer confidence index was at a record low of 49.9% in September compared to 53.8% in July.

“More respondents reported curtailment in both overall and essential spending during the past one year,” the survey report said.

The pessimism isn’t unfounded.

Last week, even the RBI’s monetary policy committee (MPC) admitted that the Indian economy will shrink by a whopping 9.5% this financial year. “Real GDP declined by an unprecedented 23.9% in Q1:2020-21 and domestic economic activity remains badly hit by the unrelenting pandemic,” said the MPC report (pdf).

Indians have been facing pay cuts and layoffs as the spread of Covid-19 has dented the already weak employment environment.

Mumbai-based think tank Centre for Monitoring Indian Economy (CMIE) states that India’s unemployment rate has fallen from a high of 23.5% in April this year to 6.9% as of October.

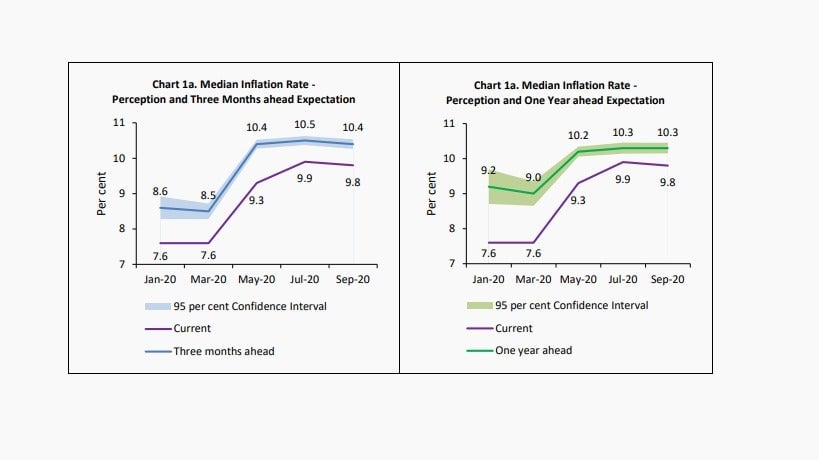

Another factor denting the revival of consumption is the expectations that prices of commodities will rise. “More households expect general inflation to increase over the three months and one year ahead periods,” said the RBI’s Household Inflation Expectation survey.

The supply-side disruption caused by lockdowns has led to a spike in prices of non-food items like personal care, medical care, and transportation.

Even as the survey said that many consumers believe the economy will improve over the next 12 months, the big question right now is whether Indians will be able to overcome their current pessimism and loosen their purse strings during the upcoming festive season. Higher spending in the coming months will be crucial to reviving the economy.