Five charts India’s new finance minister should commit to memory

Finance minister Arun Jaitley will soon sit down to write his first budget, and will come face to face with the delicate dance involved in writing India’s union budget.

Finance minister Arun Jaitley will soon sit down to write his first budget, and will come face to face with the delicate dance involved in writing India’s union budget.

With an irregular monsoon and the crisis in Iraq threatening to respectively derail inflation and fiscal deficit targets, he is not faced with an easy task. Here are five charts that lay down the threats and opportunities before him.

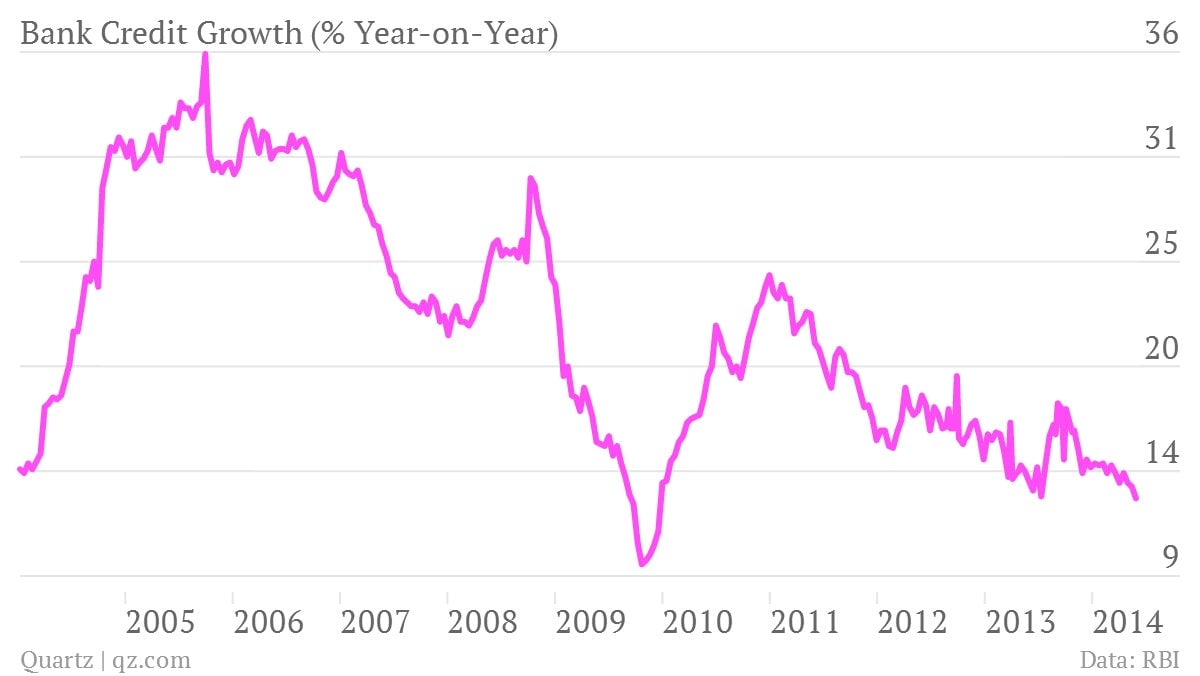

Bank credit growth has fallen to a 3.5-year low

At 13% total bank credit growth is at the lowest since December 2009. Bank credit is what goes to the non-government sector, and includes credit to companies and individuals. Is the government borrowing too much, and crowding out the private sector?

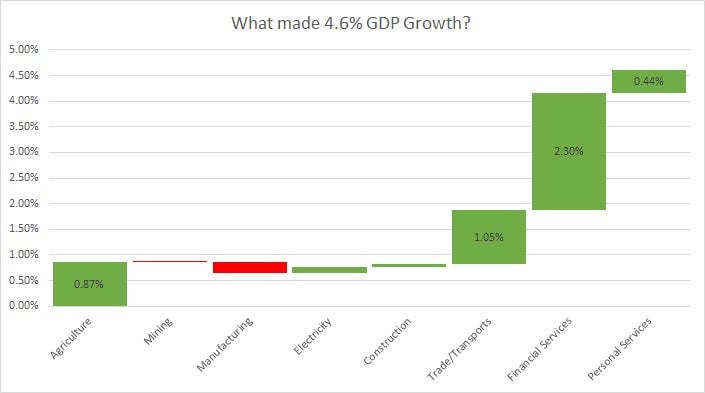

A key contributor to GDP in the last few years, financial services growth might slow down to a less-than-blistering pace and that means it will have to be replaced with something else.

