To get a loan in India, apply to an officer who speaks the same language (preferably at the end of the month)

The gap in financing faced by the micro, small and medium enterprise sector (MSME) has caught the attention of the Indian government. In yesterday’s budget, finance minister Arun Jaitley has set up a large fund to make credit and funding easier for small companies.

The gap in financing faced by the micro, small and medium enterprise sector (MSME) has caught the attention of the Indian government. In yesterday’s budget, finance minister Arun Jaitley has set up a large fund to make credit and funding easier for small companies.

In the existing set up, where lenders must depend on imperfect information to assess the creditworthiness of a loan applicant, a number of biases creep in. This result in counterproductive outcomes and actually inflates the credit risk in the loan portfolio.

Our company works with lenders to help improve their processes through psychometric evaluation. The data we have collected from 15 states of India shows two key biases. Loan officers tend to view applicants who speak their language more favourably. They are also more liberal with approvals toward the end of the month.

Preference for the familiar

Loan applicants applying outside their native place are more likely to be rejected and receive higher interest rates than their native counterparts. In one study, loan applications from non-native individuals were 82% more likely to be rejected than applications from their native peers with a similar risk profile.

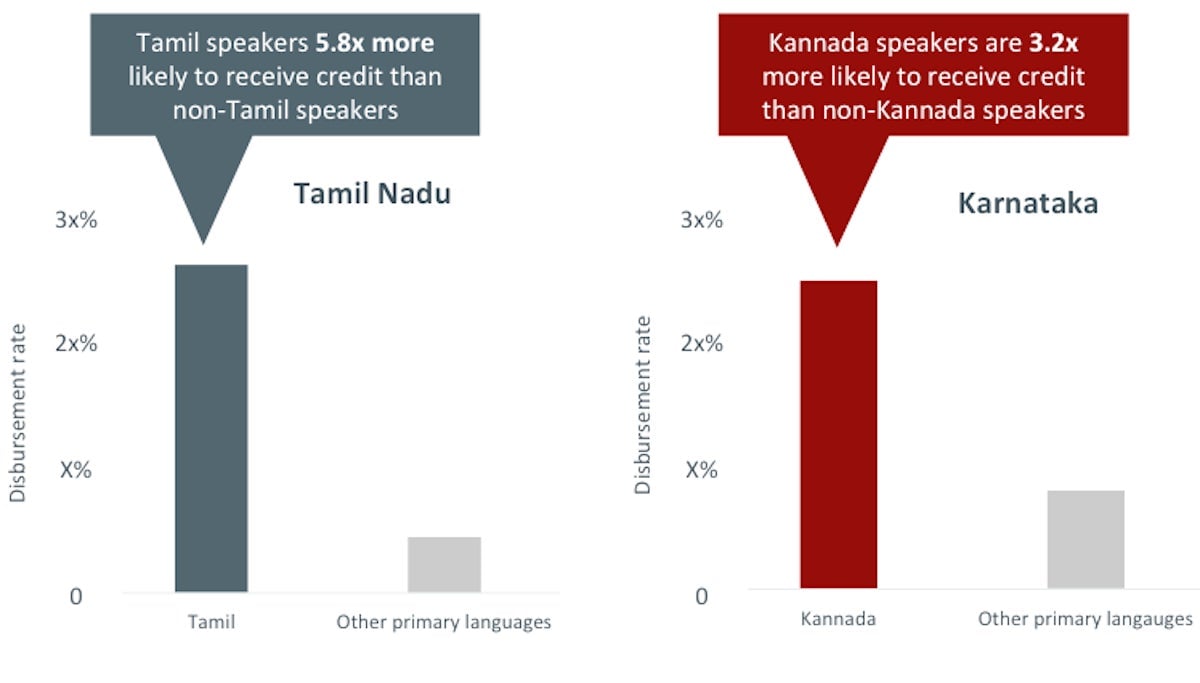

As seen in Figure 1, native Tamil speakers are significantly more likely to be approved for a loan in Tamil Nadu than applicants who primarily speak all other languages and Kannada speakers are more likely to be approved for a loan in Karnataka than applicants who primarily speak all other languages.

