Central banks, please remember there are worse problems than deflation

A specter is haunting the Euro zone—the specter of deflation, which is a decrease in the general price level of goods and services. Prices are not actually falling. The scare was prompted by the announcement that they had increased by only 0.5% in the year to May, which is much less than the 2% target of the European Central Bank (ECB). The fear of deflation is such that this was enough to convince Mario Draghi, the ECB’s president, that he had to muster all the powers at his disposition to hunt down and exorcise this specter.

A specter is haunting the Euro zone—the specter of deflation, which is a decrease in the general price level of goods and services. Prices are not actually falling. The scare was prompted by the announcement that they had increased by only 0.5% in the year to May, which is much less than the 2% target of the European Central Bank (ECB). The fear of deflation is such that this was enough to convince Mario Draghi, the ECB’s president, that he had to muster all the powers at his disposition to hunt down and exorcise this specter.

On June 5, Draghi announced a radical measure: the ECB will impose a 0.1% levy on the reserves held by the banks at the ECB, beyond the amount required by the ECB itself to keep the banks liquid. Normally, central banks pay interest for these reserves or, at the most, pay nothing on them. Charging the banks for keeping them at the ECB aims to entice the banks to lend these resources rather than depositing them in the central bank. This, Draghi hopes, would lead to increased demand and higher inflation, which is what he wants.

The emphasis on increasing the rate of inflation is odd. More production, yes. But, why should central bankers aim at increasing the rate of inflation? Why this fear of deflation?

Why is deflation bad?

Deflation got its bad reputation after the Great Depression of the 1930s, when a generalized deflation coincided with a generalized depression all over the world. Economists thought that this was not a coincidence. They thought that deflation cause depressions.

Three reasons were produced to explain why deflations do that. First, when prices are falling people anticipate that prices will be lower in the future and delay their purchases. As prices keep on falling, people delay purchases more and more. This depresses demand. Second, people become reluctant to borrow at any nominal interest rates because they would have to pay back their loans with dollars that are worth more when prices are lower than today. Since people do not borrow, investment and production fall. Third, if wages are resistant to fall, as many people assume they are, deflation reduces the profit margins of enterprises, forcing them to fire workers, who prefer to be fired than accepting a reduction in their wages. This increases unemployment.

But, does it happen? Has deflation caused depression?

Given the great faith that the economics profession has in the need to avoid deflation at all costs, it is very odd that evidence in this respect is very weak. In fact, it is ambiguous.

The long deflation

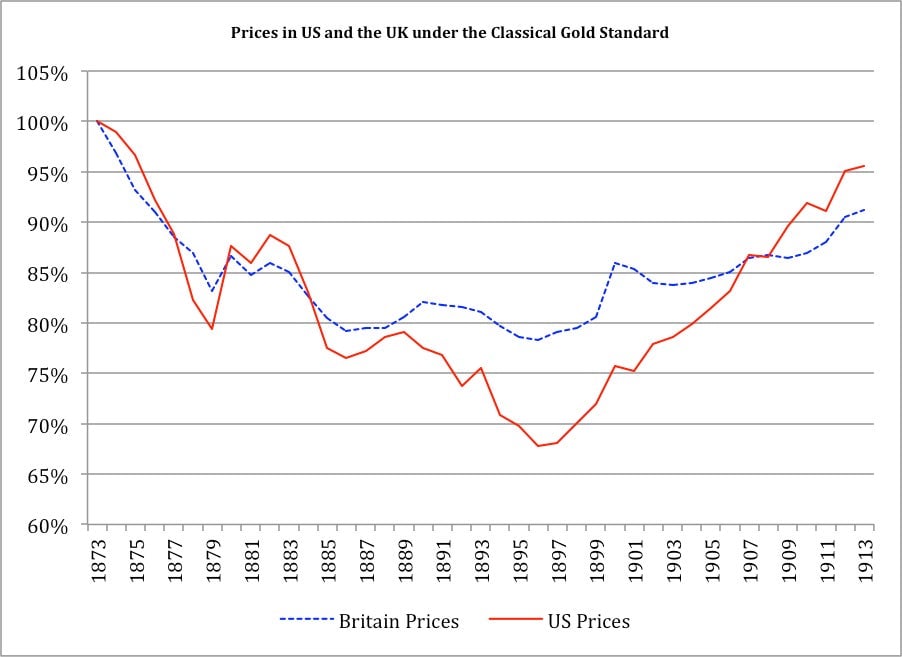

The effects of deflation on real income can be observed in what is called the period of the long deflation at the end of the nineteenth century. As shown in the next graph, prices fell from 1873 to around 1897 in both the US (by 32%) and the UK (by 22%). Then, they recovered from that date to 1913, ending the period substantially lower than in 1873. These price movements were not exclusive of these two countries. They took place all over the world at the same time.

