To make small loans, India’s banks take too long, require too much paperwork

For small business owners that need access to credit quickly, Indian lenders today have little good news to share. The response to lending to an underbanked demographic, unfortunately, has been to ask for more paperwork and insist on more bureaucratic work from the bank staff. The outcome is suboptimal all around.

For small business owners that need access to credit quickly, Indian lenders today have little good news to share. The response to lending to an underbanked demographic, unfortunately, has been to ask for more paperwork and insist on more bureaucratic work from the bank staff. The outcome is suboptimal all around.

Our company, EFL Global, helps lenders use psychometric credit scores to assess credit risk across 20 countries. We have used our data to identify bottlenecks in the MSME lending market in India.

In India, the MSME credit gap is an estimated Rs3.5 lakh crore ($58 billion). As a result, almost 80% of micro, small and medium enterprises (MSMEs) are self-financed or financed by the informal sector, which usually means a higher rate of interest.

The main reason for this credit gap is that MSME applicants generally lack detailed credit histories and other traditional documented metrics of credit-worthiness. Lenders therefore consider them to be relatively high-risk.

Given the intensive fieldwork and high levels of scrutiny required during application processing, MSME lending becomes an expensive proposition for lenders. Combined with the small ticket size of loans, the market becomes unattractive and the sector remains underbanked.

Are lenders wasting their staff’s valuable time?

In an attempt to compensate for the lack of robust credit history, lenders collect any possible available applicant information in a time-intensive and high-cost screening process.

For lenders, a single lending decision takes on average 15-20 hours of dedicated staff time. Generally, one-quarter of application processing time is spent exclusively on travel, and a substantial portion of this time is by high-cost staff such as credit officers, branch managers or collateral valuation consultants.

Within this time-intensive screening process, close to one quarter of the total application processing time is made up of applicant data collection.

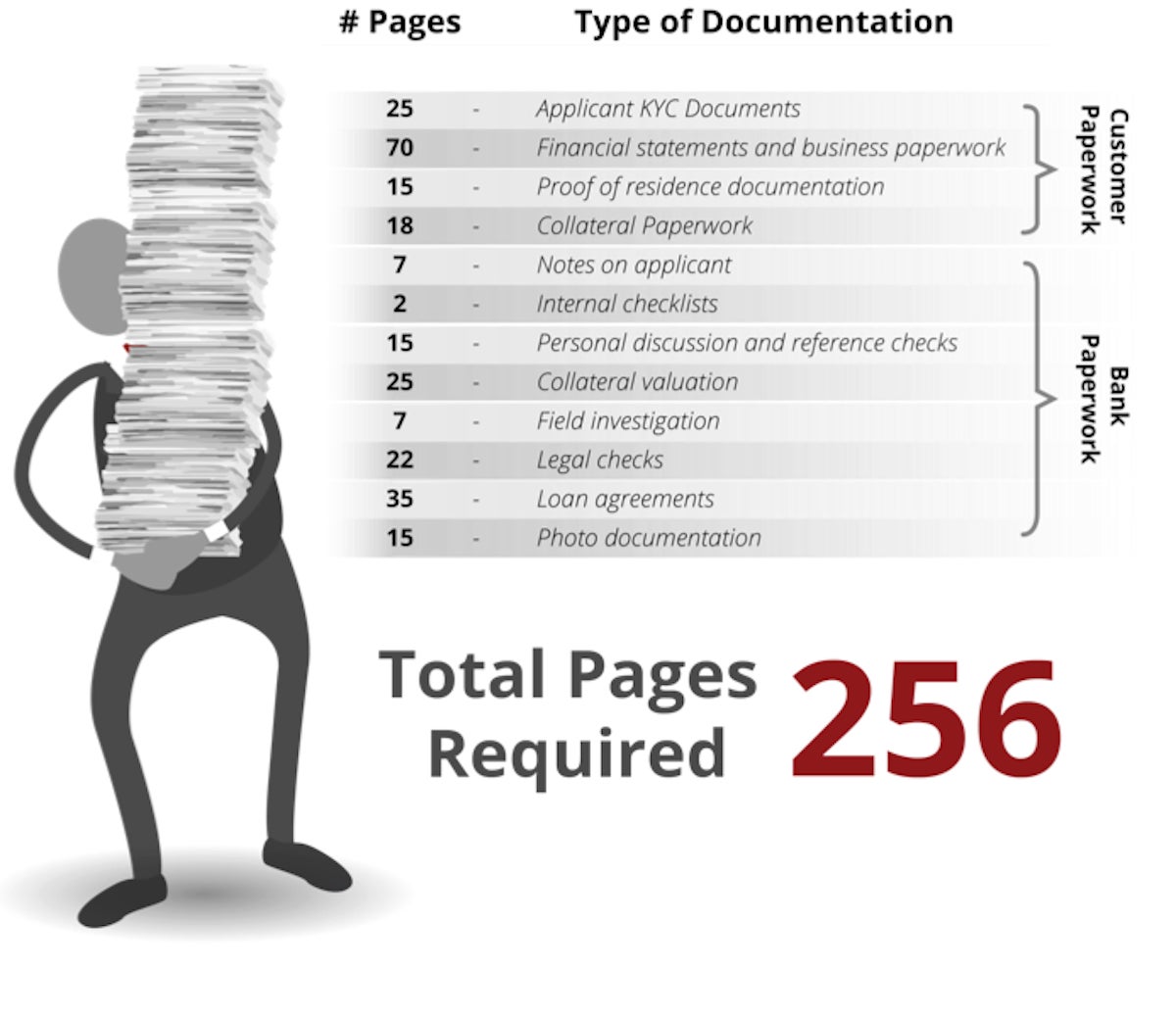

The collection of applicant information usually involves approximately 250 total pieces of paperwork.