The high level of approval for native applicants is not because these applicants are less risky than other applicants. In fact they have a greater risk profile. A loan officer’s preference in lending to local applicants is misplaced.

Pressure to meet monthly quotas

The decision of whether an applicant is approved for a loan is influenced not only by loan officers’ cultural biases, but also by sales incentives. Loan officers are often incentivized to meet sales targets each month.

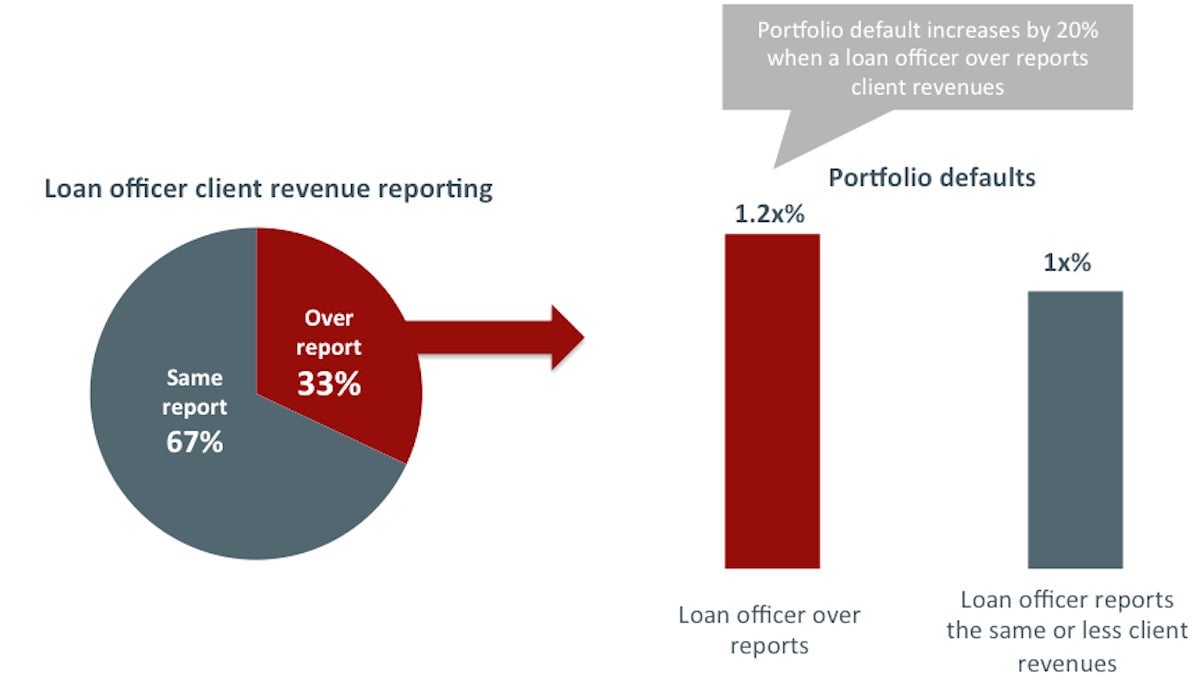

This means as the month comes to an end, the pressure to meet targets mount. During such days, loan officers tend to report false applicant financial data to ensure loans are approved. At the end of the month, over one-third of loan officers over-report client revenues in order to meet their sales targets. Our data shows that loan officers who inflate customer revenues tend to report revenue figures that are 40-50% higher than the applicant’s self-reported revenues.

Similar to the effect of cultural selection bias, loan officer inflation of applicant financial data is harmful to portfolio quality. Applications with exaggerated business revenue data are 20% more likely to fall into default than applicants with accurate data.

Today, loan evaluation is fraught with bias: loan officers are influenced by what is familiar to them and their incentives. As such, the most creditworthy applicants aren’t always those who are approved for loans. Lenders need a better system to screen applicants.