Given the bad reputation of deflations, you would expect to be told that both the US and the UK had a terrible depression lasting from 1873 to 1897, and that both countries would have attained at most weak progress during the entire period because prices in 1913 were still lower than in 1873. Knowing that prices in most other countries in the world followed approximately the same path, you would think that the world retrogressed during those years.

You would be wrong, however. In fact, the progress attained worldwide in those years stands among the most spectacular in history. This period witnessed the industrialization of the US, France, Germany, Sweden, Switzerland, and practically all of the rest of the now industrial Europe excepting Britain and the Netherlands (which had already industrialized), the development of the second stage of the Industrial Revolution (steel, chemicals, telegraph, modern shipbuilding, the automobile, the airplane etc.) and the greatest expansion of the global economy hitherto achieved. And all this happened first with deflation and then with inflation. Very ambiguous.

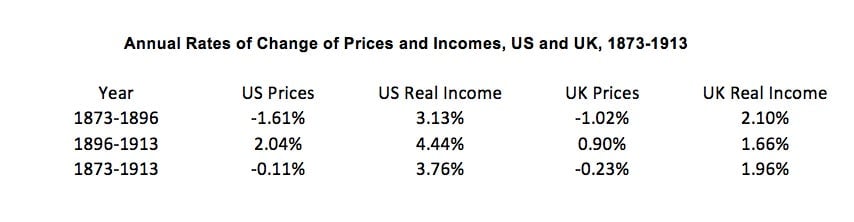

The magnitudes involved can be seen in the next table, which compares average annual growth rates of prices and real income in the two countries. The ambiguity continues. The US grew a little faster when prices were increasing. The UK grew faster when prices were falling.

Good and bad deflation

This ambiguous evidence suggests that there is no causal relationship between deflation and real income growth. Yet, the idea that deflation must be an important cause of depressions has proven to be very powerful.

To deal with the contradicting evidence provided by the long deflation, economists Michael Bordo and Angela Redish argued that there are “good” and “bad” deflations and classified in a very ad-hoc way the long deflation as a good one, and the deflation of the Great Depression as a bad one. The good deflations were described as those in which prices fall because there are productivity gains—such as those achieved, for example, by Andrew Carnegie when he drastically curtailed the price of steel during the long deflation. The bad deflations were those in which prices fall because aggregate demand is falling in the midst of crises, as in the Great Depression. Of course, this does not explain why people who were not Carnegie and were not inventing new things (and did not know the difference between “good” and “bad” deflations) kept on working, selling, purchasing and growing during the long deflation even if they could delay their purchases, and refuse loans and refuse to work because prices were falling.

The problem with ad-hoc definitions is that they fit only the specific cases taken into consideration in the definition. They tend to fail when other cases are examined. This is the case of the definition of “good” and “bad” deflations: you can find “good” deflations in the midst of depressions and even “bad” deflations that suddenly turn into “good” deflations.

“Bad deflation” in 1920-1924?

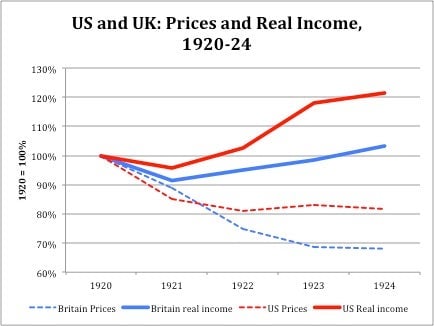

Looking for “bad deflations” you could immediately pick that which took place in the deep recession of 1920-1924, right after the end of World War I. You may think it was a bad one because, as shown in the next graph, real income in the US fell when prices were declining and then started to grow when prices began to increase.

In the UK, prices and income fell together in 1921. However, in 1922 and 1923 prices kept on falling but income increased. Deflation coincided with depression only for one year and coincided with growth in two years. Ambiguity again.

How could you explain this? Deflation was bad for one year, and then turned good for two more years?

“Bad deflation” during the Great Depression?