The collection of this paperwork often requires, on average, five distinct face-to-face meetings for the lender and its agents with a resulting turnaround time of 20 days, but for many lenders it can be as long as 40 days.

Cost of labour intensive screening

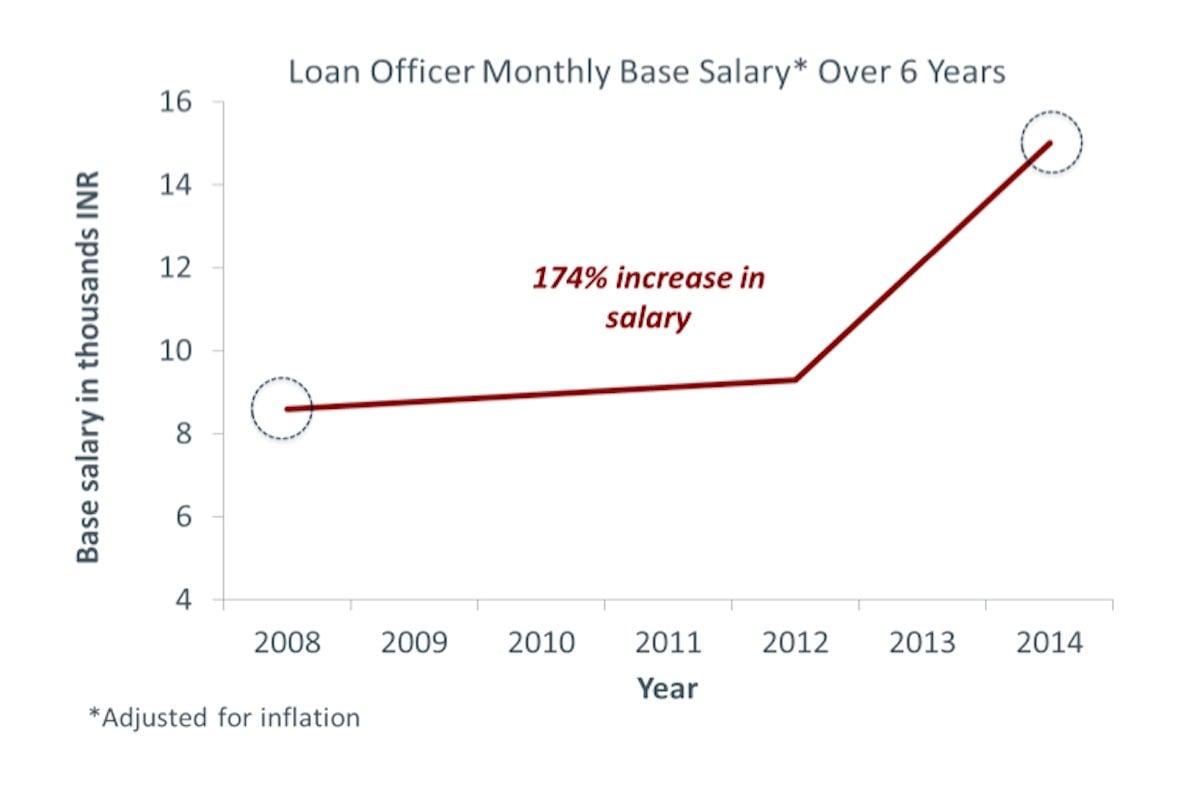

Banks have historically overcome the credit information gap through using labour-intensive screening processes, yet these processes are becoming less viable as the cost of labour increases. Given the rising competition for skilled labor in the industry over the past 6 years, loan officer salaries have increased by 174%, thus making a labour-intensive screening model unviable.

Overall impact on bottomline

Small changes in streamlining lending operations can have significant impact on a lenders’ bottom line.

A McKinsey survey of 29 MSME lenders in Asia and Africa documents that one of the top three needs MSME clients universally desire is a reduction in paperwork. The survey shows that an African bank saved Rs87 crore just by cutting its MSME application form down to two pages, while maintaining the portfolio quality.

India is moving in the right direction. The Reserve Bank of India’s recent modification of KYC requirements may slightly relieve applicants and lenders of their paperwork burdens, yet there is still tremendous opportunity to generate savings and expand portfolios by employing a data-driven approach to reconsider the value of each part of the loan application process.

Today lending in the MSME sector involves prohibitive screening costs and application processing times. As a result, many creditworthy entrepreneurs are excluded from the formal financial sector. Lenders willing to innovate to maximize efficiency while maintaining risk will be most effective in reaching underbanked populations.