Manufacturing has actually contracted in terms of real GDP Growth

In the last quarter of the 2013 fiscal, manufacturing actually subtracted from GDP growth because the sector shrunk. In comparison with real estate, exports or infrastructure, the sector has very few tax breaks or incentives. It may be sensible to realign tax sops to spur growth in the sector.

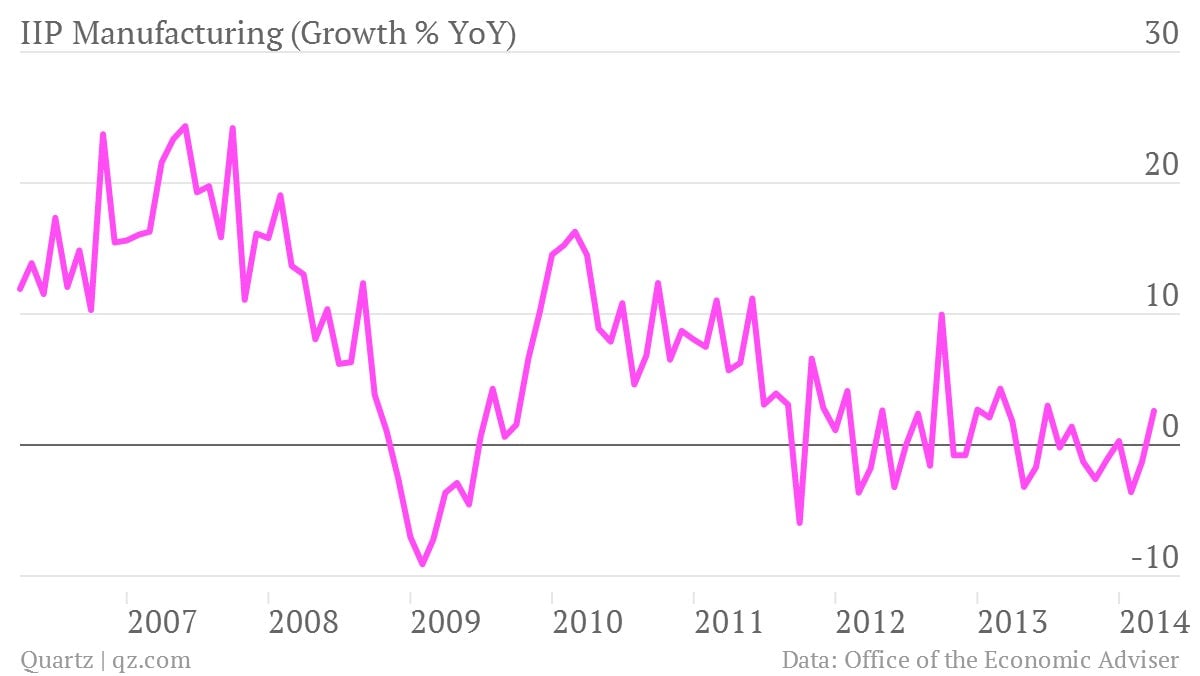

Industrial production is coming back … weakly

India’s Index of Industrial Production (IIP) has a 75% weight on manufacturing. This has, as we’ve seen, taken away from GDP Growth. In April 2014, we saw the first hint that growth might be returning to the sector at +2.6%. However, this is still not very impressive, and comes off a low base.

