India’s forex reserves have fallen by $35 billion since the Ukraine war

The Reserve Bank of India (RBI) has faced severe headwinds of late: soaring crude oil prices, the US Federal Reserve raising interest rates, and an exodus of foreign money. Its task has only gotten trickier in the past few days.

The Reserve Bank of India (RBI) has faced severe headwinds of late: soaring crude oil prices, the US Federal Reserve raising interest rates, and an exodus of foreign money. Its task has only gotten trickier in the past few days.

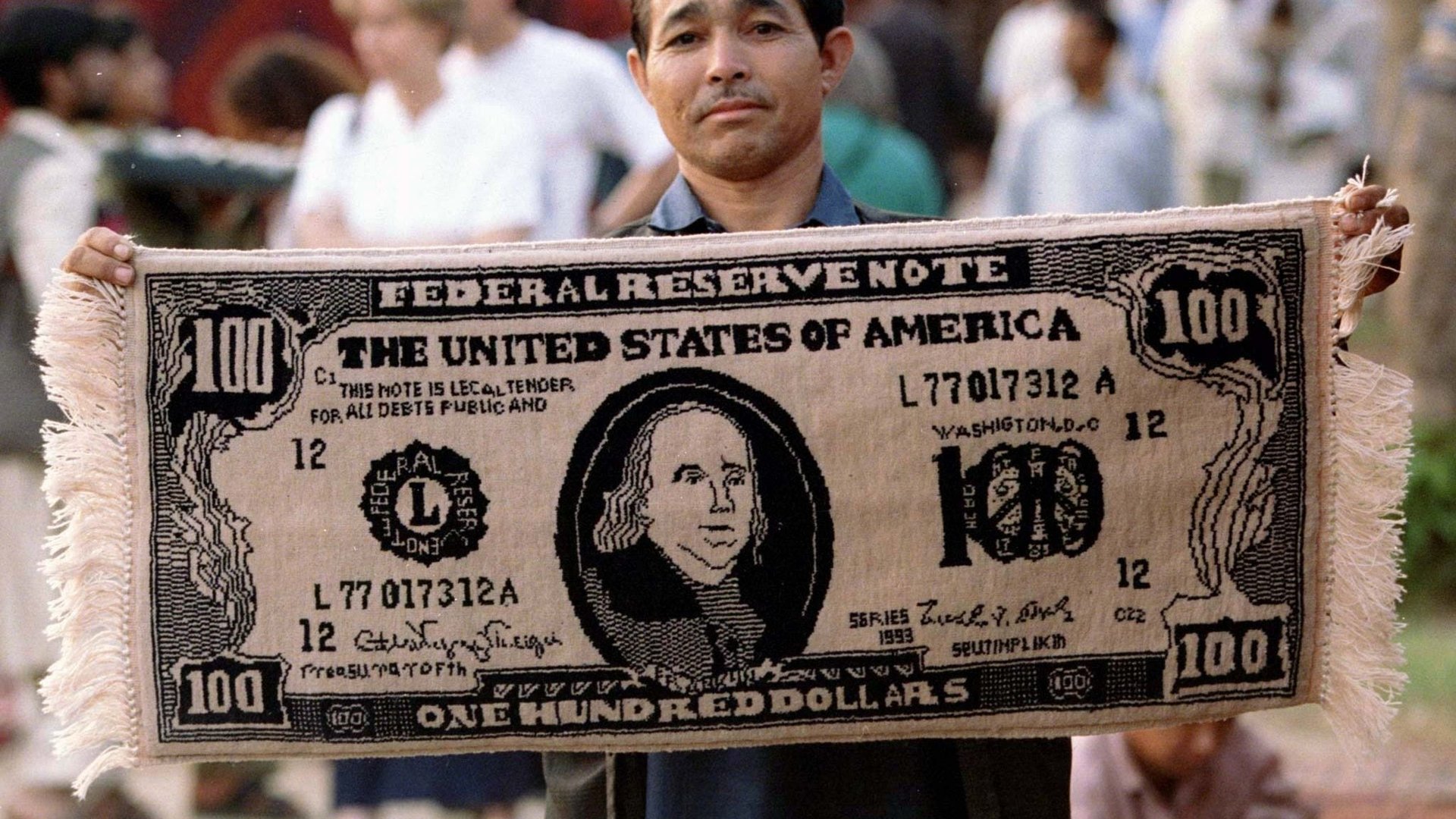

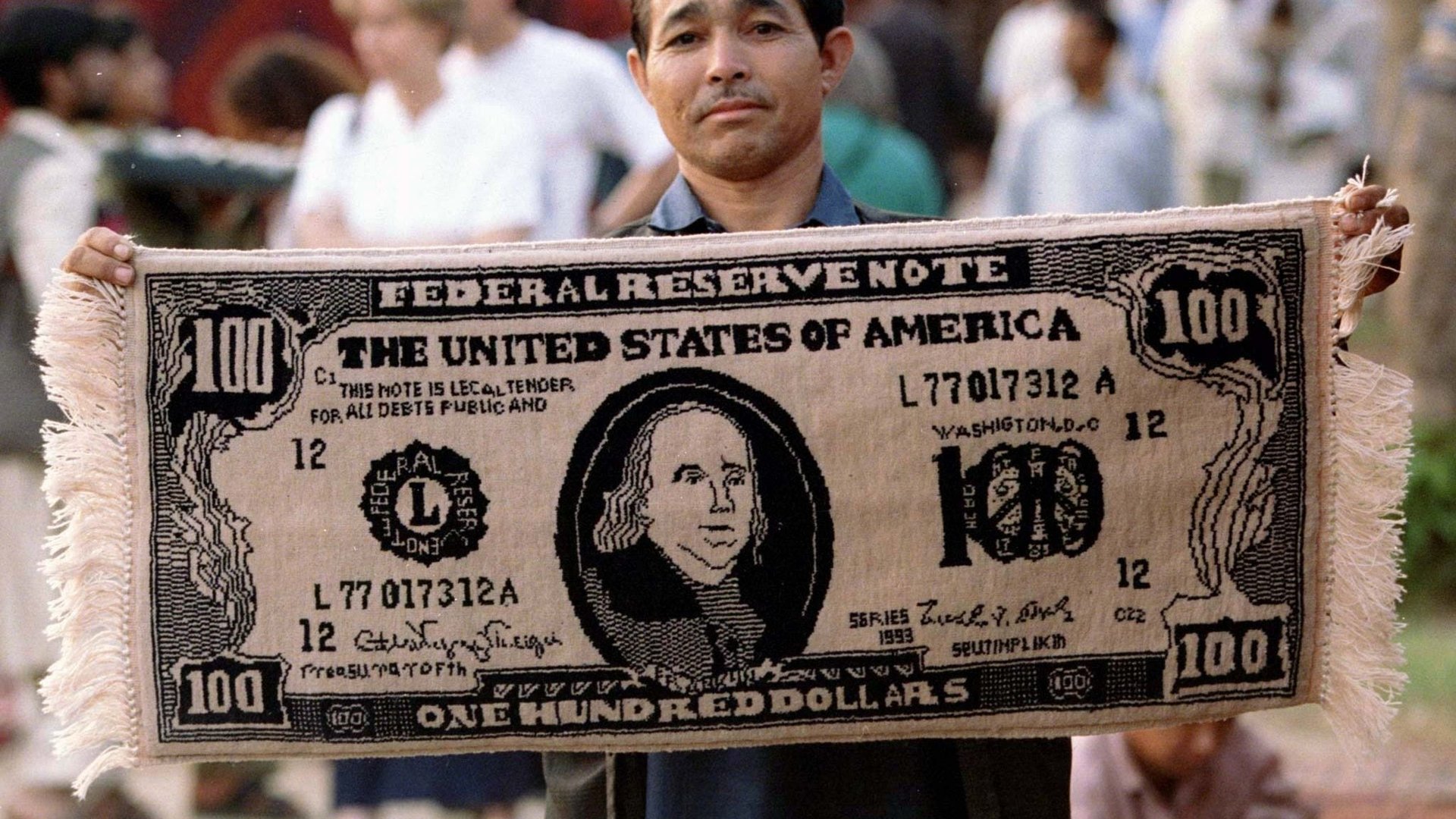

Today (May 9), the rupee fell to a record low of 77.42 a dollar—the previous low was 76.98 a dollar in March. Its forex reserves stood at $597.73 billion (45.68 lakh crore rupees) on April 29 (pdf), compared with $630.19 billion before the Ukraine war.

The rupee’s decline, however, has been staggered, with the central bank deploying its dollar reserves.

Last week, the RBI hiked its interest rate by 40 basis points in an out-of-schedule monetary policy meeting to tackle inflation. But that didn’t help much.

Why is the rupee falling to a record low?

The rupee has borne the brunt of weak sentiments since the beginning of 2022, more so after the war began in February.

Foreign funds have pulled out $17.7 billion from Indian equities this year already, the highest on record. The prospect of aggressive rate hikes by global central banks made stocks less attractive.

A surge in crude oil prices has also led to fears of a worsening current account deficit (when the country’s imports exceed exports in value). The dollar has also strengthened to a 20-year high across the board, denting the demand for riskier assets.

Even foreign funds flowing in on account of initial public offers (IPOs), especially that of Life Insurance Corporation, have not helped either.

“The FII flow has been negative for the past couple of months,” Kunal Sodhani, associate vice president of Shinhan Bank India, said. “Talking about IPOs, the inflows were also not too large…could be somewhere around $1-$2 billion. But the markets are nervous about global headwinds, and in that case, the inflows will be less.”

Sodhani expects the rupee to gradually fall further to 78.50 a dollar in the coming weeks.