One reason it’s so hard to fight India’s black money problem: typos

It was supposed to help detect tax evasion and black money: the Permanent Account Number. So to deposit more than Rs50,000 in cash into a bank account, you need to cite your PAN, the unique ten digit alphanumeric identification issued by the income tax department.

It was supposed to help detect tax evasion and black money: the Permanent Account Number. So to deposit more than Rs50,000 in cash into a bank account, you need to cite your PAN, the unique ten digit alphanumeric identification issued by the income tax department.

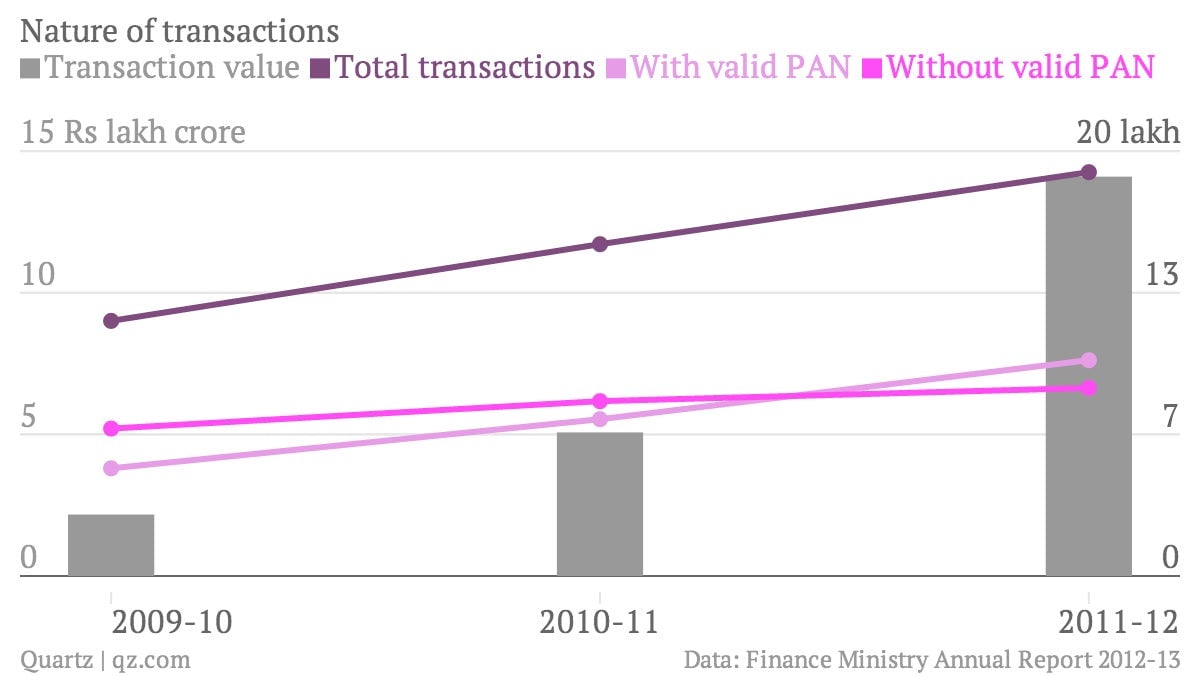

This is meant to help the authorities keep track of high-value transactions. Any cash deposits or withdrawals above Rs10 lakh is reported to the Financial Intelligence Unit, which in turn informs investigative agencies about suspicious transactions and trends. The Income Tax department on its own can also carry out investigations.

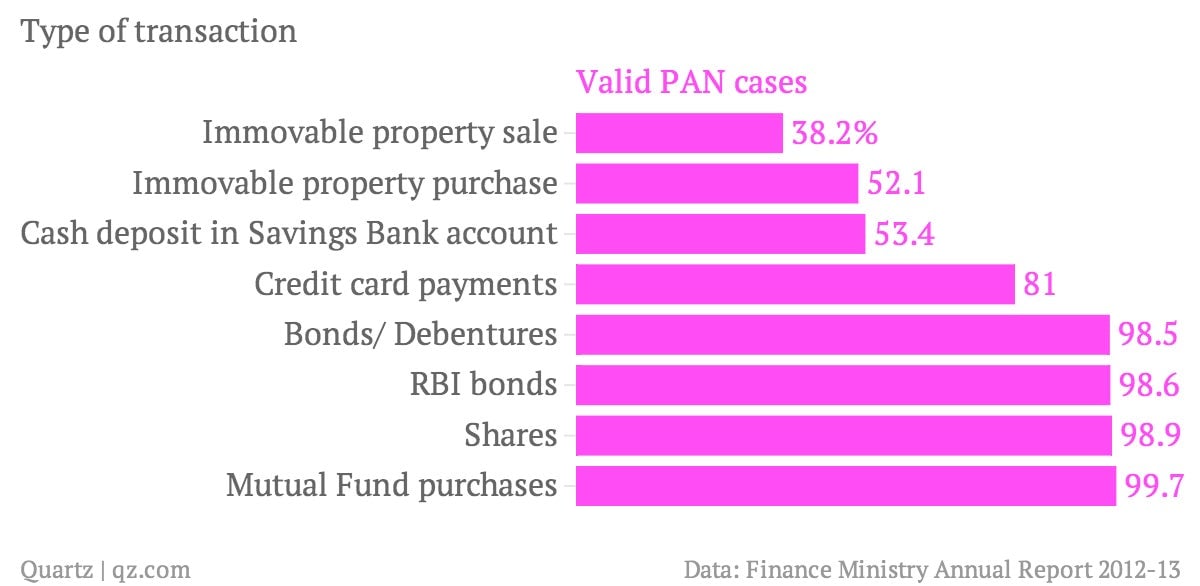

But only 53% of such cash deposit transactions (Rs10 lakh and above) last year had a valid PAN, according to the finance ministry. The rest were not valid, or were incorrectly entered.

“It will be difficult for tax authorities to track the transaction if a valid PAN is not there,” says BP Inani, a chartered accountant with Swan Finance, a corporate finance and management consultancy firm.

Among large world economies, India has the highest cash in circulation in proportion to the size of the economy. Failure to track it provides an easy opportunity for people to stash away income, even inject it into the formal banking channels, without paying tax.

With a correct PAN, the tax authorities can easily and quickly cross-check the records of a bank account receiving high-value cash deposits with the account holder’s tax return—which contains details of income history and asset ownership—to identify incongruities. The absence of a correct PAN makes it harder as the authorities only have the name and address of the account holder to go by, and they may not find a match in other records. This essentially allows most deposits of money to go unnoticed, making it hard to identify illegal transactions, such as bribes.

The total value of the transactions reported in 2011-12 was Rs14 lakh crore (or $233 billion at Rs60 to a dollar). A simplistic extrapolation yields that as much as Rs6.6 lakh crore ($110 billion) is not being tracked.

All that is needed for this problem to be fixed is for the banks and the Income Tax department to cooperate. Banks must be required to validate a PAN before accepting a deposit. The IT department and the central bank can easily work together to make this happen.

Requests for comment to the Central Board of Direct Taxes were not answered. A spokesperson for the Reserve Bank of India (RBI) says this is not its domain.

Clearly, the PAN’s role in reporting high-value transactions is being undermined. As a court-appointed investigations unit begins its anti-corruption work, this might be one reporting loophole it should look to plug.