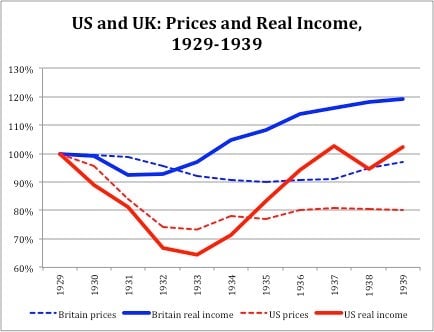

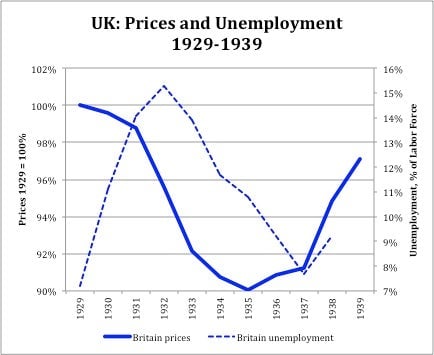

The Great Depression has been unambiguously identified as a case of “bad” deflation. Yet, the evidence, shown in the next graph, is ambiguous, too. The behavior of prices and real income in the United States in that case fits the hypothesis that deflation and depressions are related. Real income declined when prices went down and grew when prices increased. However, this was not true in the UK. Real income declined as prices fell up to 1931 but, after that date and until 1934, real income grew while prices kept on falling. Another case of evil deflation turned good?

Does deflation cause unemployment?

These cases (and many others, like Germany starting to grow during the Great Depression while prices were still going down) leave a big question mark on the supposed causal relationship between deflation and depression. What about unemployment?

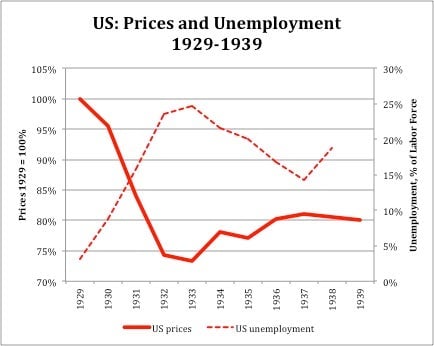

The next graph shows that the US fits the hypothesis that deflation and unemployment are associated during those years. Unemployment increased when prices fell, and decreased when prices started to increase.

The UK, however, spoils the party again. It started behaving well in accordance with the theory—with unemployment increasing fast as prices fell slightly. However, starting in 1933, unemployment declined fast as prices kept on declining till 1935. Again, a “bad” deflation suddenly turned good. Then, inflation, which was supposed to be good, turned bad. Unemployment went up from 1937 to 1939 while prices also increased—which is the opposite of the conventional wisdom.

Hope over experience

So the relationship between deflation and depression is ambiguous. Most probably, it is more of an effect of many events than a cause of them. It sometimes coincides with depressions and sometimes it does not.

Given this evidence, it doesn’t seem smart to focus all the guns of central banks in avoiding deflation. The causes of depression seem to lay elsewhere. Moreover, as shown by Japan since the early 1990s and by many other central banks since 2008, central bankers do not seem to be very good at spurring moderate inflation in depressive environments. From 1990 to today the Bank of Japan multiplied its stock of credit to the government by 8.85 times, multiplying its monetary obligations by 4.22 times. This would be enough to generate an explosion of inflation. Yet, the Bank of Japan has accomplished just an increase in prices of 5.86% over the entire period (that is, not annually, but over the 23 years). Moreover, despite all these efforts, prices have fallen in 11 out of 23 years.

The same is happening in the US and in Europe. The economies are growing only weakly and inflation rates are very low even if their central banks are creating huge amounts of money. Most probably, one day these huge amounts may create a huge inflation and bring down production, as it happened in the 1980s. But today it is unpredictable what the creation of more money will do. It might do nothing. It might launch a new crisis like that of 2008.

Central banks say that the situation would be much worse if they had not been creating money, avoiding deflation and providing enormous amounts of liquidity that is not being used (the central bank gives it to the banks and the banks deposit it back in the central bank). But the evidence does not show that this is happening.

Thus, the actions taken by the ECB to increase inflation may produce results with a second degree of unpredictability because at this moment the impact of the negative rates of interest on price changes (deflation or inflation) is unpredictable, and, if by chance they reduce the possibility of deflation in a sustainable way, the impact that this may have on the economic performance of the Euro zone (if any) is also unpredictable. It may have none. Or the higher inflation could be associated with lower growth and higher unemployment.

Altogether, it seems that the central banks do not know what they are doing. They should revise their models to come closer to reality.