The rule of thumb assumptions Indian lenders make to screen loan applicants are mostly wrong

What is the secret to getting a loan application accepted? Could your marital status or age prevent you from getting credit? The majority of loan applicants are rejected due to unfounded assumptions about which types of applicants make creditworthy customers.

What is the secret to getting a loan application accepted? Could your marital status or age prevent you from getting credit? The majority of loan applicants are rejected due to unfounded assumptions about which types of applicants make creditworthy customers.

Since April 2013, our company, EFL Global, has helped Indian lenders identify the most creditworthy applicants through psychometric tests. EFL’s data collected across 15 states shows that traditional banking “rules of thumb” or loan eligibility requirements can exclude over 70% of applicants from the formal financial sector.

Some lenders’ application criteria are very effective in reducing portfolio default risk while other criteria simply exclude a majority of the population without the resulting portfolio quality impact. When establishing criteria norms lenders must make a trade-off between reducing defaults and increasing loan approvals.

Criteria with the greatest portfolio impact

There are some tried-and-true criteria that have shown to help lenders substantially segment default risk within their applicant pool.

Age: Younger and older applicants reveal higher credit risk when compared with average age applicants. Rejecting these applicants based on age will slightly reduce the portfolio default with minimal impact on the number of rejected applicants, thus working to maximize the ratio of acceptance to default rate.

Banking history: Clients with less banking experience have higher credit risk. Rejecting clients with less banking history can substantially reduce defaults, however this criteria causes the lender to end up excluding the majority of potential applicants.

Clearly lenders cannot ignore that being old or young or without banking history makes an applicant more risky, however this doesn’t mean that lenders should eliminate these applicants from their portfolios. Instead, lenders can be most successful by creating tailored lending products for these higher risk populations.

Criteria with minimal portfolio impact

There are other minimum criteria, which significantly reduce the applicant population without a corresponding return on portfolio gain. When you consider the following three criteria, they independently exclude the majority of the population.

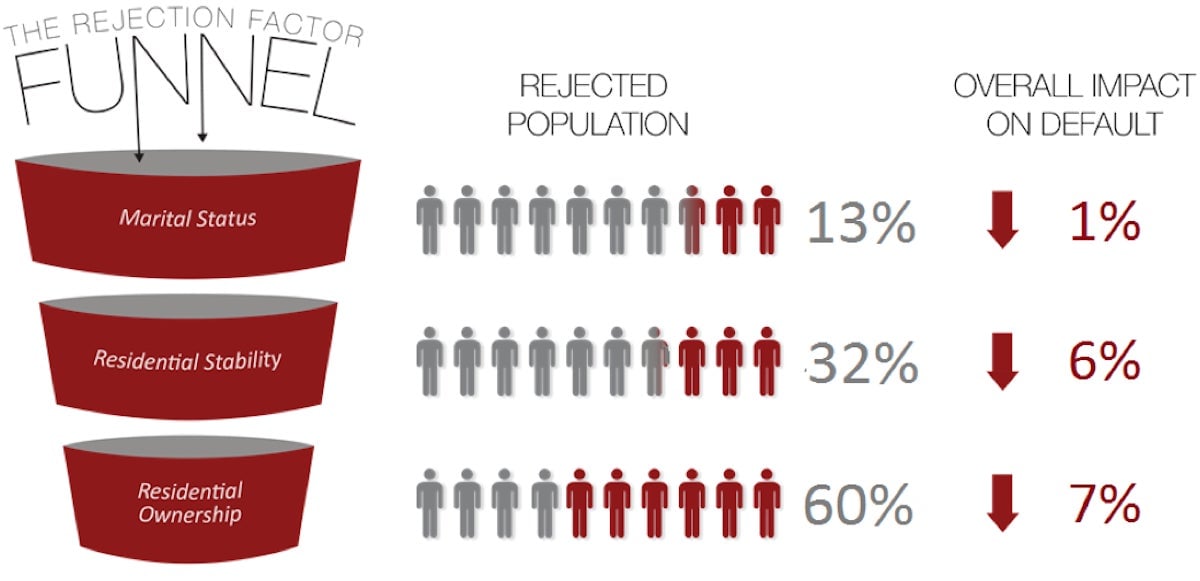

Marital Status: Divorced and single applicants are often viewed as more risky given marital partners provide applicants with a secondary source of income and financial stability. However, EFL data reveals that rejecting divorced and single applicants only slightly reduces portfolio default, while significantly reducing the approved applicant population.

Residential Stability: Applicants who have lived in one locality or residence for longer are typically considered less risky than applicants who demonstrate less residential stability. While default is reduced by a small degree by rejecting applicants with less time living in one locality, the eligible pool of loan applicants is reduced by almost one-third.

Residential ownership: Property ownership is often another proxy for credit risk, as well as a source of collateral. While requiring home ownership reduces default, this filter automatically rejects the majority of the applicant pool.

Traditional application criteria have both restricted financial inclusion and impacted lenders’ growth. Some of India’s most progressive lenders have successfully questioned and tested these traditional norms. These lenders have ring-fenced small portfolios of applicants who fall outside their traditional lending criteria to see if they can profitably lend to this much wider applicant pool. Alternatively other lenders have used the minimum criteria as filtering mechanisms to segment the population for tailored loan products. In a world increasingly dominated by data, those who look beyond rules of thumb and question and test these traditional norms will be most successful in growing large, profitable and inclusive portfolios.