The Indian central bank’s continued monetary support deviates from a global trend

The Reserve Bank of India (RBI) is seemingly following a course different from those of other global central banks.

The Reserve Bank of India (RBI) is seemingly following a course different from those of other global central banks.

A surge in inflation in major economies is forcing the others—US Federal Reserve, European Central Bank, Bank of Japan, and Bank of England—to withdraw their emergency support amid economic stress caused by the covid-19 outbreak.

Analysts at Morgan Stanley have noted that the world’s top central banks are about to embark on the largest quantitative tightening in history, sucking out $2.2 trillion from the global financial system over the next 12 months.

India, too, is grappling with price pressures. Yet, the RBI today, left its key benchmark interest rates unchanged and maintained an accommodative stance—the tenth time in a row.

“…the MPC [monetary policy committee] was of the view that continued policy support is warranted for a durable and broad-based recovery,” the RBI governor Shaktikanta Das said today in the monetary policy statement.

Calling the stance “as dovish as it could get,” Sakshi Gupta, senior economist at HDFC Bank justified it saying, despite being a deviation from global trends, “we do have different macros than the US or Europe.”

RBI’s stance on inflation

RBI said that inflation based on the consumer price index (CPI) may come well below its upper tolerance limit, at 4.5%, in the next fiscal year. This will be helped by better fresh crop arrivals, supply-side interventions, and a good monsoon.

Such an inflation outlook is a key reason that the RBI hasn’t turned hawkish.

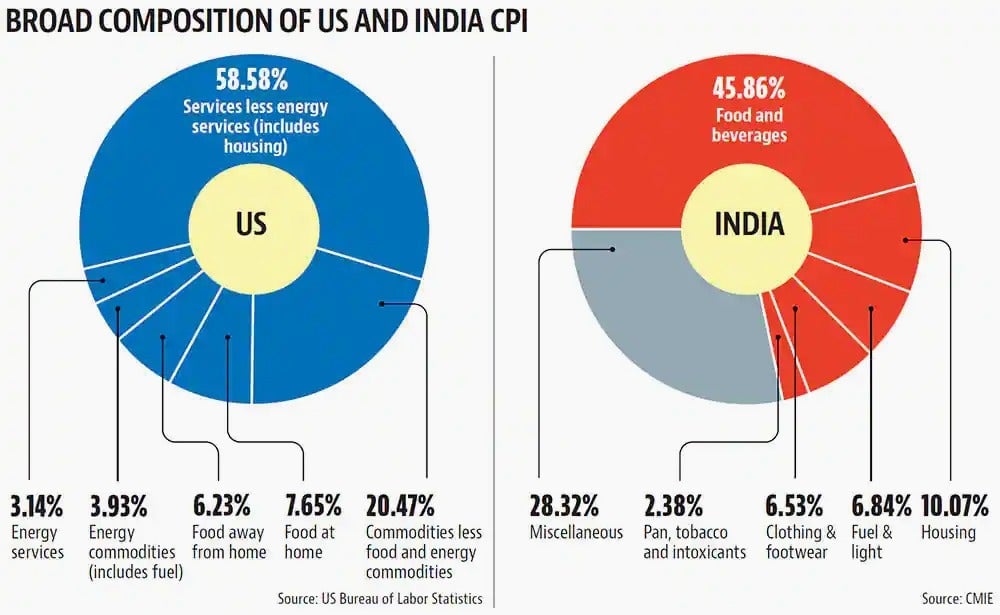

Das, the RBI governor, assured that a “detailed analysis” has been undertaken to arrive at the inflation projections for the upcoming year. The CPI inflation is expected to peak in the ongoing quarter at 5.7%. He said the “character of inflation” in India is different from those of other economies.

Yet, hardening crude oil prices present a major risk.

Global crude oil prices have risen more than 14%, briefly touching $94 per barrel, in the past month, while domestic fuel prices, which depend on international rates, have remained static. This was primarily due to November’s excise duty cuts.

However, domestic prices may rise sharply once elections in five key states end next month, ultimately aligning with global rates.

“The current behaviour of domestic oil companies is being dictated by politics, not economics,” Sunil Kumar Sinha, principal economist, India Ratings and Research, told The Economic Times. “If international oil prices sustain at this level, we should be ready for a shocker after the elections.”

Record debt borrowing by the Indian government

The Indian government aims to borrow a record Rs14.95 lakh crore from the debt market in the upcoming financial year, which is much higher than the average market expectation (Rs12-12.50 lakh crore).

Analysts said it, in this context, makes sense for RBI to tread lightly to minimise the government’s borrowing cost, besides supporting a durable economic recovery. While Das said that the massive borrowing programme will go through smoothly, it is up to the market players to “engage responsibly” for an orderly evolution of financial conditions.

“It is expected that market participants will engage responsibly and contribute to cooperative outcomes that benefit all,” the RBI statement said.