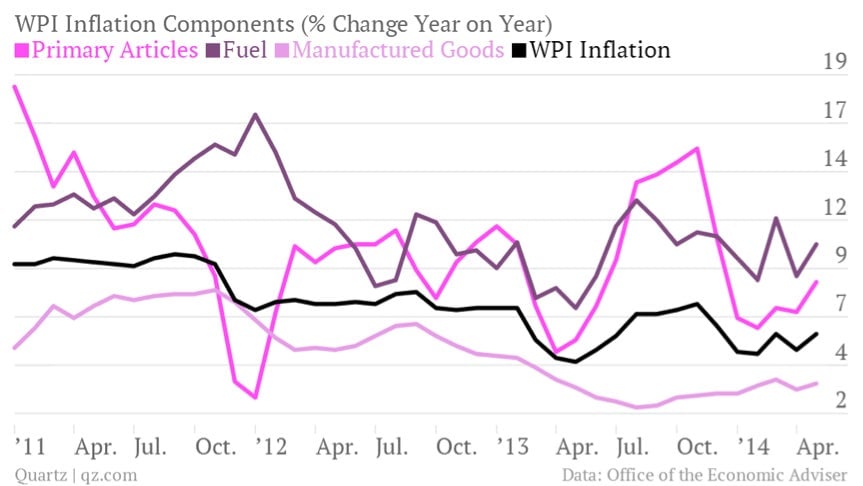

Inflation inflation inflation

India has seen slowing inflation recently but wholesale inflation just showed an increase in May 2014. Food (which is a big part of the so-called primary articles) has gone up in May compared to April, as well as fuel. Inflation in manufactured goods has also picked up pace again.

The data of many of these items are revised two months later, and the revisions have been upwards in recent months. This means the risk of inflation is back, and we might be heading into a persistent inflation combined with low growth—a dreaded quagmire known as stagflation.

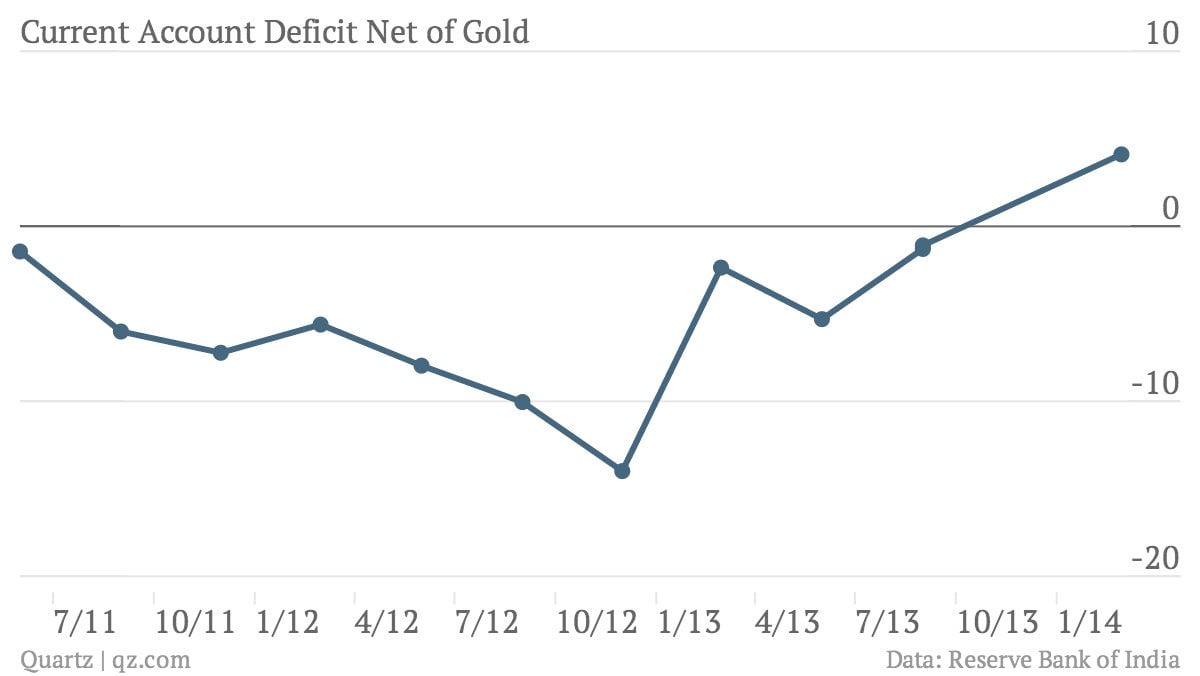

Good news on CAD front

India’s Current Account Deficit has been reducing but what’s significant is that if you removed gold imports from the whole deficit, we have now broken into positive territory for the first time in nearly three years. Gold is counted as a current account item, but it could also be thought of as capital asset (since the gold is held for investment purposes for the most part).

The reason this is important is that our competitiveness might finally be happening at the weakened rupee of Rs60 to a dollar). This matters, because even if we removed the restrictions on gold imports, it might mean that the rest of what makes up the current account can be a counter to gold imports.

The budget dance

There’s a need to keep the fiscal deficit lower than last year as a percentage of GDP. But at the same time the manufacturing sector needs some stimulus. And only with more production can we reduce inflation’s impact on the economy. The finance minister would do well to reduce tax incentives for other sectors and give a little more to manufacturing instead.